Trends—September 2015

Rising Labor Costs Eat Into Fast Food Supply Chains

When New York State’s wage board voted to raise minimum pay to $15 in July 2015, it set tails wagging around the country. The wage hike, which will be phased in over the next three years upon approval by the state’s labor commissioner, only applies to fast food chains with more than 30 locations nationwide. How the N.Y. State Department of Labor defines "fast food" is open to interpretation. But it’s an important consideration, especially as food purveyors adapt to a consumer base that increasingly expects more—on demand.

N.Y. Governor Cuomo’s latest social welfare gambit will have a significant impact on small business owners—notably entrepreneurial franchisees.

The governor encountered similar inertia from economic development and business interests in late 2014 when he shared plans to reinvent JFK International Airport by diverting freight traffic to Westchester County.

With regards to hiking pay, New York is not alone. Other states have raised minimum wage to float with inflation. Los Angeles, Seattle, San Francisco, and Chicago have passed similar measures peaking at $15. In urban areas, where the cost of living is more expensive, there is greater rationale for paying higher wages. But Cuomo’s largess includes the entire state.

A higher wage at McDonald’s, for example, means smaller businesses across all retail sectors will have a more difficult time competing for labor. That adds cost. And upstate New York’s economy is far different than the five boroughs of New York City. A 70-percent increase in hourly pay for low-skill labor will likely curb economic development and expansion in less densely populated areas.

Labor on the Line

Fast food companies operate on razor-thin margins. They have always been hyper-sensitive to price pressures, whether it’s macroeconomic trends that dictate consumption patterns or avian bird flu, which is raising poultry and egg prices. Labor is another important line on the ledger.

Consider the fast food industry workforce. Across the United States, operators employ 2.4 million wait staffers, nearly three million cooks and food preparers, and 3.3 million cashiers, according to a recent Washington Post article. More telling, 30 percent of the restaurant industry’s costs come from salaries.

Not surprisingly, companies are scaling back staff. The average number of employees at fast food restaurants fell by fewer than two people over the past decade, according to market research company IBISWorld.

Automation is inevitable. It’s hard not to think that the Internet, touchscreens, and robots will eventually replace fast food cashiers in much the same way banks and grocery stores have adapted to the technology. In some places, it’s already happening.

Chipotle allows consumers to click and collect meals at their convenience; Dominos’ online ordering system prioritizes customization; McDonald’s and Panera are testing self-ordering kiosks.

Perhaps the most avant-garde example is Eatsa, a San Francisco-based fast food restaurant that serves up bowls of Andean cuisine without any human interaction. There is no cashier or counter. Customers simply place their order on a touchscreen, then wait for robots to deliver the meal to unique cubbyholes for pickup.

New York State’s progressive labor approach may be a tipping point for automation in the fast food industry. It’s already happening in the supply chain at the warehouse level. But price pressures are forcing change at the counter as well. Governor Cuomo and the state wage board are betting the odds that raising wages is more important that expanding job growth.

The problem is, policy can’t keep pace with technology.

Total Recall

Stakeholders up and down the food supply chain are anxiously awaiting the Food Safety Modernization Act’s (FSMA) final rules of engagement. A rash of highly publicized food recalls catalyzed President Obama’s decision to revisit food safety legislation in 2011. Reform can’t come soon enough, suggests new research from Stericycle Expert Solutions.

Consumer preference for organic food products is driving an increase in healthy product recalls, creating complexities for manufacturers, regulators, and consumers, according to the Indianapolis-based recall solutions specialist.

Seventy percent of consumers believe a food item is safer, more nutritious, or of higher quality if it is labeled as organic. But as consumer awareness of and demand for healthier foods continue to grow, recalls are occurring more frequently.

More than 64 percent of food recalls have been related to healthy products since 2012, according to Stericycle’s data. This trend continued to manifest itself in the second quarter of 2015. Sixty-five percent of recall events were related to healthy food, with listeria contamination and labeling issues among the chief drivers.

“The trend shows no sign of slowing, and companies are looking for ways to expand into this high-growth sector,” explains Kevin Pollack, vice president, Stericycle. “For example, leading food manufacturers have reconfigured their products to cater to the health-conscious consumer. In other industries, companies that focus on eco-friendly products are experiencing record success.”

