Trends—July 2013

The 24th Annual State of Logistics Report: ‘Business Unusual’ Defines New Normal

A long and winding path toward recovery has arrived at a seminal question: "Is this the new normal?" That was the topic and title of the annual State of Logistics presentation at the National Press Club in Washington, D.C., in June 2013. That this year’s report, sponsored by the Council of Supply Chain Management Professionals and Penske Logistics, kicked off with a question offers a telling indication of where transportation and logistics players see the U.S. economy.

Four years removed from the Great Recession, concrete answers are still hard to come by. Economic growth remains mired in high unemployment, weak job creation, inconsistent freight volumes and rates, a looming driver shortage and capacity crunch, and a sluggish global marketplace. Pair these concerns with sequestration cutbacks, healthcare reform, and failing infrastructure, and there’s no shortage of conjecture.

For Rosalyn Wilson, senior business analyst with Delcan Corp. and the report’s primary author, one thing is clear: "There is truly no new story to tell," she says. "The same observations about bumping up and down along the bottom, but never quite getting off the ground, could be made about 2012."

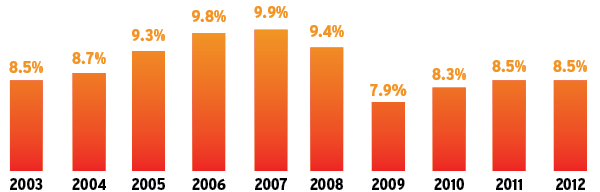

In 2012, total logistics costs increased a modest 3.4 percent, less than half the increase in 2011. Transportation costs rose three percent in 2012, about one-half the growth in 2011. Logistics as a percentage of U.S. nominal GDP remained at 8.5 percent (see chart below).

"Slow economic growth has kept the percentage lower than normal, but the supply chain sector has made great strides in productivity, asset utilization, and inventory management in the past three years," Wilson adds. "These improvements will enable us to keep the logistics percentage low, even at higher volumes."

The recession forced consumers, producers, and carriers to scale back in countless ways—and those survival mechanisms continue to impact the way businesses manage their supply chains.

Logistics Cost as a Percent of GDP

In 2012, business logistics costs held steady at 8.5 percent of gross domestic product (GDP), nearly the same level as they were in 2011, according to the State of Logistics report. Many attribute these low costs to a more efficient transportation system.

This "new order," as Wilson terms it, is shaped by uncertainty. She cites the "phasing out of the traditional peak season"— where holiday volumes are spread out, and have less of an effect on capacity and rates—as one indication of this changing dynamic. Without this certainty, visibility and flexibility upstream in the supply chain become paramount as shippers confront variable demand patterns.

The U.S. manufacturing industry offers a good example of the stops and starts—glimmers of hope and sobering realities—confronting U.S. supply chain participants. Amid rumors of a manufacturing renaissance, activity over the past few years has been on a downward trend.

In 2010, manufacturing rose 7.4 percent as consumers increased spending—likely a consequence of the Obama administration’s short-term economic stimulus package. But in 2011, manufacturing expansion slowed to about five percent, and in 2012 it dropped to less than three percent.

"Customer inventories rose 2.5 percent while supplier deliveries dropped 2.2 percent," says Wilson. "If consumers are not clearing inventory from shelves, businesses are not placing orders, and manufacturers are not producing. Then the transportation sector has nothing to move."

Consequently, growth was slower on the export side, which increased by 4.6 percent in 2012 to $2.2 trillion, compared to 14.5-percent growth one year before. Imports, meanwhile, rose 2.8 percent to $2.7 trillion. Both figures represent high-water marks for U.S. trade.

Sluggish production and seesawing freight volumes are also evident inside the warehouse. Inventory carrying costs posted a four-percent gain, as stock levels rose 6.2 percent and interest rates continued to drop.

