2022 Inbound Logistics Perspectives: 3PL Market Research Report

Our 17th annual 3PL market research report takes a deep-dish dive into the dynamics of logistics partnerships in 2022.

Rampant inflation, including high transportation costs. A tight labor market. Commodities shortages. Uncertainties tied to the war in Ukraine and the pandemic. There seems to be no end to the obstacles ready to frustrate shippers as they work to serve their customers and make a profit.

To clear those hurdles, shippers often form partnerships with third-party logistics (3PL) companies, outsourcing certain supply chain activities to experts with specialized resources. Inbound Logistics’ 17th annual 3PL Perspectives report shows that these partnerships constitute a popular strategy. A large majority of 3PLs in the survey tell us they have gained customers and seen revenues and profits climb in recent months.

The 2022 3PL Perspectives report presents and analyzes data collected from 3PLs and shippers to describe how those partnerships work across a broad range of 3PL services. Once you’ve chewed on the results, have a look at the Top 100 3PLs for 2022 to learn more about the service providers that help shippers build efficient and effective supply chain operations, whatever obstacles they may face.

About the 3PL Respondents

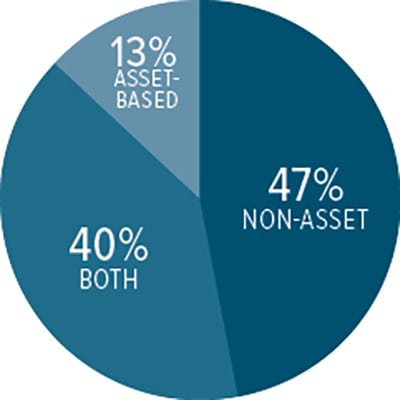

ASSET-BASED OR NON-ASSET BASED

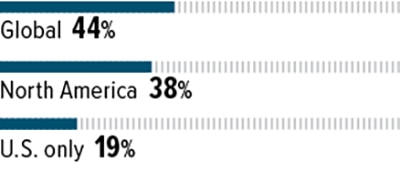

GEOGRAPHIC COVERAGE

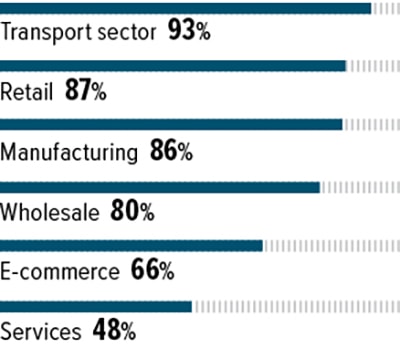

2021 REVENUE

Participants in this survey report in excess of $150 billion in gross sales in 2021.

Several did not report revenue so the total is likely higher.

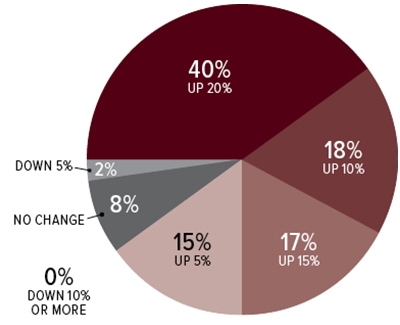

TOP CHALLENGES SHIPPERS FACE

Although the transportation capacity crunch has eased somewhat since 2021, freight rates remain high. Combine that with the challenges of an overall inflationary market, and it’s obvious why shippers are under pressure to reduce expenses.

Although the transportation capacity crunch has eased somewhat since 2021, freight rates remain high. Combine that with the challenges of an overall inflationary market, and it’s obvious why shippers are under pressure to reduce expenses.

Cutting transportation costs—not just finding lower rates, but controlling the overall costs involved in moving freight—is by far the biggest concern for shippers who responded to this year’s survey. Seventy percent named that as a crucial challenge, up from 50% in 2021.

The second most pressing challenge is finding, training, and retaining qualified labor in a tight market, cited by 55% of respondents. But the challenge that saw the biggest jump since 2021 was business process improvement. Last year, 37% of shippers named that as an important challenge, while in 2022, the number is 51%.

Another issue that has moved up the list of shipper concerns is improving customer service, cited by 38% of shippers in 2022, compared with 28% in 2021. And while only 14% of shippers say they face challenges in the area of corporate social responsibility, including sustainability, that is 10 points higher than the 4% who pointed to that issue in 2021.

