Overcoming Global Trade Barriers

Lockdowns, land wars, and rising costs had companies scrambling to keep sourcing intact in 2022. Is reshoring the key to unlocking international trade challenges?

Following World War II, international trade blossomed. Twenty-three countries—including the United States—signed the 1947 General Agreement on Tariffs and Trade, which lowered tariffs and reduced trade barriers between developed countries. Further negotiations would entrench equal trading terms between signatories and foster an environment of general economic cooperation in the following years.

Fast forward to 2023, and that momentum may have devolved into gridlock. Retaliatory tariffs, sanctions, political instability, and inflation are all creating roadblocks to international trade.

As supply chains spread across the globe, disruptions have become a near constant. In 2021, pandemic policies and transportation shortages roiled inventory management practices. Prior to the pandemic, a trade war between the United States and China made it more costly to bring goods over the border. Before that, Brexit spawned uncertainty.

Black swan events aren’t going anywhere, and a disruption in one corner of the planet can have global reverberations. What, if anything, can business logistics professionals do to keep goods flowing?

World Events Wreak Havoc on Trade

International traders have had their share of challenges to deal with in recent years. Just as executives were ironing out a dramatic fluctuation in demand—and the supply and transportation constraints that accompanied it—war broke out between Ukraine and Russia in February 2022.

Among other things, the conflict interrupted the flow of grain and metal to the rest of the world. It also wreaked havoc on fuel costs. Global crude oil prices jumped from $76 per barrel in January to more than $110 per barrel by March, pushing up transportation costs, according to GEP, a supply chain software and managed services provider.

Meanwhile, zero-COVID policies led to abrupt shutdowns at ports and manufacturing cities, causing shipping delays between China and the United States.

For example, shipping delays between China and the United States and Europe quadrupled from March to May of 2022, finds data from project44. These policies short-circuited sourcing efforts and sent companies such as Apple to seek out new manufacturing locations.

“Consumption patterns were turned completely upside down,” says Pawan Joshi, executive vice president of product management and strategy at supply chain software platform e2open. “The pandemic reduced supply, constrained logistics, created geopolitical situations, and caused a massive uptick in demand for semiconductors.

“It’s a lot to digest in three years,” he says.

Compliance: An Open-and-Shut Case

Rising global turmoil has translated into increased legal responsibilities for U.S. businesses. Ongoing conflicts in Eastern Europe and state-sponsored human rights violations in China have given rise to a growing web of conditions on where—and how—companies can source raw materials and component parts.

One example is forced labor. Although compliance in this area is nothing new—it has been illegal to import items produced with forced labor since the Tariff Act of 1930 proscribed the practice nearly one century ago—regulatory oversight ratcheted up in 2022.

In 2021, Congress passed the Uyghur Forced Labor Prevention Act (UFLPA), which bars imports from China’s Xinjiang Uyghur Autonomous Region into the United States. The law’s enforcement takes place, in part, through an interagency task force that provides ongoing updated guidance to importers.

Under UFLPA, companies must demonstrate that goods either did not come from Xinjiang, or were produced without the use of forced labor.

To prove that a product did not originate in that region, certain importers must “not only use due diligence in evaluation of their supply chain, but also to respond completely and substantively to CBP requests for information regarding entries it may review,” according to a U.S. Customs and Border Protection (CBP) known importer letter.

This requires a company’s compliance team to work with its purchasing and logistics departments to identify the origin of all raw materials and ascertain an accurate model of their supply chain.

Failure to comply with UFLPA regulations could result in the seizure or forfeiture of cargo. Even products exported from elsewhere in Asia could be subject to a withhold release order if they could have been sourced or utilized labor from the Uyghur region.

“Each time it adds complexity and cost to the overall process,” says Ron Shepherd, director of cross-border trade compliance at UPS. “You start thinking, ‘The cost of my raw material was x, but because of these additional requirements, it’s now y. Is it more advantageous to source it from a different place where we might not have this issue?’”

Straight to the Source

This tumult is leading some professionals to revisit their procurement strategies. The benefits of sourcing from historically low-cost countries aren’t worth the exposure to adverse events, especially for companies with only one or two suppliers.

