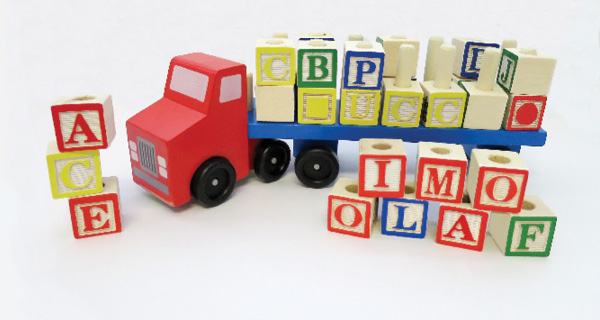

The ABCs of Supply Chain Compliance

Understanding the myriad global trade rules and regulations on the horizon is not child’s play, and non-compliance could spell T-R-O-U-B-L-E.

While supply chain professionals have always had to understand the regulations that impacted their supply chains and required their organizations’ compliance, this role has become even more pronounced. Government agencies across the globe continue to issue rules that affect supply chain operators. “Regulations now seem to be a regular component of international supply chains,” says Eric Souza, director of product marketing, ocean freight and customs brokerage with UPS. “Companies need to make sure they have a robust compliance program in place.”

Top 6 Global Trade Rules: Are You Ready?

Safe Port Act at Risk

A few themes drive most regulations: “modernization, harmonization, transparency, health, safety, and security,” says Candace Sider, vice president of regulatory affairs, Canada, with customs brokerage services firm Livingston International. Many regulatory agencies are continuing to shift from paper-based, manual processes to electronic and digital systems. They’re also trying to harmonize the standards they use in their countries with those used by most other jurisdictions. These efforts should help streamline the movement of goods across borders.

At the same time, most agencies want to obtain information on the goods coming into their countries so they can help ensure security, protect intellectual property rights, and keep citizens safe.

When the goals of efficiency and security conflict—and they often do—regulatory agencies have to weigh the differing concerns. While shippers may not always agree with the final results, they need to comply with them.

Here is a look at the regulations most likely to impact shippers in the coming year:

The staggered rollout of the U.S. Customs and Border Protection’s (CBP) Automated Commercial Environment (ACE) system. ACE is the culmination of an effort to establish one portal through which information on imported goods can electronically flow from businesses to the government agencies that require it. The new system “will help industry and facilitate trade,” says Bob Jacksta, supply chain specialist for Deloitte Consulting. Products will be able to move into the commercial stream more quickly, with better data and less paperwork, he adds.

ACE has been in development for years, and “it’s a monster,” says Tom Gould, senior director, customs and international trade with law firm Sandler, Travis & Rosenberg. “Several dozen government agencies will be collecting information through it.”

ACE’s development took on greater urgency with a 2014 Executive Order that required government agencies, by the end of 2016, to implement the “capabilities, agreements and other requirements in place to utilize the International Trade Data System (ITDS) and supporting systems, such as the Automated Commercial Environment, as the primary means of receiving from users the standard set of data and other relevant documentation.”

“We are now in the final, ‘it’s for real’ phase,” says Jonathan Gold, vice president, supply chain and customs policy with the National Retail Federation, a retail trade association.

ACEing It

At this point, the CBP has automated many of its functions within ACE. For instance, importers can file shipping documents electronically within the system, although some CBP documents still can be filed in the older Automated Commercial System (ACS). Many other federal agencies have yet to provide functionality through ACE.

A number of entries and entry summaries will shift from ACS to ACE on various dates throughout 2016. For instance, as of March 31, 2016, data required for the National Highway Transportation Safety Administration (NHTSA) and under the USDA Lacey Act needs to be filed in ACE, says Cindy Allen, founder and chief executive officer of consulting firm Trade Force Multiplier.

This deadline could particularly impact importers of vehicles and vehicle parts, Allen says. While most companies should already have the information required, it’s often scattered across multiple systems and departments. Moreover, the NHTSA is expanding the number of data elements it requires. Many companies “are concerned about gathering information and getting it to their brokers in enough time for the brokers to report it before the goods arrive,” Allen says.

On May 28, 2016, even more electronic entries and associated entry summaries shift to ACE.

During July and August, a number of federal agencies—the Centers for Disease Control, the Drug Enforcement Administration, and the Fish and Wildlife Service—are expected to provide functionality for companies to file information via ACE. As of early April, the exact dates had not been published.

By October 2016, ACE will be mandatory for all remaining electronic portions of the CBP cargo process. This includes drawback, protest, reconciliation, and statements.

Finally, as of Dec. 31, 2016, the Executive Order mandates that all agencies and functionalities be complete in ACE.

While the CBP has extended a number of ACE deadlines, experts say that’s unlikely to continue. “I don’t see a huge chance of further deadline extensions,” Gould says. If an importer or broker can’t file within the ACE system, and resorts to paper, Customs no longer will be equipped to handle the shipments. Instead, the cargo may languish on the docks.

To minimize that risk, companies should be implementing the processes needed to comply with the regulation. Supply chain professionals need to understand the data requirements and the point at which information needs to be collected, Jacksta says.

