2019 Logistics IT Market Research Survey

What’s hot in logistics IT? Which innovations are taking hold?

Advances in information technology continue to reshape supply chains. E-commerce is one obvious example. As online technology creates new shopping channels, it forces companies to think differently about how they sell products, fulfill orders, and handle returns.

What’s Driving Logistics IT Demand?

Not only does information technology continually alter what supply chain organizations do, but new IT solutions also keep emerging to improve the way companies perform those functions.

This evolution will continue. Take the advent of collaborative robots. By 2023, more than 30% of people employed in warehouse operations will do their work with help from mobile robots that move about the floor independently, according to Gartner. Also by 2023, at least half of large global companies will use artificial intelligence (AI), advanced analytics, and the Internet of Things (IoT) in supply chain activities.

For shippers who want to understand where logistics technology is headed so they can prepare for the most important innovations, the first step is to map what the landscape looks like today. That’s not easy, especially for supply chain professionals busy with day-to-day operations. That’s where Inbound Logistics’ annual survey of logistics technology providers comes in. We gather data on logistics IT trends, so when it’s time to start planning your next logistics IT implementation, you’ll have a full picture of what’s available and how other shippers are investing.

Along with the results of our survey, be sure to check out the annual IL Top 100 Logistics IT Providers list (see page 72). This detailed guide to market-leading logistics IT developers and their solutions is an invaluable resource for your next foray into the IT marketplace.

Who’s Buying and Why?

Transportation service providers make up a major market for nearly all the IT solutions developers who responded to our survey. In 2019, 93% say that their solutions serve the transportation industry, including logistics providers, warehouse operators, carriers, and companies that facilitate international trade (see Figure 1). That response is even stronger than last year, when 87% of IT companies reported that transportation providers use their solutions.

FIGURE 1: What industries do your solutions serve?

Logistics IT firms also design solutions with shippers in mind. A strong 82% of respondents say they sell solutions to manufacturers (down from 86% last year), 79% to retailers (up slightly from 78% last year), 76% to wholesalers (down from 81% last year), and 68% to e-commerce companies (down from 70% last year).

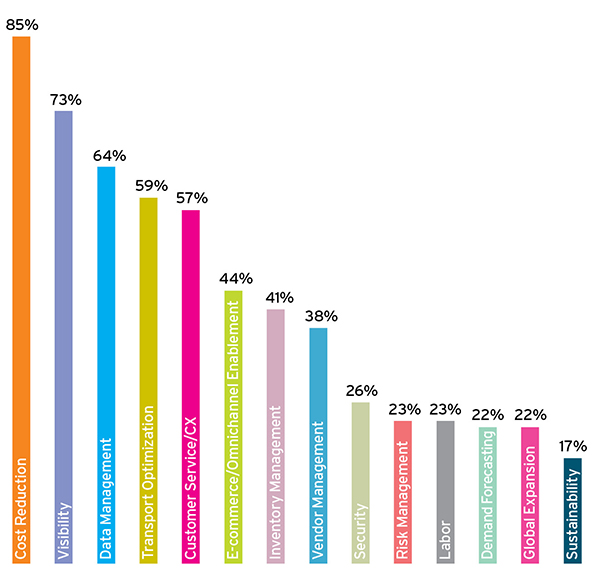

For the past several years, when we’ve asked logistics IT vendors which transportation challenges are top of mind for customers in those groups, two categories have risen above the others: cost reduction and visibility.

Cost reduction has nearly always taken the top slot. That’s no surprise. After all, every successful effort to reduce costs helps to boost a company’s bottom line. The exception was in 2018, when cost reduction fell to the number-two position, one point behind visibility.

This year, cost reduction is back on top, cited by 85% of respondents (see Figure 2), up from 81% in 2018. Seventy-three percent of vendors name visibility as a critical concern for customers in 2019, a nine-point drop from 2018.

FIGURE 2: Which transportation/logistics challenges are most critical to your customers?

Only three other issues emerge this year as critical customer concerns for more than half of vendors. Sixty-four percent of respondents cite data management, 59% mention transport optimization (a big jump, compared with 25% in 2018), and 57% name customer service or customer experience. When you consider the close links between visibility and transport optimization, it makes sense that optimization rises high on the list.