While the inventory-to-sales ratio (a measurement that compares inventory against sales for the same month, with a ratio of 1.0 indicating inventory excess, and 1.5 equating to one and a half months of inventory at current sales rates) remained stable at 1.26 through the first quarter of 2012, inventories rose the remainder of the year as sales declined.

Consequently, the cost of warehousing increased 7.6 percent in 2012, as ballooning inventories filled available capacity. Demand forecasting is still nebulous, which, combined with low interest rates, accounts for companies holding more stock.

E-commerce also affected the way companies manage inventory. Consumer expectations have changed. Product availability and speed of delivery, hallmarks of the new e-tail experience, are forcing companies to reconsider distribution and fulfillment strategies. Many traditional brick-and-mortar retailers are still trying to sort out their omni-channel management strategies, which, in the near term, favor carrying more product and more diverse SKU profiles as they optimize business processes.

Mixed Modes

Transportation performance is ultimately derivative of production output and inventory movement. Transportation costs increased three percent in 2012 as modes recorded mixed fortunes.

Trucking, the largest component of shippers’ total transportation outlay, posted a 2.9-percent rise, while tonnage increased 2.3 percent. Asset utilization is at an all-time high as shippers optimize loads and increase efficiency. New truck purchases are replacing older equipment rather than adding to the fleet. Moving forward, as freight volumes pick up, capacity will be a creeping concern.

"Truck capacity is still walking a fine line, with few shortages but industry-high utilization rates," says Wilson. "Qualified truck drivers have become a valuable commodity in very short supply. This will be more of an issue as the shortage grows from 30,000 drivers today to 115,000 by 2016."

A number of trends are impacting labor availability. More port intermodal activity increases drayage driver demand, which further shrinks the pool for mainstream trucking. Of greater concern, the Hours-of-Service regulations that went into effect July 1, 2013, will impact driver productivity; and Compliance, Safety, and Accountability (CSA) requirements have reduced the pool of eligible drivers. It’s a double whammy that will inevitably reach catharsis—whether it’s a wholesale shift toward intermodal, or policy changes at the federal and state levels, that increase truck productivity and/or add bandwidth and throughput efficiency through infrastructure development.

Ocean and airfreight carriers continue to deal with too much capacity. Costs for the water sector declined 0.9 percent in 2012, as vessel capacity jumped 7.2 percent. Steamship lines have been jockeying and divesting assets—from chassis to vessels—to get back to basics and bring supply more in line with demand.

The absence of peak-season volumes and surcharges has forced the issue for some carriers as they scale fleets or enter into vessel-sharing agreements to manage capacity and artificially stimulate rates. In the near term, Wilson expects more of the same as new ship orders come online (carriers did not stop ordering until mid-2011). Capacity is expected to rise by 10 percent in 2013 because of new deliveries.

Airfreight revenue increased 3.1 percent in 2012, while total tonnage declined 2.2 percent. Like their ocean peers, airlines are struggling with capacity. Where possible, carriers are rationalizing assets between combi-aircraft and freighters to maintain profitability. Belly cargo is more attractive than pure freighter business, says Wilson, so carriers are moving aggressively in that direction.

Railroads remain a bright spot for the U.S. transportation industry, even if their star dimmed noticeably compared to 2011. The cost for rail transportation was up 4.9 percent in 2012, down from an increase of more than 16 percent one year ago. The average length of haul increased to 948 miles from 917 in 2011, while ton-miles decreased one percent and carloads dropped 3.1 percent. Class I freight revenue per ton-mile increased 5.3 percent.

The railroads, which continue to invest heavily in new infrastructure—capital spending increased 16.1 percent in 2012, topping $13 billion—are approaching a commodity crossroads. Coal movements, once a trademark of the tracks, are trending downward. Meanwhile, a natural gas boom is creating new demand, and the impasse over the Keystone XL Pipeline has pushed more crude on rail—it’s the fastest expanding commodity group, growing 53 percent year over year.

Intermodal remains strong; 2012 volume was the second highest on record.

