Oil, Gas, and Energy: Down Goes the Boom

Volatility in the oil, gas and energy business is forcing producers and industry to confront a legacy of poor logistics execution.

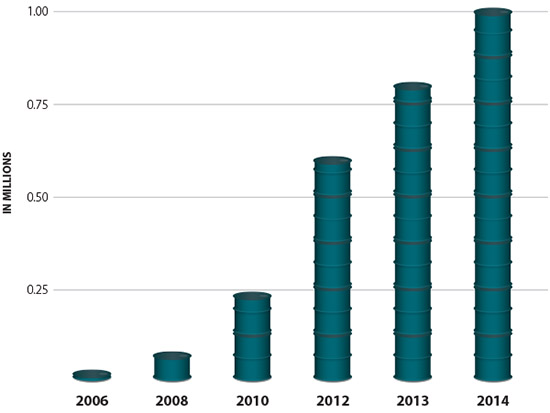

Bakken Daily Oil Production

Resources To Fuel Your Supply Chain

The North American oil and gas industry has always wavered between boom and bust. Volatility comes with the business. Supply and demand ebbs and flows as geopolitical flare-ups dictate. Wellheads dry up. New ones emerge. Producers are constantly on the move looking to locate the next big rig, whether it’s offshore or on land, drilling for conventional liquid oil or unconventional shale gas.

The last decade has been an out-and-out land grab in the North American energy sector, demonstrated by explosive growth in Northern Alberta’s tar sands, North Dakota’s Bakken shale formation, Appalachia’s Marcellus Basin, and the Eagle Ford and Permian plays in Texas. This impact is now being felt throughout the broader supply chain as cheaper energy lures industrial bases closer to demand.

For all the upstream potential, there are also inevitable headwinds. The oil and gas industry is hyper-sensitive to macroeconomic pressures, especially consumption in China and conflict in the Middle East. This past year was no different. As global demand for oil waned in 2014 and OPEC, the world’s largest oil cartel, resisted cutting back production to inflate prices, supply flooded the market. Now falling oil prices are eroding margins. Simply, it costs more to produce.

Other pressures come to bear as well. Regulatory inertia with regards to hydraulic fracturing and crude by rail remains a latent concern. The rapid growth of liquefied natural gas (LNG) has kicked open a new export market for North American producers. It’s also kick-starting a transportation revolution as carriers across all modes explore LNG for locomotion. On the legislative side, the Keystone XL pipeline impasse directly impacts midstream activities.

External factors notwithstanding, energy companies need only look under the hood to identify where they’re leaking oil—and money. Industry has long been laggard in managing costs. Growth has focused on increasing yields and generating revenue. Consequently, producers have been slow to manage and optimize their supply chains. Now these systemic failures are lowering the boom as industry confronts an inevitable bust.

Capital Punishment

The amount of investment that has seeped into the oil and gas space over the past decade is unprecedented. Speaking at the second annual SCM Leaders On Demand oil & gas symposium in Houston, Texas, in November 2014, Dennis Cassidy, managing director for consulting firm AlixPartners, documented this outlay.

"There has been a renaissance in capital flooding into the oil and gas industry," he said. "More than $1 trillion was invested worldwide in 2014; 75 percent of that was spent in upstream activities at the wellhead. There has also been a midstream bonanza in the United States, as industry looks for ways to build infrastructure to get oil to market."

But there’s a problem. Given market volatility and deteriorating oil prices, energy companies and their backers aren’t seeing the same kind of returns as in the past. Easy capital is drying up. Companies can’t just knock on Wall Street doors looking for free handouts anymore. Investors simply won’t support an industry that is underperforming. So an uneasy pressure is building within the oil and gas business that threatens to burst.

"The industry is on an unsustainable path," Cassidy said. "Something has to give."

AlixPartners has been tracking these changing dynamics, recently partnering with UK-based Oxford Economics to survey C-level oil and gas executives at more than 250 global companies across all industry streams. The results are eye opening.

For one, 70 percent of executives report they are not actively managing costs. Why? Invariably, everything the business is evaluated on—such as incentives, agreements, and leaseholds—pivots on growth. It comes down to two primary levers, according to Cassidy: First, absolute throughput at the wellhead, then portfolio management—or how companies are structuring deals and aligning with global partners.

Consequently, AlixPartners discovered that project management and cost management are far down the priority list.

"Consider that these companies are custodians of $1 trillion," Cassidy noted. "But only 20 percent of the time do they expect a project to come in at or under budget; and only 47 percent of the time do they expect a project’s rate of return to land within their original planned horizon."

