2023 Inbound Logistics Perspectives: 3PL Market Research Report

What’s trending in logistics partnerships in 2023? Our 18th annual 3PL market research report asked both providers and shippers.

About the 3PL Respondents

In a tough supply chain environment, companies often swipe right when it comes to outsourcing. And for good reason. Third-party logistics (3PL) providers can save them money, find them capacity, and help them provide better service to their customers.

In a tough supply chain environment, companies often swipe right when it comes to outsourcing. And for good reason. Third-party logistics (3PL) providers can save them money, find them capacity, and help them provide better service to their customers.

In 2023, we see a mixed supply chain terrain. Shippers enjoy lower transportation rates than last year, and capacity is easier to find. But inflation and the labor market still impose pressures that 3PLs—with their specialized capabilities, market clout, and economies of scale—can relieve.

And, of course, in any economy, 3PLs can help make strong logistics operations even better.

Each year, Inbound Logistics’ annual 3PL Perspectives report offers a snapshot of the current state of 3PL partnerships. For this, our 18th annual report, we analyzed data provided by 3PLs and shippers to reveal what shippers want from 3PLs these days, what service partners can provide, and how both sides deal with the challenges they face.

After you’ve absorbed this information, check out the 2023 Top 100 3PLs to learn more about the service partners that help keep shippers’ goods flowing in any economic environment.

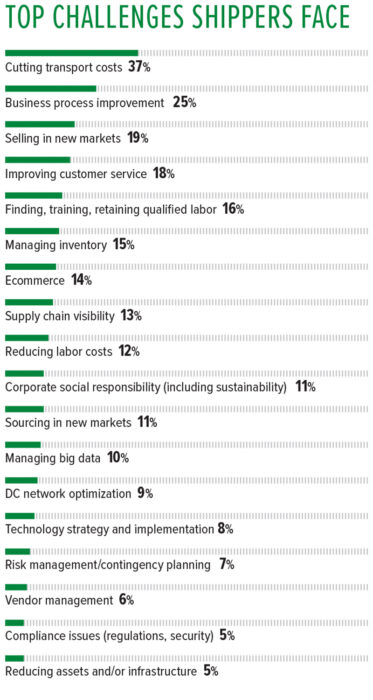

As they have in the past few years, transportation costs top the list of challenges that shippers face in their operations. But as freight rates have fallen over the past year, shippers are less anxious about reducing transportation expenses. This year, just 37% of shipper respondents cite transportation cost cutting as a significant challenge. That’s a steep drop from 2022, when 70% were concerned about this issue.

As they have in the past few years, transportation costs top the list of challenges that shippers face in their operations. But as freight rates have fallen over the past year, shippers are less anxious about reducing transportation expenses. This year, just 37% of shipper respondents cite transportation cost cutting as a significant challenge. That’s a steep drop from 2022, when 70% were concerned about this issue.

Shippers also have an easier time these days with human resources. In 2022, 55% of shippers in the survey faced challenges finding, training, and retaining qualified labor. This year, that number is just 16%.

In fact, shippers seem far less worried in general than they were in 2022. For every potential challenge we mentioned in our survey, fewer shippers than last year call it a significant concern. For example, while 51% of respondents in 2022 cited business process improvements as a challenge, half as many do in 2023. Ecommerce posed a challenge to 45% of shippers in 2022 but only 14% in 2023. Thirty-eight percent of shippers in 2022 faced challenges with improving customer service, but in 2023 the number is 18%.