Those that provide electronic data feeds to their brokers should ensure they’re communicating the data required by all the agencies with whom they interact. They also must check that their brokers are working with Customs-certified software; a list of certified software vendors is available on the Customs website.

Because many new systems can experience hiccups, especially those as complex and expansive as ACE, companies with just-in-time supply chains may want to allow additional time within their processes as ACE rolls out, Allen suggests.

While the transition to ACE will require many organizations to adjust their supply chain systems and procedures, the efforts should pay off. “Once we’re over the transition hurdle, ACE will make it easier for importers and exporters to communicate,” Gould says.

The International Maritime Organization’s (IMO) amendments to the Safety of Life at Sea (SOLAS) Convention. Effective July 1, 2016, amendments to the SOLAS Convention will require containers being loaded onto a ship for export to include a verified weight that shippers are responsible for providing.

Shippers needing to provide accurate container weights is nothing new. “For the carrier to safely stow the ship, it has to know the container weight; that’s not in dispute,” says John Butler, president and chief executive officer of the World Shipping Council, a trade group. “However, it has become evident the weights often aren’t accurate.” A number of ship accident investigations have found inaccurate cargo weight to be a factor.

In addition, if a container is much heavier than anticipated, the terminal might not have the right equipment staged to handle it. In some cases, stacks of containers have collapsed in on themselves because they’re heavier than they should be.

The SOLAS amendment is aimed at doing away with these discrepancies, Butler explains. Shippers can either weigh the loaded container, or they can weigh its contents then add the container’s tare weight, or its weight when empty.

While few disagree with the regulation’s intent, some question the way it tries to achieve its goals. For instance, it’s not clear when shippers have to provide this information so they don’t risk their cargo being delayed. Do they provide it at booking? Do they provide it to the carrier or freight forwarder? “If the rule is not well-defined, it creates the potential for confusion and delays,” Souza says.

Complicating things further, “the majority of shippers don’t own the containers they use,” says James Johannes, manager, product operations and procurement, with KPMG LLP’s advisory management consulting practice. “This change will require shippers to weigh each loaded and sealed container individually.” Obtaining and communicating this information will necessitate changes to shipper computer systems and electronic data interchange (EDI) programs, he adds.

Given the changes required, some have called for delaying the effective dates for one year. But as of early April, no delays appeared imminent. Shippers should prepare for the change. “Ocean carriers won’t load your container if you’re not SOLAS-compliant,” warns Ryan Petersen, chief executive officer of Flexport, a San Francisco-based international freight forwarder.

A first step is to understand the weighing capabilities available at the various locations from which the containers ship, Souza says. Ideally, this will include certified scales. “Shippers also need well-defined contingency plans,” he adds.

The recently signed Trade Facilitation and Trade Enforcement Act of 2015, also known as the Customs Reauthorization Bill. This act was signed into law in February 2016, and “is expected to change the landscape over the next few years,” says Richard Mojica, a partner in Miller & Chevalier’s customs and import trade practice. “The act advances the CBP’s twin goals of trade facilitation and trade enforcement.”

For instance, the act simplifies and expands duty drawback, which refers to the refund of duties and taxes collected from a company when it imports goods, once it exports a similar volume of similarly classified goods. The act expands the timeline within which companies can make claims from three years to five. It also provides clarity to the types of goods that qualify for duty drawback. “If shippers use these programs to their advantage, they can lower the landed cost of merchandise brought into the United States,” Mojica says.

The act also streamlines the investigative procedures used in anti-dumping and countervailing duties cases, while expanding the penalties. “Customs is sending a message: ‘If you don’t play by the rules, we’re hiking enforcement,'” Mojica says.

While specific timelines for implementation are yet to come, Customs likely will roll out the provisions over the next few years, Mojica says.

Changes to the Authorized Economic Operator (AEO) program in the European Union, which is part of the implementation of the EU’s Union Custom Code (UCC). The AEO concept is a main element of the EU’s Union Customs Code, which is part of an initiative to modernize customs processes. According to the European Commission, member states can grant AEO status to any economic operator meeting certain criteria, including customs clearance and compliance, appropriate recordkeeping, financial solvency, and, where relevant, appropriate security and safety standards. The benefit to gaining AEO status? It can mean swifter cargo processing through Customs.

AEO holders will benefit by gaining the ability to clear Customs more easily. For instance, they can self-assess, or provide their own documentation on their shipments. Moreover, businesses that don’t become AEO certified may need to provide financial guarantees to cover duties and VAT associated with customs warehousing, and temporary transits, among other processes.

While AEO holders may be obligated to provide financial guarantees, these may be waived or reduced in some cases, says Jacek Kapica, a Warsaw-based operations director with Sandler & Travis Trade Advisory Services.

As of May 1, 2016, businesses will have to meet new criteria under the AEO program, Kapica says. For instance, applicants will have to show they’re complying not only with customs law, but also with tax law, which wasn’t required before. AEO applicants also need to enable the customs authority to physically or electronically access their accounting systems, as well as commercial and transport records. The extent of the access required will depend on a risk analysis. “It’s a huge change,” Kapica adds.

