Knock, Knock! SMBs Deliver the Final Mile

SMB manufacturers and retailers are killing it in the middle and final miles.

It was only back in 2017 that Undercover Snacks, a New Jersey-based manufacturer, was making its chocolate and quinoa snacks by hand in a single commercial kitchen and delivering them from the back of an SUV.

Today, in an estimated 10,000 to 12,000 stores across the United States and experiencing rapid international growth, the company’s commitment and personal approach hasn’t changed much.

Not only did that approach help the company survive COVID, but committed relationships with retailers and carriers enabled it to thrive, doubling the number of stores carrying its products in 2021.

Undercover Snacks’ journey wasn’t without the transportation challenges experienced by other small and mid-sized businesses (SMB), including manufacturers and retailers. For them and others, the secret was a combination of strategies both tried-and-true and technology-based. Like many others in this crunched-capacity market, they tied themselves tightly to their transportation partners.

“We’ve had to cultivate relationships with a number of major carriers and transportation and logistics companies,” says Michael Levy, chairman and co-owner of Undercover Snacks. “For various routes, we have developed a good rapport with some companies we think highly of, but they also face challenges including driver shortages and other bottlenecks impacting performance and dependability.”

Consistency and a little bit of compassion have proven to be a winning approach for securing capacity in the current freight market.

“It stems from how you treat drivers and whether you provide them with business throughout the year that keeps them happy during the crazy times,” says Manny McElroy, senior vice president of transportation for ITS Logistics, an omnichannel third-party logistics provider based in Sparks, Nevada. “That keeps the drivers in your network and keeps the capacity with you.”

Strong carrier relationships proved decisive for Undercover Snacks during the pandemic because it enabled them to have product available. Retailers who allocate slots on a shelf want to make sure they are filled, particularly after what happened with the run on the center aisle and in grocery stores early in the pandemic.

“Part of our success was that we were able to have products available to step in if other suppliers couldn’t deliver,” Levy explains.

“We’ve forged some nice relationships that we expect to grow significantly with customers who now trust and understand that we have strong manufacturing capabilities as well as the ability to execute on the logistics side,” he adds.

Well Worn Relationships

For New Jersey-based luxury e-tailer ShopWorn, which receives almost all its merchandise from overseas, relationships with freight forwarders—some stretching back 20 years—were essential. They enabled the flow of “shopworn” designer handbags, watches, jewelry, and accessories—merchandise that has only been worn in the shop and never used—to keep flowing despite the ocean and air capacity crunch.

“Our business is built on relationships, starting with the brand and our consumers as well as with our carriers, whether for small packages or inbound freight,” says Larry Birnbaum, president of ShopWorn.

ShopWorn’s relationship with its customers continues to grow. Sales jumped 67% in 2021—more than double their average annual growth of 30%, according to Birnbaum.

ShopWorn also made a seminal technology leap in 2021 from an accounting-based solution to a system that could integrate inventory, sales, and fulfillment management.

“We just outgrew our old system. It couldn’t give us the data that we needed,” says Birnbaum. “Unfortunately, we had to launch the new system in the middle of October, which was the start of the season, but we wouldn’t have been able to do what we’ve done to date without it.”

Undercover Snacks also enhanced its systems significantly during the pandemic. They switched from an accounting platform to Oracle NetSuite, which integrates order fulfillment, financial reporting, quality control, track and trace functionality, and purchasing, receiving, and demand planning management.

“We have real-time visibility into nearly all aspects of our business,” Levy says. “Many companies wait a little longer to invest in this type of technology. While we’re still in the earlier innings, we have big ambitions.

“By putting the right system in place, we created the ability to scale to much larger volumes efficiently, and to serve world-class retailers and partners—from major retailers like Kroger, CVS, and Rite Aid to the foodservice industry to travel and hospitality companies like United Airlines.”

The system upgrade integrates customer management, supply and demand planning, and track and trace functionality—which is crucial in the food industry. Additions include implementing handheld devices used for pick and pack in the warehouse and connectivity with customers and suppliers through EDI.

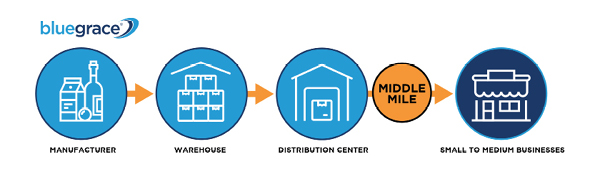

Navigating The Middle Mile

Undercover Snacks and ShopWorn’s moves to collect and use more data reflect wider trends among small and mid-sized shippers particularly in the middle mile—that leg of the supply chain between the factory or distribution center and the retailer.

One invaluable byproduct of utilizing consistent carriers is that you can build a good database to drive decisions, according to Christopher Kupillas, vice president of managed logistics at BlueGrace Logistics, a third-party logistics provider based in Los Angeles, California.

“A big mistake some small to mid-sized shippers make is trying to save a few bucks on a load,” Kupillas says. “Shopping among brokers and asset-based LTL carriers spreads your data out everywhere.

“By using five different systems and 10 different carriers, you can’t capture enough information to make actionable or valuable changes to the organization,” he adds.

“With our customers, we capture data in real time at the shipment and order level,” says Kupillas. “We do weekly performance reviews and we look at carrier performance and performance to retailers’ scorecards. What is impacting the carrier or your retailers’ on-time percentage? Because if you don’t capture this information quickly and stay flexible with how you execute it, this is a challenging market to ship in.”

