Trends—June 2012

4 Supply Chain Predictions For the Next 4 Years

Four trends are expected to impact global logistics organizations over the next four years, according to Gartner, a consultancy based in Stamford, Conn. The predictions come as 60 percent of companies surveyed as a primer for Gartner’s July 2012 Supply Chain Executive Conference in Sydney, Australia, say they view logistics as non-strategic.

"While logistics operations may be out of sight, out of mind, logistics is under significant pressure to deliver near-perfect performance, especially as business conditions become more complex, risky, and difficult," says C. Dwight Klappich, research vice president at Gartner.

Gartner predicts that by 2016:

- More than 50 percent of Global 1000 logistics organizations will be required to systematically report verified emissions and environmental data. The shift from aspirations and feel-good platitudes about sustainable logistics to verified requests for accurate environmental and greenhouse gas emissions information and actual performance outcomes is being catalyzed by industry groups, market expectations, and regulations.

- Fewer than 10 percent of logistics organizations will have a chief compliance and risk management officer. As supply chain complexity and risk grow, only 14 percent of companies are positioned to effectively exploit risk. Few have elevated compliance and risk management to an executive-level position. While compliance, risk management, and security are all issues supply chain management (SCM) organizations deal with today, responsibility for understanding and managing them is still scattered across the business.

- Twenty percent of SCM organizations will adopt a supply chain execution convergence application strategy. In Gartner’s survey, 35 percent of businesses identify as an issue the inability to synchronize end-to-end business processes, which will increase demand for SCM application convergence. Most SCM organizations struggle with functional and application silos that make orchestrating and synchronizing business processes nearly impossible.

- Slower global trade growth will force shippers to adjust from proliferation to optimization of international flows. Shippers will evaluate global sourcing options more carefully in order to gain economies of scale and visibility, and to manage risks associated with volatility in currency exchange rates, taxes, and margins. To improve efficiency and reduce costs, companies will focus attention on supply chain execution elements, including network and inventory optimization, warehouse and inventory management systems, and transportation management systems.

Got Culture?

A s on-demand transportation and logistics technology become more economical and easily deployed, and standards such as Lean, Six Sigma, and SCOR are more widely accepted within the supply chain, the importance of human capital continues to grow. Whether it’s C-level leadership acknowledging and supporting supply chain, or a workplace culture that incentivizes performance, "people power" is emerging as a major competitive differentiator.

Land O’Lakes offers a telling example. At the April 2012 Supply Chain World Conference in Miami, Ken Litke, vice president of supply chain, spoke about how the company aspires to double the size of its business in the next five years. It’s an ambitious goal. But Land O’Lakes has some experience: It doubled the size of its business over the past five years.

One growth driver is its Purina Mills feed operation. Land O’Lakes has ownership of all U.S. feed apart from the pet food business, which belongs to Nestlé. It’s the world’s number-one supplier of feed to zoos. Land O’Lakes also has an egg operation and dairy, the brand magnet.

"The company is very complex," says Litke. "Our dairy supply chain is demand-driven from a consumer perspective. But it’s also supply driven, because cows don’t care about seasonal peaks. We have to convert their perishable milk into dairy products in the spring when milk levels are high, but our demand peaks during the fourth quarter and holidays."

On the feed side of the business, Land O’Lakes has 30,000 SKUs produced—many made-to-order with a 24-hour lead time—at more than 60 global locations.

Given the complexity of its expanding global business, two years ago Land O’Lakes endeavored to set up its own processes, based on the Toyota Production System, to drive efficiencies throughout its supply chain. Litke refers to the model as the company’s "house." The two guiding principles are process and culture.

"The foundation of our house is people and a winning culture," he explains. "Next are three cost pillars—labor productivity, line efficiency, and material yield—in addition to quality and food safety, customer service, and the environment. Finally, a roof of simplicity and continuous improvement covers everything we do.

"A pillar could fall and the house would stand," he adds. "But if our foundation crumbles, we’re homeless. We spend a lot of time inspiring and empowering our workforce."

The Land O’Lakes Production System looks good on paper but the proof lies in the pudding—made with its dairy products, naturally. The company is working with facilities throughout its production network to increase operational performance and material yield by finding a better balance between people and process. Though Land O’Lakes has already begun the journey, it’s still a work in progress.

Pain in the Gas

Companies are paying close attention to fuel consumption—and for good reason, according to a recent GreenRoad survey of fleet operators. Sixty-one percent of respondents, covering a broad range of industries, fleet types, and sizes, report that fuel represents more than 25 percent of their fleet costs. Almost all those polled expect fuel costs to rise in the next year, according to the Redwood City, Calif.-based driver performance and fleet safety management company.

Surprisingly, only 55 percent of companies cite specific goals to reduce fuel costs—suggesting that many are resigned to paying more at the pump. The most conservative companies are aiming for a two-percent reduction, and the more aggressive are targeting 25 percent cuts over multiple years.

Among the survey’s other key findings:

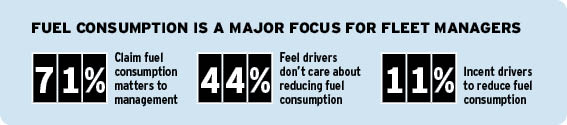

- Fuel consumption is a huge focus for management, less so for drivers (see chart). A majority of managers feel their drivers are not concerned with reducing fuel consumption or improving miles per gallon (MPG).

- While fleets generally measure MPG across a variety of metrics—specific vehicle, vehicle type, and division—only one-third of survey respondents claim to measure fuel consumption by driver.

- More than 50 percent of companies have specific goals for reducing fuel consumption, but their methods for achieving these goals vary. Approaches include everything from monitoring idling and leveraging more fuel-efficient vehicles to driver training, better reporting and communication, route improvements, and speed reductions.

While fleet leaders say they are very fuel-focused, 44 percent feel their drivers don’t care about reducing fuel consumption or improving MPG. Despite that, only 11 percent have driver incentives in place to reduce fuel consumption, and less than half say that they measure MPG by driver.

Source: GreenRoad Fleet Leader Survey