Government regulation and consumer awareness will also force the issue. Growing supply chain transparency, mandated traceability requirements, and social media hold food companies accountable.

“In order to maintain compliance, prevent financial and reputational damage, and protect consumers, it’s essential that companies review and revise their recall plans regularly,” says Pollack.

Trucks, Rails Weight It Out

The battle over truck weight restrictions has become a contentious regulatory issue, pitting railroads and trucking companies against one another. The crux of the matter is whether states or the federal government should raise the capacity threshold for over-the-road interstate commerce.

In June 2015, the U.S. Department of Transportation released its Comprehensive Truck Size and Weight Limits study, which was mandated under the provisions of the 2012 MAP-21 highway bill. The findings, and reactions from both industry and the public, have been mixed.

In summary, the study failed to deliver any definitive answer due to insufficient data—i.e., the lack of descriptive information regarding trailer weights in crash reports; and that the status quo was preferable to reform. Absent any directive, the verdict has been widely viewed as a win for those that oppose increasing weight limits.

On the other hand, pro-truck interests point to some of the report’s conclusions as justification for further study. Notably, six-axle trucks can safely weigh up to 91,000 pounds while yielding significant truckload reductions, pavement wear savings, and environmental efficiency benefits. Likewise, more productive trucks reduce congestion costs, fuel costs, and carbon emissions.

This empirical evidence led Rep. Reid Ribble (R-Wis.) to subsequently introduce the Safe, Flexible, and Efficient Trucking Act to the House of Representatives in early September 2015. Specifically, the legislation would allow states to increase the gross vehicle weight limit on commercial trucks if they are properly equipped with six axles and meet the same safety standards as trucks currently allowed on interstates.

The new move has been well received by heavy over-the-road users, such as farmers. The dairy industry, for example, relies on commercial trucks to get milk from the farm to plants, and to move dairy foods from the plants to grocery shelves across the country. Because the products are perishable, they must move quickly and efficiently.

"The current patchwork of varying maximum weights compels dairy marketers to transport partially empty loads of milk," says Jim Mulhern, president and CEO of the National Milk Producers Federation. "This uses more fuel, creates more congestion, and increases the costs of maintaining roads. Common sense changes like those included in the Safe Trucking Act will improve the efficiency and sustainability of the U.S. dairy industry."

Asset vs. Non-Asset: Does It Still Matter?

Industry discussion has long centered on what type of transportation service provider gives shippers an edge: a partner that owns assets or a non-asset-based provider that employs carriers.

Since deregulation allowed brokers and domestic freight forwarders to enter the transportation service arena, the advantages of both have been closely examined. Should shippers insist on dealing with an asset-based provider that has the necessary means to cover tendered loads? Should they partner with a non-asset-based provider with many carriers under contract that could supply more capacity? Or is a mixture of both the optimal solution?

"It depends on where the shipper feels more comfortable, and who can provide the necessary services," says Robert Voltmann, president and CEO, Transportation Intermediaries Association, an organization representing both asset- and non-asset-based third-party logistics (3PL) members.

Most shippers partner with more than one provider, according to Inbound Logistics‘ 3PL Perspectives market research report. The majority of shipper respondents (72 percent) use more than one 3PL, while only 28 percent have formed an exclusive partnership.

Brokerage Stigma Fades

The early days of brokerage were problematic and misconceptions about the sector rampant, as some practices at that time were harmful to the broker or the carrier. That has changed drastically since the 1990s, as both brokers and carriers realized they needed to revise how they worked with each other to their mutual benefit.

After 2000, the freight brokerage industry exploded with the rise of the Internet. When the economy tanked in 2008, and capacity softened, many shippers gravitated to brokers to cost-compare lanes and rates.

Signed into law in July 2012, the Moving Ahead for Progress in the 21st Century Act (MAP-21) clarified motor carrier brokerage operations, and raised the minimum bond for brokers from $10,000 to $75,000.

"We are entering a dynamic period for 3PLs and brokers; the stigma of the past is gone," says Jason England, president of non-asset-based transportation provider England Logistics, based in Salt Lake City.