Working the Middle Mile

Optimizing Through Data

Good data informs network optimization—another important strategy for SMB shippers like Undercover Snacks. “We have tailored key reports and alerts in NetSuite to track our business and logistics closely,” explains Levy. “We have much more visibility so we can talk with our various carriers or distributors about what we’re shipping and how much we’re selling within periods of time to different locations.”

Undercover Snacks relies primarily on distributors who consolidate the snacks with goods from other manufacturers to get its products to stores throughout the United States. They also ship by truckload for a small number of retailers and, to a lesser extent, rely on LTL, including temperature-controlled transportation in warmer climates to prevent the chocolates from melting.

As the company eyes Western expansion, Levy says they’re starting to look at warehouse space and speak with 3PLs to partner with.

The strategy of opening forward stocking locations to facilitate national distribution is not a given in today’s retail conditions. During the pandemic, when volume for canned goods increased, one consumer product goods manufacturer pulled national distribution back to its two factories because it couldn’t make products fast enough to allow for the lead time to get to the distribution centers and then to stores. The change required a switch to longer haul transport, from which they relied on long-standing carrier partners to execute. The company says it has no plans to change the model while stress on its inventory remains, but it continues to make adjustments to find the right carrier mix for its runs.

Network optimization is a key strategy in Undercover Snacks’ growth, too. “The fact that we’re selling a lot to distributors means that now we’re able to engage them in discussions about network planning and consolidation,” Levy says.

Working the Plan

Making the most of capacity is difficult even when the market is flush with it.

“The biggest challenge for SMB shippers is the planning process,” Kupillas explains. “They have to consider the must-arrive-by date windows for the retailer, production time, preferred carriers, and carriers’ actual transit all at the order level—and these vary by location and retailer. It’s hard for SMB shippers to do this without technology.”

Shippers have to know if they’re using the right carrier for the job and if they’re giving the carrier enough time to deliver on time by considering factors such as carrier lead time and lead time from delivering terminal to get an appointment to drop or unload a trailer at a retailer. “A lot of these aspects to deliver are complicated to manage,” Kupillas notes.

In addition to these middle-mile challenges, many small and mid-sized shippers like Undercover Snacks have to contend with the final mile to consumers. In contrast to the middle mile where big moves can have big impact, in the final mile little moves are what matter, starting with fast, free delivery.

Meeting final-mile challenges is a necessity for success. Even the potential return is part of one big experience where service defines success or failure.

“Two years ago, you’d say high-level fulfillment—the order, delivery process, and product—is a competitive advantage,” says Kasia Wenker, director of supply chain solutions, ITS Logistics. “But that’s no longer the case. Fulfillment is now a necessary condition for companies to even survive among the competition.”

Fulfillment intimately impacts operating margin today and the financial considerations of shipping decisions extend well beyond the cost of the shipping rate. Wenker cites shipping cost as an example of this. Fail to display it at checkout fast enough and you can lose the sale.

“If you can’t produce the shipping cost, if your APIs time out, consumers will abandon the cart,” she says. “You literally have three to four seconds.”

This is one example of shipping determining sales. And it’s why the customer journey should drive fulfillment options, Wenker says, because brand perception, customer commitments, and customer expectations are all affected by shipping choices.

Successful e-tailers have eliminated the line between e-commerce and e-commerce fulfillment. ShopWorn’s intentional approach to fulfillment is an example. “Our mission is to give the customer the most authentic experience possible for this luxury goods space,” says Michael Goad, vice president of revenue.

Free shipping is an inextricable part of that experience. Even with sky-high small parcel rates, there was never any discussion about charging for shipping. “Over my years, I’ve seen pushback from customers not wanting to spend extra for freight,” Birnbaum says. “You have to listen to the people.”

Protecting the e-commerce experience inspired Undercover Snacks to bring fulfillment in house, although that may change, according to Levy, as e-commerce sales continue to grow. They currently sell from a Woo Commerce platform and their products are sold on Amazon, but not fulfilled by Amazon.

“We would gladly use Fulfillment by Amazon, but they do not provide ice packs or other cold shipping solutions that are required to transport chocolate in warm climates,” Levy says.

Fulfillment by Amazon (FBA) is driving the industry forward by enabling many e-tailers to deliver products in one or two days almost anywhere in the United States. But Wenker says today’s delays in the upstream supply chain can make it hard to compete in the FBA arena.

“FBA is a wonderful product,” she says. “But if you can’t keep your products stocked with Amazon due to supply chain issues on the front end—like at the ports—your rankings will fall off. And all of a sudden, the Amazon machine will not work for you.”

A Balancing Act

Supporting service excellence while ensuring service capacity is a balancing act for SMBs with growing e-commerce sales. Both Undercover Snacks and ShopWorn like to handle fulfillment in-house to control the service and ultimately the brand experience, but they both also outsource a portion of their fulfillment to 3PLs. For now, both will continue to use a combined approach as they continue to grow.

Expanding will be an expense either way, but, as Wenker explains, it’s a piece of an evolving operating margin equation that is an unavoidable part of success in the e-commerce world.

“Your brand will no longer survive based solely upon the products you offer to the customer,” she says. “It is the delivery portion of it as well: The customer journey from the point of purchase to final delivery is part of your brand because everybody can find another cheaper, faster, better option online. Execution has to be part of your successful product offering.”

Winning in the middle and final mile will come from taking the long view on relationships with carriers, customers, and every supply chain partner between. But SMB shippers don’t have to wait for long-term results. The benefits of committed collaboration with carrier partners, and taking the steps to ensure what Michael Goad of ShopWorn, calls an “authentic” experience, are the keys to short-term success in today’s crazy capacity-stricken supply chain. And they’re the strategies many small and mid-sized businesses use to write their own success stories.