As in 2018, vendors are least likely to mention sustainability as a critical challenge for their customers. Have logistics organizations not yet focused on that issue in large numbers? Or do they manage sustainability concerns without significant help from logistics IT solutions?

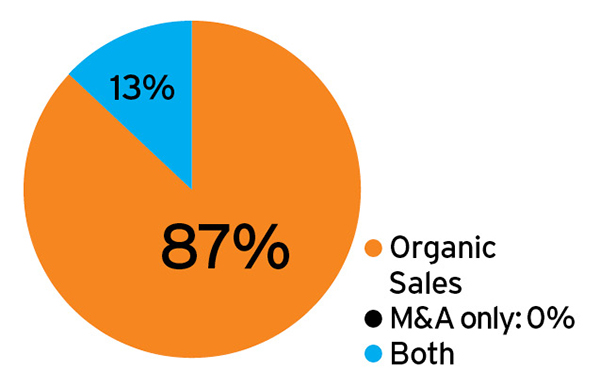

One thing that remains absolutely clear about logistics IT vendors is that they continue to focus on expanding sales. Last year, 88% of vendors said that their growth in the past year was due to organic sales. Nearly the same proportion of respondents, 87%, gives that answer this year (see Figure 3). No respondents to the 2019 survey report growth in the past year solely through mergers and acquisitions. Thirteen percent saw growth over the past year due to a combination of both factors.

Growth in the past year was due to…

The Cloud Flies High

Not many years ago, vendors who offered cloud-based solutions had to take great pains to explain what the cloud was and why customers should consider using it. They needed to convince customers that cloud computing—or software as a service (SaaS) or hosted services—offers flexibility and cost advantages. They also had to overcome customers’ fears that a move to the cloud would limit their control over their activities and data or would pose security risks.

In recent years, though, the world has embraced cloud computing. Worldwide revenues for SaaS solutions totaled $58.8 billion in 2017 and are expected to reach $85.1 billion in 2019, reports Gartner.

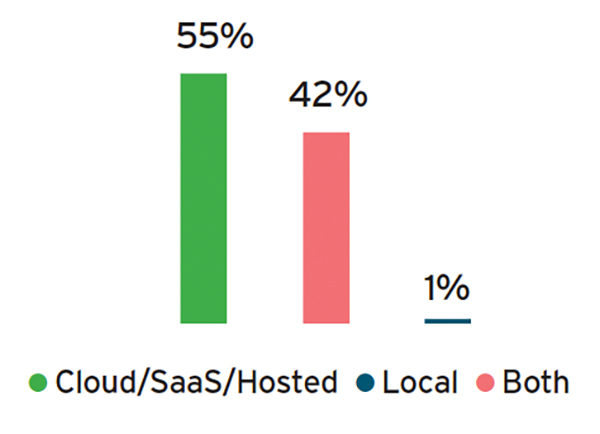

Like their counterparts in many other sectors, logistics technology firms continue the move toward cloud-based solutions. In 2019, 55% of technology vendors tell us that they provide cloud-based, SaaS, or hosted solutions (see Figure 4), a slight increase from last year’s 52%. Forty-two percent of vendors let customers choose between cloud-based or local implementation, a figure slightly lower than last year’s 46%. Only 1% of respondents—compared with 2% last year—say they deliver their solutions only for local implementation.

FIGURE 4: How do you deliver your solutions?

As one IT vendor comments in the survey: “Supply chains are rapidly adopting new technology to solve complex business issues, requiring companies to harness the power of the cloud. Companies want supply chain planning solutions that are self-sufficient and respond automatically to quickly changing business dynamics. That’s why we have invested in cloud and leverage the machine learning capabilities of the Microsoft Azure platform to empower clients to thrive amid change and complexity.”

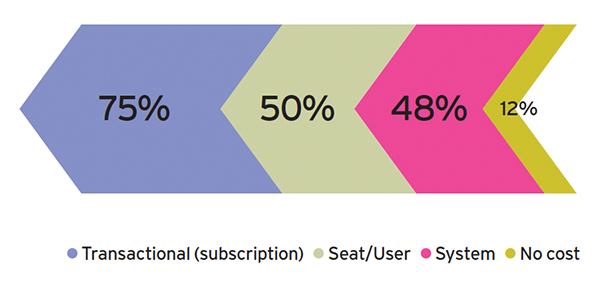

As a pay-as-you-go business model, cloud computing is naturally amenable to subscription arrangements. Three-quarters of respondents say users pay for their technology by the transaction or by subscription (see Figure 5). Vendors offer other options as well. Half have customers who pay by the seat or user (down 10% from last year), while nearly as many—48%—sell an entire system at a flat rate. Some lucky customers also receive technology services from the 12% of vendors who say they offer their solutions at no cost to the user.