That hasn’t always been the case. In 2009, average hourly compensation costs for manufacturing employees in China were a mere US$1.74, according to the Bureau of Labor Statistics. But by 2016, labor costs in China were only 4% behind U.S. workers, according to Oxford Economics.

Whatever savings are realized from overseas procurement risk getting wiped out by production delays or transportation costs.

“Low-cost country sourcing doesn’t mean paying the lowest price overall,” says Wendy Tate, professor of supply chain management at the University of Tennessee-Knoxville Haslam College of Business.

Diversification is one way to recoup some of the expenses. India, Vietnam, and Mexico have emerged as the lowest-cost countries that American businesses are currently sourcing from, according to The Reshoring Institute.

It’s important to consider the whole picture when deciding where to build a facility—labor costs matter, but so do distance, political stability, and worker productivity.

“There’s lead time to factor in, there’s inventory to finance, there are all kinds of customs and tariffs according to where a product is coming from,” says Tanguy Caillet, senior vice president of global industry solutions at o9 Solutions, a financial planning platform.

“The unit cost could be cheaper coming from Asia, but Mexico might have lower associated tariffs because of the USMCA,” he says.

A Manufacturing Home Run

Some companies are taking it one step further by moving their supply chains as close to home as possible. A few have even begun reshoring—relocating some operations to North America.

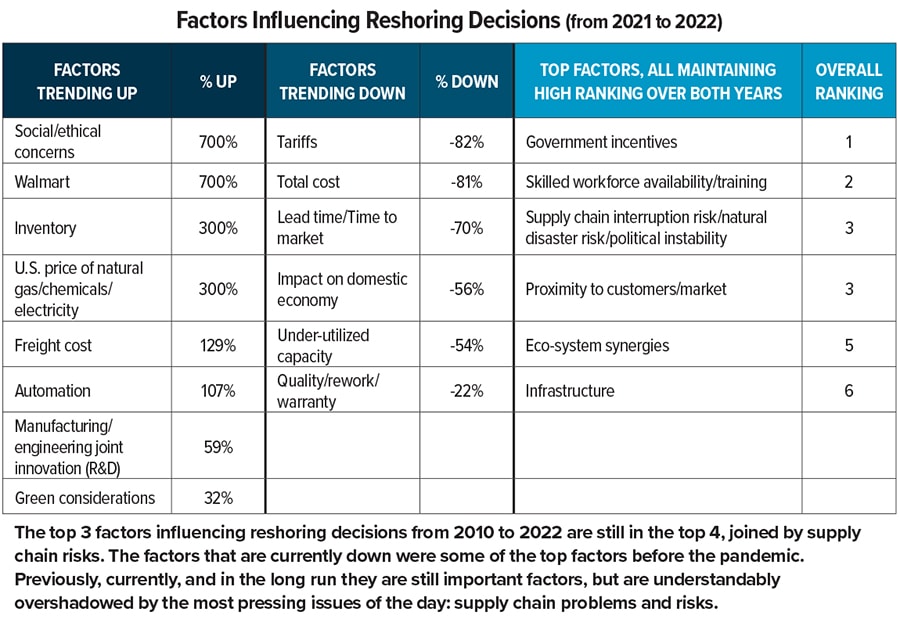

In the 2021 State of North American Manufacturing Report, 83% of manufacturers told Thomasnet.com they are either “likely” or “extremely likely” to reshore by adding North American suppliers to the mix. And 41% of polled manufacturing executives have reshored at least some of their operations within the past three years, finds a 2021 Kearney survey.

There are upsides to reshoring—shorter lead times, proximity to customers, and the availability of a skilled workforce, to name a few. But relocating supply chains to North America comes with its share of challenges, too. Many of them revolve around time and resources.

“It takes a lot of effort to move a supply chain,” says Ben Bidwell, director of North America customs and compliance at a third-party logistics provider C.H. Robinson. “You need to take the time to stand up sourcing, production, and staffing.”

Still, “don’t count reshoring out,” says Bidwell. It can be a viable means of fortifying a supply chain, especially for companies that are not diversified.

