Global—February 2014

Serving Returning Customers

In a fickle economy, retailers want consumers to be less discreet about their discretionary spending. One way they can encourage that is to make it easier for customers to return impulse buys or unwanted holiday gifts. But returns can add significant costs, especially when it involves cross-border business.

Take, for example, online sales between U.S. retailers and Canadian consumers, which represent a $292-billion export market. Free shipping for returned items is an important consideration for cross-border shoppers, according to a recent survey conducted by Purolator, Canada’s largest integrated parcel and freight delivery services provider.

About 75 percent of Canadians responding to the survey say they will probably return one or more holiday gifts this year, while also noting they’d likely shop for gifts online knowing they could be returned with free shipping. Four out of 10 respondents say they have previously shopped with a particular online vendor because it offers free returns shipping.

Product returns account for eight to nine percent of a typical business’s total sales volume, and 80 percent of those returns are undamaged items that can be re-purposed into other channels with a well-managed returns plan, thereby minimizing loss. Total returns from Canada to the United States were valued at $8.6 billion in 2011, according to Purolator.

While free shipping provides incentive for shoppers to spend money with more abandon, it also places greater onus on retailers to streamline the cross-border returns process—from transportation to regulatory compliance—to ensure optimum efficiency and economy.

China and Taiwan: Perfect Together

China and Taiwan have always shared an intrinsic, if uneasy, relationship as co-dependent geo-political allies and trade partners.

But cross-strait dynamics are changing with the times—largely a consequence of China’s maturing manufacturing base. Rising production costs make China less attractive for Taiwan’s advanced technology industries, which means the rapport between the two countries is in a period of transition, suggests a recent editorial in the Taiwan-based China Times News Group.

Taiwanese companies have adapted to these changing market conditions in one of two ways. "First, they shifted production bases to western China or Southeast Asia where labor costs were lower, but human resources were poorer and transportation was not convenient—unfavorable for global competition,” according to the report.

"Second, Taiwanese enterprises adjusted their investment structure by shifting focus from processing and manufacturing to producing end products or catering to the services sector," China Times adds. "However, Taiwan’s advantage in these new areas remains limited because global competitors are already established in the sector."

The ideal play for Taiwanese companies is to consolidate their supply chain footprint, working through local Chinese partners. Some in the manufacturing sector are shifting their role to the upstream side, providing more profitable core technologies to China by stepping out of the manufacturing role.

Still, an inherent reciprocity exists between the two countries, each dependent on the other for continued growth. In the service industry, Taiwan needs to work with Chinese enterprises because it lacks necessary distribution channels. Chinese companies, conversely, have resources but inadequate technology.

Cooling a Red Hot Chile Port Dispute

A topsy-turvy labor clash between Chilean port workers and management has reached another settlement after an initial 21-day strike, a brief reprieve, then further stoppage. Shipments of fruit and copper have been delayed at the Port of San Antonio, located 70 miles northeast of the Santiago capitol.

Industry officials say they’ve suffered more than $100 million in losses since the labor disruption first began on Jan. 3, 2014. Workers, who were demanding retroactive reimbursement for lunch breaks, will not strike again until at least May 1 under terms of the deal, according to media reports confirmed by the Santiago-based Chilean Fresh Fruit Exporters Association.

To date, the strike has had minimal impact on fresh fruit exports to North America, while European container shipments have felt more of a pinch. Importers have been able to adapt sourcing strategies and pull product through different ports.

At a macro level, however, Chile’s reputation as a business-friendly country is losing its luster. Labor strife is becoming a common occurrence. Because Chile is largely dependent on exports, disruptions are taking a toll on industry. Recurring port strikes through 2013 created upstream problems for Chile’s copper mining industry, the largest copper exporter in the world.

