Choose Your Own E-Venture

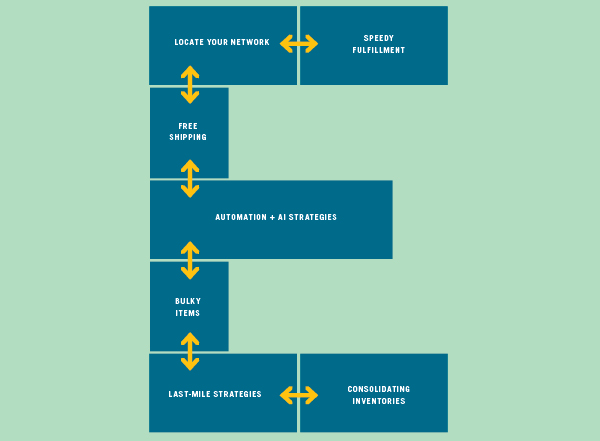

With e-commerce fulfillment as their endgame, retailers are making their move. From stepping up automation to strategically setting up DCs and integrating inventories, here’s how retailers chart a path to e-tail success.

A few years ago, Manhattan condo dwellers ordering a large dining room table from a trendy furniture store in Redondo Beach, California, would have to figure out cross-country shipping on their own.

Fortunately, that furniture retailer is now a member of Design Kollective, an online consortium of brick-and-mortar furniture stores that has cracked the code to help small retailers ship large items. Design Kollective recently engaged with uShip, a digital logistics marketplace for large item transport, to connect with regional white-glove carriers. Furniture stores can build shipping costs into their online prices and secure dedicated delivery service via uShip’s curated pool of trucking companies.

“For each store to do this individually would be almost impossible,” says Lynsey Humphrey, founder of Design Kollective. “Mom-and-pop stores are great at receiving inbound shipments and making local deliveries. Making a delivery from California to New York is where they struggle.”

Transforming the supply chain to embrace e-commerce allows small furniture stores to compete with online giants such as Wayfair and One Kings Lane.

“We’re transforming an old-school industry, the equivalent of taking the horse and buggy into the automobile age,” Humphrey says.

Small furniture stores are among the companies of all sizes revamping their supply chains in response to the e-commerce juggernaut. Overall, U.S. B2B e-commerce sales are expected to top $1 trillion in 2018 and account for 17% of total B2B sales by 2023, according to Forrester Research.

“E-commerce is increasing the speed of business in practically every subsector of the economy,” says Jeff Burkett, director of investment bank Harris Williams’ Transportation & Logistics Group. “While certainly dynamic, even fickle in the past, consumer preferences are changing more rapidly in today’s economy, creating greater competitive advantages in the marketplace for companies that can adapt with equal pace and fluidity.”

Free Shipping Frenzy

During the 2018 holiday season, 88% of shoppers valued free shipping more than fast shipping, according to a Deloitte survey

Thanks to Amazon’s Prime shipping offerings, consumers have fallen in love with free shipping despite paying a premium membership fee for the privilege. Expectations for fast and free shipping are spilling over into the B2B realm as well.

If they’re paying for fast shipping, consumers expect delivery within two days. For free shipping, a window of three to seven days is acceptable. Experts predict by 2023, one-day delivery will be the norm.

“As companies continue to build out their supply chains, delivery windows will more than likely get shorter, not longer,” explains Curt Bimschleger, managing director, Deloitte Consulting. “Successful retailers are building out their supply chains in anticipation of shorter windows. They are moving inventory closer to consumers to make sure they can compete cost-effectively.”

Reworking the Network

How are companies gearing up to meet fast shipping demands without breaking the budget? One common strategy moves inventory closer to customers. However, many companies are dealing with legacy warehouse networks built around a regional hub setup.

“While there’s still some need to have regional distribution, with freight costs going up and customer service expectations increasing, companies will locate more facilities closer to customers,” says Rich Thompson, international director and leader of JLL’s Supply Chain and Logistics Solutions practice.

Some companies are transitioning high-value inventories to smaller fulfillment centers closer to urban areas, supported by the larger hubs located in areas with less-expensive real estate.

Best Buy has focused on delivery speed and now offers same-day delivery on thousands of items in 40 metro areas and next-day delivery in 60 metro areas. The company has invested in DC capacity and moved locations closer to customers for large products such as TVs and appliances.

FINDING FULFILLMENT

Some retailers are turning empty or low-performing locations into “dark stores” which operate as fulfillment centers.

As shippers transform their operations to support e-commerce, they must be aware of the differences between running a fulfillment center versus a regional distribution center.

“A pick-and-pack operation requires about three times more space and people than a pallet-in, pallet-out warehouse,” says Rich Thompson of JLL.

To speed responsiveness, Kohl’s opened its sixth e-commerce center and fulfills 40% of e-commerce orders from stores. Kohl’s has also encouraged consumers to rely on the buy online pick up in store (BOPIS) shipping option—the least expensive form of order fulfillment.

