Tackling Tariffs and Trade Headaches: How to Overcome Supply Chain Visibility Gaps and Global Barriers

Supply chain and logistics managers face global trade barriers and geopolitical risk and uncertainty. Here’s how to handle tariffs and prepare for supply chain disruptions.

Curing Supply Chain Headaches

A data accuracy gap leaves many shippers struggling to find the level of insights, visibility, and accuracy required to drive confidence in their supply chain and respond quickly to market changes, reveals Supply Chain Integrity Outlook 2025, a recent survey of more than 1,000 logistics and manufacturing leaders conducted by RFID provider Impinj.

This gap can hinder supply chain managers’ ability to address key supply chain challenges, including:

Retail counterfeiting and theft

- 65% of supply chain managers agree it’s a challenge for their organization to reduce the amount of counterfeit goods entering the supply chain. Almost all (98%) retail supply managers are taking measures to combat counterfeiting.

- 60% of retail supply chain managers also agree that reducing rates of shrink and theft is a challenge for their organization. An overwhelming majority (99%) are investing in measures to mitigate these concerns, including increasing security checkpoints during transit and delivery (48%) and implementing new technologies for tracking goods (41%).

Misloads and delivery errors

- Almost three quarters (74%) of supply chain managers within transportation and logistics firms are concerned about growing volumes of load planning problems, misloads, and delivery errors impacting their organization. The largest volume of errors is most likely to occur as a result of delivery and last-mile misloads (24%) and label inaccuracies (22%), according to survey respondents.

- Almost half (48%) of transportation and logistics firms plan to invest in improving shipment accuracy and reducing delivery errors as a critical part of their sustainability efforts.

AI implementation

- Data accuracy is the top challenge supply chain managers face (43%) in effectively implementing AI to improve their organization’s supply chain, alongside data availability (39%) and access to real-time data (36%). Overcoming these challenges will be essential to unlock the full potential of AI across supply chain networks.

Sustainability

- 27% of respondents report continued issues reducing the environmental impact of their organization’s supply chain, while 25% cite challenges in meeting more stringent ESG regulations.

- Across sectors, supply chain managers report implementing strategies to improve sustainability that include improving the measurement of their sustainability efforts (52%), improving last-mile delivery efficiency (44%), reducing waste (41%), and implementing recycling initiatives (40%).

Investing for Improvement

As an antidote to supply chain headaches, organizations are investing in a range of areas in 2025 to improve the supply chain, according to the Supply Chain Integrity Outlook 2025 survey.

What areas do you plan to invest in during the next year to improve your organization’s supply chain?

New systems and technologies to optimize delivery and fulfillment (32%)

Improving data-driven insights and visibility (32%)

Improving supply chain sustainability (31%)

Improving shipment accuracy and reducing delivery errors (31%)

Implementing new technologies and business models to more rapidly respond to changes in customer demand (31%)

New systems and technologies to meet new retailer/partner mandates for suppliers (31%)

Data optimization (31%)

Implementing new AI and automation technologies (31%)

Upskilling workforce (29%)

New systems and approaches to reduce shrink/theft (28%)

New systems and processes to ensure compliance with new regulations (28%)

Diversifying supply chains (28%)

Addressing labor shortages (26%)

Retail Sourcing: 4 Trends to Watch in 2025

Big changes are afoot in the retail sourcing segment. Today’s successful retail supply chains are shifting from a narrow focus on cost, efficiency, speed, and other traditional metrics, to a broader focus on sustainability, resilience, collaboration, flexibility (see chart below), integration, and service.

In addition, though understanding how to implement artificial intelligence and machine learning tools is an important focus, many retail supply chains still struggle with the same fundamental issues they have for years—such as manual processes, siloed and inaccurate data, and upgrading their mix of legacy systems.

These major shifts are outlined in Trade Beyond’s new report, 2025 Retail Supply Chain Trends, which outlines four key trends impacting sourcing strategies across all consumer markets.

