E-Fulfillment Strategies That Deliver the Goods

By adding speed and visibility to their logistics operations, retailers delight online customers, and keep them coming back for more.

If you have any doubts about the strength of e-commerce, a look at some figures will set you straight. Worldwide business-to-consumer (B2C) e-commerce sales passed $1 trillion in 2012, and they’re set to grow by another 18.3 percent in 2013, according to research firm eMarketer. If you leave out food, gas, and auto sales, e-commerce retail spending in the United States accounted for 10 percent of all retail in this country in 2012, say researchers at comScore Inc.

Many retailers are still figuring out how to fit online sales into their business models. “One out of 10 retailers are confidently implementing an e-commerce or omni-channel strategy; six out of 10 are still studying it,” says Kristian Bjorson, international director at Jones Lang LaSalle, a Chicago-based commercial real estate services firm.

The other three have outsourced their e-commerce to an industry giant such as GSI Commerce or Amazon, or haven’t yet tackled the issue at all, he says.

As e-commerce explodes, the pressure is on for companies to delight online customers, and tempt new ones to fill electronic shopping carts. Much of a merchant’s success will depend on whether it develops a fulfillment operation that delivers exactly what customers want.

Make it Flawless

And what do customers want? “Flawless execution,” says Robert Toner, senior vice president and chief operating officer at Innotrac, an Atlanta-based third-party fulfillment services provider.

“It’s important to customers that they get what they ordered, when they ordered it, and how they ordered it,” he notes.

“How they ordered it” often means “fast.” Amazon has been raising the bar on speed with recent talk about offering same-day delivery. Shoppers are programmed for that sort of instant gratification.

“I’m used to walking into a store and walking out with a product, so why can’t I order it on the Internet and immediately have it?” asks Chris Arnold, vice president of operations at Intelligrated, a vendor of automated materials handling solutions based in Mason, Ohio.

Not every customer insists on same-day, or even next-day, delivery. Some simply want to receive an order when the merchant promises it, even if that’s two or three days away, Toner says.

Delivery commitments grow especially crucial when consumers place orders for the year-end holidays. “Now that next-day and second-day air services are less expensive than they used to be, people are waiting longer to shop,” says David Hauptman, vice president of marketing and product management at third-party logistics services provider OHL, Brentwood, Tenn.

As the holiday shopping peak moves closer to Christmas, merchants face greater pressure to deliver as promised.

However long the shipment takes, customers should find its arrival enjoyable and convenient. “It’s important that customers be able to open the package easily,” says Larry Kuhn, co-president of Invata Intralogistics, Conshohocken, Pa., which provides consulting, design, and integration services—plus software—for distribution and fulfillment centers.

The package shouldn’t be stuffed with environmentally harmful materials. “It’s also important that the container be easily reusable, and that the return process flows seamlessly,” Kuhn adds.

To some extent, online shoppers want to replicate the in-store experience. “When online customers open a package, they get the wrapping, the colors, and the feel as if the merchant had boxed it up in the store,” says Phillip Corwin, vice president of retail, apparel, and e-commerce logistics at OHL.

To reproduce the sense that an obliging cashier is handing you a package, many online merchants offer value-added services. Gift wrapping, for example, is one of the more popular services that customers demand.

Some retailers ask OHL to handwrite personal messages on greeting cards that customers send with gifts. One candle manufacturer asked the fulfillment center to apply sealing wax to its packages. “I’ve even seen a requirement to tune a guitar before it ships out,” says Corwin.

Customers like to earn rewards, and just as stores offer discounts and freebies to shoppers who join loyalty programs or use private-label credit cards, some merchants offer VIP treatment to top online shoppers.

“Maybe they tuck a little gift in for these highly frequent, very valuable customers, and the wrapping paper is just a little nicer,” says Corwin. A top customer might also get free-shipping upgrades, or find a special catalog in the shipping carton.

