FASTER D2C: Unpacking Fast Fulfillment and Delivery

As same-day delivery becomes the norm, businesses harness supply chain visibility, strategic inventory placement, and AI to master the intricate balance between expedited fulfillment and shipping and ever-tightening customer expectations.

The old definition of expedited shipping was simple. “Pay a premium to move faster,” says Manish Chowdhary, founder and CEO of Cahoot, a peer-to-peer fulfillment network.

Today, expedited shipping isn’t just about speed, although that remains key. It also involves leveraging intelligence, strategically designed distribution networks, and technology solutions that can help determine how best to distribute inventory and route shipments, among other capabilities.

Together, these tools can enable shippers to expedite their cargo as quickly and as cost-effectively as possible.

For many companies, the ability to speed shipments to their destinations is essential to keeping customers satisfied, especially in the business-to-consumer sector. A recent OnTrac study found that more than 80% of consumers had paid for expedited shipping at least once in the previous six months, says Vijay Ramachandran, vice president, marketing, product strategy and marketplaces for OnTrac. More than one-third had sought weekend delivery, the survey found.

Ongoing trade tensions and geopolitical disruptions also are forcing shippers to rethink their supply chains. This includes the use of expedited shipping.

“Air freight and premium shipping lanes become essential tools to navigate around global uncertainty and regulatory complexity,” says Gaurang Shastri, managing director with Lincoln International, an investment banking advisor.

The expedited shipping sector is responding to shifting consumer preferences and geopolitical events.

Historically, a handful of companies offered express services, says John Sansby, director of global partnerships with EVRi, a UK-based parcel delivery company. They provided a complete ecosystem, including their planes and hubs, but tended to be expensive.

Now, regional carriers, especially in the United States, are enjoying strong growth. Many of these carriers had focused on pharmaceutical and other high-value items. More recently, they began to add ecommerce deliveries to their service offerings.

By assembling a mix of regional and national carriers, many shippers can access a range of expedited services to find the ones that best meet their needs.

Types of Expedited Solutions

EVRi’s Next-Day Delivery service aims to deliver parcels on the next working day across the UK, provided the parcel is dropped off at a ParcelShop or Locker before the noon cut-off.

Just about every carrier has its own names and definitions for expedited shipping services. In general, however, “expedited shipping” refers to times that are faster-than-standard. The types of expedited shipping solutions can vary, depending on whether a shipment will remain within the United States or travel outside it.

Within the United States, shippers can choose from an expansive universe of private carriers, as well as the U.S. Postal Service. It’s often worth evaluating multiple carriers before partnering with one.

Many regional and alternative carriers operate seven days per week, even for standard services. When this is the case, packages can move to their destinations quickly, yet at a lower cost than some expedited services might charge.

Technology advances also allow many smaller carriers to provide more customized and quicker service, says Steve Howard, ecommerce solutions director with WCAworld, a network of independent freight forwarders.

For instance, carrier management systems can help businesses handle multiple relationships with freight carriers and ensure they’re working with the ones that best meet their needs. Functions can include tracking shipments in real time and benchmarking carrier performance.

Crossing Borders

Understanding the rules of cross-border commerce into Canada is key to keeping expedited packages moving smoothly.

The 2025 cross-border ecommerce market is worth an estimated $1.21 trillion, according to Capital One Shopping. More than 30% of online shoppers in the United States have purchased from an online retailer in another country, the report notes.

When working across borders, knowing the rules is crucial to keeping packages moving. For example, shipments over $20 Canadian traveling from the United States into Canada via the U.S. Postal Service are charged both tax and duty, says Barbara Rausch, global account manager with ePost Global, which offers international mail and parcel services.

In contrast, the tax threshold for items moving through a commercial clearance, such as a broker, is $40 CAD and the duty threshold is $150 CAD. (CAD, or Cash Against Documents, is a method for securing payment where a seller releases shipping documents to a buyer only after the buyer makes payment.) These differences can influence what service and carrier it makes sense for shippers to use.

In addition, the effectiveness of postal carriers can vary from one country to another, Rausch says. Shippers will want to rely on private delivery companies in markets where the postal systems are less robust, particularly when speed is critical.

It’s also important to consider the geopolitical climate of the destination country. An expedited service may make sense when shipping into conflict areas.

Along with paying the relevant fees, shippers and carriers need to provide the information customs authorities require about each shipment, accurately and completely.

“It’s a matter of resolving the whole loop efficiently,” says Adam Langston, chief commercial officer with Passport Global. “Technology is the only way to do it.” Generally, logistics providers or partners can provide cross-border compliance solutions that manage customs data and handle duty or tax calculations, among other features.