FIGURE 5: Supply chain solutionS offered

What’s on Offer

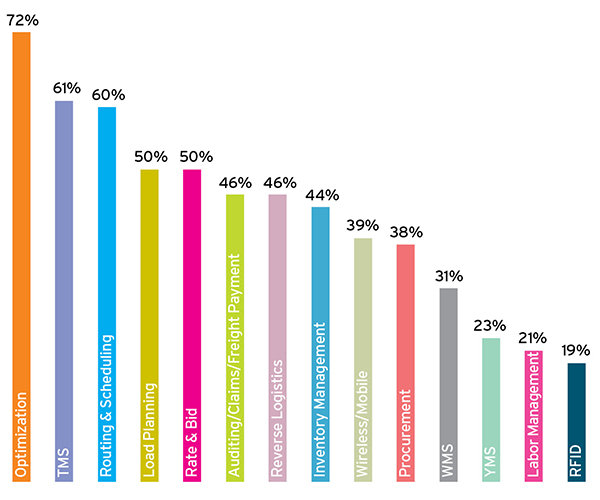

Vendors who responded to our survey offer a broad variety of technology solutions for strategic activities and execution, both for logistics and supply chain. Among the logistics solutions, vendors are most likely to offer products that help customers move product as efficiently and cost-effectively as possible (see Figure 6). The top solutions in 2019 address optimization (offered by 72% of vendors), transportation management (61%), routing and scheduling (60%), and load planning (50%). Those categories took the top spots in 2018 as well.

FIGURE 6: Logistics solutions offered

The logistics solutions that our respondents are least likely to offer include radio frequency identification systems (19%) and labor management systems (21%). Yard management systems (YMS) have seen a significant increase, however. In 2018, only 9% of technology vendors reported that they offered a YMS solution; this year 23% offer one.

One other kind of logistics solution also saw a significant jump. In 2018, 33% of vendors said they offered solutions for reverse logistics. In 2019, that number is 46%. The ongoing rise of e-commerce is spurring greater demand for software to manage returns when online shoppers find that the product they loved onscreen doesn’t quite fit the need after it’s delivered. Items purchased online are three times more likely to be returned than items purchased in a brick-and-mortar store, according to a report by the Office of Inspector General, U.S. Postal Services.

“Returns are a growing challenge and opportunity for retailers and brands,” one respondent comments. “More companies are looking for a holistic returns optimization solution to handle all of their returned and excess inventory.”

Our survey shows some significant changes among supply chain solution offerings. In 2018, 57% of vendors reported that they offered systems for supplier or vendor management. In 2019, that number is 10 points lower, at 47% (see Figure 7). Systems for modeling, forecasting, or predictive analytics saw an even bigger drop, from 41% in 2018 to 23% this time around.

FIGURE 7: Supply Chain Solutions Offered

In 2019, the supply chain solutions a vendor is most likely to provide are for supplier/vendor management (47%), supply chain control tower (41%), or demand management (25%). Distribution resource planning and materials resources planning (1% each) fall to the bottom of the list, as they did in 2018.

What’s Driving Logistics IT Demand?

As part of our annual survey, Inbound Logistics asks participants to share their views on the biggest sources of demand for logistics IT. Here are a few responses.

![]() E-commerce. “3PLs continue to evolve to high-volume fulfillment houses servicing the e-commerce space. This is especially true in the ‘nutraceutical’ space, involving high-volume picks. Also, the Amazon effect is reaching down to regional 3PLs.”

E-commerce. “3PLs continue to evolve to high-volume fulfillment houses servicing the e-commerce space. This is especially true in the ‘nutraceutical’ space, involving high-volume picks. Also, the Amazon effect is reaching down to regional 3PLs.”