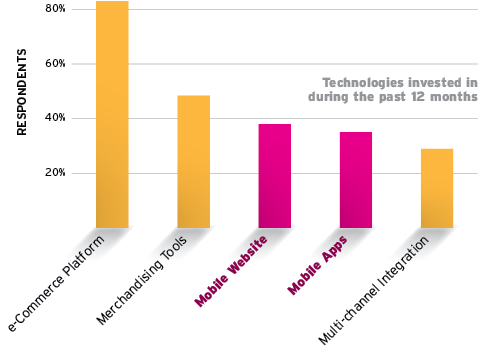

Mobile Investment on the Move

B2B e-commerce organizations don’t seem to have thrown significant budget at technology to support mobile yet, according to an Oracle survey of IT professionals. The survey predicts heavier investment in mobile technologies in the coming months.

Returning the Favor

Despite all these touches, a sale sometimes doesn’t work out. To make returns agreeable, merchants must offer convenience, visibility, and speed.

Providing correct instructions and a return label, and letting online shoppers return products to brick-and-mortar stores if they choose, help with convenience.Visibility means letting customers know that the returned product has arrived at the fulfillment center and the merchant is processing the credit transaction.

Speed also means issuing that credit as soon as possible. “Customers don’t want a credit to take two or three weeks,” Hauptman says.

Finally, customers today demand flexibility. As retailers blur the lines between sales channels, customers are coming to regard multiple options as the norm.

“We’re seeing a truly magnificent change in the retail industry, led by the consumer’s expectation that you can buy an item online or in a store, you can return it anywhere, and you can pay for it either with a credit card in the store, though a mobile app, or online,” says Corwin.

All the large retailers that use Innotrac’s fulfillment centers want to offer omni-channel services. “Whether we are the primary location they choose from, whether their retail stores are a location they fulfill from, whether customers return products to the retail stores or return them to us—retailers want the best service they can provide to the customer,” says Toner.

Some of the simplest e-commerce strategies for delivering superior service involve staffing.

A typical e-commerce facility needs three times as many employees as a traditional regional distribution center. “You can only automate so much,” says Bjorson. “Then you need the density of people to package individual orders versus shipping cases or pallets to a store.”

To accommodate more employees, companies establishing dedicated e-commerce centers look for properties with plenty of parking. E-commerce facilities also need more electrical, heating, and cooling infrastructure than traditional DCs to power automated systems and keep large workforces comfortable and safe.

Because it’s so important to ship orders correctly, e-commerce center employees must be especially careful in their work. “No matter how robust the system you build, and no matter how generic and easy to follow the system is, you still need people to pay attention to the details,” says Toner.

Innotrac also seeks employees who tend to stick with a job for a long time. “Turnover is one of the most expensive elements of fulfillment,” Toner notes.

A company opening an e-commerce fulfillment center must also choose the right location. Like a regular DC, a fulfillment center needs to be close to as many customers as possible. Because direct-to-customer fulfillment generally relies on package carriers, it’s best to locate in an area that offers good service from UPS, FedEx, and the U.S. Postal Service—or all three.

And if retailers want to offer extra-fast and flexible delivery, they might locate that fulfillment center near a carrier’s primary hub.

“We have a location in Memphis, home of the FedEx ‘SuperHub,’ so we’re able to offer late cutoff times for particular customers,” says Hauptman. Shoppers can place orders later in the evening, and still expect their packages to get moving the same day.

Height of Fashion

Along with location, warehouse design can make a crucial difference for an e-commerce fulfillment center. “Companies continue to push for a higher than traditional clear height,” says Bjorson. “Today it’s 32-foot clear, but there’s a push across the country for a 36-foot clear.”

Extra height lets a company implement a three-level mezzanine picking system, getting three times as much storage and activity into its footprint as it could on one level. “Extra height utilizes the cubic space in much different ways in markets such as New Jersey or Los Angeles, where real estate is more expensive,” Bjorson says.

