The New (Ab)Normal: Reshaping Business and Supply Chain Strategy Beyond COVID-19

What businesses have done during the chaos of the pandemic, and what they are likely to do in the coming months and years to ensure they survive the virus and thrive afterwards.

Excerpted with permission from The New (Ab)Normal: Reshaping Business and Supply Chain Strategy Beyond Covid-19 by Yossi Sheffi, MIT CTL Media, Cambridge, Mass.

Find out more: bit.ly/TheNewAbNormal

ABOUT THE AUTHOR

Professor Yossi Sheffi is Director, MIT Center for Transportation and Logistics; Elisha Gray II Professor of Engineering Systems; Professor, MIT Civil and Environmental Engineering; and Professor, MIT Institute of Data Science and Society. He is an expert in systems optimization, risk analysis, and supply chain management.

Much has been written about the personal stories of COVID-19 victims, how scientists raced to understand and treat the disease, and how governments did (or did not) take steps to protect their citizens. Less has been written about the impact of COVID-19 on the fabric of the global economy and how companies had to rapidly and radically change their operations in the face of disrupted supply, hoarding, government mandates, and the desperate need for medical supplies.

COVID-19 made clear we cannot simply turn off the economy and all shelter in place. Someone somewhere must still make and deliver the daily necessities (and luxuries) of life. Someone somewhere must still make and deliver the huge volumes of healthcare-related supplies required to treat the sick and prevent the uncontrolled spread of the disease. Civilization depends on supply chains to convert the bounty of the planet into the products we need and then deliver those products to 7.8 billion human beings at a price they can afford. When a virus, a government edict, or a recession hits hard, it tests the people and processes that keep the physical side of civilization running.

Managing for Whack-a-Mole Supply

In the ongoing pandemic and post-pandemic worlds, suppliers may fail to handle orders for many reasons. A new cluster of infections in a supplier’s facility or community might force a closure. Financial damage to the supplier—especially if the supplier depends on heavily impacted industries such as tourism, hospitality, or commercial aircraft manufacturing—might cause bankruptcy. And, of course, the world’s usual disruptions in the form of typhoons, earthquakes, floods, and other natural disasters continue whether there’s a pandemic or not.

"We experience new headwinds every day," said Darius Adamczyk, chairman and CEO of Honeywell. "But we continue to monitor our supply chain, work closely with our suppliers, and respond swiftly when new challenges arise." Managing the risk that supply won’t meet demand depends on a combination of planning, monitoring, and reaction.

Prepare for Disruptions

Before companies can prepare effectively, they need to understand the risk landscape. That means classifying potential disruptions according to how likely they are to occur and, if they do occur, how damaging can they be. These dimensions help prioritize the risks.

A third classification dimension is how quickly can risks be spotted, which helps the company think about monitoring systems and the required timelines for response to different threats.

Companies can then prepare for supply disruptions in several ways:

1. Build in redundancy. Supply chain redundancy mainly involves extra inventory and multi-sourcing, which aren’t without their own downsides. Extra inventory is expensive as it incurs inventory holding costs. Worse, it may affect product quality in that workers may find it easy to "take one from the pile" when encountering a damaged part or product rather than fix any underlying cause.

This insight was one of the roots of Toyota’s original success in building affordable, high-quality cars. Multiple suppliers mean that the company is less of an important customer to any one supplier, and its volume with each is low, leading to higher costs.

In addition, the greater the number of suppliers, the higher the risk that one of them may become involved in a social justice or environmental breach, dragging down the company’s reputation and sales.

2. Build in flexibility. Flexibility involves several elements, including:

- Cross-training employees so they can be moved around to places where they are needed.

- Standardizing parts and products so that they are interchangeable.

- Postponement, or late customization, which involves delaying the time when products are committed to a certain product variant or customer.

- A flexibility culture.

A corporate culture of flexibility has several distinguishing characteristics: a norm of speaking the truth to higher-ups freely; letting the people closest to the problem make decisions when there is no time for hierarchical approval processes; and allowing deference to expertise rather than corporate rank during a disruption.

Companies that are good at responding to disruptions are typically organizations that are disrupted frequently and cognizant of risks, such as the military, airlines, and high-risk operations like nuclear or chemical plants.

3. Develop early detection capabilities. One of the most effective ways to understand overall risk exposure and enable early warning is to know all the locations of suppliers’ facilities that make all the parts that go into the company’s products and which customers buy products that use these parts.

Armed with such a map, a company can pinpoint where natural disasters or a COVID-19 outbreak is taking place, and decide which of its parts supply, product deliveries, and customers will be affected. However, creating supply mapping is not something that can be done in the heat of the moment.