Another option for retailers with a granular view of store inventory is to fulfill orders from the store’s back room rather than a separate shipping facility. Cosmetics retailer Ulta is converting a distribution center near Chicago into the company’s first fast fulfillment center.

Kohl’s uses its stores as part of its online fulfillment process to reduce shipping time, as about 80% of the U.S. population lives within 15 miles of a store. Kohl’s began shrinking its store footprint from 80,000 square feet to 35,000 square feet per store, reducing operating costs and inventory spend. The stores stock the most popular items locally and rely on BOPIS for less-popular products.

Inventory turns are faster since Kohl’s focused on slashing product lead times, such as cutting the time for women’s fashion from 16 weeks to eight weeks. Overall, the retailer has cut gross inventory by 2% per store and 3% in overall units by offering customers fewer, but more relevant choices.

And Last Miles To Go

Closing the last-mile gap can be a major challenge as shippers balance traditional distribution models with parcel deliveries.

“The demand is still there for the larger warehouses, but a second phase includes the smaller last-mile facilities,” says Matt Powers, executive vice president, retail/e-commerce distribution practice at JLL. “The demand isn’t limited to the major metro areas, either.”

Wayfair has decided to handle last-mile deliveries in-house, operating 27 delivery facilities in North America that cover 66% of its U.S. large parcel home deliveries. Overall, Wayfair operates 11 million square feet of logistics space.

One Inventory to Rule Them All

An omnichannel view provides a high degree of confidence in both product availability and shipping options.

When companies first responded to the e-commerce onslaught, they bolted on new channels to existing operations, leading to duplicate inventory and data management efforts. Now, the goal is to connect the silos for an omnichannel view of inventory and fulfillment. If the product is out of stock at the nearest store, an omnichannel view can tell the customer where the closest store is or if the product can be shipped for in-store pickup.

The retailer’s supply chain can incorporate business rules based on shipping costs, so it may offer free shipping for store pickup or charge for fast fulfillment from the warehouse.

“The key is having the technology that provides the decision points to service the customer within the time frame they want,” says Deloitte’s Bimschleger. “Most of the time, it’s cheaper to fulfill from the warehouse. DC labor is less expensive than store labor and inventory accuracy levels are much greater.”

The difficulty increases when an online customer buys multiple items. If a customer orders three items, and all three are available at the nearest store, the retailer can offer free in-store pickup. But if not all the items are in the store, then a distributed order management system can make the best decision for fulfillment cost and the customer’s desire for fast shipping. If some products are available from a DC or a distant store, the system can choose the optimal scenario.

“It’s about having the decision-making capability in place to make the right calls that address inventory, costs, and time,” Bimschleger says.

Large Items, Small Problems

The growth of e-commerce services offered by Design Kollective and other home goods retailers reflects increasing consumer interest in ordering large and bulky items online with timely, damage-free delivery.

“At this point, we’re all comfortable buying shoes, toothpaste, and other items that show up on our doorstep in a box,” says Mike Williams, CEO of uShip. “But we also know that 37% of consumers will buy large and bulky items online in 2019.” Using an API, uShip offers real-time price quotes on a retailer’s site, similar to how Amazon displays shipping rates. Having shipping information included at checkout simplifies the process and helps convert online shoppers into buyers.

Design Kollective is trying to create another paradigm shift by breaking consumers of the return habit. Reverse logistics are costly, especially for large, bulky items such as furniture. White-glove service that prevents damage is one factor in reducing returns, along with retailers highlighting the connection to the mom-and-pop furniture store owner who is heavily invested in inventory.

“We try to get our consumers to wrap their mind around the fact they’re purchasing from a real person who has poured their blood, sweat, tears, and heart into a furniture store,” says Design Kollective’s Humphrey. “Our customers aren’t as return-oriented because they understand the story.”

For Wayfair, returns run about 5% of sales, and the company opened a liquidation store in Kentucky to sell returns rather than turn them over to a liquidator.

Automation Steps In

An Ocado warehouse uses robots to pick and pack groceries and can pull together a 50-item order in less than 5 minutes

Automation and artificial intelligence can help drive efficiencies to offset the rising cost of free shipping.

Supermarket chain Kroger has invested in robotics grocer Ocado Group to grow its online fulfillment operations. Ocado is building a network of automated warehouses for Kroger as it gears up to face the threat of Amazon opening urban grocery stores in addition to its Whole Foods stores.

At Walmart’s new 1.25-million-square-foot fashion distribution center in Bentonville, Arkansas, automation will help speed product to 1,000 stores in 15 states. High-tech helpers include a high-velocity apparel sorter that boosts order filling speed and accuracy, and a next-generation shoe sorter that takes up 15% less space than a previous version. In the past three years, Walmart has grown apparel sales by more than 7.5% while reducing inventory by 21%, says Steve Bratspies, executive vice president and chief merchant.

Even as the use of robotics grows, there will still be a need for human handling.

“A goods-to-person system where the robot brings the bin to the worker who then picks what they need is efficient,” says Deloitte’s Curt Bimschleger.