AlixPartners’ research points to several reasons why oil and gas companies are delivering projects below expectations:

- Lack of technology for execution.

- Synergies in planning processes are incomplete, inconsistent, and often too siloed.

- Culture is not focused on project management.

- Competition for resources.

- Lack of centralized processes.

- Inaccurate data.

- Poor talent acquisition.

The failure to properly apply and integrate logistics technology contributes to many visibility problems that oil and gas companies encounter. As sophisticated as industry is on the production side, back-end support is years behind.

Considering the complexity of managing well site logistics in a just-in-time (JIT) environment, costs can quickly spiral out of control.

"One of the industry’s unique challenges is moving equipment and materials to latitude-longitude coordinates," explains Alaster Love, vice president, oil and gas for Frisco, Texas-based third-party logistics provider Transplace. "For example, deliveries can sometimes be six miles into a ranch in a remote area."

As onshore development in North America expands, the amount of materials (frac sand) needed to facilitate drilling is growing accordingly. Consolidating resources and managing longer lead times in a decentralized, JIT environment is fraught with risk.

Oil Pressure

"Oil and gas companies also operate 24/7/365, so it’s sometimes necessary to receive equipment first-flight-out because of operational costs," Love adds. "If an oil well goes down, even if it’s onshore, it’s a tremendous loss. Other industries don’t have this type of pressure."

In these types of remote environments, where companies often rely on many small mom-and-pop carriers and local contractors to deliver requisite materials and services, transportation management becomes a critical success factor. But industry has been slow to adopt and use solutions to manage this complexity.

"Some of the biggest oil and gas companies don’t know what their supply chain spend is," Love notes.

Talent acquisition is another area that would seemingly be top of mind among C-level observers. Cassidy’s clients often point to human resources as one concern they grapple with. Yet it ranks low in importance.

"It’s startling that the majority of items affecting the success of oil and gas projects are execution related," Cassidy said. "Management affects these items."

While there is a burning platform for better project and cost management, industry is still largely externally focused. Surveyed executives report they are trying to do a better job of forecasting and tracking macroeconomics—in other words, predicting the price of oil. But that’s a moving target and ultimately a losing proposition.

Realistically, many of these challenges, and the levers producers need to pull, are within management’s control. But change, as often is the case in siloed supply chains, does not come easily. Case in point: when oil and gas executives were asked whether they are ready to assume these new challenges, 80 percent said "no."

That sentiment is likely to change in an $80/barrel environment.

"Professionalizing" Logistics

Given these stiff headwinds, it’s inevitable that energy companies will turn to logistics service providers for guidance. The growing complexity of on-site logistics demands a different management structure to ensure operations run as seamlessly and efficiently as possible—especially when you consider the amount of outsourcing activity at well sites.

Alberta, Canada’s Athabasca tar sands have been the epicenter of North America’s natural gas renaissance over the past decade. Most of this growth is in "unconventional" development, where horizontal drilling and fracturing are necessary to tap harder-to-reach gas reservoirs.

"The key difference between conventional and unconventional is hydraulic fracturing," says Asuyuo Edem, manager of unconventional logistics, Shell Oil Company. "A huge volume of transportation is required to deliver frac sand and water necessary to facilitate this process."

The volume of inbound material movements challenges well sites because historically there has been a low level of coordination at the field level. "It’s common knowledge that logistics is an afterthought in the unconventional space," Edem adds. "Everybody is a logistics manager and coordinator."

That’s the core problem. It’s a fragmented and decentralized environment, which only breeds inefficiency. The growing volume of transport activity in remote areas also increases risk exposure.

About six years ago, Shell Canada began looking more closely at how it manages logistics in the field. The company saw a need to enhance data quality, reduce manual processes, and improve its social license to operate—in other words, the level of acceptance or approval by local communities and stakeholders of mining companies and their operations. Shell recognized that professionalizing logistics and increasing safety go hand in hand.

"The first time I went into a wellhead to manage logistics, the site manager said he didn’t need my help to manage dispatch. That man is now one of our strongest advocates," Edem says. "We’ve moved from ground zero to setting up logistics cells in almost all the areas we manage."

Shell put in place field logistics coordinators tasked with receiving requirements from various businesses, then planning and sourcing assets to meet demand. As easy as it sounds, the approach presented a sea-change shift in how sites operate.