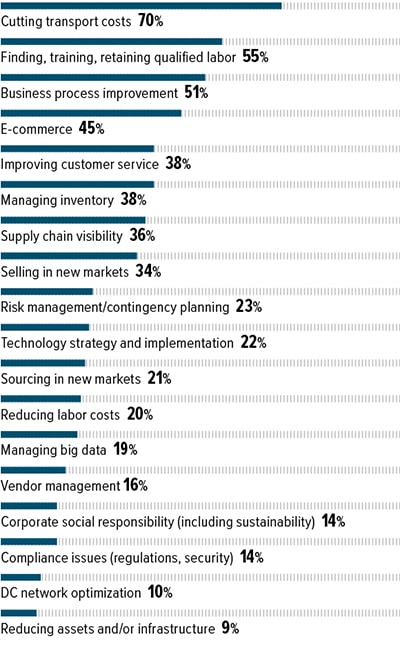

TOP CHALLENGES 3PLS FACE

Despite recent reports that it’s easier to find space on a truck or ocean vessel these days, capacity remains the top challenge for 3PLs in 2022, cited by 80% of those who responded to the survey. And even more so than shippers, 3PLs struggle with finding, training, and retaining qualified labor. This year, 70% of 3PLs named that as an important challenge.

Despite recent reports that it’s easier to find space on a truck or ocean vessel these days, capacity remains the top challenge for 3PLs in 2022, cited by 80% of those who responded to the survey. And even more so than shippers, 3PLs struggle with finding, training, and retaining qualified labor. This year, 70% of 3PLs named that as an important challenge.

But when it comes to finding and retaining customers, the picture has improved a great deal for 3PLs since 2021, when 74% of respondents named this as a challenge. This year the number is just 23%. Also, far fewer 3PLs are struggling with growth management: 29% in 2022, down from 78% in 2021.

While capacity and talent are the issues most likely to challenge 3PLs, two others stand out because of how much they have climbed the list of top challenges since last year. In 2021, only 10% of 3PLs named rising operational costs and access to capital as an important challenge. This year, 63% are concerned about how to fund their operations.

And while just 10% of 3PLs cited technology investment in 2021, over the past year that has become a concern for 46% of respondents. Given all the other challenges they and shippers grapple with today, it stands to reason that more 3PLs are looking to implement technology to make operations more efficient and support smarter supply chain strategies.

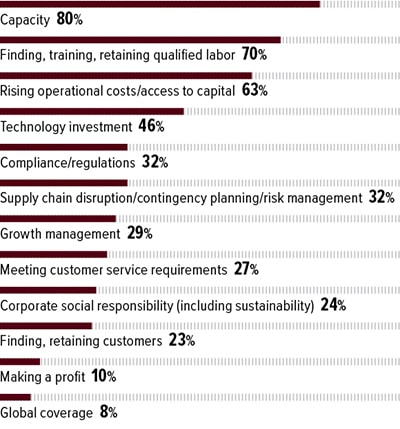

SPECIAL SERVICES 3PLs OFFER

Obviously, shippers outsource basic logistics activities to 3PLs. They rely on these partners to plan and execute freight moves, find capacity at competitive rates, store inventory, fill orders, and carry out other basic functions.

Obviously, shippers outsource basic logistics activities to 3PLs. They rely on these partners to plan and execute freight moves, find capacity at competitive rates, store inventory, fill orders, and carry out other basic functions.

Beyond that, many 3PLs differentiate themselves by offering more specialized services. The most common among them is logistics and transportation consulting.

In 2022, 78% of 3PLs in the survey said they offer services to help shippers develop effective strategies—for example, determining where to hold inventory or what combination of transportation modes offers the most effective balance between cost and service.

Another specialized service helps shippers deliver merchandise directly to retail stores without passing through distribution centers. Among the 3PL respondents, 72% offer direct-to-store service, up from 67% in 2021.

Other popular services include reverse logistics and/or product life-cycle management (61%), import/export/customs (59%), sustainability/green logistics (55%), and direct-to-home delivery (49%).

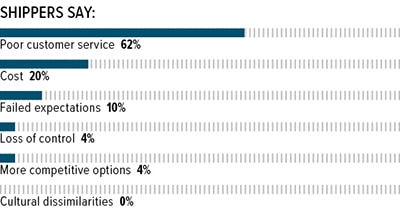

WHAT IS THE MAIN REASON FOR A FAILED 3PL PARTNERSHIP?