In 2015, the line between asset-based and non-asset-based is less distinct. In fact, 43 percent of 3PL respondents consider themselves as both, according to Inbound Logistics‘ 3PL Perspectives report. Meanwhile, 46 percent identify themselves as non-asset based, compared to 11 percent as asset-based. Some of the largest transportation service providers are non-asset-based, with revenue in the same category as the largest asset-based truckers. Most motor carriers now have a brokerage division that generates significant revenue.

"There is a place in the transportation arena for both asset- and non-asset-based providers, and brokers need the assets. Our firm made a conscious decision not to own assets," says Jeff Tucker, CEO of Haddonfield, N.J.-based Tucker Company Worldwide. The fact that his firm doesn’t own assets, he notes, is not an issue with customers. Their carrier selection process hinges on other factors.

Capacity is the main issue today, notes Tucker, adding that his company looks for the best carrier for each shipment. "Our staff has the tools, techniques, and technology to find the best carrier for a particular shipment," says Tucker.

Most non-asset-based firms have hundreds, if not thousands, of carriers under contract, and providing capacity is the broker’s job, he adds.

Capacity is also key for asset-based providers. "We’re investing and expanding because we all need capacity in the end," says Chip Smith, COO of Rosemount, Minn.-based Bay & Bay Transportation. "There are advantages in owning assets because some shippers will not deal with non-asset-based providers."

Some carriers leverage both the asset- and non-asset-based parts of the business. "While we are part of the England family, we are completely standalone, working jointly with both asset- and non-asset-based providers," says England. While having C.R. England’s assets is helpful, he notes, its portfolio of non-asset-based transportation solutions allows it to provide the optimal answer for shippers.

Firms on both sides of the equation are adding services and offerings, as 3PLs in general increasingly provide seamless transportation services.

"I see brokers as a bridge between the carrier and the shipper, providing solutions that may not be available without their assistance," says England.

Indeed, "asset-based transportation firms continue to aggressively diversify their businesses," says Monica Truelsch, director of marketing for TMW Systems. Many traditional asset-based companies are already operating in multiple business lines, and "one-third plan to expand into at least one additional category in the next three years," according to the 2014 TMW Transportation and Logistics study.

Even while operating their businesses in this manner, legal separation of the entities is a necessity between the broker or 3PL operation and motor carrier.

"It makes sense for companies that are both asset- and non-asset-based to operate each as a separate business," says Voltmann. This allows each entity to seek its own best business mix, and does not force one upon the other, he notes.

In the end, the shipper chooses whether to deal with either type of service provider, or to utilize both in a blended solution, depending on specific needs.

"We use both asset- and non-asset-based service providers," says Gary Bleazard, vice president, procurement-logistics, fleet, and co-manufacturing for Coca-Cola Company. Non-asset-based providers supply nearly 20 percent of the company’s requirements, he notes, and he doesn’t expect any major shifts in the near future.

—Walter Weart

Cashing In

Money may be the root of all evil, but the route of all money is ever so 20th century.

Moving coins and currency through the supply chain uses manual processing, says Bernie Hogan, senior vice president of emerging capabilities and industries at supply chain standards organization GS1 US. "The players are the people who handle cash behind the scenes, such as merchants, banks, armored cars, and the Federal Reserve," he adds.

Armed with the mission to create cash logistics standards, the new 28-member GS1 US Cash Visibility Discussion Group convened for the first time in St. Louis on May 20, 2015. Members included JPMorgan Chase, Dunbar Armored, Walmart, the Fed, and GS1 US.

"How you track pallets of cash or pallets of laundry detergent is similar," says Hogan, "except for the products and their value."

Using the new standards, banks can expect better data accuracy and better support of regulatory compliance requirements, faster discrepancy resolution, potential real-time access to a parcel’s whereabouts, and the efficiencies of automation. "Margins are getting thinner," explains Hogan, "and the turnaround on cash is critical."

Armored cars will find reduced dock time, which slashes fuel and labor expenses and can boost productivity.

A GS1 US proof-of-concept test—using just one Dunbar office and one Bank of America office—yielded a projected annual $1.1 million savings. A model already exists—Germany’s CashEID—which launched in 2006, and was joined by other European states.

Look for the 2015 web publication of recommendations for review and comment in October, and finalized standards in March. Then expect a fun two to three year prospect of techno-switching and learning curve migraines.

