Transportation Leaders Continue to Worry About Cyber Risk; Other Logistics News

As cyberattacks continue to increase in frequency and cargo theft remains prevalent, transportation leaders are working to better prepare their supply chains and safeguard their goods. Plus, a look at data-driven decision-making, the rise of eBLs, and nearshoring takeaways.

Cyber Risk: A Growing Concern

As cyberattacks continue to increase in frequency, no industry is immune, including transportation. In fact, according to the 2023 Travelers Risk Index, 55% of transportation leaders worry a great deal or some about cyber risks.

As strategic cargo theft continues in prevalence and severity, a potential cyberattack is a growing concern for transportation companies. About half (51%) of transportation companies worry about the potential for compromise, theft, and/or loss of customer/client records due to theft.

The transportation industry can do a lot more to become better equipped to combat threats, the report finds. Among the takeaways:

- Fewer than one-third (32%) of transportation company respondents have simulated a cyberattack to identify areas of system vulnerability.

- Fewer than half (48%) of transportation businesses purchase cyber insurance to protect against a data breach/cyber event.

- 50% of transportation companies have written a business continuity plan in the event a cyberattack occurs.

- 54% of transportation companies have a cybersecurity incident response plan in the event a cyberattack occurs.

Supply Chains Fall Behind on Data-Driven Decisions

Supply chain leaders cite the need to reduce costs, improve the customer experience and expedite delivery times as their top challenges, yet fewer than half leverage supply chain data to inform their strategy and 14% don’t use supply chain data at all to make decisions.

That’s according to a new report by supply chain visibility provider FourKites, which polled 500 supply chain leaders on their use of technology to connect disparate supply chains. The report finds:

- 48% of respondents rate themselves as “not great” or “struggling” at digitizing their supply chain.

- 43% struggle to integrate internal systems and have a single source of truth.

- 42% are investing in technology in the next six to 12 months to de-risk their supply chains. Investments are even more pronounced among enterprise companies, where 70% plan to increase tech investment.

- Nearly 52% of companies are diversifying their supplier/provider base in efforts to de-risk their supply chains.

Transportation industry Springs a Leak

Out of all industries, the transportation field ranks among the top 10 in terms of how many companies have suffered data breaches where consumer data was leaked, reveals the latest NordPass study. In total, nearly 280 transportation organizations worldwide lost clients’ data.

Key takeaways from the study:

- Private companies make up 60% of all transportation organizations whose clients’ data was stolen.

- Smaller companies were found most likely to lose clients’ data. In the transportation field, companies with up to 50 employees had their clients’ data compromised the most.

- Entertainment companies are the worst in ensuring clients’ data. While one might assume otherwise, technology companies are also not much better.

Source: NordPass

The Promise of eBLs

By Niels Nuyens, Head of Digital Trade, Digital Container Shipping Association

The Fit Alliance eBL declaration (see sidebar below) gives global trade stakeholders the opportunity to express support for digitalization, specifically regarding the bill of lading. The largest ocean carriers have committed to 100% eBL in 2030. Their commitment should also nudge trade partners to embrace digitalization.

A 2023 FIT Alliance survey found that many participants in global trade are reluctant to get started. Why? Because their trade partners are not ready. The declaration gives those in the industry who are keen to change the platform a way to publicly articulate that support.

Many of the largest trading banks have also expressed their support for digitalization through the declaration. Similarly, many freight forwarders are leveraging the declaration to express support. With both stakeholders groups as well as carriers on board, retailers, manufacturers, and exporters should now be encouraged to join the eBL movement.

It makes sense for many reasons: process efficiency, improved security, environmental benefits, and better law enforcement.

What is especially exciting are the opportunities that global consulting firm McKinsey refers to as “trade enablement.” It is expected that large corporations as well as small and mid-sized enterprises will have better and easier access to global trade, and the ability to unlock new business models.

There is an additional reason why digitalization in global trade is crucial. By 2050, it is expected that global trade will triple. This provides a wealth of opportunities. However, it also means that the involved parties must get ready to support and handle that growth or miss the boat. Digitalization is one of the enablers; so is the eBL as part of the end-to-end documentation process.

The business case for the eBL is huge, for all global trade participants.

Committing to eBLs

The FIT Alliance has introduced the Declaration of the Electronic Bill of Lading (eBL) to secure industry-wide commitment to digitalization and to help make international trade more efficient, reliable, sustainable, and secure.

The declaration’s aim is to secure commitment from all stakeholders in international trade to collaborate on driving digitalization, starting with eBLs. Nine of the largest ocean carriers have already committed, and shippers will come on board by default through the transactional platforms they use via the FIT Alliance members.

The potential impact of this change is immense, promising billions in cost savings, improved customer experiences, and greener transport methods. In fact, a McKinsey study estimates that if eBL achieved 100% adoption in the container sector alone, it could unlock $30-40 billion in global trade growth by reducing trade friction.

