Block and Tackle: How to Choose a Freight Bill and Audit Payment Provider

Interest in freight bill audit and payment (FBAP) providers has gained momentum in recent years as the demand for experts to manage transactions between shippers and carriers grows. FBAP providers can help shippers contend with complex transportation processes, while also bringing fresh tools and expertise that can add strategic value to shipper operations.

The freight bill audit and payment market has exploded in recent years and includes providers with diverse service offerings.

“The majority of players in the freight bill audit and payment space provide niche services that focus on one or two transportation modes,” says Josh Miller, vice president of sales for Memphis-based CTSI-Global. “The level of technology and the support model can vary significantly from provider to provider.

“It’s important for shippers to choose the freight audit provider that best meets their specific needs, both from a technical and support perspective,” he adds. “Not all freight audit and payment companies are alike.”

For shippers, the question becomes how to navigate the market of FBAP providers and identify the partner who is the best fit for their operation.

Who Needs a Provider?

Opinions vary about the categories of shippers that are clear candidates for enlisting an FBAP provider. In general, an FBAP provider makes sense for many types of shippers.

“Shippers with a modest and diversified transportation spend can and should consider using the services of an FBAP provider because their support extends beyond logistics activities—they support financial teams as well,” says Scott Matthews, president, freight audit and payment, AFS Logistics, based in Shreveport, Louisiana. “They are specialized and equipped with the operating systems to perform these services at significantly less expense than performing them internally.”

Companies with $500,000 in freight spend, not including parcel, should consider enlisting outside help.

“The cost/benefit and value proposition are beneficial from a purely economical perspective,” says Allan J. Miner, president of Cleveland-based CT Logistics. “A freight bill and audit payment provider can perform the required steps—if they are ISO [International Organization of Standardization] and SOC [System and Organization Controls] certified—at a fraction of the cost than a shipper’s internal accounts payable department trying to audit, pay, and accrue the open liabilities until payment is effectuated.”

Large, complex companies—including those that are decentralized and have a global presence—are obvious candidates for using a provider because they have “a lot of moving parts and different business groups and regions to consider,” says Jeff Carlson, vice president, global sales and marketing, for St. Louis-based Cass Information Systems.

The right FBAP provider not only gives those businesses a more efficient process, but also provides better data about their freight payment transactions that they can use for improved planning, he adds.

Don’t Leave Money on the Table

Meanwhile, shippers should partner with a freight bill audit and payment provider when their annual freight spend exceeds $10 million.

“Carriers consistently invoice 3-5% of your total transportation spend incorrectly,” Miller says. “If you’re not auditing every charge on each invoice, or if you don’t have visibility to your shipment level globally, then you’re leaving money on the table.”

Here are practical tips for choosing the right FBAP provider for your company.

Design your provider selection process with a sharp eye on their unique operation and needs. Thoroughly understanding those needs is a crucial first step.

“It’s important to identify and document your company’s needs prior to engaging the freight bill audit provider,” Miller says. “Solicit feedback from all departments—finance, transportation, IT, purchasing—that will be impacted by outsourcing the freight audit process.

“Once you have the requirements documented, then research freight audit providers to identify a handful that you feel may be able to meet your requirements,” he adds. “Distribute a detailed request for proposal (RFP) document with sections on operations, finance, technology, and support for both you and your carriers. Then create a scoring system to weigh the supplier responses.”

Miner agrees shippers seeking providers should tailor their inquiries and search to their unique operation, making sure any provider is a good fit.

“Shippers should base their evaluations on the specific solutions they need from the provider,” Miner says. “This includes allocating each shipment’s freight cost to the SKU level and apportioning the cost breakdown by the shipper’s specific internal accounting system general ledger numbers.”

Choose a provider that understands the process nuances specific to their industry, as details and practices can vary by industry.

“Especially with larger companies, it’s good to make sure that the provider you’re considering has at least a good working knowledge of your industry,” Carlson says. “That ensures, especially during the implementation process, that what’s being put in place actually will support your other business needs.”

Ask prospective providers detailed questions related to their capabilities unique to each mode within your network to ensure they can support all the carriers and modes you use.

Make sure providers can support all countries within your global footprint.

“The biggest difference between implementing freight audit solutions in North America versus other regions is understanding the local regulatory and tax requirements,” Miller says. “Global freight audit is not ‘one size fits all.’ Each country has its own unique requirements that must be accounted for.

“It’s important that the freight audit provider has the necessary knowledge and experience within each required country,” he adds.

For that reason, Miller advocates drilling down into a provider’s capabilities rather than accepting their surface claims.

“It’s easy to put together a flashy presentation that claims a provider can support certain processes,” Miller says. “But to truly gauge a freight audit and payment provider’s capabilities, request to see specific scenarios demoed within their system. The more specific you can be in your scenarios, the better.”

Exceptions and Added Value

Evaluate a potential partner’s emphasis on customer support. Of particular interest is how providers contend with exceptions or discrepancies in the invoice process.