The U.S. inland waterway system is enjoying mixed success. While industry dependence on barge transit is likely to grow as capacity tightens, the 2012 Midwest drought and recent flooding created lengthy bottlenecks that impede river transit. Aging locks and dams are of equal concern. Any disturbance on U.S. waterways pushes freight to other modes, which takes away capacity and increases costs elsewhere.

Ports RAMP Up to Get Back Funding

Many goods enter and exit the United States through a harbor. But those shipping channels don’t take care of themselves. The country’s port infrastructure requires constant maintenance by the U.S. Army Corps of Engineers (USACE).

Funding for USACE’s upkeep operations comes from the Harbor Maintenance Trust Fund (HMTF), which was established in 1986 as part of the Water Resources Development Act. HMTF funds are derived from port and waterway taxes.

In recent years, the HMTF has seen a series of surpluses, yet the gap between revenue deposited into the HMTF and annual appropriations to the nation’s ports has grown considerably. With the United States mired in debt, the federal government has been consistently shaving money off the top of the HMTF since about 2002.

"Port of Houston collects about $100 million a year in Harbor Maintenance Tax, and we’re only getting about $30 million this year to maintain our channels," says Phyllis Saathoff, deputy executive director of corporate affairs for the Port of Houston Authority. "We’d like to see more of the dollars that are collected here be invested back into the Houston ship channel." Due to underfunding and a backlog of maintenance needs, Port of Houston’s 2013 costs total about $70 million.

This lack of funding has caused many ship channels to begin filling up with sediment and other debris, keeping U.S. vessels from loading their maximum capacity, and causing incoming vessels to offload cargo to lighten their load before entering U.S. ports.

"We have voiced our concerns, and joined with other U.S. ports to press Congress to take action and spend all the funds that have been set forth in the Harbor Maintenance Trust Fund on maintaining our ports. That’s what it was put in place for," says Saathoff. "More than half the funds have been used to meet other needs in the federal government’s budget."

The answer for ports lies in the Realize America’s Maritime Promise, or RAMP Act, which contains a section that would reallocate HMTF funds for their intended purpose of maintaining the nation’s ports and waterways. The RAMP Act is currently under consideration by several U.S. Senate committees. In the meantime, U.S. ports are left to pay for their own maintenance or let their channels degrade.

—Jason McDowell

Port Competition Grows Heated

The race is on as U.S. ports look to grow their business in a flat economy, and position themselves to capture post-Panama Canal expansion market share. Industrial real estate availability, proximity to population density, and improved infrastructure are the three most important success factors, according to Jones Lang LaSalle’s (JLL) fifth-annual Seaport Outlook, which ranks the most prominent U.S. ports.

"Competition is rising even while trade growth is stagnant," explains Rich Thompson, managing director of JLL’s Ports Airports and Global Infrastructure (PAGI) group. "The emergence of marketplace shifts related to multi-channel retail strategies, as well as the soon-to-be completed Panama Canal expansion, are changing the positioning for many U.S. ports. To gain market share, ports must improve both infrastructure and connectivity, and possess required, Class A distribution center space to support the increasing demands of corporate supply chain strategies."

Having surpassed the California ports to claim the top spot in the 2012 index, the Port of New York and New Jersey ranks first again in 2013—by a rapidly widening nine-point margin—followed by Los Angeles and Long Beach.

The PAGI score provides a quick snapshot of U.S. seaports from the vantage point of the real estate stakeholder—those who invest in, develop, or occupy industrial property in port-centric locations. JLL bases the index on 25 measurable performance metrics, divided into two major categories: terminal operating factors and the corresponding real estate market factors. The resulting index score is a combination of the performance indicators, providing a subjective measure of a port’s value to Jones Lang LaSalle clients and their customers.

Among other ports, Savannah continues to lead the second tier, with Baltimore and Jacksonville in tow. Charleston tops the third tier, followed by Tacoma and Virginia. Charleston and Virginia switched places compared to last year’s rankings.