TREND #1: FROM SINGLE SOURCE TO DIVERSIFICATION

Flexibility Cushions Disruption: The frequency and severity of disruption in recent years due to conflicts, delays, material shortages, and higher transportation costs, has made built-in flexibility a requirement for evolving supply chains.

Source: Trade Beyond/Deloitte

Supply chain diversification is accelerating as companies reduce reliance on single-source regions like China in favor of strategic nearshoring or reshoring destinations. Disruptions, delays, and rising costs have made de-risking through onshore or nearshore strategies a priority. 73% of companies reconfigured networks from 2022-2024, Gartner notes, and experts anticipate this trend will intensify in 2025.

TREND #2: FROM LINEAR TO CIRCULAR SUPPLY CHAINS

With retail contributing 25% of global greenhouse gas emissions, retailers feel more pressure to go circular. Circular supply chains aim to reduce waste by recycling, repairing, and reusing materials, creating multiple product lifecycles. Rising consumer demand and inflation drive companies to adopt this model, which boosts profitability and brand equity, and reduces environmental impact while also balancing sustainability and cost-effectiveness.

TREND #3: FROM SUPPLY CHAIN AS A FUNCTION TO SUPPLY CHAIN AS A SERVICE

The strategic importance of supply chains is driving growth in Supply Chain as a Service (SCaaS). Companies increasingly outsource logistics, manufacturing, and order management, while some monetize in-house supply chain expertise. Amazon’s supply chain services division is a textbook SCaaS case, notes the report. The retail giant provides fulfillment services for competing platforms that don’t offer in-house fulfillment, including Best Buy, Walmart, eBay, and Shopify in North America. Amazon also drives both supply chain service innovation and revenue through its cloud and other B2B services.

TREND #4: FROM DATA SILOS TO DATA INTEGRATION

Eliminating data silos in supply chains remains challenging due to outdated systems and limited communication between internal functions and partners. Fully integrated supply chains consolidate data across sales, finance, and operations. This enables improved forecasting, inventory management, and AI-driven analytics, and enhances collaboration and visibility for streamlined operations and decision-making.

Shaking the Global Trade Jitters

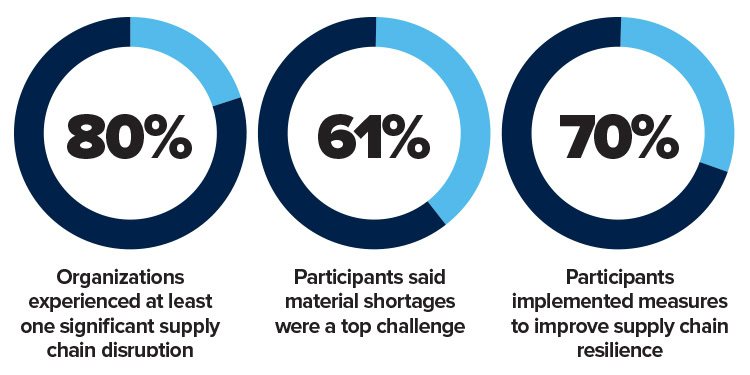

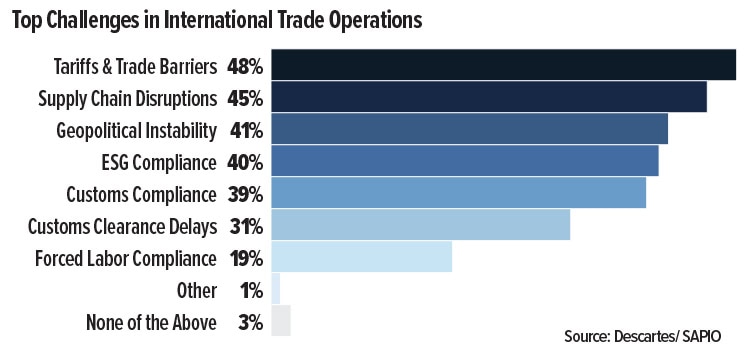

Concern over the impact of new tariff and trade policies is top of mind for logistics and supply chain professionals. In fact, respondents to Descartes Systems Group’s 2024 Supply Chain Intelligence Report: Escalating Challenges for Global Supply Chain Leaders cite rising tariffs and trade barriers as their largest concern. Nearly half (48%) of those surveyed say this is the biggest threat to supply chain stability in 2025.

