Trends—July 2014

The 25th Annual State of Logistics Report: Ready For a New Route

After a rollercoaster year for the economy and the transportation sector, the Council of Supply Chain Management Professionals and Penske Logistics released their 25th annual State of Logistics report. Aptly titled Ready For a New Route, the report focuses on 2013’s weak economy, mediocre gains by the transportation sector, and the slow road toward economic recovery in 2014.

Even though five years have passed since the Great Recession, 2013 wasn’t exactly a blowout year for the economy. But recovery is proceeding slowly. Gross domestic product (GDP) growth was only 1.9 percent—nearly one full percentage point down from 2012’s 2.8 percent. Prior to the fourth quarter of 2013, the GDP was looking positive, but falling exports and a government shutdown caused steady decline toward the end of the year and into early 2014.

The improved GDP growth rate through most of the year didn’t do much for the freight sector. "Factors pushing up GDP were mostly counter to the growth of freight volume," says Rosalyn Wilson, a transportation consultant for Parsons, and primary author of the State of Logistics report. Increased inventory investment, a slowing of imports, and falling exports resulted in less freight, despite the improving GDP, she says.

Logistics Costs as Percent of GDP

While 2013 business logistics costs increased to $1.39 trillion—topping 2012 numbers by $31 billion—the percentage of logistics costs making up the GDP fell to 8.2 percent, marking the second consecutive annual drop and suggesting that the logistics sector is recovering more slowly than the rest of the economy.

What 2012’s State of Logistics report called "the phasing out of the traditional peak season" helps to explain the fourth quarter GDP crash and lower logistics GDP percentages. Thanksgiving and Black Friday sales dropped for the first time in seven years, falling 2.7 percent. Holiday retail sales in general were weaker than 2012. Online sales posted record highs, but, because most small package carriers don’t report their data, much of the effect wasn’t factored in.

"Industrial production held steady for the first eight months of 2013, then began to strengthen somewhat for the last four months," says Wilson. Amid rumors of a renaissance, U.S. manufacturing made modest gains throughout the year. The average Institute of Supply Management PMI (composite index) in 2013 was 53.9, beginning with January’s 53.1 start, and ending with December’s 57 finish. A 4.5-percent drop in new export orders didn’t help, as order backlogs contracted 2.5 percent.

The inventory-to-sales ratio (a measurement that compares inventory against sales for the same month, with a ratio of 1.0 indicating inventory excess, and 1.5 equating to 1.5 months of inventory at current sales rates) reached 1.3 by April as sales remained slow and inventories stayed high. Higher sales and slower inventory growth in May dropped the ratio to 1.28 until October, when it bumped up to 1.29.

High inventory levels spread across all major sectors, with manufacturing inventories gaining 2.1 percent, and wholesale inventories adding 2.7 percent, mostly in the fourth quarter in anticipation of a strong holiday season. Retail inventories increased in each quarter, totaling 6.2 percent for the year, as retail sales continually failed to match predicted demands.

Inventory carrying costs rose 2.8 percent throughout the year, but interest rates continued to drop to 0.9 percent. These high carrying costs and inventory levels raised warehousing costs by 5.6 percent as all available capacity was filled. Fourth-quarter demand reached the highest level on record.

One Mode or Another

Low exports, a brutal winter, and high seasonal volumes affected transportation performance for the year. Transportation costs climbed two percent, and all modes reported similar revenue increases.

Trucking costs rose 1.6 percent in 2013, which proved to be a weak revenue year for the industry. Truck tonnage increased by 6.1 percent as the driver shortage forced shippers and carriers to move heavier loads to compensate for tight capacity. Rates have remained relatively flat, however, as shippers still feel secure in the number of options available to them—even with the industry operating at near 100-percent utilization.

Rates won’t stay flat forever, though. The capacity issue will only get worse. The Federal Motor Carrier Safety Administration‘s new Hours-of-Service laws give drivers fewer hours on the road at a time when the industry is short more than 30,000 drivers, causing capacity to decline while demand continues to increase. "Carriers should be able to raise rates significantly in 2014, probably into the five- to eight-percent range," says Wilson.

The rail industry has faced capacity problems of its own, suffering car and even locomotive shortages throughout 2013. Rail transportation costs were up 4.9 percent in 2013, rail traffic rose 9.2 percent, and total annual carloads increased 8.1 percent (the largest increase in recent history). Intermodal volume went up 10.6 percent, but rates were held down by trucking industry competition.

While rail and trucking are fighting to maintain enough capacity, the ocean carrier sector still has too much, despite increased global shipment volumes. "In recent years, the major players have been forming alliances with other carriers to shore up sagging freight rates, raise ROI, and reduce high-capital investments," says Wilson. "The largest carriers worldwide now control more than 80 percent of the total fleet capacity, up from just around 55 percent a few years ago."