—Norman Schreiber

Check Your Sources

Global uncertainty gives shippers even more cause to reconsider their offshore strategies, according to new research by Alix Partners.

Thirty-two percent of all surveyed executives and 40 percent of those domiciled in North America report that their companies have recently relocated manufacturing production closer to demand, or are in the process of doing so.

Specifically, 55 percent of North American respondents cite the United States as the most attractive nearshoring destination, up from 42 percent in 2014. Mexico is favored by 31 percent of executives, up from 2014 (28 percent), but still down compared to three years ago when one in two companies identified it as the top target. Safety and security issues remain underlying concerns.

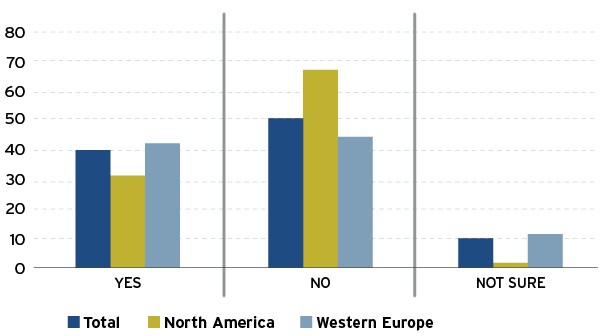

Despite positive trending, there is less urgency to nearshore in today’s environment. Only 21 percent of North American and European executives say these decisions are more important now than one year ago—however, 82 percent of North American decision makers indicate such decisions are "about the same" in importance as last year.

The availability of skilled labor further complicates nearshoring decisions, says the survey. Accordingly, that was the top challenge cited by both North American and European respondents.

Western europe movES manufacturing closer to domestic markets

Is nearshoring a possible opportunity for your company to serve domestic demand requirements?

Source: Strategic Manufacturing Sourcing Outlook, Alix Partners

From the Project Logistics Case Files…

From more than one million newly spawned fish weighing around one gram each to racecars traveling with more than 30 tons of loose spares and support equipment, these recent project logistics moves underscore the meticulous planning that goes into meeting each unique demand.

Flying Fish Take Flight in Russia

CARGO: 1.2 million Muksun fish

ROUTE: From a fish hatchery near St. Petersburg to the freshwater Ob River basin in northern Russia

Logistics team Airline company Volga-Dnepr and AirBridgeCargo’s transport professionals organized the delivery on behalf of aircraft charter broker Air Charter Service.

Accommodations The whitefish, mostly found in the Siberian Arctic waters, "flew" in four 2.5-ton water containers with oxygen tanks from St. Petersburg to Salekhard onboard a Boeing 737 freighter operated by AirBridgeCargo.

To ensure the well-being of the fish during the flight, fish breeding experts were on hand, and the aircraft’s cargo hold was maintained within a 12-14°C temperature range. The fish weigh around one gram each but will eventually grow to up to 60 centimeters. The engineers in charge developed a special loading plan for the flight and used bespoke equipment to unload the fish in their water containers in Salekhard. The fish have since been released into the Ob River.

Solar Car Heads Down Under

CARGO: Nuna Solar car

ROUTE: From Amsterdam to Hong Kong to Australia, to defend its world title in the World Solar Challenge 2015 in October

Logistics team Forwarding company CargoMasters BV arranged the delivery on behalf of the Nuon Solar Team.

Accommodations The Nuna Solar car started its journey to the race onboard one of AirBridgeCargo Airlines’ scheduled Boeing 747 freighter flights from Amsterdam to Hong Kong. The car was transported in a crate specially designed by the Nuon Solar Team, which contained the vehicle, equipment, and spare parts.

Rallycross Supercars Hell-Bound

CARGO: 19 Rallycross supercars

ROUTE: From Montréal-Mirabel Airport in Canada to Trondheim Airport, Norway. Final destination: Hell, Norway.

Logistics team Chapman Freeborn Airchartering, along with logistics partner GAC

Accommodations Marking the first time supercars competing in the FIA World Rallycross Championship have been transported by air, the supercars started their journey onboard a chartered Kalitta Air B747-200F, departing from Montréal-Mirabel Airport in Canada.

The supercars, each capable of 0-60 mph in 1.9 seconds, traveled with more than 30 tons of loose spares and support equipment.