While cost cutting is clearly a high priority, another value is far more important to shippers than cost: great customer service. According to 62% of the shippers who took part in the survey, poor customer service is the factor most likely to torpedo a relationship with a 3PL. Another 10% cite failed expectations, which could include failure to deliver on promises or communicate clearly, both important elements of service.

While cost cutting is clearly a high priority, another value is far more important to shippers than cost: great customer service. According to 62% of the shippers who took part in the survey, poor customer service is the factor most likely to torpedo a relationship with a 3PL. Another 10% cite failed expectations, which could include failure to deliver on promises or communicate clearly, both important elements of service.

Only 20% of shippers cite cost as the top reason for breaking up with a 3PL, and just 4% say they have left a 3PL to explore more competitive options, a reason also connected to cost. But those pressures are twice as important as last year, when just 10% of shippers cited cost and 2% said they had gone in search of more competitive options.

SHIPPERS, IS PRICE OR SERVICE MORE IMPORTANT?

Facing higher prices for commodities, labor, transportation, and other essentials, shippers naturally seek opportunities to cut costs. When shippers measure the quality of their partnerships with 3PLs, cost weighs more heavily in 2022 than it did one year ago. This year, 36% of shippers told us that cost is more important than service; in 2021, the number was 21%.

Facing higher prices for commodities, labor, transportation, and other essentials, shippers naturally seek opportunities to cut costs. When shippers measure the quality of their partnerships with 3PLs, cost weighs more heavily in 2022 than it did one year ago. This year, 36% of shippers told us that cost is more important than service; in 2021, the number was 21%.

Still, service remains the essential factor for a large majority of shippers—64%. When we asked shippers why they had singled out certain logistics partners for praise, many cited the quality, variety, and flexibility of the 3PL’s service. Some shippers offered more detail, such as:

“Their excellent communication and willingness to go above and beyond for their customer.”

“Quick response, weekend support, assistance with claims.”

“Excellent onboarding process; dedicated support during start up; very responsive.”

“Great rates, easy quoting and booking process, efficient invoicing and problem resolution.”

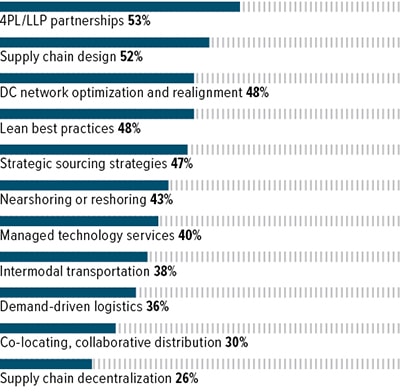

STRATEGIES SHIPPERS AND 3PLs USE TO MANAGE CHALLENGES

To keep supply chains operating smoothly, 53% of shippers and 3PLs use a fourth-party logistics provider (4PL) or lead logistics provider (LLP), having a single company coordinate the services of numerous partners. Nearly as many—52%—use supply chain design to manage challenges. Strategies focused on design can involve everything from where shippers source goods, what modes they use to transport them, what levels of inventory they keep, and how they deliver those goods to customers.

To keep supply chains operating smoothly, 53% of shippers and 3PLs use a fourth-party logistics provider (4PL) or lead logistics provider (LLP), having a single company coordinate the services of numerous partners. Nearly as many—52%—use supply chain design to manage challenges. Strategies focused on design can involve everything from where shippers source goods, what modes they use to transport them, what levels of inventory they keep, and how they deliver those goods to customers.

Shippers and 3PLs also called out several strategies that are subcategories of supply chain design. The most popular of those is distribution center (DC) optimization and realignment, a strategy used by 48% of shippers and 3PLs. Nearly as many—47%—call upon strategic sourcing strategies, collecting and analyzing data on factors such as vendor performance and supply risk to inform sourcing decisions. Forty-eight percent mentioned that they use lean best practices.

This year’s survey points to two significant strategic changes. One concerns where companies source products. In 2022, 43% of shippers and 3PLs told us they use nearshoring or reshoring to resolve some of their challenges, an 11% increase over 2021. At the same time, the principle of demand-driven logistics has become less prevalent. Thirty-six percent of respondents cited it as a strategy this year, down from 50% in 2021.

