E-Commerce Evolves

E-commerce companies carve out success through a unified approach to omnichannel order management and distribution, along with a focus on demand planning.

E-commerce and retail sales at Caraway, a cookware and home goods company, soared over the past few years. Early in the pandemic, “our brand and space became extremely relevant,” as more consumers prepared meals at home, says Mark Riskowitz, vice president of operations. The growth hasn’t let up; sales for Q4 2022 were expected to at least double that of the same period in 2021.

To help manage its growth, Caraway partnered with third-party logistics provider ITS Logistics, leveraging a “unified approach” that provides an efficient, single source for omnichannel distribution and fulfillment operations. As a result, Caraway has been able to meet a 280% jump in orders between 2021 and 2022.

Caraway also is diligent about accurate, timely demand planning. “Planning and modeling is built into our DNA,” Riskowitz says.

Sustained Performance

When online transactions boomed during the pandemic, firms rushed to bolster their e-commerce operations to handle the growth. Now, many are faced with developing strategies to make e-commerce financially sustainable.

“The accelerated e-commerce growth was great for consumers, but added a lot of supply chain costs,” notes Tyler Higgins, managing director with consulting firm AArete.

Filling and shipping individual orders tends to be more expensive than moving pallets of goods from distribution centers to stores. Complexity also ramped up, as companies now must manage orders placed through multiple channels, including brick-and-mortar stores and websites, online marketplaces, and social media.

As Caraway’s experience shows, a unified approach to omnichannel order management and distribution, along with a focus on demand planning, are keys to building a sustained e-commerce success. Visibility, efficiency, and the ability to leverage data also are critical attributes.

“Building a data-oriented, software-first approach to logistics is how you stay nimble and raise the bar on buyer experiences, even when the supply chain goes haywire,” says Soumya Srinagesh Tulloss, chief customer officer with Shopify Fulfillment Network, a provider of e-commerce solutions.

These capabilities will be especially important as organizations face ongoing supply chain disruptions and an uncertain economy. “There will be a lot of pressure on e-commerce strategies going forward,” Higgins says.

Gaining Visibility

“Visibility is foundational,” says Melanie Nuce, senior vice president, innovation and partnership with standards organization GS1-US. To capture every order possible, companies need to know what they have in inventory—across all channels. They also need to know where their products are, and then collect this information in a machine-readable way that can be managed at scale and shared with business partners.

Without these capabilities, companies risk lost sales and/or incurring higher-than-needed inventory carrying costs.

Gaining visibility across channels also requires unified, rather than siloed, operations. During the pandemic, many companies established or maintained separate e-commerce operations.

“But that backfired,” says Inna Kuznetsova, chief executive officer with ToolsGroup, a provider of supply chain planning software. It often led to duplicated efforts and lost sales because separate channels hinder a company’s ability to track inventory and fill orders—no matter where the inventory is located.

In contrast, an accurate view of all inventory units across all channels and locations allows companies to adjust to meet market or supply chain shifts.

For instance, if online sales of a product spike after a TikTok video showcasing it goes viral, companies operating with a unified approach can check inventory in their stores as they determine how to meet demand.

E-commerce retailers that operate brick-and-mortar stores can leverage their physical locations to fill online orders. The conversion of just one retail store into a mini-fulfillment center has the potential to reduce last-mile costs by more than 60%, according to a Shopify report on the future of e-commerce.

In its Q3 2022 earnings call, Target announced that it was introducing a new, larger store prototype in Houston, with five times more space to support digital fulfillment services. The retailer also is opening larger locations that can, among other capabilities, offer a suite of fulfillment options, according to John Mulligan, executive vice president and COO.

Distributed Order Management

To effectively leverage a unified, omnichannel approach, a distributed order management solution (DOM) is essential. DOMs use predictive analysis and other technologies that enable retailers to identify rules to balance conflicting order fulfillment needs.

Say, for example, a customer orders a blouse that can be delivered from two stores, one of which is several miles farther away. Most times, it probably makes sense to fill the order from the store that’s slightly closer, and cut transportation costs and time.

However, if taking the item from the closer store leaves it with no inventory for walk-in customers, it may make sense to pull from the other store. DOM solutions can account for these considerations as they identify which store should fill an order.

Because dynamic order solutions allow inventory to be routed between channels, they reduce the likelihood that inventory will pile up in one channel, while others run short, says Anshuman Jaiswal, associate partner in Kearney’s digital transformation practice.

Demand Planning Grows Critical

As Caraway’s experience shows, accurate, timely demand forecasting and planning play increasingly important roles in e-commerce companies’ growth and success. Given how quickly tastes and trends change, demand forecasts based on historical data offer less and less value. Instead, companies need near-real-time data to create accurate short-term forecasts and avoid gluts or shortages.

