2025 Trucking Perspectives

In IL’s exclusive market research report, trucking companies and shippers reveal how they are adapting their services and expectations to meet new industry demands while navigating a challenging freight environment.

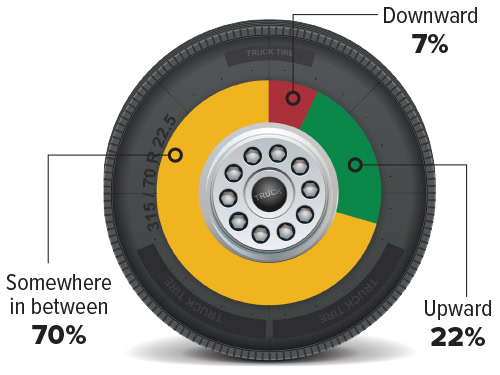

Truckers: As a leading economic indicator, where do you see the economy trending?

The trucking industry shows a modest growth in optimism in this year’s survey as 22% of respondents report the economy is trending “upward”—up 6 percentage points from 2024. Overall, though, carriers continue to maintain a level gaze at the economy with their sights on both positive and negative signs, resulting in 70% of truckers responding that they see the economy trending “somewhere in between” a positive or negative path.

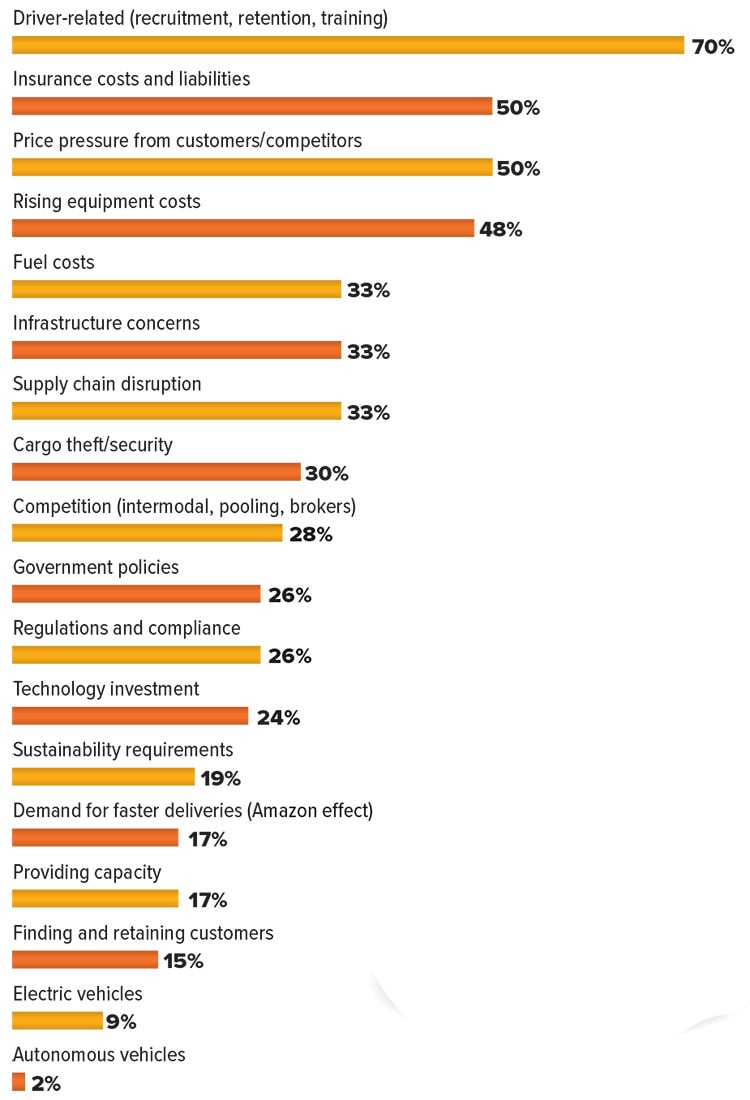

Truckers: What are your greatest challenges?

Driver issues are a top concern for trucking companies. In fact, when asked about their greatest challenges, 70% of respondents say driver-related issues, such as recruitment, retention, and training, are among them—the top response in the category and a striking rise of 23 percentage points from 2024.

The next most frequently cited challenges are insurance costs and liabilities and price pressure from customers and competitors at 50% each. Rising equipment costs also rank highly at 48%, but that marks an encouraging 10-percentage point drop over the past two years.