Supply chain disruptions rank second in the survey, with 45% of respondents citing it as their largest concern. Geopolitical instability is the third-largest threat, with 41% of respondents identifying it as a major issue (see chart).

Interestingly, the tariffs and trade barriers concern was top-ranked regardless of company size, as respondents at companies with fewer than 250 employees, 251-500, 501-1,000, 1,001-50,000 and 50,000+ employees all cite it as the most significant issue they currently face.

The level of concern did vary, however, with the success of the business: Companies anticipating more than 15% growth are more concerned about tariffs and trade barriers (51%) compared to those with flat or negative growth (43%).

“Evolving tariffs and trade policies are one of a number of complex issues requiring organizations to build more resilience into their supply chains through compliance, technology and strategic planning,” says Jackson Wood, director, industry strategy at Descartes.

“With the potential for the new administration to impose new and additional tariffs on a wide variety of goods and countries of origin, U.S. importers may need to significantly re-engineer their sourcing strategies to mitigate potentially higher costs,” he recommends.

Who’s More Optimistic: Shippers or Carriers?

Responding to key developments expected to shape the transportation and logistics sector in 2025, shippers and carriers seem to hold different mindsets about what lies ahead. Shippers and carriers show different levels of optimism about next year’s transportation market, according to the annual Transportation Pulse Report from global freight network platform Transporeon, a Trimble Company.

The report finds:

- Carriers and 3PLs on both sides of the Atlantic show strong optimism (75%), likely due to the increased freight demand and rates, coupled with a gradual capacity reduction.

- Shippers, however, seem less confident as the current trends forecast increased rates and tighter capacity: only 38% declare feeling optimistic about 2025.

- At a macro level, respondents to the survey (both shippers and carriers/3PLs) name economic conditions (56%), geopolitical events (50%), and environmental regulations (36%) as the top three factors that will shape the industry in 2025. The struggles of the manufacturing industry in Europe and the United States, global inflation, slow economic growth, and regional conflicts mean that uncertainty and risk will continue to prevail.

- While global shippers rank AI as the fourth-biggest trend that will shape the industry in 2025, it emerges as the second-biggest for carriers and 3PLs.

When asked about their top priorities for 2025, shippers and carriers both highlight maintaining and increasing profitability—but again, at different levels:

- Cost reduction is the top priority for the majority of all respondents surveyed (61%) and is particularly significant for shippers, at 76%.

- Market expansion surpassed cost reduction for carriers/3PLs: 58% highlight it as their key focus, likely reflecting a desire to capitalize on anticipated market condition improvements following a downturn.

- Supply chain digitization garnered 51% of the total votes, with European respondents showing a greater inclination (59%) than their U.S. counterparts (39%).

- Sustainability initiatives secure 44% of the votes, signifying their growing importance in the sector. European executives value sustainability the highest, reflecting a more advanced implementation of sustainability-related regulations and emissions standards.

“This year’s survey reflects a broader concern for the global economy and geopolitics beyond transportation and logistics,” says Philipp Pfister, chief customer experience officer at Transporeon. “Carriers and 3PLs especially see opportunities for technological innovation and growth, balancing optimism with caution. While digitization won’t be the answer to everything, companies recognize the benefits and aim to use digital tools to control costs, better manage customer expectations, and further sustainability practices.”

Risky Business

Mitigating supply chain risk is a top priority for many organizations as the new year kicks in. But determining where exactly to place the focus is a crucial factor to overcoming the risks. As part of its annual slate of predictions, Moody’s identifies the top three most important areas in supply chain risk in 2025.

Mitigating supply chain risk is a top priority for many organizations as the new year kicks in. But determining where exactly to place the focus is a crucial factor to overcoming the risks. As part of its annual slate of predictions, Moody’s identifies the top three most important areas in supply chain risk in 2025.

