Steering Clear of Supply Chain Disruptions

No one knows whether the 2014 U.S. West Coast port labor negotiations will go smoothly or result in import and export traffic disruptions. Evaluate your supply chain now and implement contingency plans to avoid trouble later.

Weigh Your Options

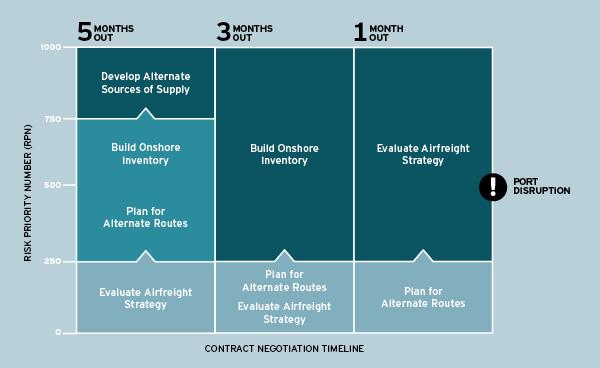

Prioritizing Risk Response

As the dock employers’ Pacific Maritime Association (PMA) and the International Longshoremen and Warehouse Union (ILWU) prepare for a complex contract negotiation in spring 2014, many companies are concerned about a potential supply chain disruption and its effect on the overall U.S. economy.

Their concern is well-founded, as past negotiations have been difficult. During the 2002 contract negotiations, the PMA introduced technology to the ports in the form of scanners, sensors, and bar-code tools to make cargo tracking and flow more efficient. These technology upgrades resulted in the elimination of 10 percent of longshore jobs. Intense talks resulted in a 10-day lockout, with normal port operations resuming only after an intervention by President George Bush.

During the 2008 negotiations, the PMA charged that the ILWU engaged in a day of disruptive activities on May 1, aimed at creating leverage at all West Coast ports. The ILWU claimed individual members used the day to protest U.S. military involvement overseas. Eventually, both sides compromised, agreeing to increase wage rates and automate cargo-handling systems to speed the flow of goods and enhance security.

In the potentially complex 2014 negotiations, ILWU and PMA primary issues include healthcare costs, pensions, and jurisdiction of related jobs some parties consider outside the current contract. These discussions may be time-consuming compared to past negotiations, when most effort focused on automation and wages.

The ILWU recognizes that productivity improvements and subsequent headcount reductions are inevitable. “We know that automation is coming,” says ILWU President Robert McEllrath. “In fact, we have a long history of accepting automation, provided that all associated work is assigned to the ILWU.”

The relatively recent Panama Canal Pilot Unions (PCPU) affiliation with the ILWU may provide a new dynamic to the talks, which affect U.S. West Coast and Panama Canal ports. Negotiations between the PMA and ILWU might result in unpredictable disruptions, which could increase costs, and lead to capacity challenges, transit time delays, and a lack of supply chain reliability.

Uncertainty Puts You at Risk

Contract negotiations in prior years entered the 11th hour with inconsistent results. In 2002, the stalled negotiations cost the U.S. economy an estimated $1 billion per day. Not only did the ports require six months to recover, but the disruption also profoundly affected retailers, importers, manufacturers, agricultural exporters, and other affiliated industries. In contrast, in 2012, Port of Portland union members secured a last-minute agreement ensuring that their jobs would not be privatized, thus preventing a disruption.

Although companies can track the evolution of negotiations over time by following the news, they can’t gain certainty about the process or results until contracts are signed.

To protect your business, assess the impact of potential disruptions on the current state of your supply chain, then create response plans that minimize its effect on landed costs and/or delivery times. Evaluating potential outcomes well before they actually occur is critical, and can make or break a response plan.

This response plan will need to evolve over time to reflect the progress of negotiations and the types of mitigation actions available at any time. Here are the steps to follow:

Phase 1: Assess the impact of disruption. Port disruptions may cause companies to deviate from their existing supply chain strategies, and optimize cost versus service within the constrained environment. For example, cost-driven companies may have to move products via alternate ocean routes with longer transit times, leading to poor product availability and lost sales.

Companies focused on responsiveness may currently be moving product via air freight, but could face sharp capacity constraints as a ripple effect if West Coast ports are affected. Thus, companies may need to work with their logistics service providers to book space in advance, secure alternate routings, or pay rapidly increasing spot prices to keep freight moving.