Where are the Suppliers?

In 2005, Bindiya Vakil got her master’s degree in supply chain management from the MIT Center for Transportation & Logistics. She joined Cisco in Silicon Valley, where her experience with several supply chain disruptions over five years showed her that companies did not know where their suppliers’ facilities were.

In an interview, she explained, "The address we had was a corporate office or their ‘ship from’ location, not the plant where the items were made."

Getting that supplier factory location data for every part from every supplier is laborious for both the company and its suppliers. For example, Cisco had more than 1,000 suppliers, including four large contract manufacturers, and purchased 50,000 types of parts going into more than 12,000 products in over 200 product families.

Many of Cisco’s suppliers were also large companies such as Flex, which had more than 100 manufacturing locations around the world and 16,000 suppliers of its own. Staff at Cisco would need to contact each supplier and ask where it made each part, while staff at all the suppliers would need to track down all that location data for all the parts they sold to Cisco.

If many companies tried to map their supply chains, then suppliers would be inundated by requests for location data from all their customers.

Vakil understood that for cost-effective mapping of supply chains involving multiple companies and multiple suppliers, the information "needs to be flowing through a single platform." A third-party service provider could get much of the data once from each supplier and amortize the information collection costs over multiple customer companies.

Mapping and Monitoring

Vakil left Cisco and founded Resilinc in 2010, with the goal of mapping and monitoring all of the facilities of a company and its suppliers.

For industries in which a mapping company such as Resilinc has documented the supply chains of a few original equipment manufacturers (OEMs), mapping a new OEM is relatively quick because companies in the same industry often use many of the same suppliers.

Vakil explained the leverage a single platform offers: "Supplier A could sell five parts that are made at three sites to customer X and 25 parts made at all 80 sites to customer Y. Each customer will get that tailored view. But to the supplier, it’s less work because they had to do this work once, and the system parses the data intelligently to 50 customers over time."

The next step in this exercise is to cross-reference the bills of materials (BOMs) of the company’s products with the suppliers’ locations that make each part to identify which products and how much revenue are at risk in the event of a disruption at a given supplier location.

Finally, combining this product risk data with customer order data allows the company to determine which customers might be affected by a disruption at that supplier location. This data is then combined with a global alert system, so that when a supplier location experiences a disruption, the company can know immediately which products will be in short supply, which customers may be affected, and how much revenue is at risk.

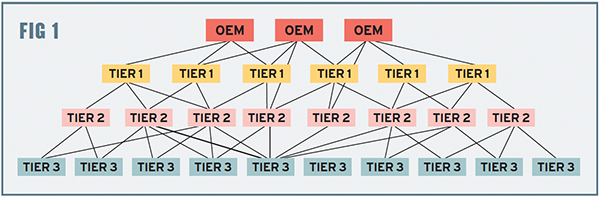

FIGURE 1: AN INDUSTRY SUPPLY CHAIN SCHEMA

This schema depicts an industry’s overall supply chain with three OEMs drawing on a deep pyramid of tiers of suppliers.

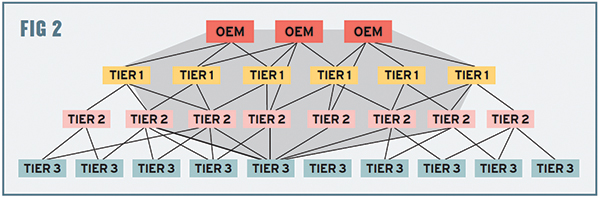

FIGURE 2: A DIAMOND SUPPLY CHAIN SCHEMA

Unbeknown to the OEM, many of its deep-tier suppliers may rely on a single supplier. In other words, instead of a broad pyramid industry supply chain structure as shown in Figure 1, the supply chain structure looks more like a diamond in this case.

Risky Diamonds and Clusters

When people who are not supply chain experts think about a company’s suppliers, they typically think of its direct suppliers: those who send material to the company and get paid by it. These are known as the company’s Tier 1 suppliers.

Note that each of a company’s Tier 1 suppliers has its own suppliers—they are the company’s Tier 2 suppliers. The Tier 2 suppliers have their suppliers, who are the first company’s Tier 3 suppliers, and so on. Like a big family tree, a supply chain extends all the way back to the raw materials suppliers, such as the farmers who grow food or miners who extract ore.

In a given industry, the competing OEMs often share suppliers, although each OEM might have some unique Tier 1 suppliers, too (see Figure 1).

Typically, companies don’t know who their deep-tier suppliers are. Direct suppliers tend to be reticent about their own suppliers, because they consider it proprietary information that is part of their competitive advantage.