Among the less-prominent challenges, supply chain disruption registers a 16-point jump to 33%, a possible effect of ongoing tariff policy changes and the accompanying uncertainty they have brought this year.

Demand for faster deliveries (17%, up 7 points) and providing capacity (17%, up 11 points) are among other challenges showing substantial increases, while sustainability requirements (19%, down 7 points) and electric vehicles (9%, down 10 points) reflect eye-catching drops as the policy landscape for green energy efforts has shifted.

Autonomous vehicles have been attracting a lot of headlines, but just 2% of respondents see them as a challenge at the moment.

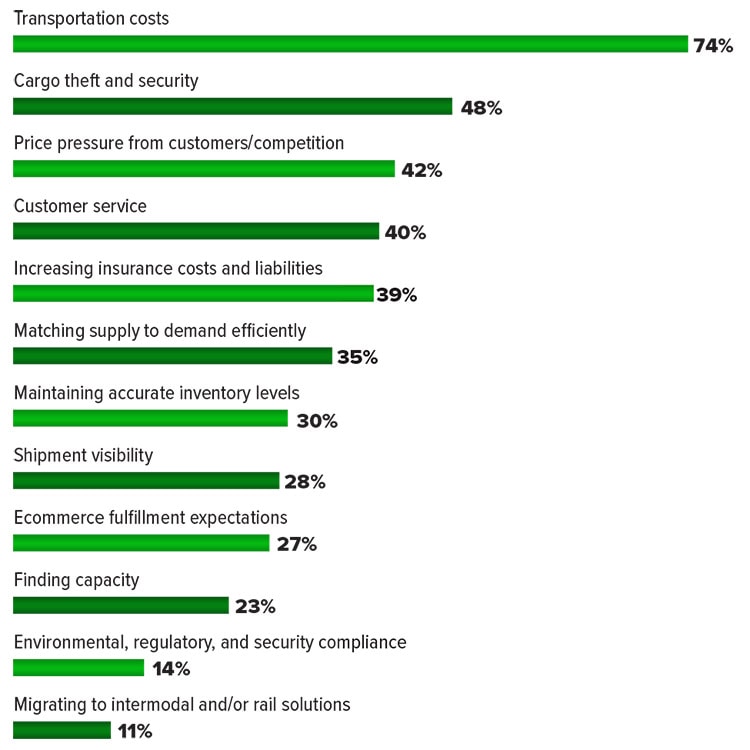

SHIPPERS: What are your greatest challenges?

For shippers, financial worries continue to matter the most. In particular, transportation costs at 74% register as their biggest challenge, which has been the case each of the previous two years.

A major takeaway from the shippers’ insights is that cargo theft and security concerns have risen dramatically from just 12% in 2023 to 48% in 2025, making it shippers’ second most-cited challenge.

Some other prominent challenges for shippers include price pressure from competition/customers (42%, down 7 points from 2024), customer service (40%, sharply down 10 points), increasing insurance costs and liabilities (39%, up 2 points), and matching supply to demand efficiently (35%, up 2 points).

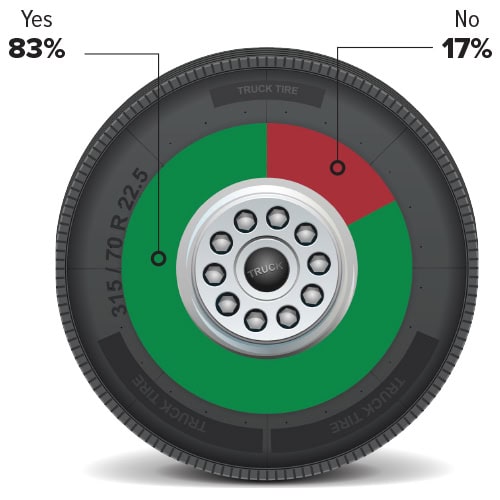

Truckers: Do you have a freight brokerage or logistics services division/subsidiary?

Eighty-three percent of truckers say that they have a freight brokerage or logistics services division or subsidiary, up 7 points from 2024.

