Supply Chain Reset: 7 Trends Remaking Manufacturing

Through reshoring, retooling, and redefining resilience, manufacturers are embracing a new normal shaped by volatility, vision, and the drive to stay ahead.

For decades, manufacturing supply chains were optimized to find the lowest cost ways to store and move items. Given a relatively stable, predictable business environment, it was reasonable to focus on a few variables, and cost and service typically rose to the top of the list.

More recently, however, continued disruptions, geopolitical tensions, and a lack of clarity around tariffs are decimating predictability and stability, while continued labor shortages are hampering production schedules and, in some cases, quality. At the same time, an increased emphasis on sustainability by many consumers and governments is prompting initiatives in more environmentally friendly supply chains.

These changes mean the old ways of managing manufacturing supply chains often are no longer optimal. “Unpredictability is more likely to be the new normal,” says Cam Javor, a member of the consumer products and performance improvement practices with Bain.

Rather than wait for a return to predictability, supply chain organizations need to manage and even leverage their exposure to uncertainty and risk. “That will be the biggest differentiator in today’s world,” Javor says.

As manufacturing supply chain leaders navigate today’s environment, several trends are shaping their efforts. Many are implementing new technology and automation solutions to drive resilience and visibility, and to navigate labor shortages. Some are considering more regional supply chains, including nearshoring or reshoring. Some supply chain organizations are finding that operating sustainably provides not only environmental benefits, but also can help them rein in costs and boost resilience. Here’s a closer look.

1. AI, Automation and Digital Solutions

Automation and technology solutions such as artificial intelligence (AI) are starting to help manufacturing supply chain organizations compete in today’s environment, and more manufacturers are taking note.

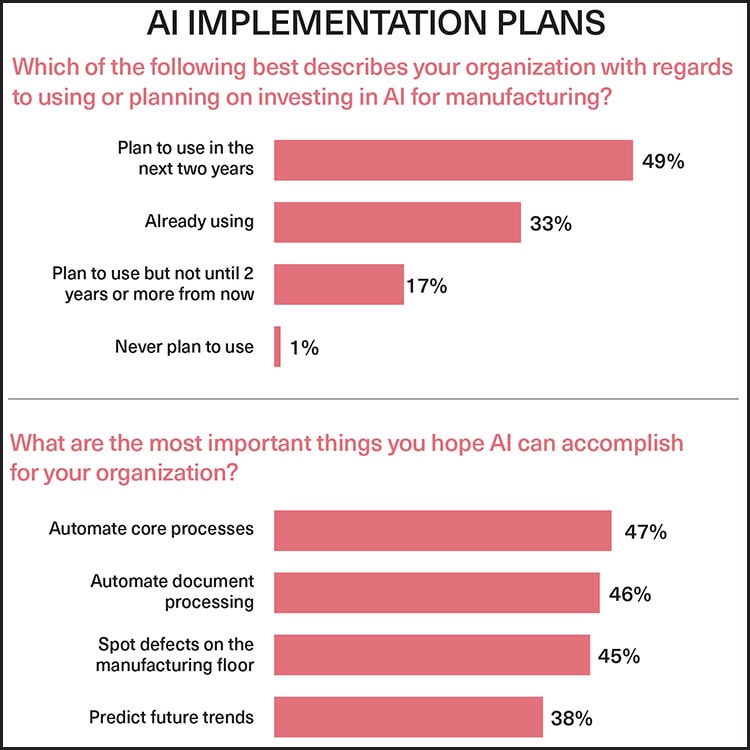

Nearly half of respondents to the ETQ Pulse of Quality in Manufacturing 2025 Survey say they plan to implement AI in the next two years, while about one-third already use it. Top functions for applications include automating document processing and core processes, and spotting defects on the factory floor, ETQ says (see charts below).

Source: ETQ Pulse of Quality in Manufacturing

Over the next few years, AI solutions will continue to take over not just physical manufacturing but also support functions. Demand planning and purchasing will become more automated through AI, since the rapidly shifting market makes historical demand models less reliable. In contrast, AI solutions can help companies more quickly adapt and update demand models, leading to more efficient production planning and better control of inventory levels.

Better planning also will facilitate a return to just-in-time supply chains. “Disruptions will be more predictable, and building an excess of inventory ‘just in case’ will be costly and less widely practiced,” says Jeremy Tancredi, a partner in West Monroe’s supply chain practice.