Crossing Oceans

Passport Global handles the complexities of duties, taxes, and customs clearance to help expedited shippers avoid border delays and ensure faster delivery to customers.

Moving shipments quickly across oceans can mean turning to the air. However, air shipments are expensive and thus, generally reserved for high-value items such as critical machine parts and pharmaceutical products, says Tim Binkis, chief client success officer with ICC Logistics Services. For many other products, the cost of air delivery is prohibitive.

However, some carriers have begun offering a service that consolidates multiple shipments into one shipment for air delivery to the destination country, where each shipment is then delivered locally by an integrated carrier or the postal service, Binkis says.

Often, the delivery time frame is approximately one week, which isn’t as quick as next-flight-out, but it is speedier than an ocean vessel can offer.

Just as customers expect real-time delivery updates for domestic deliveries, many expect the same when shipments are moving across borders. One way to handle this is through a scannable label that allows for traceability.

Expediting Success

Expedited companies such as UPS can handle immense daily volume, which allows their logistics networks to isolate and prioritize more time-sensitive freight and meet tight delivery windows.

Whether a package needs to speed across town or around the world, a first step to moving it quickly and cost-effectively is visibility.

“The more visibility you have into your supply chain, the less you need to rely on last-minute, high-cost expedited options,” Shastri says. Visibility helps shippers pinpoint the location of their inventory, so they can reserve expediting for times when it’s truly the best option to meet a delivery requirement.

While ensuring that all paperwork required on expedited shipments is in order may seem like a bureaucratic technicality, it’s also critical. Mistakes can leave parcels, including expedited ones, on hold before they reach their destinations.

Given the importance of accurate information, shippers that work with logistics providers should ask how they will move both their products and information, and the steps required for this to happen. “The devil is in the details,” Langston says.

This is especially true when it’s necessary to engage multiple transportation providers, as the ability to track data becomes more difficult with more parties involved. Successful logistics providers should be able to assemble multiple sources of data into one seamless flow of information.

Inventory placement—or locating inventory so orders can be delivered as quickly as possible—plays an increasingly important role in expediting decisions. That’s especially true for retailers that have brick-and-mortar stores from which they can fulfill online orders, Binkis says.

Shippers that lack physical stores need to weigh the cost and complexity of carrying additional inventory, often within warehouses, against the benefits of shorter delivery timeframes.

In completing these calculations, shippers should analyze where most of their orders come from and then map delivery times from potential warehouse locations. Ideally, they can position inventory close to high-volume customer zones. Then, they may want to use third-party fulfillment partners for other regions.

It also makes sense to check how the company offering expedited solutions will hurry your package along, says Chris White, vice president of relations with USKO, a provider of logistics services, as well as president of The Expedite Association of North America.

If the cargo is high value, it may pay to order an exclusive delivery truck. That way, the driver won’t have to make multiple stops, which can boost the likelihood of damage, White says.

You’ll also want to confirm whether the shipment will begin its trip the moment it’s handed to the provider, or if there will be a time lag before it begins its journey.

One technology that is proving its value in expedited shipping is predictive labeling, Chowdhary says. Predictive shipping labels are part of a larger supply chain strategy of predictive logistics, which uses artificial intelligence (AI) and machine learning to forecast demand and optimize shipping processes and inventory placement.

Rather than generate a label after an order is placed, predictive systems use historical and real-time performance data to select the optimal carrier for each shipment based on factors such as cost, speed, and reliability.

Consider the Options

USKO’s expedited services primarily use a large fleet of Sprinter vans and straight trucks for fast, dedicated ground transport.

The rise of regional transportation providers in the United States and other parts of the world allows shippers to assemble networks of carriers that together can offer coverage across a country, Langston says. Savvy regional logistics operators often can leverage economies of scale in their local markets, which can translate to lower rates for shippers.

Ultimately, the goal is to find the “sweet spot” by identifying the carriers and services that meet the delivery and cost goals for each product type and destination, Rausch says.

For instance, high-value items such as cell phones may warrant express services, while standard delivery might be fine for charging cables. AI can examine options at a granular level to determine the best routes, carriers, and service offerings, based on the parameters and business rules the company sets.

When working with different carriers, shippers should track their performance closely, as late deliveries boost costs and diminish customer loyalty. They can zero in on metrics such as the percentage of on-time deliveries, delays, and carrier performance by route, and then use these to evaluate carriers and warehouse locations.

Tariffs Add Complexity

The fluctuating tariff environment adds complexity to expediting decisions and inventory placement calculations. Businesses that might have sold items from overseas to U.S. consumers may now want to locate more inventory domestically.

Not only can this speed delivery timeframes, but it may be possible to apply the tariff rate to the wholesale, rather than the retail value of the goods, Langston says.