An unconventional wellhead is a hub of activity. Drilling groups, frac crews, production facilities, and construction/maintenance are all dependent on transportation. A high volume of service calls and multiple on-site representatives (OSRs) need materials "yesterday." Transportation tends to be highly uncoordinated. In a decentralized environment, consolidation is challenging. Backhaul opportunities go wanting.

By 2013, Shell decided that it needed to push its logistics delivery model to another level by adopting a 4PL-type model. The strategy was not without precedent. The multinational has used DHL as a 4PL provider in its Oman oil field operations. Applying that experience to North America was an attractive option.

"Pre-2009, we were highly decentralized," recalls Edem. "From 2009 to 2011, we put in centralized logistics at the field level. Then we made a push to professionalize this further with the 4PL concept."

Migrating to a 4PL Model

Today, Shell uses 4PLs throughout its North American operational footprint. For example, Ryder manages unconventional freight in the United States, while Schneider handles bulk and water moves. In Canada, Shell works with Menlo Worldwide.

Shell defines the 4PL role as an entity without assets. In other words, the "lead" logistics provider is charged with sourcing the resources and expertise necessary to manage 3PL activities and create value. But given the relative novelty of using 4PLs in the oil and gas space, Shell and its outsourced logistics partners have been challenged with adapting solutions that have traditionally been optimized for retail and manufacturing.

3PL on the Scene

Menlo entered the picture in 2013. The San Cupertino, Calif.-based 3PL started up its oil and gas operations about three years prior, with an account in Anchorage, Alaska. Andy Graff, a 15-year veteran with the company, who also spent five years working on a drilling rig in Prudhoe Bay, currently serves as senior program manager for oil and gas accounts.

Most upstream producers are at the "firefighting stage" in terms of their operational maturation, says Graff. "There are a lot of 3 a.m. phone calls, hotshot trucks, team drivers, air freight, and other considerations that ultimately increase overall costs," he says. "Five to 10 years ago, those were accepted practices. In the words of one CFO, ‘logistics was a rounding error.’"

But times are changing. As natural gas becomes more difficult to reach, especially in unconventional shale formations, producers are drilling holes in their supply chains to mine new efficiencies and economies that offset increasing exploration and production costs. Logistics is an area ripe for improvement.

When Menlo came on board, it prioritized a few key facets within its existing solutions set. First, the 3PL wanted to invest in the business overall. In some industries, such as retail, it’s easy to leverage other resources. But oil and gas has unique requirements—from transportation equipment to labor. The 3PL specifically trained its team on oil and gas process and terminology. It placed special emphasis on building a safety culture.

Menlo also wanted to create a scalable solution that could match the volatility of upstream logistics. Producers are on the move all the time, migrating between sites. It’s a dynamic that differs from other industries where, seasonality aside, operations are more constant.

Importantly, Lean principles underpin these mandates. For example, Menlo worked with Shell to create a strategic vision, then a five-year roadmap that underscored goals they wanted to achieve during the project’s lifetime.

"On a more tactical level, we break that roadmap down into what we call an impact matrix, which allows us to focus on initiatives that deliver the lowest level of effort and highest returns—quick wins," explains Graff. "That generates initial savings and creates a baseline for success moving forward."

Deploying Solutions

Given the oil and gas industry’s logistics immaturity, it has ample opportunities to adapt best practices from other disciplines. Automotive, for example, presents similar JIT dynamics that dictate inventory management tactics; CPG companies know the cost of selling and moving product down to the cent.

"Oil and gas companies generally hold too much inventory," says Love. "They can’t recognize demand, and don’t have confidence in shipment tracking or arrival times. If companies had a more efficient logistics program—and therefore visibility—they wouldn’t have to stockpile additional inventory. They could buy as they need."

Poor visibility and inefficient inventory management inevitably bleed into transportation. That became a burning platform for Menlo as it progressed with Shell’s project.

"Carrier management is a big focus for us," says Graff. "It comes down to visibility and data reporting. Before we got involved, much of the communication was hearsay. Decision-making was based on perceptions among local operators. Bringing data in to track incidents, service failures, late deliveries—in effect, putting data behind those comments—drives a lot of value for our carriers and customers."

Menlo also saw opportunity to help Shell’s OSRs become more proactive in identifying and communicating their requirements. Better planning on the front end reduces costs and creates efficiencies for carriers and operators.

Menlo identified several tactical deployments to address these concerns. Adapting a transportation management solution to the needs of the well site was a cardinal consideration. Logistics technology has largely been developed and optimized for mature retail and manufacturing supply chains. Well site logistics requires more nuanced tweaks.