Lack of visibility into the deeper tiers leads companies to encourage (or require) that their suppliers manage their own supplier risks and develop business continuity protocols. A March—April 2020 survey of senior supply chain executives by the World Economic Forum found that 53% of companies were supporting suppliers with analysis on their COVID-19 risks in order to mitigate the risks for these suppliers.

COVID-19 also provided an added impetus for many companies to diversify their supply sources by adding second and third suppliers for a given part or service. An April 2020 PwC survey of U.S. CFOs found that 56% of companies were planning to develop additional alternate supplier options.

Sometimes, however, multi-sourcing doesn’t reduce the risk because of two supply chain phenomena that create hidden risks in the supply chain, especially the deeper tiers.

The first issue is that, unbeknown to the OEM, many of its deep-tier suppliers may rely on a single supplier. In other words, instead of a broad pyramid industry supply chain structure as shown in Figure 1, the supply chain structure looks more like a diamond in this case, as shown in Figure 2.

The problem of the diamond structure can be seen in the example of the Evonik disruption. In March 2012, an explosion and devastating fire destroyed an Evonik chemical factory in Marl, Germany. The factory made cyclododecatriene (CDT), a clear liquid that smells like turpentine. Chemical manufacturers use CDT to make cyclododecane and then laurolactam.

None of these three obscure chemicals are in the BOMs of any car, which may be why car makers were initially unaware of the event.

However, plastics manufacturers use laurolactam to make polyamide-12, also known as PA-12, a tough plastic used to make strong, lightweight parts. PA-12 helps car makers reduce the weight of vehicles to meet green goals for fuel economy. At the time, cars averaged 46 pounds of PA-12 and related nylons scattered across dozens or hundreds of different parts (tubing, gears, housings, and more) made by many different suppliers.

That one Evonik factory had been responsible for about 40% of the world’s supply of CDT; the loss of the factory severely curtailed supplies of PA-12 to all the makers of parts made from PA-12.

The accident almost brought the entire automobile industry to its knees. Only quick collaboration among eight competing automakers and 50 suppliers helped the industry avoid a significant disruption.

A second category of deep-tier risk comes from an economic phenomenon known as industrial clusters, in which many companies and suppliers in a particular industry co-locate to be near each other in order to take advantage of a talent pool, natural resources, knowledge exchange, or government support.

Examples include Detroit for automobiles, Silicon Valley for chips, and Hollywood for movies.

Clusters are a favorite strategy of government economic development efforts, because once clusters reach a certain scale, they foster a natural positive feedback loop. As they grow, they become more attractive to more industry players, and their rate of growth accelerates. Thus, governments only have to "prime the pump" to achieve economic development.

Moreover, clusters attract investment in related infrastructure and education, making the cluster renowned for its signature product.

While clusters can create a competitive advantage, they also create a concentration of geographical supply chain risk. For example, in 2011, floods in Thailand disrupted 35% of the entire hard disk industry. Four of the five top suppliers of drives all had facilities or key suppliers clustered in Thailand. The shortage of hard disks prevented PC makers from fulfilling demand.

Monitoring the Supply Chain

Early detection of a disruption and recognition of its implications allow a company to find alternative supply sources, alert customers, change manufacturing plans, and, in general, be proactive.

This is particularly important as disruptions, such as COVID-19, may affect all suppliers in a given industry. Reacting ahead of competitors may be the difference between a successful response and a failed one.

One of the important initiatives a company has to focus on is monitoring and sensing the health of its suppliers. In fact, the April 2020 PwC survey of CFOs in the United States found that 54% of companies were planning to gauge the financial and operational health of suppliers as a result of COVID-19.

Companies monitor the health of their suppliers via special services (such as Dun & Bradstreet for public companies), banking relationships, news media, social media, and information collected by local tiger teams. They watch for layoffs, scandals, morale problems, turmoil in upper management, and financial troubles. Even something as simple as a dirty or messy factory can signal a potential problem.

In many cases, suppliers’ operational hiccups (e.g., product defects, late deliveries, incomplete orders) signify that management is preoccupied by issues other than customer service. During the pandemic, supplier monitoring included assessment of the infection risks associated with a supplier’s HR practices that might force a facility shutdown, as happened in a number of meatpacking plants in the United States, Germany, and elsewhere.

A variety of third-party news filtering services can help gather, curate, collate, and prioritize new events from around the world. In the case of COVID-19-related disruptions, daily data on new infections and government-published criteria for economic reopening or closing can help judge the risks of the infection affecting suppliers. Superimposed on a supply chain map with all the company’s BOMs, risks to products and revenues can be assessed quickly.