The growing importance of demand forecasting is elevating the role of data analytics as a tool that can help supply chain organizations better anticipate demand shifts, so they can optimize inventory levels and drive efficiency. “Data is more important than ever,” says Drew Taranto, senior director, strategy, North America, e-commerce with DHL.

Leveraging customer data also offers a competitive advantage. “Understanding your audience deeply allows you to drive higher sales and improve inventory turns even as market conditions change,” Tulloss says.

Removing Friction

About one-third of merchants responding to the Shopify survey planned to digitize legacy manual processes within their supply chains during 2022. Cutting manual steps and removing friction has become essential to sustainable e-commerce operations. One reason is the current labor shortage, which makes throwing more bodies at cumbersome and manual processes less feasible.

And as both the cost of labor and the volume of e-commerce sales have jumped, some automation investments that previously didn’t make financial sense now are more likely to. Similarly, solutions like autonomous mobile robots (AMRs) often can be implemented less expensively than, for instance, the behemoth sortation systems of the past.

One function that’s typically a contender for automation is inventory management, as many companies still use spreadsheets. Order processing is another.

“Companies that receive a few hundred orders per day can manually sort them,” says Johannes Panzer, head of industry solutions-e-commerce with Descartes Systems Group, a supply chain management solutions provider. “But as soon as you reach 500 or so daily orders, you need some automation.” Panzer says.

Most of Trade Show Labs’ business-to-business client transactions occur online. The company, which develops custom strategies that help clients boost trade show leads, has seen business grow significantly in the past year, resulting in many time-consuming, repetitive tasks. To address this, Trade Show Labs is implementing software that will introduce automation to collecting and tracking inventory, assessing compliance, and scheduling updates, among other functions.

“It eliminates human errors and allows people to focus their time and efforts on actually running their business,” says Maria Britton, the firm’s chief executive officer .

Considering Risk

Before the pandemic, many organizations “had fine-tuned just-in-time inventory management like a Maserati,” says Ed Romaine, vice president, marketing and business development with Conveyco, a provider of warehouse automation. They slashed costs but were vulnerable to disruptions.

Since disruptions likely will continue, organizations have to consider just-in-time inventory management through a lens of risk, including the risk of lost sales because they lack inventory.

The challenge? The customer dissatisfaction that results from lost sales is difficult to calculate, but it can kill a business. Conversely, holding extra inventory imposes bottom-line, calculable costs that are hard to ignore.

Advancing inventory management solutions can provide accurate, updated inventory records, lowering the risk of both dead inventory and stock-outs. For instance, RFID scanners embedded in the ceiling of a store or warehouse can count inventory units outfitted with RFID tags at a rate of 12,000 to 18,000 per hour. “It’s a high-speed way of counting,” Nuce says.

Centralize or De-Centralize?

Allocating inventory across multiple locations can help supply chain organizations meet increasingly tight delivery time frames.

For example, Hairbro.com, which offers hairpieces and wigs to customers globally, is boosting the number of its last-mile delivery centers by 10 to 15%. These centers are responsible for moving goods from warehouses to their final destinations.

The company is also establishing small, automated micro-fulfillment centers that can offer same-day delivery service. “As more individuals shop online, companies need to have a speedy and effective way to supply their products,” says Adam Garfield, Hairbro’s marketing director.

At the same time, distributing inventory is expensive, particularly as the cost of capital increases. It also adds complexity. Rather than predict one set of demand, companies have to predict multiple sets.

Companies can consider other ways to accelerate order speed. One is streamlining processing and fulfillment, so orders quickly move out the door. Another is negotiating with carriers to hand off orders later into the evening.

“If you get these right, you can overcome other competitors that have more resources,” says Chris Ball, chief executive officer with BW Retail Solutions, which offers end-to-end e-commerce solutions.

Supply Chain Control

Just how much control do e-commerce retailers need over their own supply chains? “It’s incredibly valuable to control your own supply chain and your own infrastructure,” Ball says. That’s especially true as companies increasingly need to capture consumers wherever they are, whether that’s social media, online marketplaces, or brick-and-mortar stores.

Yet, for all but the largest e-commerce companies, complete vertical integration is unrealistic. The investment required to own all the supply chain infrastructure will be outside most budgets.

Companies also need to consider how quickly they need to scale their operations. If their time frame is tight, they’ll likely find working with a logistics provider a practical strategy.

Companies can work closely with their logistics providers to align expectations. Shopify found that 44% of brands were investing in closer collaboration with their supply chain partners.

Caraway, for instance, treats ITS Logistics as its partner. “We are vocal and transparent about what we expect,” Riskowitz says. “At the same time, we treat our partners the same way we treat our customers.”

Along with boosting efficiency within a warehouse or distribution center, successful e-commerce companies need to move orders to consumers quickly and accurately.