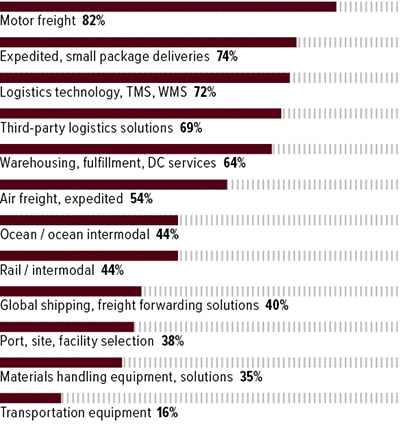

SERVICES SHIPPERS BUY

With access to a broad range of carriers at competitive rates, 3PLs are the go-to source for all manner of transportation services. Motor freight tops the list: 82% of shippers in our survey purchase over-the-road transportation through their 3PLs. Nearly three-quarters of shippers turn to logistics partners for expedited transportation and small package deliveries.

With access to a broad range of carriers at competitive rates, 3PLs are the go-to source for all manner of transportation services. Motor freight tops the list: 82% of shippers in our survey purchase over-the-road transportation through their 3PLs. Nearly three-quarters of shippers turn to logistics partners for expedited transportation and small package deliveries.

Fewer shippers purchase other modes of transportation through their 3PLs, but the numbers are still significant: 54% buy air freight or expedited services, 44% buy ocean or ocean intermodal transportation, and 44% buy rail or rail intermodal services. Also, 40% obtain global shipping or freight forwarding solutions through their 3PLs.

Shippers also rely on 3PLs to manage inventory and distribute product, often gaining broader reach, economies of scale, and flexibility when they use a logistics partner’s assets. Among shippers who participated in the survey, 64% said they buy warehousing, fulfillment, and/or DC services from 3PLs.

Besides physically moving goods through the supply chain for shippers, 3PLs often provide information technology (IT) to support shippers’ operations. Shippers could purchase transportation management systems (TMS), warehouse management systems (WMS), and other logistics solutions from vendors that operate strictly in the IT sphere. But as they implement technology for their own operations, many 3PLs are able to share those capabilities with shippers as well. In 2022, 72% of shippers said they buy logistics technology from 3PLs.

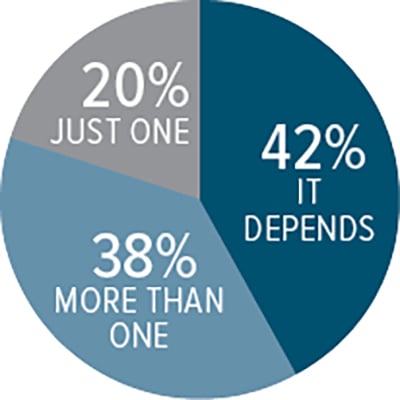

SHOULD SHIPPERS PARTNER WITH ONE OR MORE 3PLs?

What’s the ideal number of 3PLs a shipper should work with at one time? “It depends,” said 42% of shippers in our survey. In some circumstances, a shipper might benefit from the varied strengths of different partners. In others, it could be best to have a single, strong partner to serve all needs and respond to all questions. Thirty-eight percent of shipper respondents told us it’s always best to work with more than one 3PL. Only 20% prefer to rely on a single logistics partner.

What’s the ideal number of 3PLs a shipper should work with at one time? “It depends,” said 42% of shippers in our survey. In some circumstances, a shipper might benefit from the varied strengths of different partners. In others, it could be best to have a single, strong partner to serve all needs and respond to all questions. Thirty-eight percent of shipper respondents told us it’s always best to work with more than one 3PL. Only 20% prefer to rely on a single logistics partner.

3PL Services + Capabilities

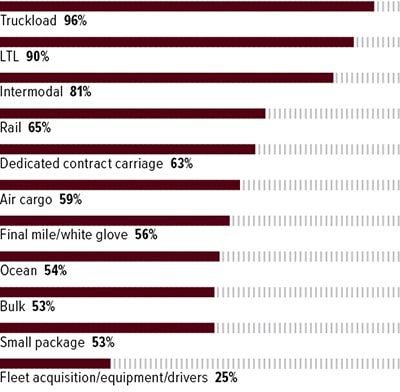

TRANSPORTATION

If you need truckload transportation, almost any 3PL in the survey—96% of them—can help. Ninety percent provide less-than-truckload (LTL) transportation, and 81% include intermodal in their portfolios. More than half of the 3PLs can execute freight movements by rail, air cargo, or ocean, or can provide specialized services such as dedicated contract carriage, final mile or white-glove delivery, bulk shipping, or small package delivery.

