COVID Hangover, Port Funding and More News

U.S. Ports: Let’s Have Some Funds

The U.S. Department of Transportation selected 41 projects to receive $653 million in grant funding under the Port Infrastructure Development Program, part of approximately $17 billion included in a 2021 infrastructure spending bill for ports and waterways.

The program was designed to improve U.S. port capacity and efficiency and, in turn, help multimodal shipping networks meet rising demand for freight services, according to the Biden Administration.

Nearly $173 million in grants are earmarked for smaller port facilities, which officials say will improve regional supply chains and ease pollution concerns. One of the largest awards—more than $43 million—will replace the lone dock in the remote city of Cold Bay, Alaska.

The largest grant—more than $54 million—will overhaul and expand the Husky terminal at the Port of Tacoma. Other top grants:

- $52 million for projects at the Port of Long Beach, California.

- $50 million for a new container yard at the Port of Wilmington, Delaware.

- $47 million+ for an offshore wind manufacturing hub at the Port of Baltimore.

Taking the Supply Chain’s Pulse

While it has been four years since the start of the pandemic, risk and resilience still dominate supply chain concerns. Companies continue to accelerate efforts to diversify and localize their supply networks, according to McKinsey’s latest annual survey of supply chain leaders.

While it has been four years since the start of the pandemic, risk and resilience still dominate supply chain concerns. Companies continue to accelerate efforts to diversify and localize their supply networks, according to McKinsey’s latest annual survey of supply chain leaders.

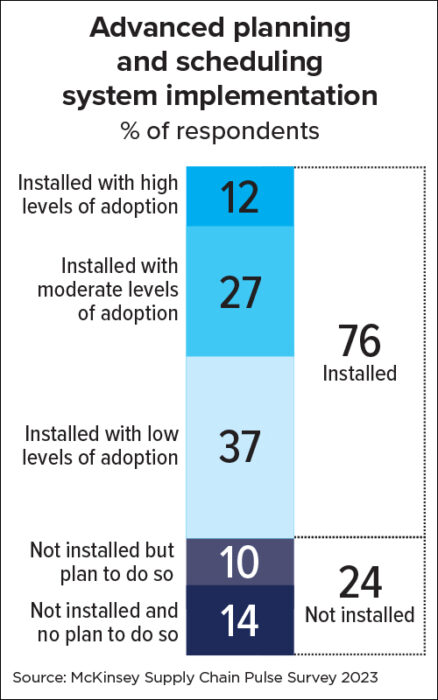

The survey also reveals a dramatic revolution in the way companies operate their supply chains, with a sharp increase in the adoption of advanced techniques for supply chain planning, execution, and risk management.

Among the survey’s additional highlights:

95% of respondents report challenges with their supply chain footprint in the past 12 months.

50% report their supply chains are reliant on another region and 89% plan to reduce this dependency with focus on Western Europe and Southeast Asia.

64% regionalized their supply chains, with 42% bringing production closer to where they expect to sell their goods. 100% doubled backup production sites in the past year.

66% brought suppliers closer to their main markets, driven mostly by the automotive and consumer industries, while 78% moved away from single sourcing of raw materials.

In 2022, 68% of companies planned to review their inventory management strategy. In practice, 55% of retail and consumer companies are on backswing with too much inventory amid a pullback in spending. That’s a stark contrast to high-tech industries that increased inventories (55%) as buffer to offset the risk of supply chain disruptions amid increased demand.

While 71% increased digitization, 92% report having insufficient talent to operate digitally enabled supply chains.

67% planned to improve supply chain visibility, yet only 30% completed implementation in the past 12 months.

All in Favor, Say AI

Manufacturing CEOs are investing significantly in artificial intelligence (AI) and workflow automation tools, according to Xometry’s latest quarterly American Manufacturing Resilience poll with Forbes and polling firm John Zogby Strategies.

Manufacturing CEOs are investing significantly in artificial intelligence (AI) and workflow automation tools, according to Xometry’s latest quarterly American Manufacturing Resilience poll with Forbes and polling firm John Zogby Strategies.

Fifty-seven percent of U.S. CEOs say they invest in these new technologies to improve efficiency and strengthen their supply chains,

In addition to AI, 28% of manufacturing CEOs are investing in robotics, and 27% are focusing on job training and upskilling. Among those who have implemented AI, 67% have already seen a significant return on investment, while 31% expect a strong ROI in the future.