A key part of the monitoring process is assessing, filtering, and prioritizing the never-ending stream of bad news to decide which events can be ignored, investigated, or deftly handled with a minor tweak; and which events require alarm bells and all hands on deck.

Mitigating Impacts

As was the case during the 2008 financial crisis, the COVID-19 crisis made companies worry about the financial health of their suppliers. In early 2020, many took steps to support smaller, more vulnerable suppliers.

For example, defense contractor Lockheed Martin advanced more than $50 million to small- and medium-size enterprises in its supply chain. Telecom company Vodafone committed to paying its European suppliers within 15 days (down from the standard 30- to 60-day payment terms).

The World Economic Forum survey showed that such practices were quite common. Indeed, 49% of companies were guaranteeing purchase of supplies, 46% were paying suppliers in advance, and 40% were paying suppliers a premium to offset the costs of additional precautions imposed during COVID-19. A scant 1% of companies surveyed were taking no actions to mitigate the immediate impact of the pandemic on suppliers.

Rapid Reaction

As demand for granola bars surged among panicked consumers hoarding for a pandemic Armageddon, General Mills was shocked to learn in late March that a supplier wouldn’t be able deliver cranberries for a week.

"Within 24 hours, we were able to get a new supplier qualified and new product in," said John Church, the top supply chain and logistics executive at the company. Granola bar production never ceased.

As the example shows, once a company spots a problem, it can react with urgency before customers are affected. That rapid reaction can include accelerating the deliveries of inventories throughout the supply chain, finding and contracting for materials from alternative suppliers, and securing logistics capacity as needed to manage the disruption.

Redundancy provides the first line of defense in any disruption. For example, Hershey built inventory in anticipation of COVID-19’s effects.

"As the situation began to unfold," said Michele Buck, CEO at the chocolate maker, "we built inventory in both raw materials and finished goods to mitigate risk and to help us to continue meeting demand."

Even without disruptions, and despite companies’ focus on lean management principles, inventory kept in various tiers of the supply chain (including in transit) can provide a buffer of days, weeks, or even months.

The other element of redundancy is multi-sourcing. However, many companies found that their sources were concentrated in certain hard-hit areas and thus had to quickly seek alternative suppliers in less-affected regions. This involved determining capacity, validating quality, and quickly negotiating delivery contracts.

A frantic search for additional supplies during a disruption comes with additional risks: counterfeit or substandard parts from unknown suppliers. In March 2020, the Netherlands recalled 600,000 defective N95 masks it had bought from a Chinese supplier. The Centers for Disease Control and Prevention in the United States even created a web page depicting dozens of different kinds of counterfeit N95 respirators that buyers needed to avoid.

Desperation is the mortal enemy of prudence and the best buddy of avarice.

Disruptions also often require additional transportation capacity: for instance, to move inventory ahead of a regional COVID-19 shutdown or approaching hurricane; move parts from alternative suppliers; redistribute finished goods to fulfill demand; or bring recovery supplies (e.g., PPE) to the disrupted area.

Often, these shipments must be expedited to help accelerate recovery or prevent late deliveries to customers. Thus, rapid reactions to a disruption entail quickly arranging rapid transportation.

Reacting with urgency helps in any large-scale disruption such as COVID-19 that hits multiple companies in an affected region at the same time. As each impacted company seeks resources, those companies with faster reflexes have a better chance of securing all they need and can recover faster than the laggards.

Finally, in situations where supply simply cannot meet total demand, companies have no choice but to deliver less total product than customers would wish for or would have ordered.

Between the deep uncertainties wrought by the pandemic and the inability to travel or even go to the office, companies and managers sought understanding—and, in particular, visibility—into what was taking place throughout their global supply chains, and some semblance of control through data. Where is the shipment? When will the part be in stock again? How much product does the customer really need? Is the quality of a new supplier as good as they claim? Can the supplier make the quantity it promised by the deadline?

In the computer era, data has always been a source of competitive advantage. With COVID-19-imposed restrictions on in-person gatherings, data and its analysis became even more important. People needed to know what was really happening in the supply chain to separate fact from fiction and fear from reality. More broadly, the trend toward more data from more parts of the supply chain is a trend toward more control of the supply chain through digital technologies.

Those technologies also enable contact-free operations—reducing the need for workers to touch potentially infectious surfaces or come close to other workers. Importantly, the technologies create data streams that enable process improvements.

