Trends—August 2015

Warehouse Performance: It’s a Whole New Game

One new way to save money on warehouse labor costs is to turn work into a game. No, we don’t mean a chucking-things-across-the-warehouse-floor kind of game, but creating competition through gamification. It’s a way to drive down warehouse labor costs by increasing employee performance and morale. The process displays performance data on the warehouse floor to create incentives for employees to perform better, while also making them feel part of a company team.

“For a long time, warehouses have been looking for different ways to produce better performance within the labor force,” says Peter Schnorbach, senior director of product management at Atlanta-based supply chain software provider Manhattan Associates. “It’s a natural extension for them to jump on the gamification bandwagon.”

In one obvious way, warehouses have been gamified since they posted “x hours lost to injuries” signs on their walls. “Safety is the oldest measured performance in the book,” Schnorbach says. “Why do you think they posted it? Because it incentivized people.”

For companies that measure employee performance, that information can turn work into a competition that incentivizes whatever needs improvement, whether it’s productivity, accuracy, or still, safety.

In addition, gamification can help employees feel less isolated, especially in large warehouses where they aren’t likely to interact with each other, Schnorbach says. It can make employees more satisfied with their work, which reduces turnover—another cost saver—and maintains a happy and productive warehouse workforce.

“Exposing performance in the form of a game engages employees,” he adds. “It lets them know they are important, that how they perform is important, and that they’re contributing to the operation.”

The concept is still new to warehouses. “If you said ‘gamification’ five years ago, nobody would have known what you were talking about,” Schnorbach says. “Today you get fewer blank stares. Most people understand the concept.”

Companies are starting to incorporate the use of flat-screen TVs in the warehouse to post performance information. More sophisticated gamfication programs give employees concrete rewards; for example, employees in the top 10 receive a medallion, and then, after collecting a set amount of medallions, they receive a reward.

Gamification will become more popular in the future, Schnorbach expects, and vendors will come up with a framework to make it more standard.

—Jen A. Miller

Disrupting the Supply Chain

Disruptive technologies have the potential to rapidly redefine supply chain rules of engagement. But they’re not always a sure thing. Since 2005, radio-frequency identification (RFID) has been identified as the next major step change in logistics, but its application has been evolutionary, not revolutionary. That may yet change.

As industry continues to ride the wave of disruptive influences such as cloud computing and containerization — indeed, half a century removed, Malcom McLean’s “box” is still shaping global trade—innovators and investors are looking to identify the next big thing. From delivery drones to virtual reality, many advances are poised to create new pathways for supply chain practitioners.

To help separate fact from fancy, Inbound Logistics‘ July 2015 3PL Perspectives market research report asked more than 250 third-party logistics (3PL) providers to share their opinion on the disruptive innovations that will have the greatest impact on logistics and supply chain management in the future.

3PL providers overwhelmingly cite the Internet of Things (IoT) (42 percent) and driverless vehicles (41 percent) as the two innovations most likely to impact the supply chain. U.S. driver shortages and capacity constraints are top-of-mind concerns for shippers. Recent news that Daimler will begin testing self-driving trucks on European roads adds further credibility to survey responses. With regard to IoT progressions, semiconductor manufacturers and suppliers are already looking to lock up key precious metal resources in advance of growth expectations.

While Amazon continues to generate buzz about its drone delivery program, only 25 percent of 3PL respondents identify this as a major disruptive force in the supply chain. More surprising, 24 percent of respondents cite 3D printing as having a similar impact—equal to RFID.

New Web Platform Supports CSR

Mandates to drive corporate social responsibility (CSR) compliance are becoming increasingly common as industry recognizes the importance of aligning capitalism with conscience. A new venture spearheaded by the International Institute for Sustainable Development (IISD) aims to spark further change.

The non-profit research organization, based in Winnipeg, Canada, has launched a new web platform to support its State of Sustainability Initiatives (SSI)—a research effort that provides a bird’s eye view of sustainability standards and trends across different markets.

IISD’s long-term goal is to develop the website into an information hub for supply chain sustainability stakeholders, including procurement agents, investment advisors, CEOs, policy-makers, and NGOs.

“The SSI website will enhance global learning and understanding about the role and potential of market-based voluntary sustainability initiatives such as eco-labels, sustainability standards, and roundtables,” explains Jason Potts, associate at the IISD and author of the SSI Review.