By keeping square footage to a minimum, the vertical strategy lets a company save on real estate costs while locating in a region with access to a large population.

E-commerce merchants can also use active pick locations to speed the flow of orders to customers. Rather than sending workers all over the warehouse to retrieve orders, a company can store a few units of each product in one spot, replenishing as needed. Order pickers take items from this active location, increasing the number of orders they can fill while keeping travel time to a minimum.

Workers might pick complete orders, or different individuals might pick different portions of the same order and put them on a sorter for consolidation. Which process a company chooses depends, in part, on the number of stockkeeping units (SKUs) in the facility.

“A company picking from 60,000 different SKUs probably wants a consolidation process,” Toner says. That allows individuals to specialize in picking specific products from specific parts of the pick module.

“Workers get familiar with the SKUs and the area they work in, and they become more efficient in the process,” he adds.

A sorter is just one of many automated systems a company might install in a fulfillment center. The approach a company takes—whether low-tech and labor intensive, highly automated, or somewhere in between—depends in part on how much product flows through the facility.

A company that ships 1,000 orders a day probably can’t justify a heavy investment in machinery. “But a company shipping 100,000 orders per day needs a very high level of automation,” says Kuhn.

A system that integrates the functions of a warehouse management system (WMS) with a warehouse control system (WCS) can also add efficiencies that improve customer service. For one thing, an integrated WMS/WCS helps a company optimize labor assignments as needed, keeping orders flowing as smoothly as possible. The system can also forecast the need for labor and materials as order patterns change.

“If a specific item is becoming a bestseller, the retailer can move that item to an area where it can optimize labor, perhaps eliminating many touches in the process to enhance the shipping experience,” says Arnold.

Other tips for giving online customers a terrific experience include:

Segregate single-piece orders. Picking several items to send to one customer requires more labor or automation than filling an order for a single product. “As orders come in, they have to be organized so they will be in optimal groupings for fulfillment,” says Kuhn.

An order management system might direct all one-piece orders to one group of employees, allowing another group to specialize in multi-piece orders, and a third in orders that require special handling—maybe because they’re fragile or temperature-sensitive. This keeps orders flowing efficiently.

Segregate the bulkiest items. One merchant’s offerings might encompass everything from fishing lures to kayaks, or napkin rings to bedroom suites. During the peak shopping season, some companies that run their own fulfillment centers move the largest, hardest-to-ship products elsewhere.

“Core operations for peak season can scale phenomenally higher with smaller items, and maintain service levels,” says Corwin. “Retailers leverage partners such as third-party logistics companies to concentrate those non-conveyables into one or two facilities, as opposed to all their regional distribution centers.”

Use pop-up space. Many e-commerce fulfillment centers have plenty of capacity for most of the year. Then holiday season rolls around, and order volume explodes.

To relieve that pressure, a merchant might move some of its inventory into a 3PL’s warehouse for just a few months, then pull it back after the holidays.

Pay attention to cartons. Because carriers charge by volume as well as weight, it’s smart to ship an order in the smallest carton possible. Cartonization software analyzes each order as it’s received to assign it to a particular size and type of carton.

“At the end of the picking process, the software directs the material—either in an automated way, or in an instruction to the picker—to particular pack stations set up to handle that shipment size,” says Kuhn. If one item in the order could damage another, the software might also determine that the shipment needs two cartons.

“Cartonization impacts the end user’s experience, and can have a significant effect on shipping costs,” Kuhn says.

Make cartons to order. Instead of stocking a large range of cartons to accommodate shipments in every conceivable size and shape, some e-commerce merchants implement automated systems that make custom cartons on the fly from rolled corrugate. “Making cartons to order helps minimize the wasted cube and amount of dunnage in the carton,” says Arnold.

When employed in the right way, labor, facility and network design, automation, software, and other aspects of supply chain strategy combine to make e-commerce fulfillment efficient, correct, and fast. That’s delightful for the customer, and for the online retailer as well.