Better Shipment Visibility

Express parcel carriers like UPS and FedEx pride themselves on offering almost real-time shipment movement visibility for shippers and consignees. By scanning every package at handover points along the journey, these carriers can show the customer the progress of their shipment at certain intervals.

Unfortunately, the workaday world of larger shipments of ordinary goods moving between commercial enterprises does not provide such simple visibility. Whereas UPS, for example, has direct end-to-end control of almost all of the facilities, conveyances, and people involved in transporting a parcel, the same cannot be said for most freight shipments, especially in global trade.

For global trade, each shipment typically involves a series of independent truck, rail, and ocean movements managed by both independent carriers and intermediaries. Moreover, shipments might sit for a time in the no-man’s-land of a port’s container yard awaiting customs approval or pickup for the next leg of the journey.

The result is that most businesses cannot track a shipment seamlessly from an overseas factory to its destination.

Shippers (the beneficial owners of the cargo, like manufacturers, retailers, distributors, and hospitals) and carriers (the owners and operators of transportation assets) are working on improving visibility in transportation using technology. Smartphones put an internet-connected optical code scanner, machine vision camera, and GPS locator in every pocket. As shipments get scanned, images get processed, and conveyance location positioning gets updated. The data can be used for near-real-time shipment location information and stored for later analysis.

Companies store more and more such data in the cloud, where users anywhere can find relevant data sets and related specialized applications. These visibility applications are typically part of event management systems designed to alert companies to deviations from the normal (or planned) patterns of shipments and movements.

In the broader world of supply chains, technology adoption faces a special challenge. Unlike the situation with the integrated carriers (UPS, FedEx, DHL, TNT, and postal services), shipment visibility—even just from a factory in Asia to a retailer in the United States—requires more than just one company to have the needed sensors and other hardware and software to achieve continuous visibility into goods’ flows.

Supply chain visibility also needs all (or at least enough) participants to adopt compatible technology and agree on a set of standards so that they can all use the data.

Many companies have not mapped their inbound supply chains and may not even know the physical locations of their direct (Tier 1) suppliers’ manufacturing and distribution facilities.

However, what supply chain and material handling managers really want is more than just visibility of the inbound shipment from Tier 1 suppliers into their facility. They would like to know as early as possible if there is a problem—late shipment, quality issues, shipment damage, customs delays—anywhere in the supply chain, so they have time to react. For this to happen, they need visibility beyond their Tier 1 suppliers into deeper tiers of their supply chain (recall Figure 1).

Visibility into deeper tiers of the supply chain is a perennial challenge that, as yet, almost no manufacturer or retailer has cracked. The reasons for this are not so much technological (even though conflicting standards and non-cooperating software platforms do not help). Rather, most companies do not know who their deep-tier suppliers are.

Tier 1 suppliers consider the identity of their suppliers (who are Tier 2 suppliers to the OEM) a trade secret. And even in cases where an OEM can identify its deep-tier suppliers, it has no leverage over these suppliers and cannot compel them to share data, because the OEM itself is not a customer of these deep-tier suppliers.

Furthermore, parts made by deep-tier suppliers may end up at higher-tier suppliers, serving not only many companies but also multiple industries. As a result, it can be impossible for an OEM to pinpoint deep-tier suppliers that make specific parts.

Other companies are using more technology to gain visibility on the retail and consumer ends. For example, while many companies are wondering what panicked consumers are doing with all the products they bought during COVID-19 hoarding, Procter & Gamble knows.

The company knows that people aren’t just buying more product such as Tide detergent in order to hoard it; they really are doing more loads of laundry during the pandemic. P&G gets this insight from data collected directly from the washing machines of a select sample of consumers.

P&G has long invested in efforts to gain more visibility into how consumers use its products. Its marketing mantra is grounded in two "moments of truth" for products. The first moment is when a consumer chooses a product in the retail environment from among the competing products. The second is when the consumer actually uses the product. P&G monitors the first moment of truth through interviews, Nielsen data, and point-of-sale data.

Previously, P&G would ask select consumers to keep diaries of their experiences using its products in order to understand the second moment of truth, but technology now enables a paperless process.

The P&G example illustrates another trend accelerated by COVID-19. This kind of seamless, contactless digital data collection is enabled by the Internet of Things (IoT), which combines specialized sensors, low-cost computer chips, and ubiquitous wireless networking such as home WiFi or cellular phone networks.

These technologies are becoming more sophisticated and less expensive, leading to the presence of sensors everywhere to measure, gather, and transmit data continuously to analysts and managers who can act on it.

Tackling the Visibility Challenge

Every automobile has an average of 30,000 parts made by thousands of component suppliers scattered across the globe. The parts flow from these suppliers into automotive assembly plants using every mode of transportation and hundreds of transportation carriers.