1. Supply chain restrictions

Supply chain restrictions continue to play a large role, putting upward pressure on costs. Recent examples: European tariffs on Chinese autos and the United States’ plan to prevent Chinese software and hardware from entering cars.

2. Reputational risk in the supply chain

Reputational risk will likely be at its highest in recent memory. This is a result of polarization of public opinion and ever-present social media. Doing business with a supplier whom a lot of your customers view negatively will be hard to navigate. Furthermore, legislation like the German Supply Chain Due Diligence Act exemplifies a global trend of corporate transparency and due diligence laws addressing modern slavery, forced labor, human trafficking, and environmental damage. This will continue to sharpen the focus on supplier due diligence and pose reputational and financial risks to firms with flawed processes.

3. Value at Risk

Supply chain executives have long pushed for a way to quantitatively measure the impact of different issues and crises on a company’s performance. It has been a long-standing gap, but data availability, new technology (including GenAI), and advances in supplier risk assessments make it easier to size up problems before they fully materialize. Value-at-risk calculations can help organizations determine whether their risk mitigation strategies represent value for money when compared to the potential revenue losses in the event of a supply chain disruption.

Red Sea Attacks Impact Shipping

About one year ago, tension erupted in the Red Sea when Houthi rebels started attacking global shipping vessels. Since then, Houthis have targeted more than 90 commercial vessels, damaging more than 30 ships and sinking two. Attacks continue in the area; most recently, drones attempted to attack a U.S. warship.

The ongoing Houthi attacks have drastically impacted global shipping routes, particularly through the Suez Canal, leading to significant delays and disruptions.

How has this impacted international shipping overall? Global supply chain platform project44 has released a report illustrating the current status.

The report notes that carriers have been forced to reroute vessels, resulting in increased transit times on key trade lanes. The rerouting has hit European ports the hardest, while the U.S. East Coast has seen less disruption because the Panama Canal offers an alternative route.

Key highlights from the report include:

- Major ocean carriers continue to avoid the Red Sea and faced high transit times throughout peak season in 2024.

- Volume through the Suez Canal remains low. Despite the peak season for ocean shipments, November 2024 saw a 72% decline in container vessels passing through the canal compared to November 2023.

- Vessel types most disrupted by the attacks are containers, followed by bulk vessels and tankers.

- Transit time between Southeast Asia and the U.S. East Coast has increased 47%, with a 33% increase to Europe.

- China to Europe has seen a 25% increase in transit time.

- Sailing schedules are still seeing delays of 4-6 days but have improved by up to 70% since February 2024.

3 Critical Supply Chain Reorganization Mistakes to Avoid

Supply chain reorganizations often fail to deliver desired results.

Supply chain reorganizations often fail to deliver desired results.

Gartner conducted interviews with supply chain leaders who underwent successful organizational redesigns and found that leaders who succeed prioritize balance, strength, and speed in their designs, tailoring structures to meet unique organizational needs.

Gartner also determined the following three errors derailed reorg efforts aimed at achieving critical business outcomes:

Mistake 1: The Either/Or Approach

Many organizations adopt a binary approach, choosing either centralized or decentralized models. This oversimplified framework leads to delays, gaps in performance, and confusion over responsibilities. Successful companies integrate both centralized and decentralized elements, ensuring efficiency where standardization is needed while allowing flexibility for customized solutions. This balanced approach supports better alignment with diverse customer requirements.

Mistake 2: Debilitating Headcount Reduction

Cutting headcount to save costs often weakens long-term organizational capabilities. While reducing expenses may yield short-term gains, it risks the loss of critical talent and expertise essential for sustained growth. Instead, high-performing organizations focus on strengthening internal capabilities, investing in talent development, and creating adaptable work structures. Prioritizing people and processes over immediate cost-cutting builds resilience.

Mistake 3: The Copy/Paste Approach

Simply copying organizational designs from other companies without considering unique business needs limits effectiveness and slows decision-making. Successful leaders design structures that empower rapid decision-making, streamline internal processes, and differentiate between day-to-day operations and transformational efforts. Clarity in authority and responsibility eliminates bottlenecks and ensures responsiveness to market demands.