Omni-Channel Retail: Roadmap To Profit

Omni-channel retail supply chains are forging new paths to profitability. Here’s what they look like.

Global e-commerce sales will reach $3.5 trillion within the next five years. That sounds like great news for retailers. But there’s a catch.

The fact is, more than one decade into the omni-channel phenomenon, many retailers still lose money on e-commerce—or, at best, break even.

A traditional brick-and-mortar retailer typically operates at a profit margin of five percent or below. However, the cost of fulfillment and logistics for online orders can be up to four times higher per unit than conventional brick-and-mortar models. Final-mile delivery is expensive; fulfillment costs for picking order quantities of one ("eaches") are higher than case picks; and high return volumes further erode margins.

This is not news to the retail sector. According to an Ernst & Young survey of global retailers, 86 percent of respondents think "current supply chains are not fit for purpose to deliver a successful omni-channel offering." Eighty-one percent believe that "supply chain transformation—not incremental improvements—is required to succeed in an omni-channel world."

"On a scale of one to five, with five being a perfectly operated, profitable omni-channel solution, where is the industry? I’d say we’re at 2.5," says Perry Belcastro, vice president fulfillment services at third-party logistics provider Saddle Creek Logistics Services.

The trillion-dollar question, therefore, is how do you manage omni-channel retail and make a profit? What does the "right" omni-channel supply chain look like and how do you implement it?

To answer this question, let’s start with some background on the industry, and what is now known as "the Amazon effect."

Amazon sets the competitive bar for omni-channel retail. Only a handful of the largest retail chains in the United States have the customer base and supply chain infrastructure in place to mimic Amazon’s fulfillment capabilities.

To provide Amazon-like service, therefore, many retailers have turned to their store network to fill the gap. "Stores are no longer just the end of the supply chain," notes Mike Passales, chief supply chain officer at Chewy and former vice president, fulfillment and transportation at Target in a recent report. They are now an integral part of the omni-channel offering.

Let’s Get Physical

Having physical inventory close to the customer—in the store—enables retailers to offer flexible fulfillment and return options, as well as shorter delivery times that can match those of the leading online pure plays. Store fulfillment also allows for inventory synergies across channels and the opportunity for in-person upselling.

Store-based fulfillment will continue to grow. Ninety percent of the retailers responding to an Accenture survey expect store-based fulfillment to account for up to 35 percent of their total online order volume. Eighty percent of these retailers also plan to enable up to 80 percent of their stores for store-based fulfillment. Ninety-three percent of respondents cite that enabling ship-from-store had resulted in a positive uplift in online revenue, 77 percent indicated it had reduced their fulfillment costs, and 88 percent said it had improved their customer satisfaction metrics.

However, store fulfillment poses a number of challenges, including:

- High picking costs of using store personnel, and complexities of managing store personnel roles.

- Highly sophisticated inventory management systems required to maintain true inventory accuracy.

The second point, maintaining in-store inventory accuracy, continues to stymie most retailers. "There is an ongoing conflict with the in-store inventory," the head of operations for an upscale UK-based retailer notes. "A customer takes the time to check online for a product, see it is in the store, jump into her car, arrive at the department store, browse and shop at her leisure only to find out that the product she was just about to put her hands on has been taken by somebody else picking it up for a home-delivery order." The result: a dissatisfied customer who is likely to share her experience on social media.

The store fulfillment model is evolving, however, as retailers get smarter about managing this offering. According to the latest research from the Retail Industry Leaders Association and Auburn University, rather than use all stores as fulfillment nodes, leaders are adopting a hub-store strategy. This approach consolidates store fulfillment inside larger and/or centrally located stores rather than establishing fulfillment capability across the entire retail network. The hub store may keep larger inventories or have extra backroom space to support picking of high-volume items.

Whatever model retailers pursue, one fact is clear. "The desire on the part of companies to try and compete with Amazon has significantly raised supply chain costs and complexity," observed Brittain Ladd, former Deloitte consultant, in a 2015 industry roundtable discussion on omni-channel retailing.

A Total Cost Approach

In the face of this complexity, retailers need a supply chain that can handle forward and reverse product flows effectively, efficiently, and profitably. More specifically, explains Fred Takavitz, senior vice president, DHL Supply Chain, building a profitable omni-channel supply chain rests on eight key capabilities:

- A flexible physical fulfillment network designed to support the various fulfillment requirements.