If you need truckload transportation, almost any 3PL in the survey—96% of them—can help. Ninety percent provide less-than-truckload (LTL) transportation, and 81% include intermodal in their portfolios. More than half of the 3PLs can execute freight movements by rail, air cargo, or ocean, or can provide specialized services such as dedicated contract carriage, final mile or white-glove delivery, bulk shipping, or small package delivery.

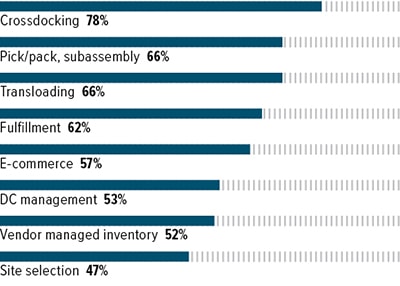

WAREHOUSING

Shippers that outsource warehouse operations can call on many 3PLs for crossdocking, pick/pack and subassembly, transloading, and fulfillment. More than half of our respondents provide services related to e-commerce, DC management, or vendor managed inventory.

Shippers that outsource warehouse operations can call on many 3PLs for crossdocking, pick/pack and subassembly, transloading, and fulfillment. More than half of our respondents provide services related to e-commerce, DC management, or vendor managed inventory.

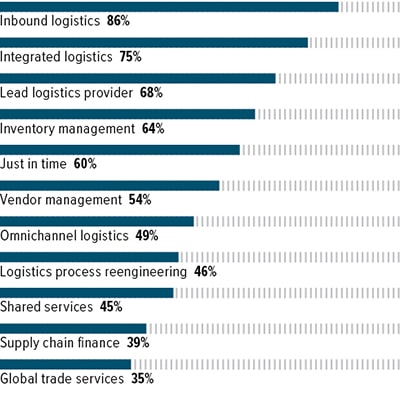

LOGISTICS

The most commonly offered 3PL logistics services focus on inbound moves (86%). Many respondents can take a holistic approach to a shipper’s needs, either by providing soup-to-nuts integrated logistics services (75%) or orchestrating the services of several partners as a lead logistics provider (68%). More than half of respondents offer inventory management (64%), just-in-time logistics (60%), or vendor management (54%).

The most commonly offered 3PL logistics services focus on inbound moves (86%). Many respondents can take a holistic approach to a shipper’s needs, either by providing soup-to-nuts integrated logistics services (75%) or orchestrating the services of several partners as a lead logistics provider (68%). More than half of respondents offer inventory management (64%), just-in-time logistics (60%), or vendor management (54%).

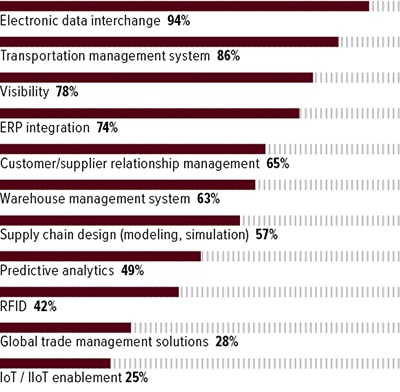

TECHNOLOGY

Although newer technologies have emerged to help companies share data, electronic data interchange (EDI) remains important in logistics, and 94% of 3PLs provide that capability. Many also offer IT solutions to support day-to-day logistics operations, such as transportation management (86%), visibility (78%), customer/supplier relationship management (65%), and warehouse management (63%). In addition, 3PLs offer technology to help shippers evaluate their operations and plan improvement, such as supply chain design solutions (57%) and predictive analytics (49%).

Although newer technologies have emerged to help companies share data, electronic data interchange (EDI) remains important in logistics, and 94% of 3PLs provide that capability. Many also offer IT solutions to support day-to-day logistics operations, such as transportation management (86%), visibility (78%), customer/supplier relationship management (65%), and warehouse management (63%). In addition, 3PLs offer technology to help shippers evaluate their operations and plan improvement, such as supply chain design solutions (57%) and predictive analytics (49%).