To coordinate the flow of parts, material handling managers need to know when those parts are going to arrive at the plant. In fact, they often need these arrivals to be prescheduled in order to manage the dock doors where the incoming trucks unload the shipments.

While carriers serving commercial enterprises can give shippers an estimated time of arrival of their vehicles to a plant, a store, a warehouse, or a hospital, this does not address the needs of transportation and material handling managers. What they really need to know is when particular parts needed to make particular products at a particular time will arrive. For this, they need to know which parts are loaded on each of the hundreds of trucks, railcars, ocean vessels, or airplanes transporting those parts.

In 2014, former Ford material handling manager and serial entrepreneur Lorne Darnell launched FreightVerify Inc. to tackle the challenge of merging the carriers’ information (about the location of their conveyances) with suppliers’ data (about the contents of their shipments) and cross-linking these data to the shippers’ SKU numbering schemas.

He started by focusing on some of the most daunting inbound transportation challenges—those of the automotive industry. By 2017, the company was offering a cloud-based platform on which an automotive manager could look up any SKU number and find where all those in-transit parts were at any given time.

For example, some may be on a truck at the plant’s yard waiting to be unloaded, others may be several hours away on a truck heading to the plant, still others may be on a railcar several days away, and even others may be offloading at a port.

In all cases, FreightVerify gathers the data on the location of the parts (and the specific trailers, railcars, vessels, airplanes, and the containers these parts are in) and transmits it directly and frequently from the vehicle to its platform for the receiving plant to see.

In addition to providing key information such as the location of the part number and the vehicle carrying it, the software provides a very accurate estimated time of arrival, accounting for road congestion, weather delays, highway construction, border crossing problems, and so forth. Each shipment movement is based on a plan that the platform follows in real time, noting any deviation, since many of the loads follow complex routes involving multiple stops and relays.

Naturally, companies also use the platform as a source of business intelligence, to evaluate carrier performance, and to identify long-term bottlenecks. In 2019, General Motors adopted the software for all movements into its assembly plants as well as for tracking finished vehicle deliveries and aftermarket parts. Ford followed suit, and FreightVerify began serving other automotive companies and then other manufacturers—and even hospitals.

As the pandemic was creating havoc in the reliability of transportation movement, such shipment visibility became more important than ever. Furthermore, going forward, such capabilities allow companies to improve service while cutting costs.

Formula for preparedness

Supply chain problems such as supplier product fraud or customers gaming order allocation systems mean that to be relevant, supply chain visibility requires transparency on the part of supply chain partners. That is, suppliers and customers must be willing to share timely and accurate data with partner companies.

Transparency on the part of suppliers means sharing essential data on their capacities, sourcing of key materials, and deeper-tier suppliers that might affect the supplier’s ability to deliver quality and quantity on time.

Transparency on the part of customers means sharing downstream inventory and sales patterns so the supplier can plan its production.

Transparency enables cost-effective resilience. Correcting for unplanned situations requires physical resources in the form of both redundancy and flexibility of assets, labor, and processes. The ability to deal with unplanned events also depends to a large extent on the amount of forewarning—the time lag between receiving data about a disruption and the impact of that disruption. Such a lag can be used to redirect shipments, find alternative sources of supply, release inventories, alert customers, and more. Without it, a company will have to keep redundant capacity and large inventories in order to avoid stock-outs, production disruptions, backordering, or worse: lost customers. Transparency provides greater forewarning.

In essence, transparency and visibility provide the eyes, ears, and nose for the supply chain while physical resources provide the muscles. The brains of the organization then connect the sensory apparatus of transparency to the muscles of resilience. Those brains include both people and technology.

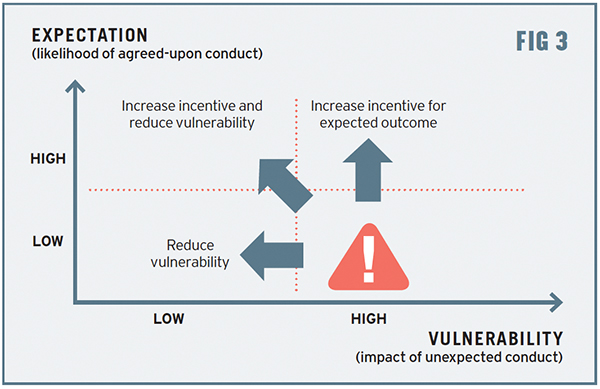

FIGURE 3: VULNERABILITY AND EXPECTATIONS OF TRUST

The riskiest quadrant is where vulnerability is high and there is little expectation that the counterparty will fulfill its obligations and abide by the agreement (Low Expectiation/High Vulerability).