The changes that make up the larger UCC program are scheduled for completion by 2020. At that point, customs agencies should be fully electronic. However, “the provisions are known and applicable in May 2016,” Kapica says, so countries can start implementing earlier than 2020 if they wish.

EU Antifraud Agency (OLAF). Effective Sept. 1, 2016, carriers will have to file with the OLAF container status messages that tell, for example, when a container is loaded on a ship or moves to a terminal gate. This will enable the creation of “centralized databases containing information on container movements and on the goods entering, leaving, and transiting the EU,” according to the European Criminal Law Associations’ Forum.

“Many fraudulent activities—especially cigarette smuggling or counterfeited goods—are related to container usage,” Kapica says. “The EU has decided to monitor the containers and collect information about their status. All information will be provided electronically.” Because shippers already keep such data, the requirement should not have a big impact on them, he adds.

Regulations in the United States And Around the World

The CBP and other U.S. agencies have been working with their counterparts across the globe to standardize many procedures in customs, shipping, air transport, and other areas.

For example, the U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) amended the Hazardous Materials Regulations to harmonize with international standards, including recent changes made to the International Maritime Dangerous Goods (IMDG) Code, the International Civil Aviation Organization’s Technical Instructions (ICAO TI) for the Safe Transport of Dangerous Goods by Air, and the United Nations Recommendations on the Transport of Dangerous Goods (UN Model Regulations).

The amendments have led to changes in shipping names, hazard classes, packing groups, and vessel stowage requirements, among other items. “These changes ensure that domestic hazard classification, hazard communication, and packaging requirements are consistent with those employed throughout the world,” according to PHMSA.

Voluntary compliance began Jan. 1, 2015, while compliance with the amendments generally was required beginning Jan. 1, 2016.

A Compliance Culture

While technology and systems will, not surprisingly, be critical to success in complying with many of these regulatory changes, the shifts required in an organization’s culture may be even more profound.

“All the additional regulations occurring around the world require a greater degree of process rigor,” says Sean Riley, global industry director, manufacturing, supply chain, and logistics, for IT company Software AG. Rather than depending on “back doors” to move shipments, supply chain professionals will need to incorporate upfront the processes that can ensure compliance.

For example, some shippers have been able to lean on their freight forwarders, who, in turn, could lean on enforcement agents to accept shipments with estimated, rather than actual, container weights. No longer.

“Shippers won’t be able to say to their forwarders, ‘You’ve pulled this off in the past,'” Riley says. “Now, if the shipper hasn’t provided the actual weight, the shipment won’t move.”

Instead, shippers and freight forwarders need to obtain and record the required information within their systems. While such changes may sound insignificant, supply chain professionals will need to gain an understanding of the activity, and then add rigor to their processes so they can consistently meet their compliance obligations, Riley says.

When evaluating logistics providers, shippers should ask additional questions relating to compliance. Riley suggests asking:

- How does the provider ensure that it follows correct processes throughout its organization?

- Does the provider maintain a repository of compliance best practices?

- How does the provider keep compliance processes up to date?

Given their heightened expectations of providers, many shippers will end up focusing less on price, although it will remain important, and more on value. Logistics providers who can’t provide the robustness needed to deal with increasing trade regulations won’t offer the value shippers require.

Even when they work with outside experts, shippers need to maintain a thorough understanding of the supply chain regulations with which they must comply. “Shippers need to be aware of how their supply chains operate, what the new regulations are, and how they might have an impact,” Gold says.

Top 6 Global Trade Rules: Are You Ready?

These are the regulations most likely to impact shippers in 2016:

- The staggered rollout of the U.S. Customs and Border Protection’s Automated Commercial Environment (ACE) system.

- The International Maritime Organization’s amendments to the Safety of Life at Sea (SOLAS) Convention.

- Changes to the Authorized Economic Operator program in the EU, part of the implementation of the EU’s Union Custom Code.

- Amendments to regulations to allow better tracking of containers of goods entering, leaving, and traveling across the European Union.

- Changes made by the Department of Transportation to more closely align Hazardous Materials Regulations with international standards.

- The recently signed Trade Facilitation and Trade Enforcement Act of 2015, also known as the Customs Reauthorization Bill.

Safe Port Act at Risk

The Safe Port Act of 2006 mandated that all containers coming through U.S. ports be screened. The current deadline is July 2016. According to the legislation, the screening would have to consist of either physical inspection or X-rays, says Ryan Petersen, chief executive officer with Flexport, a San Francisco-based freight forwarder and customs broker.

Currently, only a small sampling of containers is X-rayed. “To screen 100 percent of containers would require a massive investment in scanning equipment,” Petersen says. On top of that are the space constraints. And examining all containers would require redeveloping the country’s ports.

“The Safe Port Act is an unfunded mandate,” says Jonathan Gold, vice president of supply chain and customs policy for the National Retail Federation, a retail trade association. A risk-based approach would be more effective, he adds.

As to the July deadline, “I don’t think it will happen,” Petersen says. “The ports would clog up.”