Freight Is Fraught

The double-whammy of skyrocketing fuel prices and out-of-control inflation has put a hurt on the freight industry. So have flattening modal growth trajectories, seasonal factors, and softening demand.

So says the new edition of the Cowen/AFS Freight Index, which provides predictive pricing tools for such sectors as less-than-truckload (LTL), truckload (TL), and parcel shipping (separately focusing on express and ground).

Inflation is working as a double-edge sword: while pushing prices up, it also is limiting demand by slowing purchasing power, according to Tom Nightingale, CEO of AFS. Compared to a record-breaking Q1 in the previous report, the new report indicates that growth trends are more likely “to subside but not tumble,” with the index remaining elevated in comparison to its 2018 baseline and annually.

“Businesses are shifting modes and re-optimizing carrier networks proactively to limit their exposure to higher pricing, but carriers are using fuel surcharges and other accessorials as subtle but effective tools to expand revenue,” Nightingale adds.

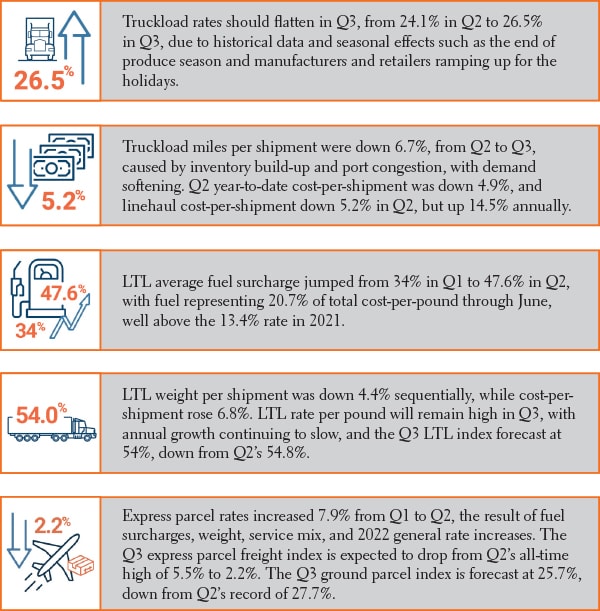

Other takeaways:

The better-than-expected pricing trends data in the TL findings may be related to capacity coming out of the marketplace, which Cowen notes could be at a rate higher than expected. “That said, we are still cautious on TL pricing in Q4 2023 due to the macro-economic backdrop,” says Jason Seidl, a Cowen analyst.