Building Trust

Transparency requires trust—a company must be willing to share some of its sensitive data with its key trading partners. During a crisis, the bond of trust between buyers and sellers is typically put to the test. A definition of trust is "the willingness to accept vulnerability based on positive expectations of the intentions or behavior of the counter party."

Per this definition, Figure 3 illustrates the two dimensions of trust: expectation of outcomes and vulnerability. The riskiest quadrant is where vulnerability is high and there is little expectation that the counterparty will fulfill its obligations and abide by the agreement (Low Expectation/High Vulnerability).

Increasing Trust

The two principal ways to increase trust are either to increase the incentives for a good expected outcome or to reduce the vulnerability (or both). A company can increase the likelihood of getting what it needs from a supplier by offering higher payments for better performance, penalizing underperformance, or promising the potential for growing future volumes of business.

It can also reduce its vulnerability by having multiple sources of supply or redundant inventory to cover shortfalls from an untrustworthy supplier.

Trust in suppliers can be especially challenging for companies engaged in e-commerce on sprawling multi-supplier platforms such as Etsy (which lets artisans sell direct to consumers). Customers need confidence in product descriptions and supplier reliability.

Suppliers can mitigate trust issues by asking for upfront payment. An early payment reduces the supplier’s risk, especially if the payment covers the raw material cost and the work. An early payment also creates an incentive for the customer to follow through with the order, since it has already paid for it (in full or in part).

In a crisis, parties can get away with not fulfilling obligations by, for example, shipping subpar products, not paying on time (or at all), or canceling orders and leaving suppliers stuck with sizable raw material inventory. The crisis provides a ready excuse for nonperformance, including invoking force majeure clauses. It also creates many opportunities for one-time deals where there are no ongoing relationships and, therefore, lower incentives to deliver the expected outcome.

In contrast, during day-to-day business, these risks are limited because trading between the supplier and customer is ongoing, and neither side desires to cause a breakup in the relationship.

Value-Added Relationships

One of the results of the coronavirus crisis is that companies have gained a deeper appreciation of the importance of trust built over a long period.

As Lynn Torrel, chief procurement and supply chain officer at the giant contract manufacturer Flex, explained, "We’ve had a few escalation calls with suppliers, and you get on a call and there are critical needs. Often, it’s someone I’ve known for many years. We had a hard negotiation and then had a really good dinner and spent time together, and we’re always seeing each other at different events. I think that personal side is important, especially the relationships and trust that build over time."

The existence of trust in supply chain relationships means that a customer does not have to pay extra or look for new suppliers to reduce its vulnerability in a crisis. And suppliers will not have to raise their prices or demand early payments to cover a nonpayment risk.

Such relationship building can be even more important when business contacts are based in faraway countries. Trust is key to overcoming cultural, geographic, and language differences between trading partners. The value of personal relationships in creating trust may be difficult to build through video calls. As a result, businesspeople will still have to board airplanes, stay in hotels, and share meals with distant suppliers and customers to continue building the personal relationships that create trust.

However, in today’s COVID-19 world, remotely gathered digital data and virtual meetings are here to stay and can replace some of the time-wasting business travel and in-person gatherings that plague many workplaces and business-to-business relations. Online collaboration platforms will continue to improve, as will people’s ability to use virtual meeting places to transact business and carry out day-to-day managerial tasks.

But there is still no substitute for personal contact when it comes to building business relationships, and this is unlikely to change in the foreseeable future.

Hands-Off Hand-Offs

COVID-19 pushed small shippers and the 3.5 million truckers in the United States to look for ways to eliminate paperwork.

Before COVID-19, people thought nothing of touching a keypad, signing in on a clipboard, or handing a credit card to a cashier. The fact that the SARS-CoV-2 virus can survive on surfaces for hours (sometimes days) applies pressure on supply chains to go paperless and, even further, contactless.

Although supply chains do use a lot of electronic communications and documentation, some steps still require paper documents, especially in transportation and import/export transactions. Both of these activities involve legal or government documents, such as purchase orders and bills of lading, that must be scrutinized and signed by different parties as the goods travel.

One key example of supply chain documentation that is still often maintained in paper form is the bill of lading, which is the legal record of the traded goods. It goes with every shipment and must be signed by the carrier’s driver (in triplicate) and the consignee (after comparing the information on the bill of lading to the information in the purchase order).