Knowing the financial impact of disruption enables companies to develop a pre-disruption plan that balances investment in developing and implementing a contingency plan against the cost of responding without planning.

Phase 2: Explore options. Align your planned response to your supply chain strategy. Contingency response options for affected product flows resulting from a port disruption include:

- Develop alternate sources of supply. Suppliers closer to demand points will avoid material movement via transportation points or ports deemed to have higher risk of disruption.

- Build onshore inventory. Increase safety stocks of materials that are typically routed via ports with high potential for disruption.

- Plan for alternate routes. Map out and assess alternate, contingency routings to move products.

- Evaluate airfreight strategy. Examine the impact of a mode shift from ocean to air by comparing the trade-offs of cost, transit time, and service.Consider the constraints and benefits of each option in the context of your supply chain strategy to ensure the responses align with your supply chain goals and objectives (see sidebar).

Phase 3: Prioritize the response options. Some response strategies, such as building onshore inventory and developing alternate sources of supply, require long-term planning and implementation horizons. Thus, the earlier you start planning for the potential disruption, the more response options you have, and the better prepared you will be to minimize any impact.

Use a Risk Priority Number (RPN) to quantify the risk of disruption. RPN is a combination of three factors: severity, occurrence, and detection.

- Severity of impact (S): For example, the result of a contract negotiation between the PMA and ILWU could vary between no impact, a slowdown due to reduced hours, or a complete shutdown of certain ports. The severity would also depend on the disruption’s duration. Rate the impact’s severity on a scale of one to 10, with 10 being the most severe.

- Occurrence (O): Rate the estimated probability of occurrence of impact on a scale of one to 10, with 10 representing a high probability. For instance, if an agreement seems likely, then the probability of port disruption is correspondingly low. Occurrences of a slowing process could suggest a higher rating.

- Detection (D): Rate the probability of knowing definitively the severity and occurrence at any given time on a scale of one to 10, with 10 representing the lowest probability of detection. Leverage relationships with neutral logistics service providers, and refer to industry journals and news outlets to enhance visibility to negotiation developments to improve detection.After you assign each response’s severity, occurrence, and detection rating, calculate its RPN by multiplying the three ratings using the formula RPN = (S)(O)(D).

Next, prioritize the responses by RPN versus the time to a fixed point—for example, contract expiration. Refer to the sample matrix to identify the appropriate response by looking at RPN and the time to contract expiration when you start drafting your contingency plan.

In the example, to minimize the impact of port disruptions companies should:

- Monitor developments throughout the negotiations and select the response that balances Risk Priority Number and time to a key event occurrence.

- Incorporate response planning into the sales and operations planning process to communicate and align changes throughout the extended supply chain.

- Engage with your logistics service providers to plan for transportation capacity, alternate routes, expedited modes, and warehouse space for additional inventory build.

The sooner you initiate planning for potential scenarios, the better prepared you will be to make informed decisions.

Adapted from Strategic Planning for Potential Supply Chain Disruptions, by Richard Delseni, Director, Supply Chain Design & Innovation, and Ankur Sood, Senior Consultant, Supply Chain Design & Innovation, UTi.

Weigh Your Options

Identifying the benefits and constraints of possible contingency responses to supply chain disruptions can help ensure your plan aligns with your objectives.

Develop alternate sources of supply

Benefits

- Meet service level requirements by avoiding material flow via affected ports.

- Increase sources of supply.

Constraints

- Commit well in advance to qualify new suppliers.

- Manage additional suppliers.

Build onshore inventory

Benefits

- Provide in-stock products to meet customer service level requirements.

Constraints

- Ties up capital in inventory.

- Lack of production capacity and storage space for additional stock.

Plan for alternate routes

Benefits

- Meet service level requirements by avoiding material flow via affected ports.

Constraints

- Increased transit time.

- Must commit to space early.

Evaluate airfreight strategy

Benefits

- Meet service level requirements by avoiding material flow via affected ports.

Constraints

- Must commit to space early.

- Delay due to congestion.

- Increased costs.

Prioritizing Risk Response

Evaluating specific aspects of each possible risk response allows you to assign each response a Risk Priority Number (RPN), then determine the appropriate action depending on the time remaining before contract expiration.