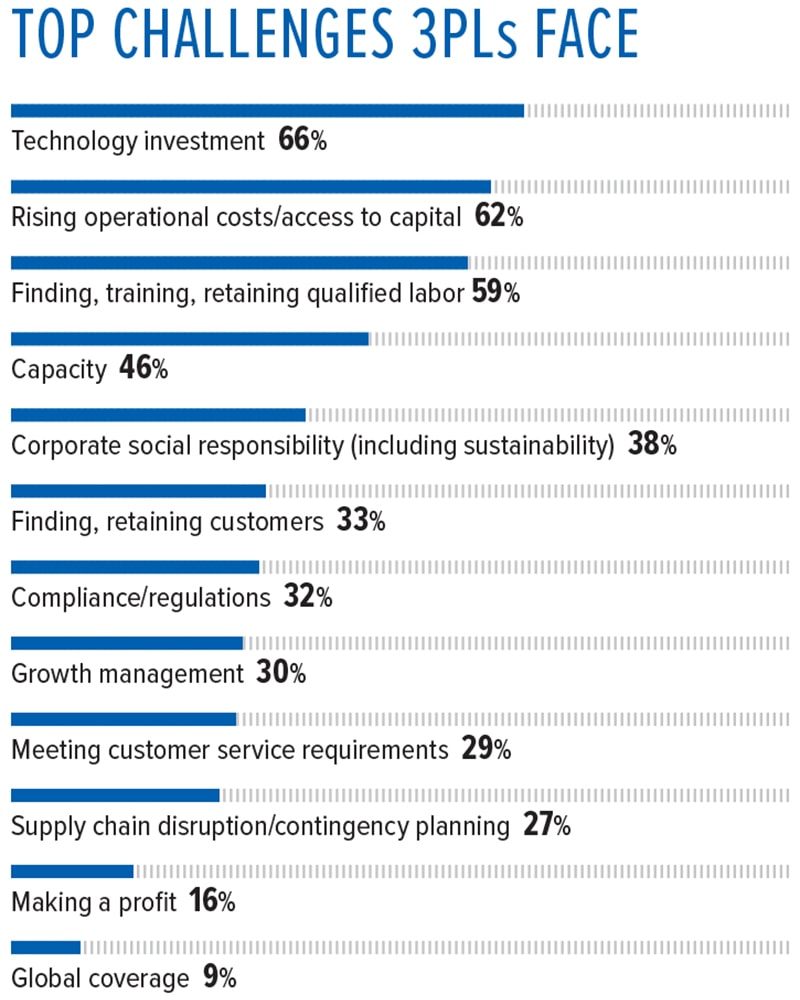

The capacity crunch isn’t fully gone, but it’s considerably less dire today than one year ago. In 2022, 80% of 3PL respondents said finding space for their customers’ cargo was a top concern. In 2023, only 46% worry about whether they can book the capacity they need.

The capacity crunch isn’t fully gone, but it’s considerably less dire today than one year ago. In 2022, 80% of 3PL respondents said finding space for their customers’ cargo was a top concern. In 2023, only 46% worry about whether they can book the capacity they need.

Instead, this year the top challenge for 3PLs is technology investment, a sign that service providers want to streamline their operations and gain competitive advantage through better use of data. The second-biggest challenge concerns rising operational costs and access to capital. Apparently, 3PLs are more likely to struggle with the cost of doing business than their customers are.

More 3PLs than shippers worry about finding, retaining, and training qualified labor, but not as many as last year. In 2022, 70% of 3PLs faced human resources challenges. In 2023, the number drops to 59%.

More 3PLs than shippers worry about finding, retaining, and training qualified labor, but not as many as last year. In 2022, 70% of 3PLs faced human resources challenges. In 2023, the number drops to 59%.

Along with technology investment, a few other challenges are drawing more concern in 2023 than in 2022. They include corporate social responsibility (38% in 2023 vs. 24% in 2022), finding and retaining customers (33% in 2023 vs. 23% in 2022), and making a profit (16% in 2023 vs. 10% in 2022).