Organizations that are unsure whether to make the move could start by reviewing their customs history to find cost-saving opportunities, Bidwell recommends.

The Eye On the Storm

If there’s one constant in supply chain management, it’s unpredictability. Geopolitics may currently be at the forefront, but that doesn’t mean that a financial disruption or weather event couldn’t take place tomorrow. Supply chains rarely operate in a steady state environment.

Given these circumstances, companies need to be familiar enough with their sourcing to know how it could be impacted by an unforeseen incident, explains Sam Polakoff, founder and CEO of Brilldog, a supply chain management platform headquartered in New Freedom, Pennsylvania. Even businesses that aren’t directly affected by a particular disruption may find that one of their vendors is.

Weather events are one example. In November 2022, a 5.6 magnitude earthquake struck the west coast of Indonesia’s Java Island. Tremors could be felt as far as 60 miles away.

“An earthquake might not impact a business directly, but what about your suppliers?” Polakoff says. “A vendor in the United States might still buy parts for your product from the affected area.”

An array of visibility technology can help anticipate snags before they materialize. For example, Brilldog’s platform helps companies find new sources of supply when an initial vendor is compromised.

“The key is to get visibility into where a problem could occur,” Polakoff says. “That way, you can divert your supply chain so you don’t run into the issue in the first place.”

Coming off of a year of economic shocks and pandemic uncertainty, world trade is expected to be subdued in 2023. The World Trade Organization (WTO) forecasts that global trade will expand by a paltry 1% this year.

That prediction accompanies an equally muted economic outlook. The World Bank expects that global GDP will rise by a mere 1.7% annually—outpacing only 2009 and 2020 in terms of economic growth since the start of the 21st century.

The culprit behind these meager estimates varies by continent. Efforts to clamp down on rising inflation are what will mute import demand in the United States, according to the WTO. Monetary tightening will cut into spending on housing, vehicles, and fixed investment. Meanwhile, high energy prices and resource scarcity will kneecap spending in the rest of the world.

One Bright Spot

Falling demand and a softening economy might not sound ideal to some executives. But there is an upside to the situation: Contract manufacturers may have more available capacity, making it an ideal time to refresh sourcing practices or make changes to a product.

“If a company can tap into its suppliers’ expertise, it can leverage existing capacity while accounting for changes it wants to make,” says Venky Arun, strategic operations partner at Kearney. “This is the best time to do that, because suppliers will want to work with you.”

It could create a world of opportunity for U.S. importers for years to come.

Mexico Delivers the Goods

Unrest, delays, and exorbitant prices have sent some companies hunting for manufacturing locations outside of Asia. An increasingly popular alternative is Mexico. Annual foreign direct investment rose by nearly one-third in the first nine months of 2022, according to the country’s Economy Ministry.

“Nearshoring is a cool buzzword right now, but we are seeing it happen,” says Jay Gerard, head of customs at Nuvocargo, a digital platform that facilitates trade between the United States and Mexico. “A lot of producers that have always shipped out of Asia are looking to diversify.”

There are a few reasons for this, Gerard explains. The first is proximity. Relocating to Mexico enables companies to bypass some of the shipping costs and bottlenecks that characterized 2020 and 2021.

Another element is labor costs. According to NAPS International, a compliance management services provider, wages in Mexico averaged $3.95 per hour in 2019, compared to $4.50 in China.

Finally, legislative cooperation between the two countries is incentivizing some manufacturers to set up shop just below the United States’ southern border. The United States-Mexico-Canada Agreement, which replaced NAFTA in 2020, helps companies avoid the Section 301 tariffs, and other duties associated with Chinese manufacturing. Similarly, the IMMEX program, developed by the Mexican government, creates a mechanism to import raw materials duty-free. Finally, B-1 visas facilitate smoother transportation into the United States for Mexican truck drivers.

As more–and more advanced–production facilities are built in Mexico, it’s supporting the country’s growing infrastructure development. For example, in mid-2022, Mexico’s government revealed plans to invest US$38.6 billion on 15 rail infrastructure projects.

It’s a virtuous, upward cycle.