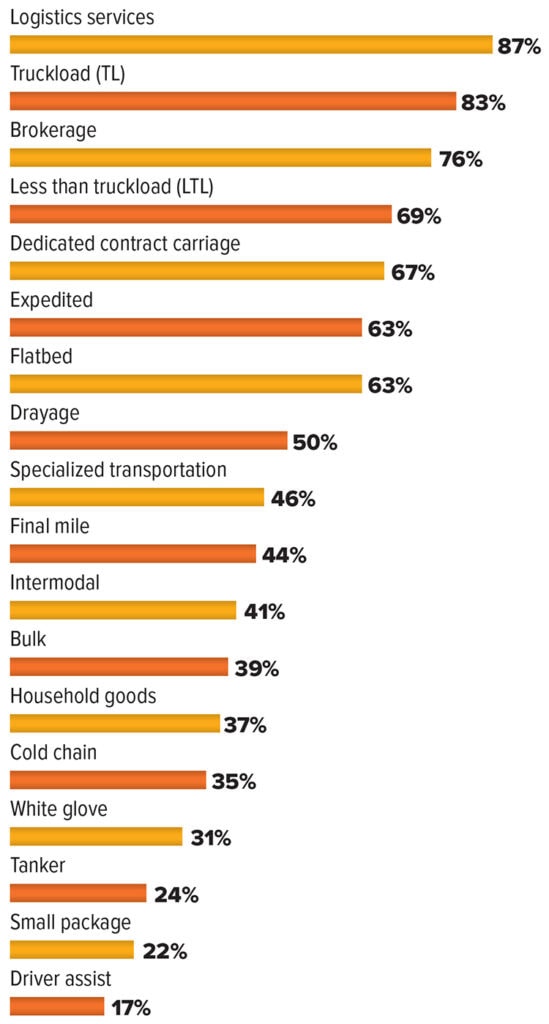

Truckers: What types of services/solutions do you offer?

Truckers increasingly are providing a variety of services and solutions to clients, and this year’s survey helps to underline the depth and breadth of that trend.

At the top of the list, 87% of trucking company respondents say they provide logistics services—an 11-point jump from 2024. That spike in truckers offering those services makes it No. 1 on the list ahead of truckload services (83%) for the first time. Brokerage (76%), less than truckload (LTL) (69%), and dedicated contract carriage (67%) complete the top 5.

With the Amazon effect and the rise of rapid delivery demands, expedited continues to climb as an offered service, having jumped from 49% to 63% as an offering over the past two years and rising from ninth to sixth place in the rankings.

The industry trend in adding services and solutions—versus shedding them—is backed up by the survey showing that 14 of the 18 service categories either showed growth or remained the same from 2024 to 2025.