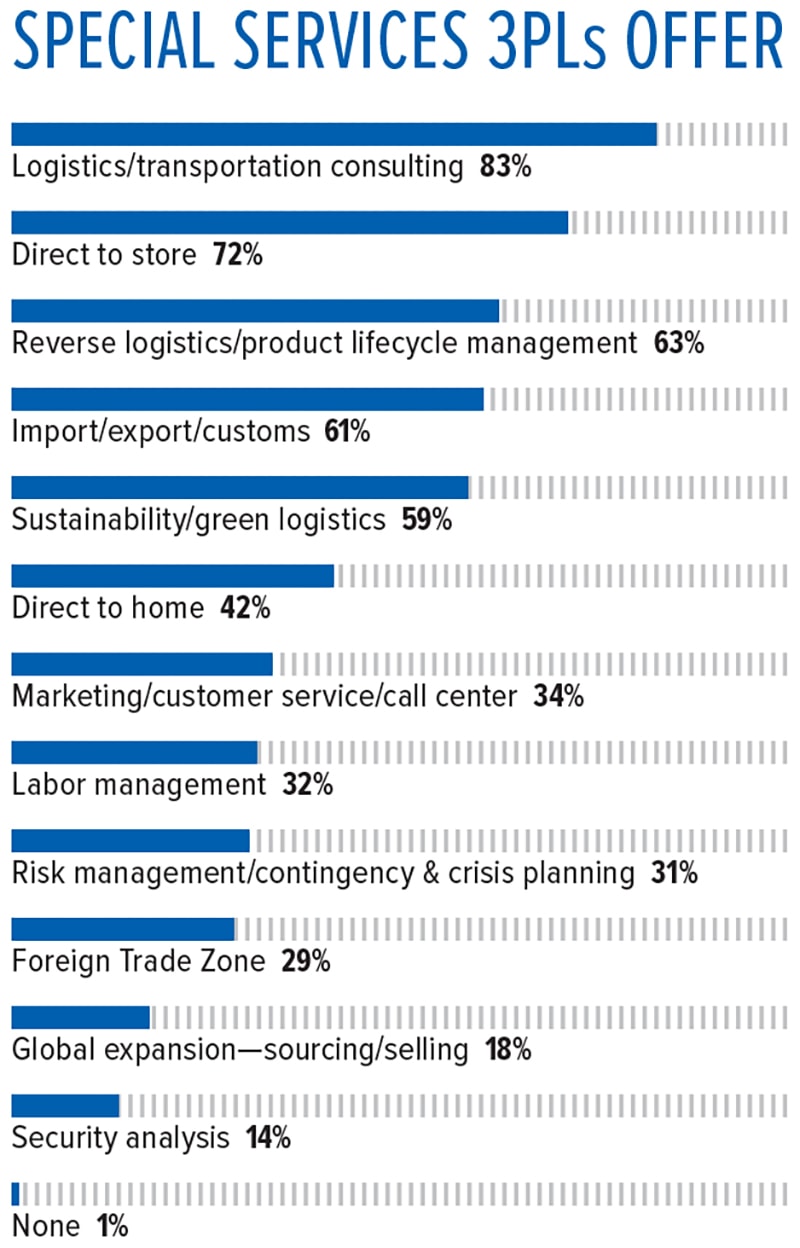

3PLs do a lot of bread-and-butter work for shippers. They determine efficient and cost-effective ways to move freight, manage those moves, receive and store product, fill orders, and more. Beyond those basics, many 3PLs offer specialized services, applying their expertise, in-house technology, and buying power on shippers’ behalf.

Foremost among those special services is logistics/transportation consulting. In 2023, 83% of our 3PL respondents say they help shippers develop or hone their supply chain strategies—for example by re-engineering distribution networks or determining how to allocate freight to carriers. That’s a small increase over the 78% who offered those services in 2022.

Foremost among those special services is logistics/transportation consulting. In 2023, 83% of our 3PL respondents say they help shippers develop or hone their supply chain strategies—for example by re-engineering distribution networks or determining how to allocate freight to carriers. That’s a small increase over the 78% who offered those services in 2022.

The second most common special service is transportation from factories or vendors to retail stores, without making a stop at a distribution center. Seventy-two percent of this year’s respondents offer direct-to-store shipments. Many 3PLs also help retailers manage product that buyers return, or that no one has bought at all. This year, 63% of 3PLs in the survey provide reverse logistics/product lifecycle management.