“Look for a provider that takes a proactive approach to supporting their customers,” Miller says. “You want a provider that actively troubleshoots exception invoices to identify root causes as opposed to a company that puts the burden on you by just slotting the invoices to the customer exception portal.”

Verify that a prospective provider can offer more than just access to a platform to process their transactions.

“Exceptions will exist so having a provider that identifies the root cause to correct immediate issues while implementing solutions to resolve them is of significant value,” Matthews says.

Tech tools and automation are critical but must be accompanied by expertise and collaboration.

“While technology provides for improved velocity, it’s important for the service provider to demonstrate their integrated exception management functionality,” Matthews says. “Managing exceptions requires oversight from the carriers, shippers and the FBAP provider.

“Shippers seeking to choose an FBAP provider should evaluate these processes significantly as it’s the exceptions that can cause disruption in relationships and services performed by all parties,” he adds.

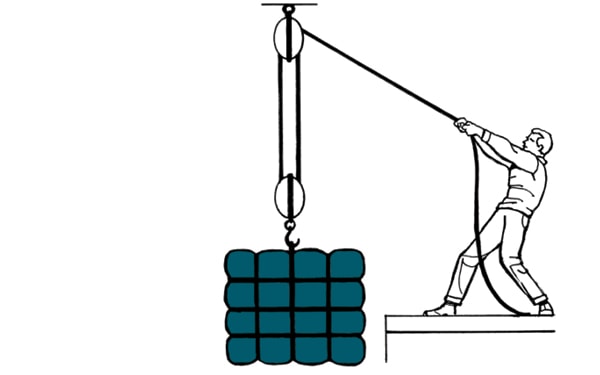

First and foremost, a provider must be able to manage basic “blocking and tackling” responsibilities, such as taking in freight bills, but he says shippers, especially large ones, should be looking for what other products and services providers have to offer.

“Can a provider do claims management, for instance, or do they have a program that will help facilitate a working capital goal of extending payment terms out, but not in a way that hurts carriers?” Carlson says. “It’s a question of identifying value points.

“Freight payment is a relatively commoditized business,” he notes. “It’s the other services—such as consulting and expertise—that can help a business grow.”

Finding the Best Fit

Ask an array of key questions during the selection process.

Shippers considering providers will want to ask about their IT infrastructure and the security protocols that protect the shipper’s data, Miner says. A provider should have full-time, in-house IT staff and experienced freight auditors for all relevant modes of transportation, among other considerations.

Client tenure is a positive sign.

“Being in this business for years and having tenured clients are good indicators that the provider is worthy of closer consideration,” Matthews says.

Ask for a list of references specific to your industry and geographic region, and poll your carriers.

“A lot of trucking companies have dealt with multiple providers, and they can probably feed you open and accurate information—at least from their viewpoint—about a provider you are considering,” Carlson says.

Investigate the length of service among team members, including the senior management team.

“Is there high employee turnover?” Carlson says. “What is the length of experience at that company? If they are churning through a lot of people within a year or two, it could be a sign of other issues.”

Meet with the provider’s principals and the key staff supporting their operations.

“If you’re going to make an investment in a relationship, get to know people before you sign a contract,” Carlson says. “There’s no business relationship where everything goes perfectly. When a problem does pop up, can you work together as a team to resolve the problem and move forward? That’s a big piece of it.”

Technology, Cost, Trustworthiness

Tech-based tools and how they can serve shippers are also important considerations.

“The real thrust of FBAP business today is actionable information that shippers receive via the web or create from their FBAP provider’s website with ad hoc reports,” Miner says.

Even so, providers must prove their tech capabilities.

“It’s important that the freight audit and payment provider demonstrate their commitment to technology,” Miller says. “Do they offer a modern, feature-rich platform? Do they offer a robust reporting package with dashboard analytics? Do they offer additional capabilities, such as a transportation management system, that can drive additional value?”

Providers must demonstrate they are investing in technology with an eye not only on the present but also on the future.

“Are FBAP providers investing in technology not only for today but for the next three to five years?” Carlson asks. “How well do they understand it? Freight payment providers deliver the most value for clients who have been up and running for a while through data analytics.”

Selecting the provider with the lowest fees could lead to higher costs down the road through higher freight spending than would occur with a provider with higher fees who is more adept at catching overcharges and mischarges.

“Securing a quality service has a marked difference in cost over a bargain service, but price is only part of the overall picture,” Matthews says.

Similarly, Carlson warns against turning the search for a provider into “a pure procurement exercise looking for the lowest cost,” particularly for large, complex enterprises.

“The lowest cost is not always the best, because the question becomes, ‘What am I losing in terms of value?'” Carlson says. “Also, the more efficient and experienced the FBAP, the less your own resources will still need to be involved. That’s very big for shippers.”

Transparency is a critical must-have, and one that shippers should be clear will be part of any provider relationship.

“FBAP providers must offer transparency into data and processes and have the trust of all parties—shippers and their carrier network,” Matthews says. “All parties involved should work to accelerate the velocity of the payment process and eliminate errors resulting in inaccurate information and overcharges.

“The objective,” he adds, “is to get freight bill payment and audit done right and expeditiously.”