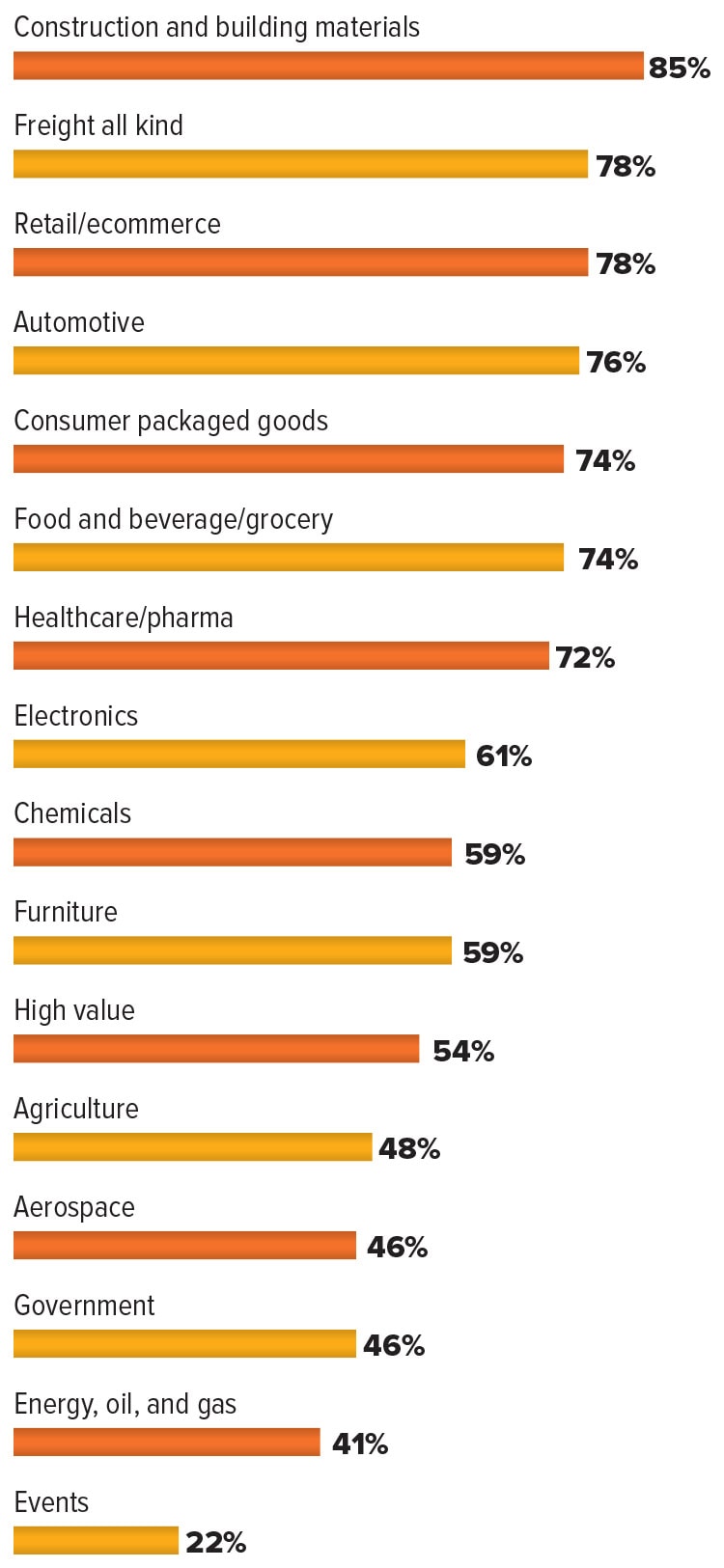

Truckers: What industries/commodities do you serve?

Construction and building materials hold the top spot for the second consecutive year among the industries and commodities that truckers serve with 85% of respondents checking that box. Others topping 70% include freight of all kinds (78%), retail/ecommerce (78%), automotive (76%), consumer packaged goods (74%), and food and beverage/grocery, a category which has fallen 13 points since 2023 to 74%.

Among those other industries and commodities seeing the most notable drops in service from truckers are high value, which has dropped 19 points to 54% in two years, and agriculture, which has fallen 18 points to 48% during that same time period.

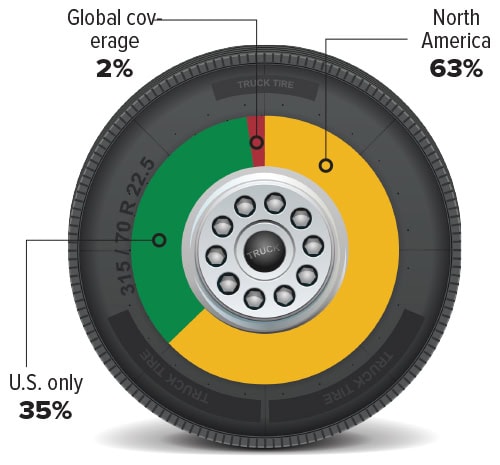

Truckers: What is your operating area?

Of this year’s trucking respondents, 63% consider North America to be their operating area with 35% focused on the United States only and 2% providing global coverage. These numbers show moderate changes from one year ago when 58% said North America was their operating area, and 36% were considered U.S. only, with 6% offering global coverage.