- Real-time visibility into the entire pool of inventory, to reduce safety stock and inventory carrying costs.

- Dynamic, real-time control over access and allocation of inventory.

- Processing and shipping of individual orders at the lowest cost, regardless of the source.

- Flexible fulfillment paths to meet demand, regardless of source channel.

- Maximized efficiency in every part of the supply chain to meet customer expectations.

- An effective, cost-controlled returns process.

- Minimum cost to serve.

These capabilities are built on a foundation of accurate and complete cost information—answering the question, ‘exactly what does it cost to satisfy each and every customer order, regardless of channel?’ Surprisingly, says Richard Sharpe, CEO of Competitive Insights, few retailers can fully answer this question.

"Retailers know their costs at a high P&L level," Sharpe says, "but close the door and go off the record, and they admit they don’t have the visibility into profitability by item or customer. They need this information to operate profitably. They can’t afford to treat every customer and channel the same."

Granular cost information is hard to get a handle on, in large part because omni-channel commerce introduces a multitude of different cost dynamics that add significant complexity to the supply chain. This complexity stems from the fact that consumers have adopted a mindset that they will return many of the products they order.

"This returns paradigm creates a double hit to the P&L," Sharpe notes. "Returned products not only incur the sunk costs associated with fulfilling the order, but the revenue associated with the sale is actually returned to the consumer."

A total cost approach, then, starts with having cost and profit visibility at the product and customer level. With this information, a retailer can begin to segment customers by the net revenue, cost, and profitability associated with fulfilling their needs. "But the information has to be accurate and comprehensive," Sharpe insists, "otherwise you’re wasting your time."

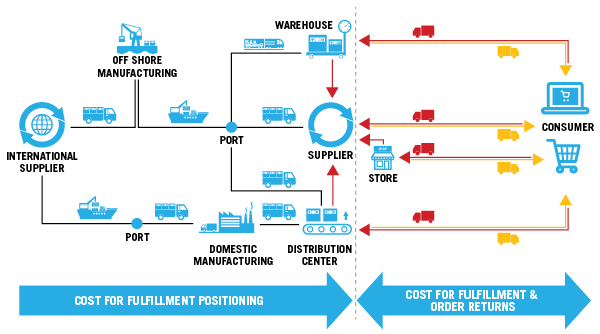

More specifically, the total cost to serve an omni-channel consumer can be broken down into three parts: the costs to position products to be ready for order fulfillment activities—including inventory carrying costs, the costs associated with fulfilling the order to the consumer and, when applicable, the costs associated with a product(s) being returned (see Figure 1).

Figure 1: Omni-Channel Total Cost to Serve

Source: DHL Supply Chain, 2016

Understanding the true costs of storage and handling, inventory carrying, and outbound delivery costs, allows the retailer to develop appropriate strategies for delivery options and speed, inventory and fulfillment and network design.

Delivery is a critical driver of customer satisfaction. Retailers must find the right mix and balance of delivery options, whether for home delivery, store collection and fulfillment, or delivery to a pick-up point.

"Speed and cost are inextricably linked," with cost rising as speed increases," notes Marcel Beelan, vice president, global business development fashion and lifestyle, DHL Supply Chain. "An effective delivery strategy optimizes for both service and cost—and again, is based on accurate total cost data."

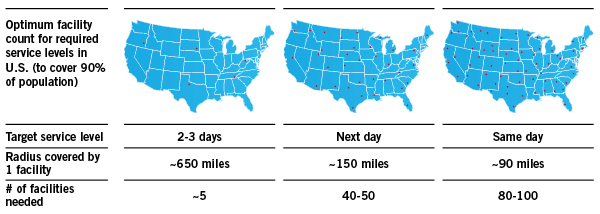

Delivery parameters directly affect network design and costs. In the United States, a two- to three-day day delivery lead time requires approximately five facilities across the country, explains a recent DHL report. A next-day service level requires an additional 40 to 50 facilities and, for same-day service, the number is closer to 100 (see Figure 2).

Figure 2: Supply Chain Responsiveness

Source: DHL Supply Chain, 2016

One has only to look at Amazon’s rapid expansion of its fulfillment center footprint to see this strategy playing out. The e-commerce giant operates 200-plus fulfillment centers in the United States alone, with more on the way. Here again, Amazon’s network expansion raises the omni-channel service bar, escalating the pressure on all retailers.

