VERTICAL FOCUS | Fast-Moving Consumer Goods

4 Things FMCG Retailers Need to Know

FMCG retailers need to be aware of four key areas as they build their future omnichannel supply chains, finds RSR Research’s Supply Chain Management 2018 report.

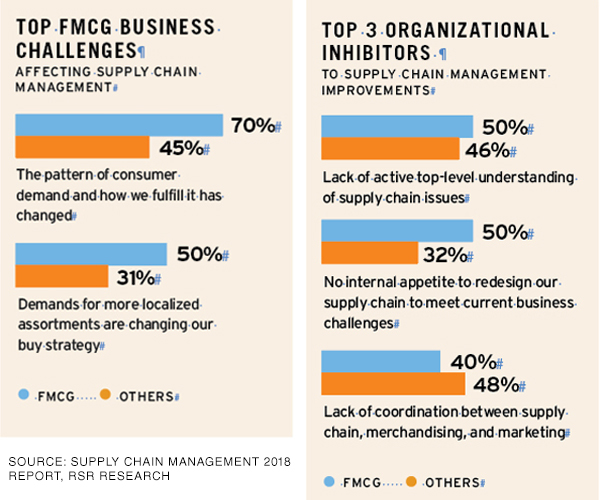

1. Change signals. Retailers are increasingly aware that new digitally enabled consumer behaviors are challenging a key operational assumption—that consumers will start and end their consumer journeys within the four walls of the physical store. Of the FMCG retailers that responded to the RSR survey, 70% see the change in the pattern of consumer demand and how they fulfill it as the top business challenge affecting supply chain management.

2. Learning to play with new service models. All FMCG retailers have adopted the self-service model to some degree, but omnichannel consumers who want something more are challenging that model. However, many retail executives are concerned that omnichannel orders are not profitable, with 70% of FMCG retailers stating that quantifying labor and shipment costs for cross-channel fulfillment is a challenge in supply chain management. To address this concern, retailers need to implement operational key performance indicators that will measure the new costs. When these are implemented, retailers will be able to prioritize improvements to the supply chain to meet the new demand.

3. Change starts at the top. FMCG retailers, more than other verticals, cite "lack of top-level understanding of supply chain issues" and "no internal appetite" for changing the supply chain as top organizational inhibitors. So, whether senior executives want to change or not, they have to, as new formats and agile new competition are already challenging traditional operators’ most basic operating assumptions.

4. What was a differentiator is now a necessity. Previously, supply chain masters offered products at low prices to consumers, but since the relatively halcyon days of the late 1980s to 2000, using low price as the primary competitive wedge has been harder to do, as other retailers have figured out ways to compete at that level. Retailers that responded early to the looming challenges created by consumer omnichannel shopping behaviors gained a strategic advantage. But what was a strategic differentiator has now become a strategic necessity, according to 60% of respondents. Retailers are learning how to calculate demand with greater precision than before and how to manage the complex last mile of the omnichannel supply chain. These efforts are tied to how retailers are redesigning the role of the store as an omnichannel order fulfillment center, in addition to offering a great experience for consumers who choose to use the store in the traditional way.

What’s the deal with FMCGs?

Fast-moving consumer goods (FMCGs) are products that sell quickly at relatively low cost. Consumers purchase these goods frequently and consume them rapidly; retailers price them low and sell them in large quantities.

FMCGs have a short shelf life because of high consumer demand—for soda and confections, for example—or because they are perishable.

Types of FMCGs

- Baked goods

- Bottled beverages

- Cleaning products

- Cosmetics and toiletries

- Dry goods, such as raisins and nuts

- Fresh and frozen foods

- Medicines that can be purchased without a prescription

- Office supplies

- Prepared, ready-to-eat meals

- Processed foods, such as cereal and boxed pasta

Top 10 FMCG Companies

- Nestle

- Johnson & Johnson

- Procter & Gamble

- PepsiCo

- Unilever

- AB InBev

- Coca Cola

- JBS

- Phillip Morris

- L’Oréal