VERTICAL FOCUS: Raw Materials

Insight into the latest supply chain trends for raw materials.

Steeling for Growth

It’s all about the crude, dude. The U.S. crude steel market could reach $110 billion by 2026, according to a ResearchAndMarkets report, U.S. Crude Steel Industry: Insights & Forecast. The report predicts a 6.1% compounded annual growth rate between 2022 and 2026; however, excess crude steelmaking could hinder this growth.

“Growth in the U.S. crude steel market has been supported by factors such as a booming automobile industry and accelerating urban population,” the report states. “The United States-Mexico-Canada Agreement also is likely to have a positive impact on the U.S. crude steel market.”

In 2021, the U.S. crude steel market reached $82.22 billion. Typical customers include the construction, automotive, machinery/equipment, energy, and appliances markets. Crude steel market production processes fall into two buckets: electric arc furnace, which is the dominant process in the United States, and basic oxygen furnace.

The market also can be segmented by chemical composition. In order of market share, these are carbon steel, alloy steel, stainless steel, and tool steel.

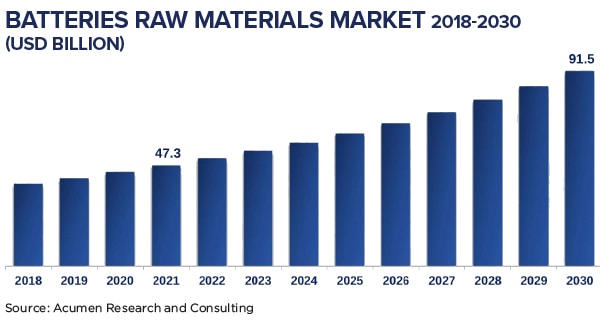

Global Battery Market Charges to $91.5 Billion

Lithium ion batteries continue to power the market, driven by rising demand for consumer electronics, the automotive market’s push to offer more environmentally friendly options, and an increased emphasis on the waste management of lead acid batteries.

In 2021, lithium ion batteries represented about 48% of overall market share and, as technologies advance, is predicted to see the most growth moving forward, finds an Acumen Research and Consulting report. Industry adoption of recycled lithium ion batteries could spur further growth.

The global battery raw materials market accounted for $47.3 billion in 2021, and Acumen predicts the market will grow to $91.5 billion by 2030, with a compounded annual growth rate of 7.7% between 2022 and 2030 (see chart).

“Because of rising environmental concerns, battery-powered lithium particle batteries are increasingly being used in place of traditional lead corrosive batteries,” says the report. “Utilizing sustainable sources of energy, for example, solar, should also result in increased interest in lithium batteries.”

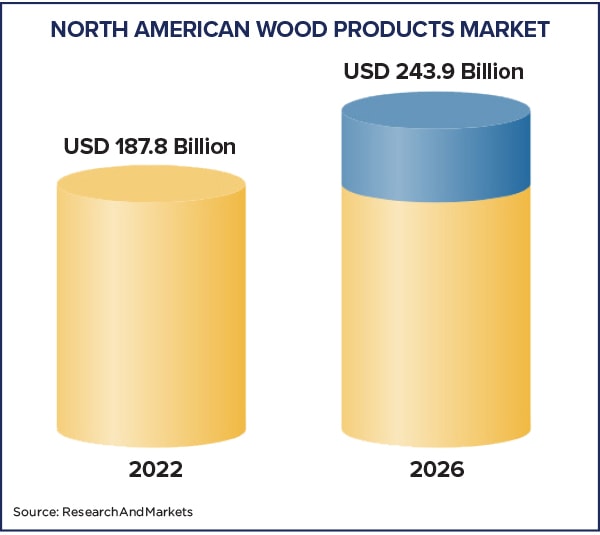

Out of the Woods

Despite well-publicized shortages during the pandemic, the North American wood products marketplace, including softwood lumber and engineered wood products, will trend upward between 2022 and 2026, with a 6.75% compounded annual growth rate (CAGR), predicts a ResearchAndMarkets report. Current estimates value the wood product market at $187.8 billion in 2022 (see chart). At the projected CAGR, the wood product market will grow to $243.9 billion by 2026.

Population growth and new residential construction are primary drivers of this growth, but price fluctuations and increased availability of wood alternatives could provide challenges, the report warns.

The United States represents the fastest-growing market in North America due to consumers’ fondness for home repair and remodeling, increased new residential construction, and abundant forest reserves. Wood is also perceived as an environmentally friendly material, which may also spur manufacturing increases.

Additional growth drivers include consumer preferences for engineered wood and increased investment in tourism infrastructure, according to the report.

Check the Oil

Oil demand and prices are a particular concern in the transportation sector. With a weakened economy in China, the European energy crisis, production differentials, and a strong U.S. dollar, demand for oil will weaken in 2023—from 2.1 million barrels per day (mb/d) in 2022 to 1.6 million barrels per day, predicts The International Energy Agency. In the near term, Q4 2022 is expected to show a decrease in oil production by 240,000 barrels per day (kb/d).

Although world oil supply rose by 410 kb/d in October 2022 to 101.7 mb/d, forecasts call for drops up to 1 mb/d for the remainder of 2022, prompted by OPEC+ cuts and bans on Russian crude. This situation could impact an already delicate diesel market.

In October 2022, diesel prices and cracks (differential to crude oil price) rose 70% and 425% higher, respectively, year-over-year—representing record levels. Compounding the problem, distillate inventories are the lowest they’ve been in decades. And worker strikes in Europe, combined with impending embargoes, drove prices past $80/bbl above North Sea dated crude oil price assessments, a benchmark to measure the price of North Sea crude against other grades of crude around the world. Prices also rose in the United States ahead of the winter heating season.

Price increases fuel inflation and raise pressure on world oil demand. Despite the projected downturn in production, there could be growth in jet fuel and LPG/ethane for petrochemicals markets. This could drive even higher prices.

“Competition for non-Russian diesel barrels will be fierce, with EU countries having to bid cargoes from the United States, Middle East, and India away from their traditional buyers,” notes the report. “Increased refinery capacity will eventually help ease diesel tensions. However, until then, if prices go too high, further demand destruction may be inevitable for the market imbalances to clear.”