The second most common special service is transportation from factories or vendors to retail stores, without making a stop at a distribution center. Seventy-two percent of this year’s respondents offer direct-to-store shipments. Many 3PLs also help retailers manage product that buyers return, or that no one has bought at all. This year, 63% of 3PLs in the survey provide reverse logistics/product lifecycle management.

Other special services that 3PLs are most likely to offer include import/export/customs services (61%), sustainability/green logistics (59%) and direct-to-home deliveries (42%).

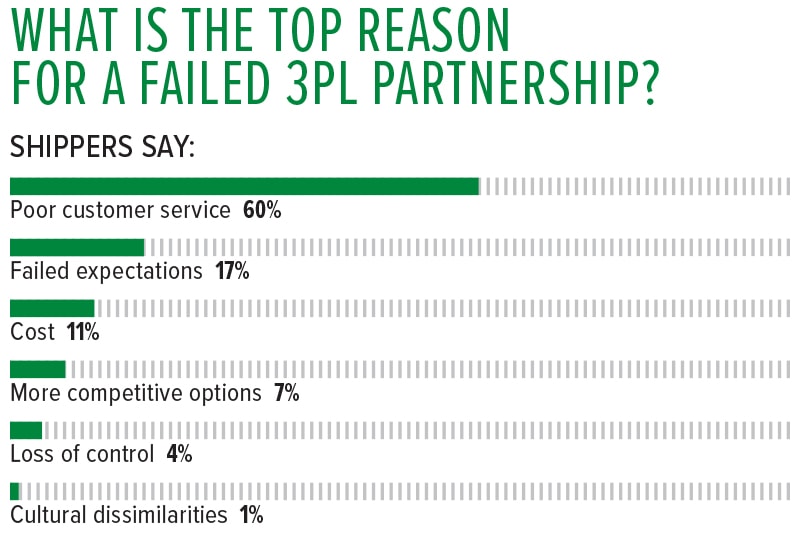

More than anything, shippers want 3PLs to treat them with respect and care. When asked what factors are most likely to break up a 3PL partnership, a full 60% cited poor customer service. No other reason came close. Another 17% of respondents cite failed expectations. Certainly, if a 3PL doesn’t deliver service or savings as promised, that will sour its relationship with the shipper.

One interesting change from 2022 involves the role of cost in 3PL partnerships. Last year, 20% of shippers noted cost as the top reason they might stop working with a particular 3PL. In 2023, only 11% cite this reason for a breakup.

One interesting change from 2022 involves the role of cost in 3PL partnerships. Last year, 20% of shippers noted cost as the top reason they might stop working with a particular 3PL. In 2023, only 11% cite this reason for a breakup.

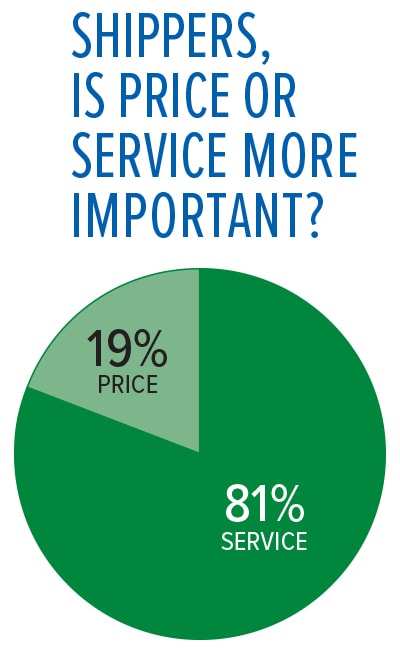

While most businesses strive to control costs any way they can, the majority of shippers consider service even more important than price in a 3PL relationship. That was true in 2022, when 64% of shippers named service the more important factor, compared with the 36% who chose price.

This year, service is even more crucial: 81% of shippers name it as the top factor in a 3PL partnership, while just 19% name cost. As freight rates have eased, perhaps shippers find it easier to invest more in services that deliver impressive benefits. Many shippers in the survey cite excellent service as the reason why they singled out some of their 3PLs for particular praise.