10 Supply Chain Game-Changers

Many volatilities threaten efficiency and economy in today’s global supply chain. To help companies account for these challenges, and improve their operations, the University of Tennessee (UT) Global Supply Chain Institute pinpoints 10 game-changing supply chain trends in a recent report. UT faculty surveyed 163 supply chain professionals from 132 global companies including retailers, manufacturers, and service providers. As defined by the survey, these game-changing trends can greatly impact a firm’s shareholder value, and can be extremely difficult to implement successfully.

1. Customer relationship management. Leading companies are successfully segmenting their products and customers, and developing tailored supply chain solutions for each segment. This approach allowed one firm to eliminate nearly half of its inventory, while still improving on-shelf availability from 96 percent to nearly 100 percent.

2. Collaborative relationships. A win-win collaboration between supplier and customer may be rare, but it can produce amazing results. These collaborations should be built on a foundation of common metrics, shared benefits, and trust.

3. Transformational strategy. Only 16 percent of firms have a documented multi-year supply chain strategy, yet developing these strategies can produce spectacular results. One example: Whirlpool used a transformational strategy to deliver record-high service levels while decreasing inventory levels by more than $100 million and logistics costs by $20 million.

4. Process integration. Functional silos still exist and disrupt supply chain performance. One opportunity that can have tremendous impact is integrating purchasing and logistics. Although both functions are traditional supply chain functions, UT research confirms significant payback when these two areas align their objectives and operating plans.

5. Driver-based metrics. Simply changing a company’s performance measurement and goal-setting system can greatly enhance overall supply chain performance. By applying this concept, Procter & Gamble dramatically increased customer service levels, market share, and sales.

6. Information sharing and visibility. Businesses are changing the game by sharing and linking together masses of information from multiple sources (also referred to as big data), and interpreting the data using business analytics expertise.

7. Demand management. No one buys a company’s stock because of the company’s ability to forecast. Yet increasing forecasting accuracy, along with integrating the demand and supply functions across the supply chain, can drive higher revenue, lower working capital, and decrease costs.

8. Talent management. Talent management is the number-one requirement for transforming a supply chain. Critical competencies in hiring top supply chain talent include global orientation, leadership and business skills, and technical savvy.

9. Virtual integration. One fundamental of a great supply chain is a company sticking to its core competencies—and leaving the rest to world-class service providers. When outsourcing, firms should create a win-win vested outsourcing framework with its service providers.

10. Value-based management. Supply chain excellence is the key to creating shareholder value. On average, the supply chain controls 100 percent of the inventory, manages 60 to 70 percent of the cost of goods sold, and provides the foundation to generate revenue by delivering outstanding availability.

DHL Investment Soars in the Bluegrass State

DHL Express, a division of global logistics company Deutsche Post DHL, spent four years and more than $105 million to expand its Americas hub at Cincinnati/Northern Kentucky (CVG) Airport into a super-hub, adding an 180,000-square-foot sorting facility that can handle larger express shipments, a facility-wide technology enhancement, and a new ramp that can accommodate wide-bodied aircraft. The expansion allows DHL Express to auto-sort more than 125,000 letters and parcels per night, and connect customers to flights from more than 220 countries and territories, as well as every region of the United States.

While touring the hub, Inbound Logistics spoke with Stephen Fenwick, CEO, DHL Express Americas. "Our investments in the DHL CVG hub enable us to respond quickly and effectively to growing international activity, especially among small and mid-sized businesses," Fenwick says.

The expansion has also been a boon for the Cincinnati/Northern Kentucky area, adding 2,000 jobs over the past four years. "DHL Express is a valuable resource for our state, not only enhancing our strong logistics network for international trade, but also for the Northern Kentucky community itself, which has benefited from the company’s continued investment and development," says Kentucky Governor Steve Beshear.

Fenwick agrees. "DHL has been a big contributor to the Kentucky area, and the Kentucky area has been a big contributor to us."

—Jason McDowell