An expanded physical network has a downside, however. "A lot of retailers are betting on the fact that having product closer to the consumer is essential," says Sharpe. "But when you do that, your inventory carrying costs go through the roof. So this may be an OK strategy for gaining market share today, but it probably isn’t sustainable over time."

Inventory and Fulfillment Approaches

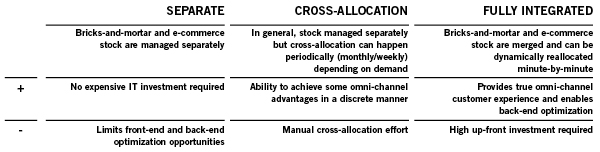

For a retailer managing brick-and-mortar and e-commerce channels, the most critical decision regarding inventory management is whether to separate or integrate inventories for different channels. There are three typical industry practices regarding inventory management: separate, cross allocated, and fully integrated (see Figure 3). Omni-channel leaders are moving toward the fully integrated model, otherwise known as the channel-agnostic approach.

Figure 3: Inventory Management Practices

Source: DHL Supply Chain, 2016

This ‘seamless inventory strategy’ treats demand the same regardless of channel or fulfillment location, and requires retailers to build inventory positioning flexibility across the network, the RILA-Auburn University study notes. It allows for a single integrated stock to be allocated dynamically in the most cost-efficient way across channels.

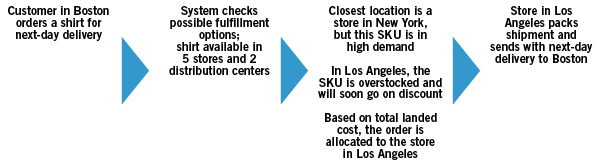

Dynamic order fulfillment capabilities leverage the entire stock throughout the supply chain. Orders are allocated in real time, based on a number of parameters including: shipping cost, picking cost, inventory levels, demand forecast and unit value. Figure 4 (below) shows how this system works, using the example of a shirt ordered in Boston for next-day delivery.

Figure 4: Flexible Fulfillment Model

Source: DHL Supply Chain, 2016

This model requires a substantial investment in highly sophisticated inventory and order management technology. "While this is certainly best practice, most companies have a long way to go in realizing this integrated model," Beelan reports.

To sum up, a best-in-class omni-channel retail supply chain model looks like this:

- Inventory. Single stock at all levels (DC and stores) with full visibility and real-time allocation.

- Fulfillment and warehousing. Flexible fulfillment with real-time order management decision-making.

- Delivery. Best-fit providers portfolio, dynamic delivery operations, IT-enabled optimization for service and cost.

- Network. Design mapped to fulfillment and returns customer service and brand strategy, aligned to cost-profit considerations.

- Returns.Optimized returns management by cost, speed, profit management.

The Importance of IT

Information technology underpins the profitable omni-channel retail operation, and required investments are substantial. "You have to invest in IT, or find a provider who has done so and partner with them," insists Takavitz. "You cannot succeed without this foundation. Period."

Next, standardize operating processes as much as possible. "It’s a balancing act," Takavitz notes, "but the more you can standardize, the better your cost and profitability profile will be."

Strengthening the Core

Consider outsourcing. "Many retailers and merchants are good at product development, marketing, and branding, but logistics is not their core strength," says Belcastro of Saddle Creek. Retailers may want to look for an Amazon alternative—a third-party logistics firm with the breadth of capabilities to provide Amazon-like solutions."

"This is a tremendous potential opportunity for logistics service providers," suggests Sharpe, "but they must move fast to capitalize on it—because Amazon is on it."

Finally, on a higher level, profitable omni-channel retailing "all starts with self reflection," Belcastro notes. "Define or redefine your mission as a retailer. How do you want to position the brand with respect to meeting your customers’ expectations? That provides the foundation for your omni-channel strategy.

"Successful omni-channel retailing is about driving more profitable sales and growth," he adds. "That should be the expectation that directs all of your activities."

Do retailers have a choice whether or not to embrace omni-channel fully? "If you don’t participate, you’ll be out of business," says the chief supply chain officer for a global fashion retailer. "The question is moot. So spend your time looking at best practices and figuring out what works and what doesn’t."

"Through it all," he concludes, "the customer has to be at the center of our strategy. Then we have to figure out how to give customers the products they want, with the quality of service they expect, and do so faster and cheaper than ever before."