At the same time, before supply chain leaders invest in technology, including AI solutions, they need to clearly understand the return they can expect. For at least the past few years, many manufacturers have boosted efficiency and throughput, but because of pricing pressures and higher supply costs, as well as their investments in technology, their own costs have continued to rise.

“Despite increasing operational efficiency, many manufacturers are not necessarily making more money,” says Cara Walton, director and lead of Wipfli’s manufacturing benchmarking tool.

So manufacturers need to know—and many do—how they’ll earn a return on their investments or how a solution will benefit the organization’s broader strategic plan.

Global technology company Lenovo offers an AI device that can work within harsh factory environments and connect to sensors or cameras to capture data from manufacturing lines. The devices look for quality or other issues and then alert operators in near real time, says Scott Tease, vice president and general manager of the infrastructure group products.

Lenovo itself uses AI computer vision to ensure the assembly of servers and other devices is properly completed, Tease says. For example, the solution checks the installation of memory DIMMs within servers. “It delivers higher quality without slowing down the manufacturing process,” he says.

2. Nearshoring and Reshoring

The historical preference for “long and inflexible supply chains” is shifting rapidly, Javor says. These supply chains are efficient but they’re also fragile, while shorter supply chains tend to be more resilient. This recognition is prompting interest in more regional supply chains, including nearshoring, reshoring and other variations of shoring.

Aided by reshoring, construction in U.S. manufacturing plants grew by 45% in 2023 and 21% in 2024, to $234 billion, according to a recent Bank of America Global Research survey.

At the same time, several factors could limit companies’ interest in returning to the United States. One is the uncertainty around tariffs.

“There’s a paralysis everywhere because nobody knows what the tariff rates will be,” says Edward G. Anderson, Ph.D., professor for business at the University of Texas. Before companies make significant investments in new capacity, most will want some assurance that they won’t be blindsided by a drastic shift in tariff policies. Once businesses gain some certainty, reshoring and multishoring could accelerate, Anderson says.

Many manufacturers have made significant investments in their current infrastructure.

“It’s not easy to unwind an existing supply chain and find new suppliers, especially if you’ve built a relationship with your suppliers,” says David Isaacson, vice president, product marketing, with ETQ. Over time, manufacturers will adjust their operations, but for the next few years, it will be about making existing facilities and employees more efficient and effective.

The preference of many customers to purchase locally made products may also prompt companies to maintain operations in multiple countries. It’s one reason Lenovo has 30-plus factories globally. Locating plants near customers also cuts transportation and lead times. The goal is to be “globally powerful but locally ingrained,” Tease says.

Reshored supply chains also need to make financial sense. “If you make the shift and it’s not cost efficient, you’re at a disadvantage,” Javor says. The goal is a “right shore approach,” typically with a mix of strategies, he says. Supply chain organizations need to identify the setup that will provide the most agility and resiliency regardless of where the next shock originates from.

3. Resilience, Visibility, and Scenario Planning

The importance of resilience has become a significant trend, given the external shocks hitting supply chains. Companies looking to boost resilience can start by understanding and mitigating their exposure to risk.

Scenario planning can help them identify single points of failure in their supply chains and assess exposure to them. Then they can determine, for instance, the havoc that would result if X, Y, or Z went wrong.

Along with defensive moves such as risk mitigation, supply chain organizations can play offense by identifying ways to take advantage of competitors that are exposed to the same risks. Say a company has a strategic partnership with the lowest-cost provider of a specific raw material. It can identify ways to use its position to improve its performance, Javor says.

Scenario planning, a building block for resilience, should include projecting not only changes in sales, but the organization’s plan of action, Walton says. If sales jump or drop by 25%, how should the organization adjust? Will it need to institute layoffs or boost hiring? Should it increase automation?

Prompt cash collections are another critical element of resilience. The reason? They allow an organization greater flexibility, Walton says.

A diverse base of suppliers is also a resilience building block. “This allows companies to shift to alternate suppliers quickly if disruptions occur,” Tancredi says.

Organizations that have visibility several tiers into their supply chains can often see when operations are about to go awry and then can proactively adjust, Anderson says.

Often, the actions they need to take early on are relatively less expensive than the steps required if the organization has to wait to act until an issue becomes more visible and urgent.

4. Circular Supply Chains

Global technology company Lenovo designs its products with circularity in mind from the start, ensuring they can be recycled and reused at the end of their life cycle. This approach strengthens supply chain resilience and attracts sustainability-focused customers.