After many years of running 21st century companies with 19th century technology (bills of lading actually originated in the 16th century), almost every loading dock, warehouse, and logistics management office is looking to replace paper documents with digital versions.

Part of the challenge to going fully paperless (and contactless) is universal adoption of standardized electronic document systems among all the parties. At the very least, this involves the supplier, the carrier(s), the consignee, and government authorities.

For international shipments, the parties can also include banks, multiple carriers, and various government bodies such as customs, export control, import inspections, and others at both ends of the trip.

To be digital, all of these parties must be able to access the right documents, enter data into them, be able to provide legally binding signatures, and yet not be able to tamper with the underlying information in the document. Such a system must be fully secure in order to manage trillions of dollars in trade and be acceptable to competing parties and all participating governments.

One approach, being developed and tested by various companies, uses the blockchain technologies popularized by cryptocurrencies (such as Bitcoin) to create a secure, tamper-resistant, distributed database. Blockchain-based systems do not require a central managing authority and can ensure the integrity of the transactions without it.

Another typical supply chain activity that requires hands-on, in-person interaction happens as companies work with suppliers to develop, refine, and manufacture new products. Representatives of the customer and supplier fly to present product designs, review materials, and assess manufacturing samples. COVID-19 brought an instant end to that travel and even made express-air shipments of samples an expensive and unreliable process.

Though the trend of virtual product development existed before COVID-19, the pandemic greatly accelerated its rise. Instead of travel and express parcels, virtual product development uses instantly delivered digital files, 3D models, and high-resolution video for collaboration.

Even before the pandemic, some companies (especially those in apparel) had been adopting virtual product development for speed: the shorter the development time, the better the company can handle fickle market trends.

Digital design processes enable around-the-world, 24-hour, rapid development—an Asian supplier or innovation center can work during their day (overnight for U.S. headquarters) on a new product and send the digital results for early morning review at headquarters. The review staff—marketing, sales, customer representatives—can take all day and send feedback that arrives early the next morning (local time) at the supplier.

Retail is another arena looking for contactless transactions. Walking into an Amazon Go grocery store seems like stumbling upon a sedate and leisurely looting incident. People seem to be plucking items off the shelf, putting them in their bags, and then walking out without paying. But that’s exactly what Amazon wants customers to do. The posted instructions say, "Use your app as you enter. Bag as you shop. JUST WALK OUT."

Scanning a customer’s smartphone on entry identifies the customer for billing purposes. Cameras and sensors throughout the store record everything and use computer vision to know exactly who is taking what (or putting it back). The store needs no checkout counters, cashiers, or baggers.

Remote Control

Two-way flows of data enable both remote visibility and remote control. For example, contract manufacturer Flex created Flex Pulse, which is both a software-based system and a network of physical "control tower" facilities for using supply chain visibility to manage and improve supply chain performance. The software enables real-time visibility and control for some 6,000 users on their desktops, laptops, and mobile devices.

Nine Flex Pulse centers around the world have walls of large interactive touchscreens that display a wide range of user-selectable information, such as real-time news of supply chain disruptions, social media streams, maps of global in-transit shipments, heat maps of inventory levels, maps of exceptions, graphs of lead times, and other supply chain data. Each Flex Pulse center acts as a network operations center.

Operational information is also available on user desktops, which helped users navigate the situation during the pandemic. Flex’s Torrel and her associates used Flex Pulse to manage the supply chain during the COVID-19 crisis: "We created some specific dashboards to address COVID-19 so that we could understand at a customer level, at a site level, and at a part-number level where there potentially could be impacts," she said.

COVID-related physical distancing, limited travel, and restrictions on group gatherings all accelerated the trend toward using telepresence technologies for control and management. For example, even before the pandemic, Walgreens used in-store sensors to monitor its 9,500 U.S. locations—mostly for security. But it also uses the system for other critical situations.

For instance, electrical power sensors alert Walgreens to blackouts, which lets the company quickly contact the power company, supply backup generators, or send refrigerated trucks to recover perishable inventory. High-definition cameras allow managers to monitor inventory and manage personnel to serve customers faster. The video signals can feed into AI-based image recognition systems that either help measure the normal ebb and flow of activity or spot anomalies that need attention.

These exceptions could include a wet cleanup in Aisle 5, a forgotten pallet by a dock door, a blocked conveyor belt, or a surge in customer arrivals in the parking lot that portends the need for more checkout lines in the next 30 minutes.

Video cameras and sensors also allow a worker to be at home and in the factory, warehouse, or store at the same time. The next step is the remote control of simple facility functions, leading to remotely operated robots, and even the science fiction concept of a "dark facility," which is fully automated and operates on its own.