Trends—December 2011

Transportation Management Breaks Out

Transportation management system (TMS) solutions and TMS-managed services have been evolving at hyper-speed over the past few years, largely driven by an economy in a tailspin, corporate mandates to reduce costs at all costs, and the emergence of Software-as-a-Service (SaaS) and cloud-connected networks. The facility with which companies can develop and deploy function-rich transportation systems, and the reception from ROI-oriented shippers, has opened the floodgates for new companies, different approaches, and greater value.

While technology vendors continue to dominate the transportation and logistics solutions space, third-party logistics providers (3PLs) are making their own impression. Transportation management continues to be a focal point as shippers confront looming Hours-of-Service changes, inevitable capacity and driver shortages, and fluctuating fuel costs. Accordingly, 3PLs are shaping their portfolios to provide shippers with a more intuitive product.

Managed TMS service is one example of how providers are helping shippers separate functional dissonance from supply chain noise—identifying tactical transportation problems, then engineering strategic solutions that cut across all logistics disciplines.

3PLs such as C.H. Robinson Worldwide, Inc. have contributed to this growing market niche by bundling TMS technology with management and execution. Ten years ago, TMC emerged as a separate division under the C.H. Robinson umbrella, with the specific intent of helping customers target transportation management.

"TMC is organized as a standalone division because many shippers want to retain control of carrier selection," says Jordan Kass, executive director of TMC, based in Eden Prairie, Minn. "This move demonstrates our commitment to a fair and level playing field in areas such as bidding and rate confidentiality."

Still, some TMC customers also use C.H. Robinson as a core transportation services provider, recognizing the advantage of a partner that can provide a totally integrated transportation management program—from brokerage through to execution and optimization.

As another example, Menlo Worldwide Logistics—the San Mateo, Calif.-based logistics arm of Con-way—recently divined a new business approach that similarly breaks out the transportation piece. The roll-out of Menlo Transportation Services, which combines traditional transportation management with solutions engineering, is designed to remove waste, create new efficiencies, and introduce lean continuous improvement processes to transportation network operations.

Given the entrenched market pressures shippers now face, Menlo saw an opportunity to deconstruct its previous transportation management platform and rebuild it around lean concepts, creating a more progressive and sustained value proposition.

"We realized that what we considered core services—warehousing and transportation—were, by definition, waste," says Carl Fowler, senior director of operations at Menlo Logistics Worldwide. " Current market headwinds forced our hand to be more proactive about delivering value to customers."

Menlo endeavored to infuse its transportation management offering with lean guiding principles that probe for deeper solutions rather than immediate economies. "The goal is to provide sustaining value, not just find cheaper rates," says Fowler. "We want to help customers link upstream and downstream processes to this supply chain node."

Transportation management has always provided a natural entrée into other supply chain areas such as procurement, vendor management, demand forecasting, and order management. By developing this new platform, Menlo wants to let lean methodology identify problems, guide better transportation best practices, then unleash these efficiencies elsewhere in the supply chain for further optimization.

In effect, C.H. Robinson/TMC and Menlo are drawing out the transportation function, isolating its value within a broader supply chain context, then building it back up. Getting back to basics is the natural instinct when complexity muddies supply chain backwaters. And many shippers welcome this grass-roots solution as directives to reduce costs remain top of mind.

But logistics service providers are also challenged by shippers to continually provide more value, and these approaches facilitate continuous improvement, demonstrating and reinforcing the value of transportation outsourcing. They also simplify transportation management by making it more distinct and accessible, which is particularly relevant for small- and medium-sized businesses that have yet to capitalize on their transportation and logistics operations.

The State of Transportation

As transportation funding floats to the top of state agendas, government and transportation authorities are focusing attention on measures to finance infrastructure development and enhance freight movement. Here is a roundup of some recent legislation:

Ohio: In a move that other cash-strapped DOTs will watch closely, Ohio legislators are mulling future options for managing the Ohio Turnpike and other roads amid rising costs.

Transportation officials are working with consultants to determine the best course of action—maintaining the status quo, removing tolls altogether, or leasing the roadway to a third party. Privatization opponents fear an immediate cash infusion will lead to a service downgrade, higher tolls, and trucks diverting to and damaging nearby roads. Apart from keeping the current system in place, the original provision for creating a turnpike was to remove the tolls once the initial construction debts were repaid. That never happened.

Wisconsin: Governor Scott Walker, along with support from the Wisconsin Department of Transportation and the Department of Agriculture, Trade, and Consumer Protection, recently signed into law nine transportation bills that will benefit both the agriculture and freight transportation industries. For farmers and producers, the new laws will streamline the permitting process, which will specifically help shippers transport agricultural products such as fruit, grain, vegetables, and livestock to ports for export.

California: The forecast for transportation funding in the Golden State is turning cloudy. It will take more than $500 billion through 2020 to maintain crumbling roads and outdated freeways, and alleviate traffic congestion, according to a recent preliminary report by the California Transportation Commission. It is a funding gap that could delay more than 3,000 safety improvements.

Officials are exploring the possibility of raising the gas tax, which will greatly inflate transportation costs in a state where fuel prices are already sky high because of low-carbon fuel mandates.

GE Shines Light on New DC

The recent debut of General Electric’s (GE) centralized logistics center for renewable energy components in Olive Branch, Miss., demonstrates the continuing growth of the U.S. renewable energies sector, and the need for efficient distribution and parts replenishment. The company says the new facility will help improve customer response times throughout North America as more wind and solar energy projects are developed and existing power facilities require maintenance.

GE Energy’s renewable energy services group will use the new logistics center to distribute replacement wind turbine parts and solar technology components. Additionally, it will produce customer-specific kits that include multiple parts for each service activity, which increases productivity by ensuring that all of the parts required for a project are packaged together. The center also will provide and maintain specialized tooling for GE’s field services team.

The new facility also complies with Leadership in Energy and Environmental Design (LEED) Silver Certification standards. Sustainable features include skylights, upgraded insulation, an efficient warehouse lighting system, and highly reflective white TPO roofing to reduce cooling loads.

Temp-Controlled Capacity Challenges Heat Up

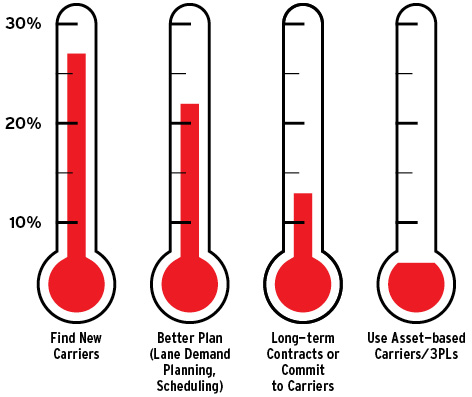

Truck capacity continues to be a primary challenge for temperature-controlled shippers. More than 27 percent of shippers participating in RWI Transportation’s 2012 Temperature-Controlled Transportation Report deal with a lack of capacity by finding new carriers. Thirteen percent enter into long-term contracts with carriers, and six percent specifically seek out asset-based carriers and 3PLs as strategic partners. Other temperature-controlled shippers are making significant efforts to optimize lane demand planning and improve scheduling.

Source: 2012 Temperature-Controlled Transportation Report, sponsored by RWI Transportation