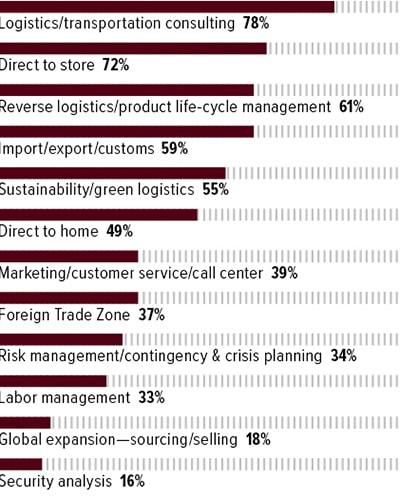

Sales/Customer Base/Profits

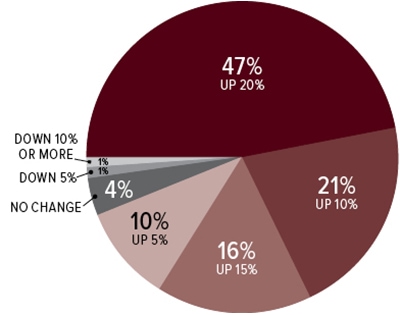

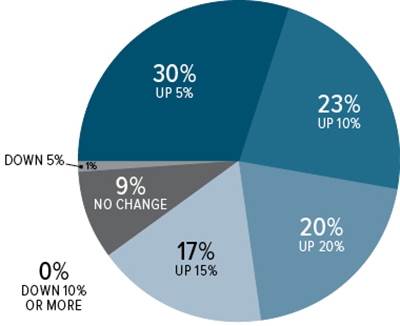

SALES: DURING YOUR LAST MEASUREMENT PERIOD,

WERE SALES UP OR DOWN? BY HOW MUCH?

PROFITS: DURING YOUR LAST MEASUREMENT PERIOD,

WERE PROFITS UP OR DOWN? BY HOW MUCH?

CUSTOMER BASE: DURING YOUR LAST MEASUREMENT PERIOD,

DID YOUR CUSTOMER BASE GROW OR SHRINK? BY HOW MUCH?

When the world throws major challenges at shippers, that gives 3PLs a chance to shine. That’s the story today, as the 3PLs in our survey demonstrate. Ninety-four percent of them reported increased sales in their last measurement period, even better than the 88% who conveyed that good news in 2021. Ninety percent saw their customer bases grow, and 90% said they’re enjoying greater profits than our survey showed one year ago.

Those gains look even more impressive when we drill into the specifics of 3PLs’ growth. Sixty-three percent of 3PLs saw sales increase by 15% or more, and another 21% reported sales up by 10%. Profits didn’t quite keep pace with revenues, but a healthy 57% of 3PLs said their profits were up by at least 15%, and another 18% reported a 10% gain. 3PLs did not gain customers at the same rate as profits—only 37% reported increases of 15% or more on that measure. But only 1% of 3PLs lost customers in their most recent measurement period, and that by only 5%.

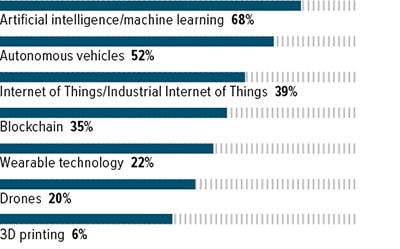

MOST IMPACTFUL TECHNOLOGIES

When leaders at 3PLs look across the landscape of technologies with potential to transform supply chains, artificial intelligence and machine learning emerge as the most likely disruptors, cited by 68%. And although we don’t yet see fleets of driverless trucks hauling goods across the interstate highway network, more than half of respondents ranked autonomous vehicles among the most impactful technologies. Some of those 3PLs may already be using this technology on a smaller scale, in the form of autonomous robots in the warehouse.

When leaders at 3PLs look across the landscape of technologies with potential to transform supply chains, artificial intelligence and machine learning emerge as the most likely disruptors, cited by 68%. And although we don’t yet see fleets of driverless trucks hauling goods across the interstate highway network, more than half of respondents ranked autonomous vehicles among the most impactful technologies. Some of those 3PLs may already be using this technology on a smaller scale, in the form of autonomous robots in the warehouse.

Beyond those two forms of digital innovation, no other technology received a majority vote. But a solid 39% of 3PL respondents said the Internet of Things/Industrial Internet of Things (IoT/IIoT) will influence the supply chain, and 35% look to blockchain technology to bring important changes.

Notably, very few respondents—only 6%—cite 3D printing as a potential disruptor. Clearly, leaders at 3PLs foresee that we will continue to transport goods as needed, not simply print up components or finished products on the spot.