One step that can help is integrating order management with the logistics function, says Anar Mammadov, owner and chief executive officer with Senpex Technology, a logistics and delivery service. This streamlines logistics processes and allows customers to easily schedule and track deliveries.

Once products start their journey to the end customer, the focus on deliveries has often been around speed. However, battling for one- or two-day delivery quickly gets pricey. The last mile of the e-commerce supply chain can account for 60 to 70% of overall e-commerce logistics costs, based on industry research and conversations with shippers, Taranto says.

It is possible to rein in delivery costs. “The emergence of consolidators, and regional and local carriers, provides potential opportunities to improve both cost and service where there is a good fit for the shippers’ business,” Taranto says.

And while e-commerce operators can’t ignore delivery expectations, it’s not the only metric to consider. Accuracy, options, and communication also matter.

Many online consumers also want to be able to choose from several delivery options and then be confident everything will arrive as expected. As they wait for their goods, they also expect communication that tracks the shipment.

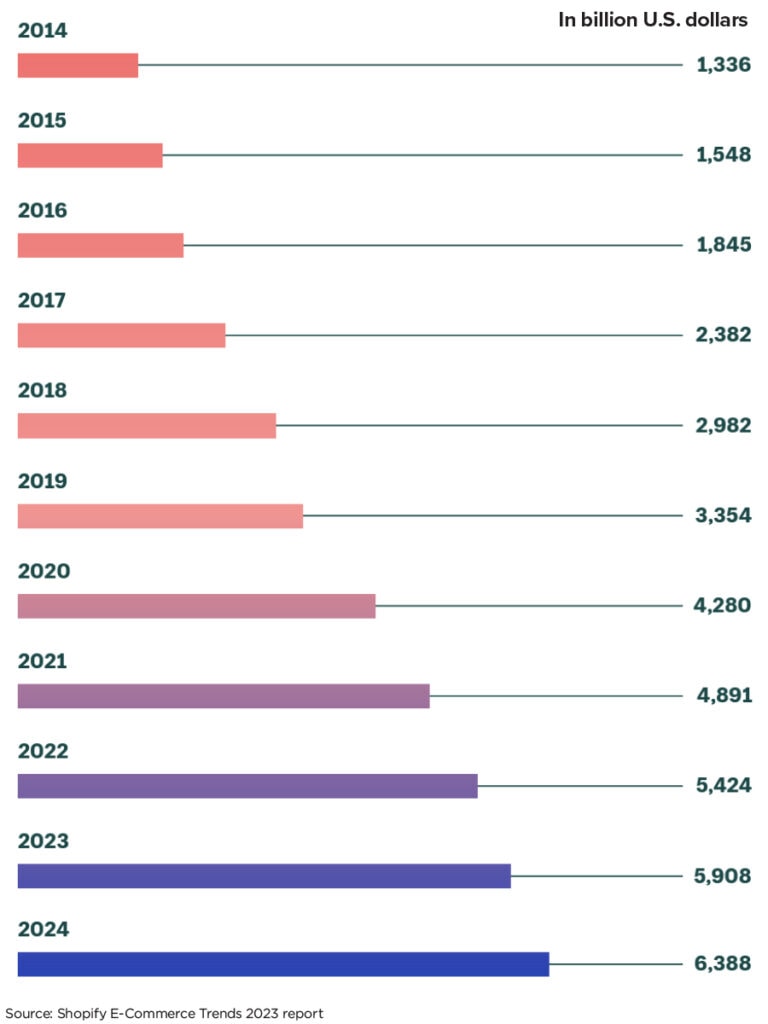

Retail E-Commerce Sales Worldwide (2014-2024)

Advancements in technology and the growth of available marketplaces have made it easier than ever to buy and sell online. The e-commerce market is expected to grow by almost $11 trillion between 2021 and 2025.As businesses came online during the pandemic, the global trend toward digitization surged ahead at lightning speed. Even as regions begin to reopen, e-commerce sales are still climbing. Global e-commerce sales are expected to reach $5 trillion in 2022, and $6 trillion by 2024.

Still Evolving

Looking ahead, the e-commerce world will continue evolving. One example is the growing interest in “intelligent substitution” for e-commerce orders, Nuce says.

Offering alternatives is an efficiency play, but it requires e-commerce companies to know their inventory, the alternatives to each product, and each consumer’s preference.

For example, if a retailer is out of organic berries, which customers will accept non-organic? Artificial intelligence and machine learning will be used to assemble the relevant data and disseminate it to another system or human that can make the decision.

Yet even as e-commerce changes, the critical role of logistics and supply chain operations as drivers of differentiation and performance will remain.

“The past few years have put supply chain in the spotlight,” Riskowitz says. Companies that invest in operationally savvy employees and in operations solutions such as order management systems can gain phenomenal returns.