The cost for the water sector rose 4.5 percent in 2013, showing improvement despite negative numbers in 2012 and the looming overcapacity problem. Imports and exports underperformed at U.S. ports in 2013, and may continue to do so for ports that aren’t prepared for larger vessels.

The air cargo industry also continues to be plagued by capacity issues. Revenue remained virtually unchanged for 2013, but cargo yields were down 5.3 percent on domestic shipments, and five percent on international shipments. Overall revenue tons carried by air declined 0.7 percent.

"Passenger jets are carrying growing volumes of cargo in their bellies, taking market share from cargo freighters," says Wilson. Cargo airlines carried more than 79 percent of revenue ton-miles of freight, but commercial passenger airlines carried the remaining tonnage.

The U.S. inland waterway system enjoyed mixed success in 2013, as strong first and fourth quarters offset low coal shipments, poor harvests, and bad weather during the rest of the year. Worldwide demand for U.S. grain saved the industry in the fourth quarter, but outdated equipment, droughts, and floods continue to plague performance. New legislation aimed at reallocating unused funding to fix or rebuild lock and port systems nationwide might solve some of the river industry’s problems.

What’s Next?

The good news is that 2014 is looking up. After a dismal fourth quarter in 2013, and a cautious first quarter in 2014, the "new normal" trend was shaken off in the second quarter. The logistics sector added 288,000 jobs in April, shipment volumes and freight payments climbed, and construction projects began to grow.

These trends continued into May, as retail sales also increased and the Consumer Confidence Index rose from 81.7 percent to 83 percent. "The first five months of 2014 have been the strongest since the end of the Great Recession," says Wilson. "All indications are that freight will grow moderately for the rest of the year, and the economy should follow suit."

The State Of Logistics: For What It’s Worth

(in $U.S. billions, except where noted)

| Carrying Costs ($2.459 Trillion, All Business Inventory) | |

| Interest | $ 2 |

| Taxes, Obsolescence, Depreciation, Insurance | $ 330 |

| Warehousing | $ 137 |

| Subtotal: | $ 469 |

| Transportation Costs | |

| Motor Carriers: | |

| • Truck—Intercity | $ 453 |

| • Truck—Local | $ 204 |

| Subtotal: | $ 657 |

| Other Carriers: | |

| • Railroads | $ 74 |

| • Water | |

| – International | $ 30 |

| – Domestic | $ 7 |

| • Oil Pipelines | $ 13 |

| • Air | |

| – International | $ 13 |

| – Domestic | $ 20 |

| • Forwarders | $ 38 |

| Subtotal: | $ 195 |

| Shipper-Related Costs | $10 |

| Logistics Administration | $ 53 |

| TOTAL LOGISTICS COST | $ 1,385 |

| Source: State of Logistics report | |

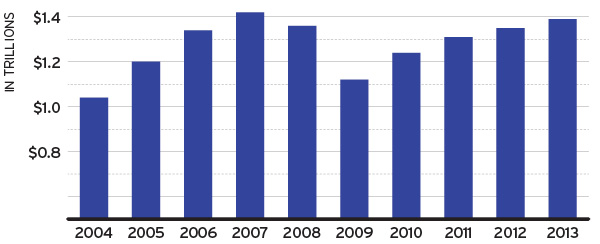

U.S. Business Logistics Costs

Total U.S. business logistics costs rose to $1.39 trillion in 2013, a 2.3-percent increase from the previous year.

Note: Revised to reflect updates in BEA Private Inventories series. Source: State of Logistics report

Inventories Continue to Climb

High inventory levels spread across all three major sectors, with manufacturing inventories gaining 2.1 percent, and wholesale inventories adding 2.7 percent.

Source: U.S. Department of Commerce, Census Bureau

Freight Brokerage M&A Shakes Things Up

The freight brokerage space experienced a lot of churn in 2013, with players such as Coyote Logistics, XPO Logistics, Echo Global Logistics, and Blue Grace Logistics acquiring new assets. Tightening capacity and market fragmentation continue to feed a fertile mergers and acquisitions (M&A) market.

Case in point: The Transportation Intermediaries Association’s (TIA) 1st Quarter 2014: TIA 3PL Market Report indicates freight broker revenues are increasing.

Despite a difficult environment, all three primary modes—LTL, truckload, and intermodal—recorded double-digit profit growth. Intermodal was the only mode that saw an increase in shipment volume, invoice amount per load, and total revenues, according to TIA.

LTL posted the largest increase in total shipments, while all modes experienced a margin percentage decline. Truckload volume decreased modestly, and LTL invoice amount per load decreased as well. Overall, the results point to continued growth.