"We were challenged to bring in a system that created value for end users and field coordinators," Graff adds. "OSRs are making or receiving 100 phone calls every day. So how can you make that communication more efficient from their initial order request to carrier dispatch?"

Menlo deployed its traditional over-the-road transportation solution. Further, it developed a front-end order entry interface that is customized for use in the field. Importantly, the 3PL is also helping Shell incorporate freight audit payment functionality to better understand and assess transportation performance.

A Quick Win

Traditionally, oil and gas companies haven’t had resources at the local level to audit carrier invoices. As Menlo has worked with Shell and other energy companies this has become a quick win from day one. In fact, Graff points to one project in Alaska where the 3PL paid for itself on two months of freight audit payment savings alone.

Love agrees. Producers can find cost savings by calculating freight accessorials. "These benchmarks are used by shippers to change carrier behavior; or by carriers to make sure they’re properly compensated for all the extra service they provide to the shipper," he says.

"Common examples include detention and stop-off charges, both of which contribute to and affect a shipper’s costs," Love adds. "Benchmarking against the market can put companies in a better position to control accessorial costs. Executing the right action plan can help uncover savings."

Beyond freight spend, Menlo has also helped Shell’s on-site workers capture more accurate data and gain better visibility into all aspects of the operation. For example, given the capricious nature of drilling, producers often lease, rather than buy, equipment. But local operators make their own decisions, often without economy in mind. Menlo helped Shell reel in those costs.

OSRs now have access to a low-level Web tool—a simple interface for use in the field—that lets them access information, and track resources and utilization in real time. This pushes the envelope further as operators begin using KPIs to measure performance and align benchmarks with organizational goals.

When Shell began taking a more proactive approach to logistics management in the field, it had some clear targets in mind. First and foremost, the company wanted to improve its safety culture.

"We have been able to dramatically reduce our transportation risk exposure. It’s one of the strongest drivers," says Edem. "Although cost and efficiency are important, safety in light of the social license to operate is a big deal."

Logistics Pays Off

Consequently, Shell has reduced serious incident rates by more than 50 percent. As is often the case, prioritizing logistics pays dividends in countless ways.

"Between 2011 and June 2014, we totaled 80 million truck miles, and 850,000 moves," Edem says. "In that space, we’ve reduced about eight million truck miles through optimization, consolidation, and backhauls. We’ve taken about 80,000 trucks off the road. Consider the impact that has on risk exposure and safety. That’s a huge win."

Bringing Menlo into the fold has similarly accelerated the maturation. "We often see a six-month return on investment with our oil and gas engagements—in other words, after six months we’ve saved more money than we’ve invoiced. It’s not a 24-month ROI," says Graff.

While these quick impacts are positive, they also speak to the execution gap that still exists for many oil and gas companies. Declining oil prices will only widen that divide.

Shell and other leading edge energy companies, in concert with 3PL partners, are working toward establishing industry standards that raise the bar for everyone that plays in the oil and gas space. This entails sharing best practices, standardizing regulations, and developing the social license to operate.

"We have a lot of companies with different models and preferences," Graff says. "But there are areas where we can find collaboration."

Bakken Daily Oil Production

The Bakken reached an important milestone in 2014 when it surpassed one million barrels of production daily, which equates to 76 percent of the oil imported from Saudi Arabia.

Resources To Fuel Your Supply Chain

The following logistics experts can help you improve productivity, compliance, and customer service in your oil, gas, and energy value chain.

C.H. Robinson

C.H. Robinson, an expert in oil and gas logistics, can help you develop and implement proven standard operating procedures and controls, obtain specialized equipment for regular and expedited shipments to serve your customers, and leverage critical logistics information to identify options for improving service and reducing costs.

Learn more at www.chrobinson.com/en/us/Logistics/Industries/Oil-Gas

A.N. Deringer

As one of the largest, privately held customs brokers in North America, Deringer helps deliver value to you and your customers by providing integrated supply chain solutions including customs brokerage, international transportation, warehousing and distribution, and oil and gas compliance.

Learn more atwww.anderinger.com

Dupré Logistics

Dupré’s Energy Distribution Services Group manages the inventories of thousands of retail and fleet fueling stations, as well as managing dedicated fleets. Its automated data flow is customizable, which means you choose the types of data you’d like integrated into your business’ system. Dupré Logistics’ Energy Services Group has delivered 99.7 percent error-free service over a five-year period.

Learn more at www.duprelogistics.com