Trends—March 2014

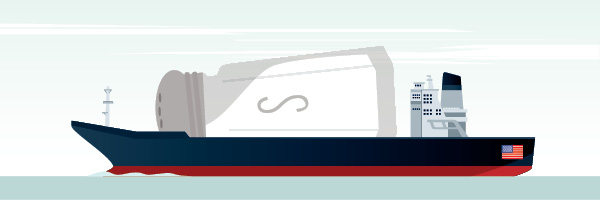

Is the Jones Act Worth its Salt?

A briny tale about a man named Jones, complete with international intrigue, American protectionism, twisted truths, and misplaced blame unfolded recently when a 40,000-ton shipment of road salt bound for New Jersey got waylaid in Searsport, Maine.

The man in question is Wesley Jones, the U.S. senator from Washington who introduced the Merchant Marine Act in 1920—colloquially called the Jones Act.

After heavy snowfall during winter 2014 caused the New Jersey Department of Transportation to run out of salt, state officials found a solution sitting at a dock in Maine.

But without an emergency waiver, U.S. law prevented the recently arrived Anastasia S., a bulk freighter sailing under the Marshall Islands flag, to call on another U.S. port. The 1920 Jones Act was drafted to ensure only U.S.-flagged vessels could ferry product between domestic ports.

The salt shipment in Maine eventually was loaded onto barge for transshipment—which was further delayed by bad weather. In the end, a Chilean ship arrived to save the day with necessary resupply.

But the story invariably turned to the Jones Act. Over the past decade, transportation experts have speculated whether a legislative vehicle crafted during the Gilded Age could use a fresh set of sails. As over-the-road capacity issues grow increasingly dire, ample opportunity exists to tap short-sea shipping, and even capitalize on inland distribution through the Great Lakes and Gulf Coast.

The Jones Act doesn’t necessarily preclude short-sea shipping, but it complicates matters. By law, all goods carried via water between U.S. ports must move on U.S.-flag ships constructed in the United States, owned by U.S. citizens, and crewed by U.S. citizens or permanent residents.

In 1955, 1,072 vessels sailed internationally under the U.S. flag. Today, that number hovers around 100, and represents two percent of global tonnage, according to the U.S. Maritime Administration.

"Some parties discuss changing the Jones Act, while others question why we need to keep it at all," says Donald Maier, associate dean and professor at the Loeb-Sullivan School of International Business & Logistics, Maine Maritime Academy.

One obvious concern is national security. But the greater issue is labor. Many in the U.S. maritime trade believe the Jones Act protects their livelihood. "Our merchant marine is in dire straits, and would implode if we dropped the Jones Act," declares one Merchant Marine Academy captain. "The government has overlooked addressing our port needs for commerce, and no solution is in sight.

"The recent issue around Searsport was overblown," the captain adds. "We had adequate bottoms to get the salt to New Jersey, but the owners were looking for a shortcut solution from a ship that happened to be in the port. If they had started right away to arrange U.S. barging, this would not have been a story.

"The United States needs to push for transportation infrastructure upgrades so we do not need to rely on foreign bottoms to move our essential cargo," he adds.

The fundamental provisions of the Jones Act go back to the beginning of the United States—in effect, protecting domestic U.S. commerce from outsiders. Then and now, it’s a matter of self-preservation.

And it’s not just maritime trade. Cabotage rules—which govern transporting goods or passengers between two points in the same country by a vessel or craft registered in another country—also apply to air, road, and rail. Foreign-owned airplanes can’t deliver passengers between U.S. cities, for example.

The gist of the Jones Act and other cabotage laws is to protect U.S. jobs. But that becomes problematic if they result in higher costs and entitlements that restrict U.S. business. That’s why some are pushing for an amendment to the existing rules.

Looming capacity and driver constraints may force the question. Maier says a business case can be made for pushing more product on U.S. coastal and inland waters, but that will take time. Shippers will have to change their mindsets.

"Shipping by water takes longer, but if the shipper will save on transport costs, it becomes a better deal," Maier says. "It comes down to whether shippers can manage inventory levels well enough to compensate for additional time."

Some commodity shippers—notably in agriculture—are well-practiced in using inland waterways to export products. But what if there were more capacity and greater competition—especially with rail—to deliver between U.S. ports? Or if shippers could find an intermodal alternative to the rail-road norm?

The greater question is whether poor New Jersey planning and a convenient legislative scapegoat will move minds, then moorings.

Mapping the Auto Supply Chain

In a landmark moment for the U.S. automotive industry, Automotive Industry Action Group (AIAG) is creating the first online industry database for identifying the physical movement of finished goods, parts, and materials through the global supply chain. The database—with participation from General Motors, Chrysler Group, and Toyota—will initially map supplier shipments into the United States.

"The first casualty of globalization has been transparency," says J. Scot Sharland, executive director of AIAG. "For the first time in the auto industry’s history, key automakers are collaborating toward creating a centralized supplier data platform for greater visibility into the global supply chain.

"Led by these three early adopters, we’re launching a system that puts command and control of the data into the suppliers’ hands, and is driven by a federal border security initiative," he adds.

The first generation of the AIAG platform—named Supply Safe-Supplier Security Assessment—will map shipments via the U.S. Customs and Border Protection’s Customs-Trade Partnership Against Terrorism (C-TPAT) certification program.

The frequency of truck and shipping container inspections decreases by a factor of five for C-TPAT-certified companies, and the expedited processing helps the auto industry improve the speed with which parts and materials arrive at destination.

To better identify suppliers that have C-TPAT credentials, each participating OEM will ask Tier-1 suppliers to create a profile in Supply Safe indicating their C-TPAT certification status. As part of its profile, each supplier will enter relevant C-TPAT data, including geolocation of international sites that produce automotive parts and materials, entry points of shipments into the United States, and final destinations of those shipments.

Tier-1 suppliers will be asked to solicit data from their suppliers, and cascade the data input request down through the supply chain. Each supplier will maintain security of its data profile, controlling which companies have the ability to view it.

Currently, nearly 1,000 automotive supplier sites are C-TPAT certified, and OEMs prefer to use certified suppliers to lower their risk of production stoppages caused by delivery performance shortfalls, especially with imported products. AIAG expects additional OEMs and suppliers to participate in the Supply Safe platform as the initiative matures.

UPS Unpacks New Hazmat Shipping Guidelines

UPS will transmit hazardous material information by phone, fax, and electronically beginning June 1, 2014. The new method of communicating "shipping paper" information affects UPS small package tractor-trailer operations, the movement of small package shipments between UPS facilities, and tractor-trailer deliveries. All UPS operations will continue to carry hard-copy shipping papers for hazardous materials.

Under the new protocol, authorized by the U.S. Department of Transportation’s Pipeline and Hazardous Material Safety Administration, when an inspector or emergency responder requires hazardous material shipping papers, drivers will provide a toll-free number to call for access to documents containing a manifest of any hazardous materials contained in the shipment.

This new process is expected to streamline the sharing of information with inspectors and first responders.