The abrupt elimination of the de minimis exemption for goods coming into the United States has also created chaos, Howard says. Typically, regulatory changes are announced one year or so in advance, giving organizations time to adjust their processes. The speed of this change is leaving some companies scrambling.

As with tariffs, the elimination of the di minimis exemption is prompting some businesses to bring products in bulk into the United States. They then may be able to more quickly fill orders, Binkis says.

Organizations that take steps now to evaluate and cost-effectively shorten delivery timeframes will be better positioned to stay ahead of ever-tightening delivery expectations. Eventually, same-day delivery likely will become the norm.

“People are used to receiving their orders the same day, and that will set the benchmark,” Binkis says.

The landscape of expedited shipping has evolved beyond simple speed. It now demands strategic networks, advanced technology, and meticulous planning to achieve both rapid and cost-effective deliveries. Shippers must navigate a complex environment of regional and national carriers, cross-border regulations, and fluctuating tariffs, all while striving for greater visibility and optimized inventory placement.

Ultimately, by leveraging predictive logistics and carefully evaluating transportation options, businesses can meet ever-tightening delivery expectations and ensure customer satisfaction in a rapidly changing global market.

5 Ways to Manage Expedited Costs

The costs of expediting can quickly add up. The following steps can help to rein in the expense:

1. Consider the product and customer. If a shipment doesn’t absolutely need to be there quickly, consider a slower delivery service that costs less. This is a basic step, but one that’s easy to overlook when trying to move goods out the door.

2. Consolidate shipments. Using expedited shipping on a consolidated group of parcels can reduce duplicate handling, packaging, and transportation costs, says Preston Pickett, owner and CEO of Get ERR Done Courier Service.

3. Forecast demand as accurately as possible. Use historical data, market trends, and customer insights to predict delivery needs ahead of time, Pickett says. This helps when scheduling labor, planning routes, and allocating resources, reducing waste and controlling costs.

4. Compare the cost and speed of ground versus air delivery options. A package moving second-day air may cost more and arrive no sooner than a package traveling over-the-road, if, for instance, a ground carrier can engage sleeper teams and trucks to move the cargo overnight, says Tim Binkis of ICC Logistics Services.

5. Also compare the delivery speed and prices of expedited services against less-than-truckload (LTL) services. Currently, some LTL rates have increased significantly, while many expeditors’ rates have remained largely unchanged, says Mike McCallum, president of Rydex Freight Systems and TEANA vice president. As a result, an expeditor’s rates may be competitive or less than those of an LTL carrier.

DELIVERY DILEMMA: WHY RETAILERS LOSE SALES ON SHIPPING

Capabilities such as predictive delivery dates, 7-day carrier services, and weekend fulfillment are consistently tied to higher conversion and repeat purchase rates—yet remain underutilized across most brands’ logistics strategies, finds OnTrac’s latest The State of Speed research study.

The findings show where delivery makes the biggest impact on ecommerce outcomes, and how many retailers are still leaving revenue on the table.

Retailer Delivery Defaults and Missed Opportunities

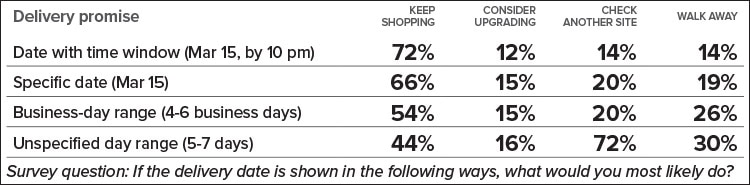

- Vague delivery timing. 88% of retailers still show delivery ranges such as “4-6 business days” at checkout, despite shoppers being two times more likely to abandon carts due to vague delivery timing (see chart below).

- Demand for expedited shipping. 84% of consumers have used expedited shipping in the past six months, and 37% have sought out weekend delivery, indicating that delivery flexibility is now a baseline expectation.

- Stagnant delivery speeds. 65% of retailers report no change in their standard delivery speeds over the past 24 months. Additionally, 59% are not expanding fulfillment networks, and 23% are consolidating them.

- Reduced consumer spending. 37% of consumers plan to reduce overall spending this year, intensifying competition for fewer ecommerce dollars.

What Top-Performing Brands Do Differently

- More than half of retailers using 7-day/week last-mile carrier services saw improvement in Net Promoter Score (NPS), customer lifetime value, and a decrease in abandonment rate.

- Brands in the top 50th percentile for conversion, repeat purchase, and NPS were two times more likely to use predictive delivery dates and over three times more likely to operate warehouses on a seven-day schedule (either year-round or seasonally).

- Retailers adopting predictive delivery dates were half as likely to expand fulfillment networks and one-third as likely to introduce new premium shipping options.