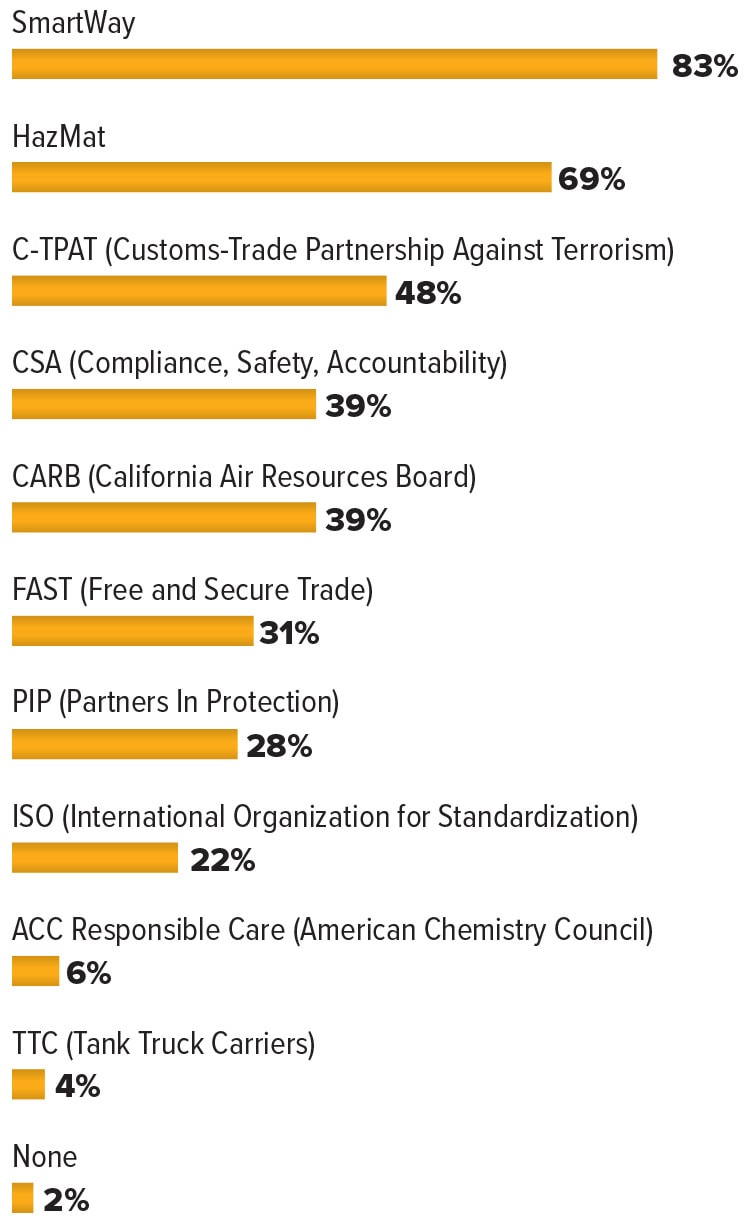

Truckers: What certifications do you hold?

Truckers report the certifications they hold through the survey, and those numbers have remained relatively steady in recent years. The most popular certification by far each of the past three years is the U.S. Environmental Protection Agency’s SmartWay, which 83% of respondents say they have in 2025.

Truckers report the certifications they hold through the survey, and those numbers have remained relatively steady in recent years. The most popular certification by far each of the past three years is the U.S. Environmental Protection Agency’s SmartWay, which 83% of respondents say they have in 2025.

Others in the top five include HazMat (69%), C-TPAT (48%), CSA (39%), and CARB (39%). ACC Responsible Care has seen a sharp drop with 6% of respondents saying they have it this year, representing a 12-point decline from 2023.

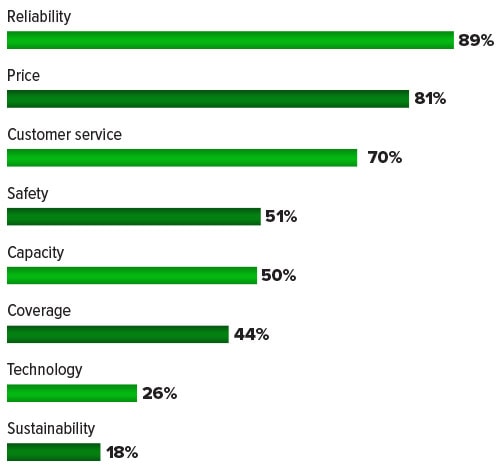

SHIPPERS: What are the most important factors to consider when choosing a motor carrier?

Shippers weigh a host of considerations when selecting a motor carrier, but those responding to the survey say that reliability is their clear no. 1 with 89% calling it one of their most important factors. Cost unsurprisingly is also an enduringly top priority, as evidenced by 81% of shippers saying that price is a primary factor in their decision-making.

Customer service has climbed in importance to 70%—up 16 points from 2024—and safety (51%, no change from 2024) and capacity (50%, down 11 points in one year) also appear on at least half of the survey responses of shippers. In keeping with green-related questions in other categories, sustainability saw a 13-point drop to 18% among the most important factors, making it the least frequently cited consideration this year.