U.S. Seafood Imports Make Waves

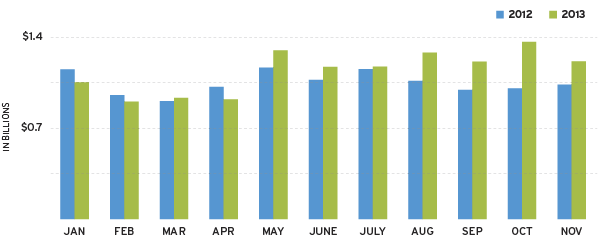

U.S. seafood imports skyrocketed from 2012 to 2013, especially since May. The increase is partly due to a rise in demand for shrimp, salmon, and tilapia.

Source: Zepol Corporation

Abu Dhabi Launches Master Plan

Transportation officials in Abu Dhabi, United Arab Emirates, unveiled a new integrated framework that will set standards and regulate the country’s growing freight logistics sector. The so-called Multimodal Freight Master Plan is being developed in close coordination with government and private sector stakeholders directly involved in planning and providing freight transportation services for the Emirates, and beyond its borders.

Fueled by oil, a construction boom, and an emerging manufacturing base, the government has made infrastructure investment a priority. The plan is geared toward supporting socio-economic growth in Abu Dhabi, integrating infrastructure such as the new Khalifa Port and Etihad Rail, and providing regulations and guidelines for future development.

"With the Emirates’ economy forecast to increase 250 percent between 2014 and 2030, freight is an integral part of the economic diversification plans for Abu Dhabi—where moving goods and commodities is poised to be the catalyst for development and prosperity," says Mohamed Nasser Al Otaiba, director of freight division, Department of Transport in Abu Dhabi.

Mondelez Debuts New Standard

The parent company of British confectioner Cadbury has become the first supplier certified in its use of GS1 supply chain standards through the new GS1 UK Certificate of Excellence program.

The certification, which launched in 2013, comprises more than 100 checks for best-practice compliance with GS1 standards across suppliers’ processes and product information. The aim is to drive data quality, delivery accuracy, and trust in the trading relationship.

"We joined the Certificate of Excellence Program believing our processes and procedures were robust," explains Rob Bullen, director customer supply and center of excellence, Mondelez UK. "But there were insights that retailers and suppliers have become adept at working around data issues, rather than tackling them.

"While we may have experienced few issues as a result of data errors, this was still causing avoidable downstream activity," he adds. "As a result of the certification process, we are now easier for our retail partners to do business with."

Retailers increasingly want greater assurances that vendors they work with are trusted partners who will work collaboratively to reduce costs, and meet end customer expectations.

For suppliers, the new distinction comes with some perks: lower incidence of product rejection; quicker delivery times; fewer manual procedures and less human error; fewer fines; and faster payment.

UK grocer Tesco, a Mondelez customer, has already seen benefits, especially with regard to inbound processes.

"It allows us to reduce dwell time from vehicle arrival to the product being available to assemble," says Jim Dickson, Tesco E2E supply chain development manager. "It also helps us to support other product availability initiatives. We look forward to working with GS1 UK to roll out the program to all our leading suppliers."

European Re-shoring Renaissance?

Europe is looking to the United States for inspiration as it shores up an eroding economy. Amid speculation that the European Commission will ease national mandates for future renewable energy targets, countries are taking that directive as impetus to rebuild their manufacturing bases.

Energy independence as a matter of national sovereignty—in other words, a decentralized approach to reducing CO2 rather than top-down enforcement—empowers countries to be more proactive about growing sustainable business in a more organic way.

At the January 2014 World Economic Forum in Davos, Switzerland, UK Prime Minister David Cameron presaged a plan that would mold Britain into a "re-shore nation."

"If we make the right decisions, we may see more jobs that were once offshored coming back from East to West," he explained. "At the same time, a number of factors are pulling companies back home. Some companies are choosing to locate production nearer to consumer markets in the West. By shortening their supply chains, they can develop new products and react more quickly to changing consumer demand."

Allowing countries the latitude to address sustainability measures at their own pace, and in accordance with their own economic development growth, opens the door for England and other countries to explore natural gas, among other energy sources. At the very least, it offers a concession that balances out other manufacturing obstacles—namely, labor costs.