Sustainability is yet another supply chain platform where shippers can remove silos and start integrating disparate functions, value chain partners, and industries. With regards to sustainable sourcing initiatives, many companies are looking at how to assess social, environmental, and economic impacts as they target new markets. The SSI website presents a comprehensive look not only at market trends but also the degree to which standards meet these requirements.

For example, it tracks sustainable sourcing commitments and best practices of companies, including Dole, Coca-Cola Company, Tetley, Unilever, Hershey, Home Depot, Lowe’s, Starbucks, Nestlé, IKEA, and Adidas, among many others.

“We recognize the value in using a web-based platform to reach an international community of stakeholders with business-critical information on a $31.6-billion industry,” Potts adds.n

Big Data and Big Blue Converge

Marine transport is arguably the smartest modal option when it comes to economy and environmental impact. Now, in an unlikely tandem, South Korean shipbuilder Hyundai Heavy Industries and Dublin-based consultant Accenture intend to raise that superlative even higher by integrating digital technology and data analytics into new ship designs. These “connected smart ships” will help steamship lines use digital technologies to better manage fleets and reduce costs.

Using a network of sensors that will be built into new vessels, ship owners will be able to capture a range of information including location, weather, and ocean currents, as well as on-board equipment and cargo status alerts. By applying real-time analytics to new and historical fleet data, and using data visualization technology to present these insights, users will be able to monitor a vessel’s status and condition in real time so they can make data-driven decisions that support more efficient operations.

“Businesses can gain a competitive advantage by embracing the connectivity wave underpinning the Internet of Things and integrating digital services into their products to keep pace with the next wave of innovation,” says Eric Schaeffer, senior managing director, Accenture.

With real-time data collection and exchange across vessels, ports, cargo, and land logistics, Hyundai Heavy Industries will be able to create additional services and revenue streams for customers throughout the lifecycle of ships and journeys, removing barriers between different elements of a ship’s operation.

Top Disruptive Innovations

3PLs cite these innovations as the most likely to impact logistics and supply chain management in the future.

- Internet of Things: 42%

- Driverless Vehicles: 41%

- Drones: 25%

- 3D Printing: 24%

- RFID: 24%

- Embedded Sensors: 23%

- Artificial Intelligence: 21%

- Wearable Technology: 20%

- Virtual Reality: 7%

Source: Inbound Logistics 3PL Perspectives report

Industrial Distributors Adapt Sourcing Tactics

New research indicates that changing market conditions are challenging conventional thinking among industrial distributors. The UPS Industrial Buying Dynamics study, conducted by research firm TNS, reveals that buyers are increasingly willing to purchase outside their existing supply base, especially via online channels.

The study polled 1,500 purchasing professionals to better understand factors that influence the purchase of industrial products.

Thirty-eight percent of online industrial product buyers report they are sourcing products from a new supplier (compared to 34 percent in 2013) and 72 percent say they would shift spending to a distributor with a more user-friendly website.

“Customer loyalty today is built on a different foundation than the one distributors have built over generations,” says Brian Littlefield, UPS director of industrial manufacturing and distribution marketing.

“Once price and quality standards are met, buyers are willing to explore vendors that better fit their needs, whether for a more convenient website, a better price, or simply someone who quickly answers product questions,” Littlefield adds.

The UPS report reveals four market forces impacting how distributors source product:

- Increasing buyer expectations that require a more integrated and user-friendly purchase process.

- Growth of direct-from-manufacturer purchasing and online marketplaces.

- The universal acceptance of, and demand for, B2B e-commerce.

- The purchasing habits of millennials as they become the next generation of purchasing leaders.

Purchase direct-from-manufacturer

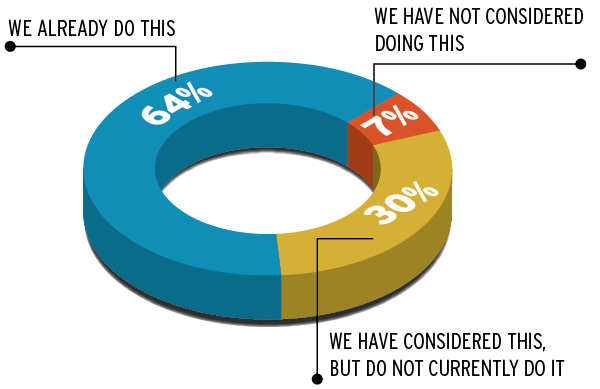

When it comes to buying direct-from-manufacturers, which of the following best describes your company?

Source: UPS Industrial Buying Dynamics