"The brokerage market is in a land grab phase," explains Jett McCandless, president and founder of Carrier Direct, a Chicago-based transportation and logistics consultant. "The big players that have access to capital via equity or debt markets have found that growing market share through M&A can be a strong complement to their own organic growth activities.

"Cold starts can be very expensive in new markets, but buying a company that has already gone through the effort to develop the market and attract talent can be a better option at the right price," he adds.

Market consolidation will continue, McCandless predicts, provided acquirers can find companies that fit the right profile. That reality remains to be seen.

"The target company has to have the right characteristics to be worth something to the buyer," he adds. "It has to be big enough (more than $25 million in revenue), have strong customer relationships (contracts preferred), a direct sales force (not agent-based), good carrier relationships, and maybe proprietary technology."

The 2012 federal highway funding authorization, which stipulates that freight brokers carry a surety bond of $75,000, has also influenced industry contraction. Up to 35 percent of brokers lost operating authority as a consequence of that rule, which went into effect in October 2013, projects the Association of Independent Property Brokers & Agents. The Federal Motor Carrier Safety Administration pegs that number at a more conservative 10 percent.

Regardless, there has been attrition. And some in the brokerage space expect change to continue, especially as private equity companies pour more investment into a "sure thing."

"Companies are selling for one of two reasons: one, the natural progression of baby boomers selling as they near retirement; and two, as the industry develops, small companies can’t compete with technologically progressive companies with deep pockets and long-term growth plans," says Robert Nathan, CEO of Load Delivered, a Chicago non-asset 3PL.

Beyond that, some brokers are morphing into 3PLs—adding non-asset value through new technologies and services. Lines continue to blur. What differentiates one from the other remains in question.

As capacity grows scarce, and shippers and carriers look to find space and fill backhauls, one might even consider whether pure-play brokers will come back into vogue. Nathan doesn’t think so.

"By 2020, freight brokers will either be dead or have evolved into 3PLs," he says. "Companies aren’t looking for someone to handle one load; they’re looking for a full-service, managed transportation partner that can work with them to create the most efficient and effective supply chain network possible. We are moving into a world where organizations want to focus on their core competencies, and to do so, they are looking for sophisticated partners."

FMCSA Extends Comment Period For ELD Implementation

It’s only a matter of time before the Federal Motor Carrier Safety Administration (FMCSA) dials up a final deadline for trucking companies and drivers to deploy electronic logging devices—an Hours-of-Service regulation requirement.

The FMCSA initially floated October 2015 as a target date, but that will likely be pushed out to 2016 or 2017. The Commercial Vehicle Alliance recently asked the FMCSA to extend the comment period until late summer 2014. The effective enforcement date will be two years after publication of the final rule.

When final, the regulation will require all drivers who currently keep records of duty status to use electronic logging devices—formerly known as electronic onboard recorders. Only drivers who operate under short-distance exceptions will be exempt.

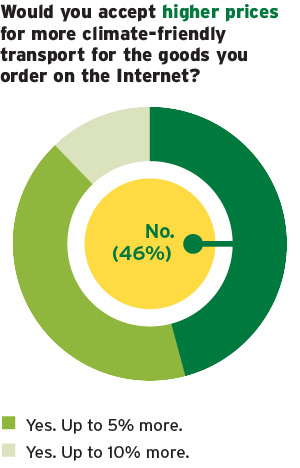

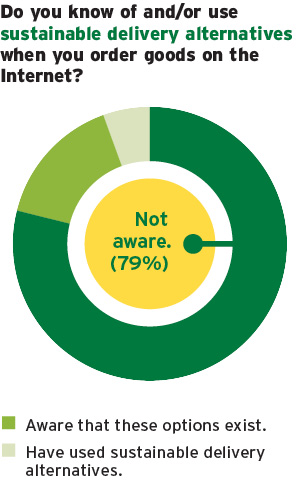

Online Shoppers Willing to Spend Green on Green

Online consumers are more receptive to sustainable delivery options than you might think, according to Need for Green or Need for Speed, a new study by business consulting firm West Monroe Partners.

The study surveyed more than 600 U.S. consumers to determine what compromises they’d be willing to make for more sustainable delivery of products purchased online. Highlights of the results include:

- 12 percent of U.S. consumers would pay up to 10 percent more for sustainable delivery.

- Annual income does not influence consumers’ willingness to pay more for sustainable delivery. In fact, respondents who earn more than $100,000 annually are slightly less likely to accept higher prices for climate-friendly transport.

- Similarly, age has only a minor impact on attitudes toward sustainability, with 18- to 25-year-olds slightly less likely to pay more for climate-friendly transport compared to 26- to 35-year olds.

More than half of those surveyed are willing to pay at least five percent higher prices for products ordered online if they’re delivered in a greener manner, while 76 percent would wait at least one extra day for climate-friendly transport.

