Uncle Sam’s Infrastructure Spending, Explained

With several key federal bills that bring dollars to logistics and transportation infrastructure passing recently, it can be hard to keep track of which funds are going where—and what it all means for supply chain and manufacturing professionals.

Commercial real estate firm Savills breaks it down:

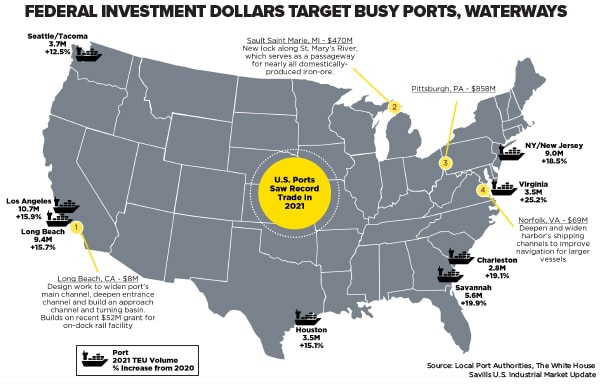

Infrastructure Investment and Jobs Act: Signed into law by President Biden in November 2021, the goal of this domestic spending agenda is to direct billions of dollars to state and local governments to upgrade the outdated physical infrastructure. Less than one year later, the injection of funds has already had an impact on construction in the industrial sector. $4 billion in funding to expand key ports across the United States, announced in January 2022, is particularly impactful as domestic trade activity rises to record high levels.

Inflation Reduction Act: Enacted by President Biden over the summer, the Inflation Reduction Act is a game-changer for the electric vehicle (EV) industry, as one of its key aims is to incentivize the growth of the EV market within North America. As electric vehicle production proliferates in the United States, more manufacturing space is needed to produce component parts and batteries, as well as infrastructure for charging. This boosts industrial demand. Since the legislation was passed and the value of producing electric vehicles has increased, plants have been announced in Kansas and Oklahoma, with more likely to follow. Also exacerbating the trend toward EV production is California’s recent vote to restrict and eventually ban gasoline-powered cars in the state, further increasing demand for EVs in the United States.

CHIPS and Science Act: Passed in August 2022, and signed into law, CHIPS and Science Act funding aims to enhance domestic semiconductor production. To be eligible for the monetary incentive, a company must produce chips in the United States; this includes building and operating factories.

- $4 billion earmarked: For funding of ports and waterways projects as part of the Infrastructure Investment and Jobs Act.

- Expanding key ports: Long Beach—the second busiest port—and Norfolk—the fastest growing port—will get deeper and wider channels.

- Enhancing inland waterways: Navigable waterways are receiving major investments in the form of new locks to increase capacity and help relieve landside congestion.