![]() Omnichannel retail. “There is a major gap in the omnichannel retail market. In the United States, only 27.5% of retailers (with fewer than 10 store locations) offer BOPIS (buy online, pick up in store) services. Yet IHL Group reports that 46% of shoppers used in-store pickup over the 2018 holiday buying season. Retailers that invest in solid order management technology will see increased sales and foot traffic because of consumers’ desire for convenient click-and-collect options. The next few years will see a race to implement systems to close this gap between market demand and retail supply. We also see more non-traditional retailing businesses requesting order management systems as more 3PLs start to offer this service to retail clients.”

Omnichannel retail. “There is a major gap in the omnichannel retail market. In the United States, only 27.5% of retailers (with fewer than 10 store locations) offer BOPIS (buy online, pick up in store) services. Yet IHL Group reports that 46% of shoppers used in-store pickup over the 2018 holiday buying season. Retailers that invest in solid order management technology will see increased sales and foot traffic because of consumers’ desire for convenient click-and-collect options. The next few years will see a race to implement systems to close this gap between market demand and retail supply. We also see more non-traditional retailing businesses requesting order management systems as more 3PLs start to offer this service to retail clients.”

![]() Blockchain. “The cutting edge of logistics technology is via the blockchain, where shipping data can be transparent and secure along the entire chain.”

Blockchain. “The cutting edge of logistics technology is via the blockchain, where shipping data can be transparent and secure along the entire chain.”

![]() Warehouse management systems. “The need for a WMS to bring efficiencies to the warehouse is critical for both 3PLs and distribution companies, not only to reduce errors, but also to increase labor productivity. The ‘floor’ technology needs to understand the workforce is turning over rapidly and the solutions technology companies deliver need to be more intuitive. Distributors and manufacturers continue to search for best-of-breed WMS solutions to match ERP solutions.”

Warehouse management systems. “The need for a WMS to bring efficiencies to the warehouse is critical for both 3PLs and distribution companies, not only to reduce errors, but also to increase labor productivity. The ‘floor’ technology needs to understand the workforce is turning over rapidly and the solutions technology companies deliver need to be more intuitive. Distributors and manufacturers continue to search for best-of-breed WMS solutions to match ERP solutions.”

![]() Freight bidding. “Shippers are looking to automate freight bidding activity and benchmark against contracted rates.”

Freight bidding. “Shippers are looking to automate freight bidding activity and benchmark against contracted rates.”

![]() Positioning technologies. “There’s a need for indoor positioning using real-time location systems (RTLS), which enables use cases for digital twin, eKanban, safety, and other areas, mainly in automotive, warehousing, and heavy industry.”

Positioning technologies. “There’s a need for indoor positioning using real-time location systems (RTLS), which enables use cases for digital twin, eKanban, safety, and other areas, mainly in automotive, warehousing, and heavy industry.”

![]() Integration. “We see a need to integrate our cargo planning software with customers’ ERP or similar systems at a bigger scale, to be deployed across more locations, especially via cloud-based services.”

Integration. “We see a need to integrate our cargo planning software with customers’ ERP or similar systems at a bigger scale, to be deployed across more locations, especially via cloud-based services.”

![]() Business intelligence. “Corporations continue to seek business intelligence solutions that help create a competitive advantage through reduced costs, increased efficiency, and better decision-making capabilities. This includes the continued automation and convergence of transportation management, accounting, and accounts payable systems. Accounting departments require accurate accrual and allocation of transportation expenses. Supply chain/logistics departments seek greater visibility and timely access to their data to manage and control processes.”

Business intelligence. “Corporations continue to seek business intelligence solutions that help create a competitive advantage through reduced costs, increased efficiency, and better decision-making capabilities. This includes the continued automation and convergence of transportation management, accounting, and accounts payable systems. Accounting departments require accurate accrual and allocation of transportation expenses. Supply chain/logistics departments seek greater visibility and timely access to their data to manage and control processes.”

![]() Increased automation. “We see demand around automation and labor reduction to improve efficiencies. There’s also demand for applications that shippers can use to schedule arrivals and departures themselves within the confines of availability.”

Increased automation. “We see demand around automation and labor reduction to improve efficiencies. There’s also demand for applications that shippers can use to schedule arrivals and departures themselves within the confines of availability.”