"The modern consumer is paying more than lip service to environmentally conscious decisions these days, and plenty are willing to put their money and patience where their mouths are," says Yves Leclerc, managing director and leader of West Monroe Partners’ supply chain practice. "Given the dominance of e-commerce, and trends such as same- and next-day delivery, order fulfillment’s impact on the environment is a significant one."

The study demonstrates that, if informed about the options available to them, many consumers would make at least minor concessions for more sustainable delivery (see chart below).

Dutch consultant BearingPoint conducted the same study in Europe, and found consumers there are more aware of green delivery options than those in the United States.

Of the 1,000 European respondents BearingPoint surveyed, nearly half are aware of climate-friendly shipping alternatives, and one in five has already used them. Almost 60 percent are willing to pay more for green shipping, and 76 percent are willing to wait up to three days longer for sustainable delivery.

The study concludes that e-commerce organizations should consider new ways to promote delivery alternatives to please both consumers and shareholders. It may just be another consideration that tips consumer whim one way or the other.

Consumers & Compromise

Shippers Can’t Get No Satisfaction

If you’re a shipper or consignee, retailer or consumer, keep an eye on these two soberingtrends:

Customers are not happy with the service they are receiving from parcel carriers. Satisfaction dropped nearly four percent in 2013, largely attributed to the holiday delivery debacle, reports the annual American Customer Satisfaction Index (ACSI).

“The surge in online shopping just before Christmas created a fair amount of customer angst with Internet retailers, but carriers weren’t spared consumers’ ire,” says David VanAmburg, ACSI director. “Even large carriers with the most resources weren’t sufficiently prepared for the rush of last-minute deliveries, and many packages did not arrive on time for the holidays.”

Parcel delivery companies struggled with a shortened holiday shopping season and an unexpected last-minute, last-mile rush. They simply didn’t have capacity to keep up with velocity. That may be a recurring problem moving forward.

Shippers are losing leverage to trucking companies. Capacity is tightening and costs will increase as a consequence, according to FTR’s latest Shippers Conditions Index. The forecasting firm expects the tight environment to moderate slightly in the coming months unless freight growth picks up as a result of a strengthening economy. Any additional freight tonnage improvement could push transportation costs even higher for shippers – and likely consumers, FTR cautions.

“Shippers learned that it doesn’t take much for a market that is operating with slim excess capacity to jump into the driver’s seat for rate increases,” says Jonathan Starks, FTR’s director of transportation analysis. “The strong spot market rate increases during January, February, and March 2014 highlight how quickly the environment can change on them.”

It’s a remarkable turnaround from 2013, when general rate increases fell below year-ago levels, and shippers were netting rate reductions. “A static economy allowed that to take place, but new Hours-of-Service rules for drivers in July 2013 changed the game,” Starks says. “Add the potential for further economic acceleration in 2014, and it’s unlikely shippers will achieve the rate reductions they got last year.”

FTR projects a general rate increase of four to five percent for truckload in 2014, with national rate figures hitting six percent or higher compared to last year.

Prepping Vets for Private Sector Careers

The U.S. military drawdown in Afghanistan, and further government budget cutbacks, are creating an exodus of sorts as veterans enter the civilian world. The Obama administration expects to cut the active-duty army from a wartime peak of 570,000 soldiers to about 450,000. Further downsizing will create a surplus of veterans looking for jobs – in an employment market that remains muddled at best.

If there’s one sector with steady demand for the kind of disciplined skillset coming out of the army, it’s supply chain management. Still, military and private sector logistics are not the same.

That’s why the University of Kansas (KU) School of Business, in concert with the U.S. Army Command and General Staff College at Fort Leavenworth, established a graduate program that offers active-duty officers a specialized degree in supply chain management.

The Master of Science in Business with concentration in Supply Chain Management and Logistics complements the training and experience military logisticians already possess, while providing a broader, civilian economy focus. Majors and major-eligible captains assigned to Fort Leavenworth for Intermediate Level Education (ILE) form the program’s principal base, and the KU schedule is designed to mesh with that of the ILE curriculum.

The program is an accelerated, demanding 10-month program that aims to provide officers with the necessary requisites to pursue supply chain careers in the private sector when they muster out, says Greg Freix, program director and retired Air Force Colonel. But he’s quick to point out that it’s not a bridge to civilian life, because many officers still have years of service to fulfill their commitments.

“When we developed the program in 2008, we had two explicit goals. The first we could measure quickly – to provide education that would make officers better logisticians on active duty. We’ve received a lot of unsolicited feedback from our graduates saying the program is valuable,” explains Freix. “The second goal is to provide a springboard for officers when it comes time to hang up the uniform for civilian employment.”

The program is already at full capacity – a reflection of its popularity. Freix hopes that, in the future, the school can build a center of excellence that provides an incubator for sharing best practices between the military and private sector.