VERTICAL FOCUS: Pet Supplies

Biofuels: A Pet Peeve

A proposed EPA rule has the pet industry howling.

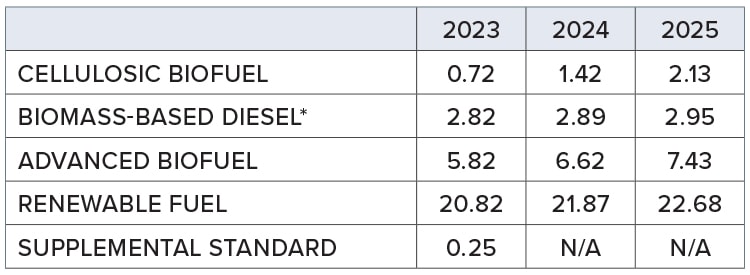

The rule would establish required Renewable Fuel Standard (RFS) volumes and percentage standards for 2023, 2024, and 2025 (see chart). The EPA also recommended a series of modifications to strengthen and expand the RFS program.

The pet food industry’s response was swift but mixed due to concerns that the proposal could impact feed stocks. For example, some analysts predict that the United States would need an additional 55 million to 60 million acres to plant soybeans to meet renewable diesel demand. However, U.S. farmland is already accounted for, so these additional acres would displace any current crops.

“It is important to pause further increases in biodiesel blending quotas until it is demonstrated that the production of necessary feedstocks can catch up to demand, allowing for fuel and food producers to avoid competing for edible oils,” says Dana Brooks, president and CEO of Pet Food Institute, a pet food makers association. “Such competition will further exacerbate supply issues and increase prices.”

Proposed Volume Targets

(billion Renewable Identification Numbers)

*Biomass-based diesel is in gallons Renewable Identification Numbers are serial numbers assigned to a batch of biofuel for the purpose of tracking its production, use, and trading Source: U.S. Environmental Protection Agency

Shortages Hound Pet Supply Growth

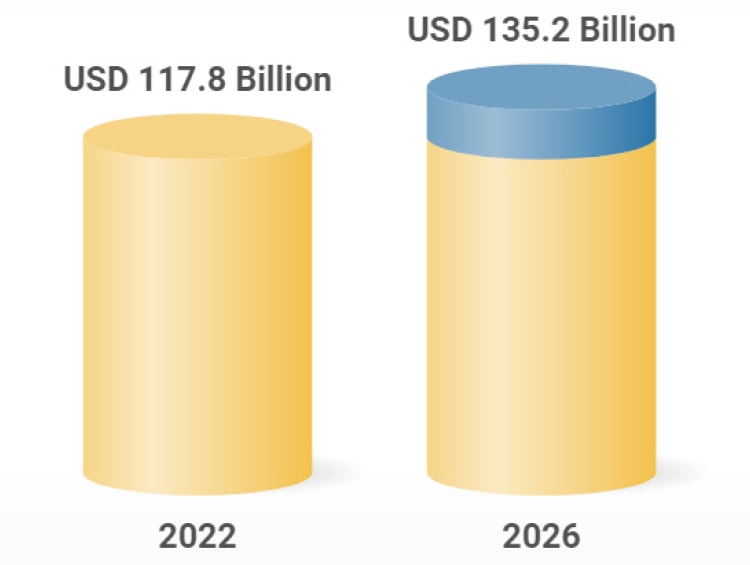

A rising millennial population, growing adoption of e-commerce to buy pet care products, and an increasing number of single-person households are driving growth in the U.S. pet market. The U.S. pet market will reach $135.2 billion by 2026, predicts a Research and Markets report, with a compounded annual growth rate of 3.5%.

But with that growth comes supply chain challenges, including pet food shortages. A primary contributor to these shortages: surging pet ownership during the pandemic. Pet ownership rose to 70% of U.S. households in 2020, according to the American Pet Products Association. In 2025, that number stands at 71% of all households, according to the APPA’s 2025 Industry Report and Survey which found 94 million U.S. households own a pet.

Other factors include inflation, shortages of feed stocks and aluminum used to make cans, and dwindling farmland devoted to producing feedstock.

Surging pet ownership led to increased pet food sales, and in 2021, consumers continued to buy pet supplies through e-commerce. This trend will continue. Nearly one-third of pet supplies sales will be through e-commerce channels by 2025, predicts a Statista study.

The most popular e-commerce sites for pet supplies? Based on revenue, they are Amazon, Walmart, and Chewy, according to the Statista study.

U.S. Pet market

Market forecast to grow at a CAGR of 3.5%

Source: Research and Markets

Mars Petcare Unleashes Acquisition Strategy

Most pet food companies are enjoying increased sales and revenue growth as more people acquire pets. To capitalize on those market dynamics, Mars Petcare, the largest global pet food company, acquired pet food maker Champion Petfoods.

Champion Petfoods’ dry food products–including the Orijen and Acana brands–are sold in more than 90 countries and manufactured in company-owned kitchens in Canada and the United States. The acquisition complements Mars Petcare’s existing pet food portfolio by adding brands in the premium pet food category while broadening its offering within pet specialty and e-commerce channels.

The Mars/Champion acquisition is just one high-profile deal in the pet food industry. As of the end of August 2022, more than 25 pet food mergers and acquisitions had taken place.

Purina Vets Factory Expansion

Factory automation tools and technologies are going to the dogs. Pet food giant Purina recently completed a $156-million expansion of its factory in Clinton, Iowa. The expansion adds capacity and production capabilities that include new cooking and packaging lines. It also adds 96 new jobs.

To support its investment in digital tools and technology that promote manufacturing collaboration, Purina added a 3,800-square-foot technical training center as part of the expansion. The training center serves as an onboarding hub and provides factory workers with structured and self-driven training with digital tools. It also facilitates training with replicas of production equipment.

Purina also retrofitted a newly purchased building adjacent to the existing factory for packaging and storage for two Purina brands–Purina Pro Plan Veterinary Supplements and Just Right, a personalized dog food brand.

Logistics Know How Helps Friends in Need

Humanitarian logistics applies to pets, too. When Blue Cross in the UK donates pet food supplies to food banks, it often has trouble getting them to the people and pets that need them most. So Blue Cross partnered with Macfarlane Packaging to ensure pets remain fed in times of owner need.

Under the partnership, Macfarlane Packaging deploys some of its regional distribution centers (RDCs) and a number of its fleet to tackle Blue Cross’ distribution issues. Macfarlane collects and delivers pallets of the donated pet food to its RDCs, then delivers them to Blue Cross’ pet food banks and community distribution points. More than 40 deliveries already are scheduled and will continue into 2023.

Feeding Fido Fast

It’s a situation many pet owners dread. The family pet is hungry, and you are out of food. Same-day delivery to the rescue, thanks to a new partnership between pet supplies superstore PetSmart and Shipt, an expedited delivery company.

The partnership adds 1,300 PetSmart stores to the Shipt marketplace and provides same-day pet food delivery nationwide. Customers can place pet food orders in the Shipt app, which features about 200 retail partners, and receive delivery later that day. Hungry pets no more.

“Same-day delivery is a key component of our omnichannel strategy,” says Cherise Ordlock, senior vice president of digital at PetSmart. “It’s important to expand our e-commerce offerings as demand for convenient shopping options continues to grow.”