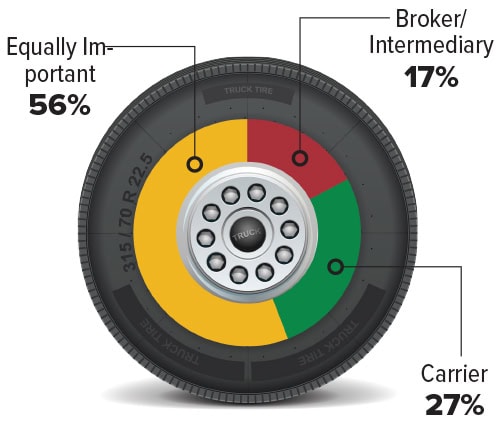

SHIPPERS: Which is more important, your relationship with your carrier or with your broker/intermediary?

Shippers continue to largely see their relationships with their carrier and their broker/intermediary as being of equal importance with 56% making that claim. Meanwhile, 27% say the carrier relationship is more important, and 17% favor the broker/intermediary one.

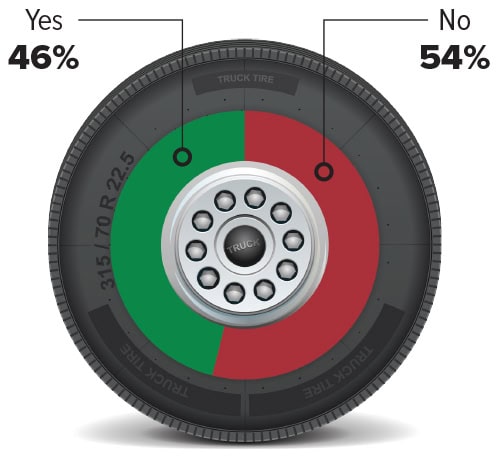

SHIPPERS: Have you experienced a shortage of truck capacity?

Truck capacity appears to be improving in the minds of shippers. In particular, 54% of respondents say that they have not experienced a truck capacity shortage, a drop of 9 points from one year ago.

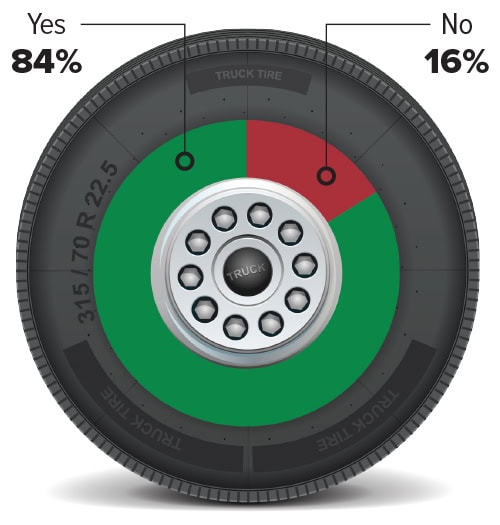

SHIPPERS: Have you experienced rate hikes apart from fuel surcharges?

Rate hikes remain commonplace, according to shippers, and the survey shows that 84% report rate increases in 2025 (apart from fuel surcharges), up 2 points in one year.

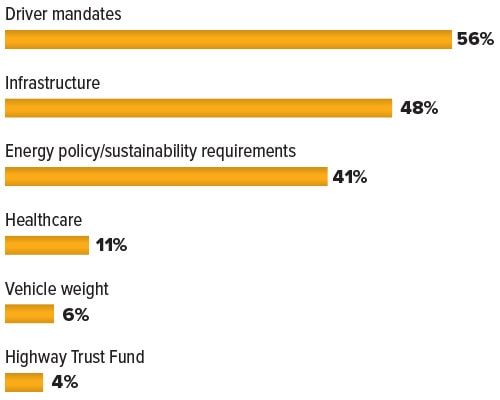

Truckers: What legislative measures have the greatest impact on your business?

Like any industry, truckers must keep a close eye on the ever-shifting policy landscape and how developments there can potentially benefit or undermine their field. In 2025, driver mandates are the legislative measures that truckers are most closely watching with 56% of respondents calling that area to be the one with the greatest impact on their business. Infrastructure comes in at no. 2 among legislative measures at 48%, but that issue has seen a 31-point drop among respondents since 2023.

Meanwhile, energy policy/sustainability ranks no. 3 at 41%, a 15-point decline in just one year. Healthcare (11%, down 10 points in two years), vehicle weight (6%, down 8 points since 2024), and the Highway Trust Fund (4%, down 6 points in two years) also log dwindling importance in the views of truckers.