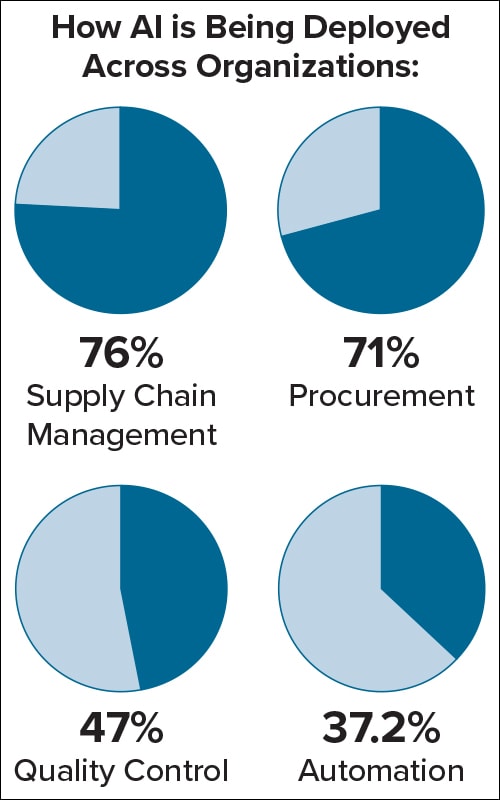

Manufacturing CEOs have taken significant proactive measures to prepare for the AI boom, deploying AI in various measures in their organizations (see chart), with 76% of it being used in supply chain management, followed by procurement (71%), quality control (47%), and automation (37%).

Highlights of the poll include:

- Reshoring continues to accelerate, as 76% of CEOs have successfully reshored some or all of their overseas facilities or are in the process.

- 83% of CEOs believe that the health of American manufacturing depends on reshoring production capabilities.

- 70% of manufacturing CEOs are on track to beat last year’s sales and 68% are on track to beat last year’s profits.

- 65% say they will increase wages by the end of 2023, with 33% holding the line and only 2% decreasing wages.

When it comes to the supply chain, CEOs are most concerned about a major cybersecurity attack (24%), followed by a large-scale or global war (20%), banking instability (16%), labor strife (14%), terrorist attack (11%), and pandemic (6%).

In the labor domain, the manufacturing industry faces challenges in attracting highly skilled talent as it becomes more high-tech. More than 56% of manufacturing CEOs struggle to find qualified, highly skilled employees.

COVID Hangover Still a Thing

To analyze expectations around the 2023 peak season, third-party logistics company Kenco conducted two surveys: its Annual Supply Chain Survey, polling 125 supply chain practitioners, and its eCommerce Peak Season Pulse, surveying more than 225 U.S. adult consumers.

Some key insights from the surveys include:

- 60% of supply chain practitioners say the “COVID hangover” still impacts supply chains.

- 30% of practitioners say managing inventory challenges is their biggest concern .

- Consumers show similar inventory concerns; 60% indicate product availability as their top concern.

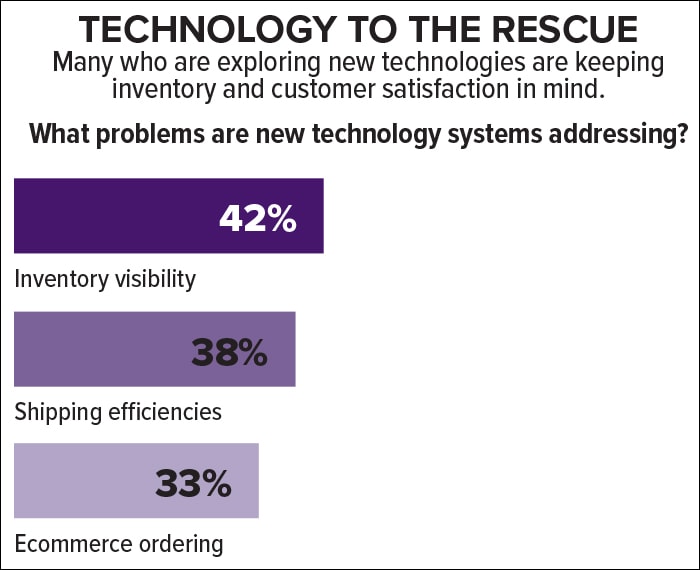

- 35% of practitioners have implemented new technology to prepare their operations for peak season (see chart), including 35% who have explored AI for their operations to manage everyday processes.

- 72% of consumers say they would select slower shipping options if it means free shipping.

What’s Up With 3PLs?

Harris Williams, a global investment bank specializing in M&A advisory services, highlights key insights into the future of the third-party logistics (3PL) space and lessons from the market.

- U.S. 3PLs’ continued focus on technology innovation, coupled with a more nimble workforce and open market transparency accelerating out of the pandemic, supports further enhancements in productivity and economic growth potential—even amidst an evolving broader U.S. economy facing the uncertain impacts of continued inflation and interest rate changes.

- Within the 3PL landscape, economic challenges and resulting shipping volume declines led to excess freight capacity and an extended dip in freight rates in 2023. A meaningful pickup may not occur until Q2 or Q3 2024.

- Shippers are putting far more emphasis on procurement and supply chain management. 3PLs must expand their solutions to meet shipper challenges and add incremental value as thought partners offering end-to-end solutions rather than simply serving as suppliers.

- M&A activity is expected to stay strong despite challenging market conditions, while the thesis and target criteria for investing within the transportation space have changed to include more asset classes: from a prior focus on hard asset ownership and core infrastructure opportunities, infrastructure investors are now expanding their aperture to include select asset-light businesses. They are also more open to establishing long-term or perpetual funds to support their investments across economic and transportation environments.

- The best 3PLs are adopting purposeful technology, adding sought-after services, and offering valuable, consultative approaches to their shipper partners while staying ahead of the pack on key market themes such as onshoring, ESG, and cybersecurity.