Reshoring Speeds Up

Reshoring is accelerating as U.S. and European companies want to de-risk their supply chain from geopolitical developments and supply chain disruptions. Companies are also moving production from China and Asia to Europe and the United States to reach their CO2 emission reduction goals.

Those are the findings of a recent BCI Global survey of supply chain leaders from large European and U.S. companies.

Half of the interviewed companies implemented reshoring initiatives in the past three years, totaling up to 20% of their Asia-based production capacity. Barriers include selecting cost-effective production locations and finding the right suppliers.

One out of four companies that reshored is disappointed about the cost savings, finds the research.

Nine out of 10 surveyed companies want to decarbonize their supply chains, mainly driven by their own strategic objectives. But for 50% of respondents, compliance with regulations and customer requirements are important drivers as well.

Unlocking the Future for SCM Professionals

Supply chain management is often regarded as a dynamic and evolving industry, but what’s the perspective of young professionals entering this field?

A recent collaborative effort among the Council of Supply Chain Management Professionals, Penske Logistics, and Korn Ferry sought to uncover just that by gathering responses from nearly 200 young professionals under the age of 30.

Here are some key findings from the study:

- High job satisfaction. A remarkable 96% of young professionals express excitement about their supply chain careers, with an equally high percentage keen on recommending these careers to others.

- Diverse career motivations. More than half (58%) of young professionals in the supply chain field are attracted by the diverse range of opportunities available, highlighting the attractiveness of the sector.

- Tangible impact. 57% recognize the tangible impact supply chain roles have on business outcomes, emphasizing the significance of their contributions.

- Exposure and awareness. More than half (53%) have gained firsthand supply chain exposure through internships or education, contributing to an increased awareness of the field.

- Changing perceptions. Interestingly, the percentage of those “strongly agreeing” that supply chain is an excellent career choice has declined by over 10% since 2016. This shift likely reflects the heightened competition in the field and underscores the importance of compensation, advancement opportunities, and work flexibility in retaining talent.

3PLs Perform a Balancing Act

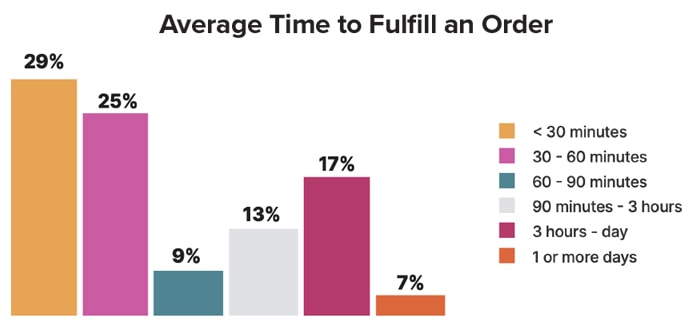

Time to fulfill is getting shorter year over year. Nearly 54% of 3PL respondents pick, pack, and prepare packages for shipment within one hour of order receipt. 76% of all orders get fulfilled in less than three hours. Only 7% of companies take more than one day to fulfill, on average.

Source: Extensiv 3PL Warehouse Benchmark Report

Record fulfillment times (54% fulfill in less than one hour), more available warehouse capacity (65% operate at less than 90% capacity), and a more tempered outlook for 2024 are among the results of Extensiv’s fourth annual Third-Party Logistics (3PL) Warehouse Benchmark Report.

Key takeaways from the 2023 report include:

- Slowing growth. While a majority of 3PLs still show positive order and profitability growth, a larger group of 3PLs now see flat or declining profits as the economy fluctuates. Although approximately one-third of 3PL respondents show more than a 25% increase in order volume growth year over year and 42% indicate an increase of up to 24%, 22% of respondents either remained the same or saw a decline. The number of 3PLs with no change or declining order volumes more than doubled in 2023 compared to 2022.

- Available capacity. More warehouses report being under capacity or under-utilized than in the prior three years, opening up the opportunity to bring on more clients, diversify services, or partner with other 3PLs to create geographically dispersed 4PL fulfillment networks. This available capacity also will lead to more aggressive customer acquisition efforts in 2024.

- Expensive labor. Although companies report slightly more labor availability, the workforce comes at a higher cost this year, leaving 3PLs to focus on ways to optimize worker productivity and time to contribution. Seventy percent of respondents cite increased labor costs over the last year, and 53% indicate that labor makes up more than 40% of overall business costs.

- Cash flow. With lengthy invoice creation cycles, high interest rates, and customer time to payment slowing, 3PLs see more pressure on managing cash flow and less ability to invest for the future. Those who experienced high profitability growth capitalized on process efficiencies and, on average, were 187% more likely to spend fewer than 8 hours monthly on billing and invoicing.

- Faster fulfillment. This year shows the fastest time to fulfill versus any previous year (see chart), highlighting the need for brands to expand shipping cut-off times for end consumers. Participants who reduced fulfillment time to 90 minutes or less were, on average, 1.5 times more likely to experience high and medium profitability growth.