Somewhat surprisingly, operating with the environment in mind can, in some cases, actually boost resilience. Approximately 60% of respondents to a recent survey by Kestria, a global alliance of executive search firms, say sustainable production practices make either a moderate or significant contribution to their organizations’ competitive advantage.

Lenovo is designing products so they can be recycled at the end of their lives, Tease says. “We make sure we’ve got a circular supply chain in mind from the very start when we begin designing the product,” he says.

This boosts resilience in several ways. In many parts of the world, companies are looking to work with organizations that have a strong mandate for sustainability, he adds. A circular supply chain can attract customers. Plus, using recycled materials helps to diversify a company’s supplier base.

The cost to recycle steel or aluminum is often a fraction of the cost to access new materials, Tease says, adding that many of Lenovo’s servers incorporate more than 10% recycled content. Nearly 300 products included recycled plastic content from end-of-life IT and electronics, Lenovo says.

Circularity and landfill harvesting are core to Eco Material Technologies’ business model. The company harvests and processes legacy fly ash, a byproduct of coal burned to generate power. Eco Material removes it from utility landfills and repurposes it into high-performance, low-carbon cement alternatives. “It’s not just sustainable; it’s regenerative,” says Marci Jenks, director of rail logistics.

The company has sourced more than 3 billion tons of reclaimed supplementary cementitious materials (SCMs) in the United States. (SCMs are recovered from landfills or disposal sites, and often are fly ash that was stored decades ago.) “We’ve built a supply chain that’s not only resilient but fully aligned with the push for greener, American-made manufacturing inputs,” Jenks says.

5. Supply Chain Network Redesign

Eco Material Technologies powers a circular supply chain by harvesting legacy fly ash from utility landfills and transforming it into low-carbon cement alternatives. By reclaiming 3 billion+ tons of supplementary cementitious materials, the company turns waste into a regenerative resource for sustainable infrastructure.

Earlier in 2025, Eco Material opened its Blissville Rail Terminal in Queens, New York. The terminal is the company’s first major presence in the city and will allow it to annually distribute about 50,000 tons of harvested fly ash from its national network to support local infrastructure projects, the company says.

By connecting East Coast demand to a national fly ash network, the terminal helps Eco Material reduce both costs and its carbon footprint while increasing supply chain flexibility, Jenks says.

The Blissville Terminal represents one of many strategic projects intended to redesign the company’s logistics network to reduce reliance on truck transport and bring low-carbon materials directly into dense urban markets by rail. “It’s about both carbon efficiency and resilience—strengthening last-mile access while reducing emissions in one of the most demanding logistics environments in the country,” Jenks adds.

Eco Material isn’t alone. Nearly three-quarters of companies responding to a 2024 Gartner survey said they had added or removed production locations from their supply chain networks, driven by a desire to increase resilience or redundancy as a way to manage risks, as well as the need to improve agility or flexibility.

6. Labor Shortages

An ongoing shortage of labor continues to shape manufacturing supply chains. To address the issue, some organizations have begun re-evaluating their automation strategies, especially in skilled manufacturing positions, Tancredi says. They’re exploring modular automation solutions and focusing on specific processes within their operations that could benefit from lower-cost automation options.

For example, they might automate material handling tasks that don’t require advanced skills. Skilled employees can then spend less time on these activities and concentrate on higher-value tasks, reducing a company’s overall labor needs.

Technologies such as mobile devices, wearable tech, and quality and warehouse management systems can connect workers and offer them real-time data and decision support, Isaacson says. By boosting efficiency, reducing errors, and accelerating training, these tools can also help to close the skills gap.

7. Taking Action Now

Even as uncertainty pervades the business environment, some argue that taking action is the best move. “The ones who take action, even if it’s just starting to think about where they need to go, will be in a much better position,” Javor says. Rather than reactive participants, they’ll be proactive trailblazers within their industries.

Mineral Dependence: Cracks in the Chain

As companies work to bolster the resilience of their supply chains, one emerging concern is the availability of critical minerals, such as barite, lithium, and titanium.

These non-fuel minerals or mineral materials are essential to the economic or national security of the United States, have no viable substitutes, and yet face a high risk of supply chain disruption. Currently, China controls 60% of worldwide production and 85% of processing capacity, according to The German Marshall Fund of the United States, a nonpartisan organization focused on transatlantic affairs.

Companies that can accumulate three to six months of stockpiles should be better able to deal with short-term disruptions, says Edward G. Anderson, professor for business at the University of Texas. Over the long term, it makes sense to reshore production of these minerals to the United States or at least move purchases to a more friendly country.