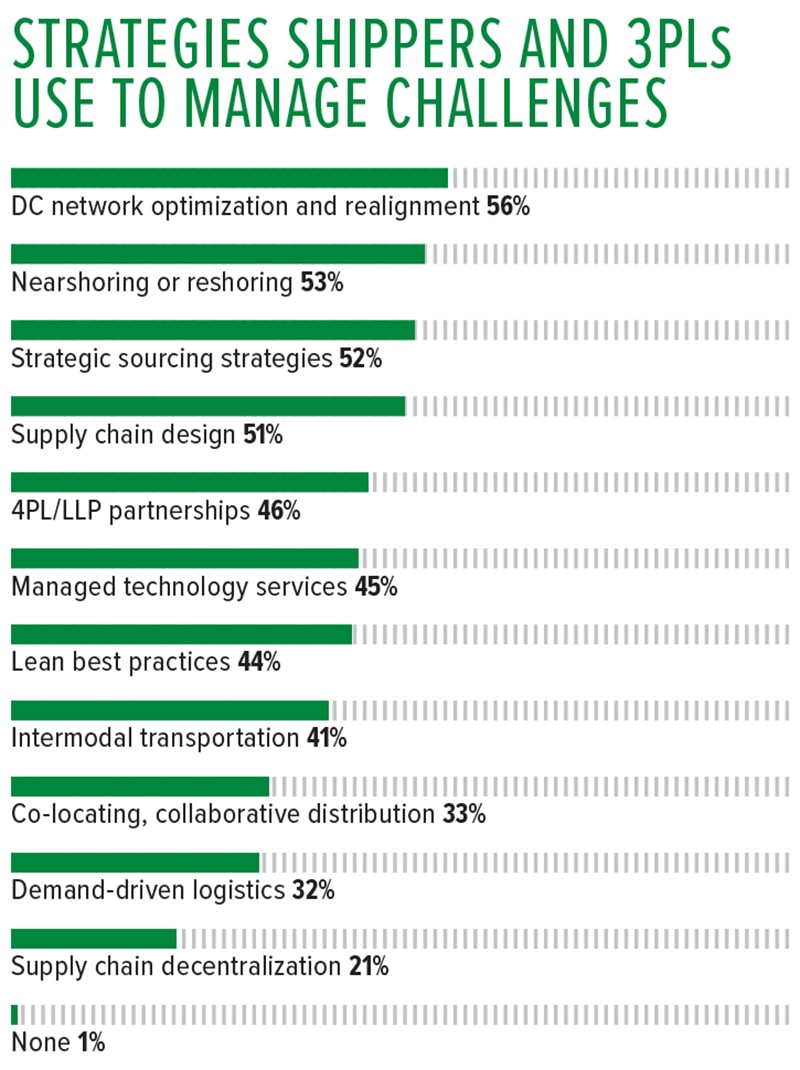

One year ago, two challenges for managing logistics challenges rose above the rest: 1. using a fourth-party logistics (4PL) provider or lead logistics partner (LLP) to oversee the contributions of various service providers, and 2. using supply chain design to improve operations. Those strategies are still popular in 2023. Forty-six percent of this year’s respondents rely on the 4PL or LLP model, and 51% overcome challenges through supply chain design.

One year ago, two challenges for managing logistics challenges rose above the rest: 1. using a fourth-party logistics (4PL) provider or lead logistics partner (LLP) to oversee the contributions of various service providers, and 2. using supply chain design to improve operations. Those strategies are still popular in 2023. Forty-six percent of this year’s respondents rely on the 4PL or LLP model, and 51% overcome challenges through supply chain design.

But three other strategies have become even more important. In 2023, 56% of respondents manage challenges by optimizing and realigning their distribution center (DC) networks. Another growing trend is the quest to develop a shorter, tighter supply chain. This year, 53% of respondents use reshoring or nearshoring to manage their challenges, compared with 43% in 2022. In a similar vein, 52% this year seek improvements through strategic sourcing.

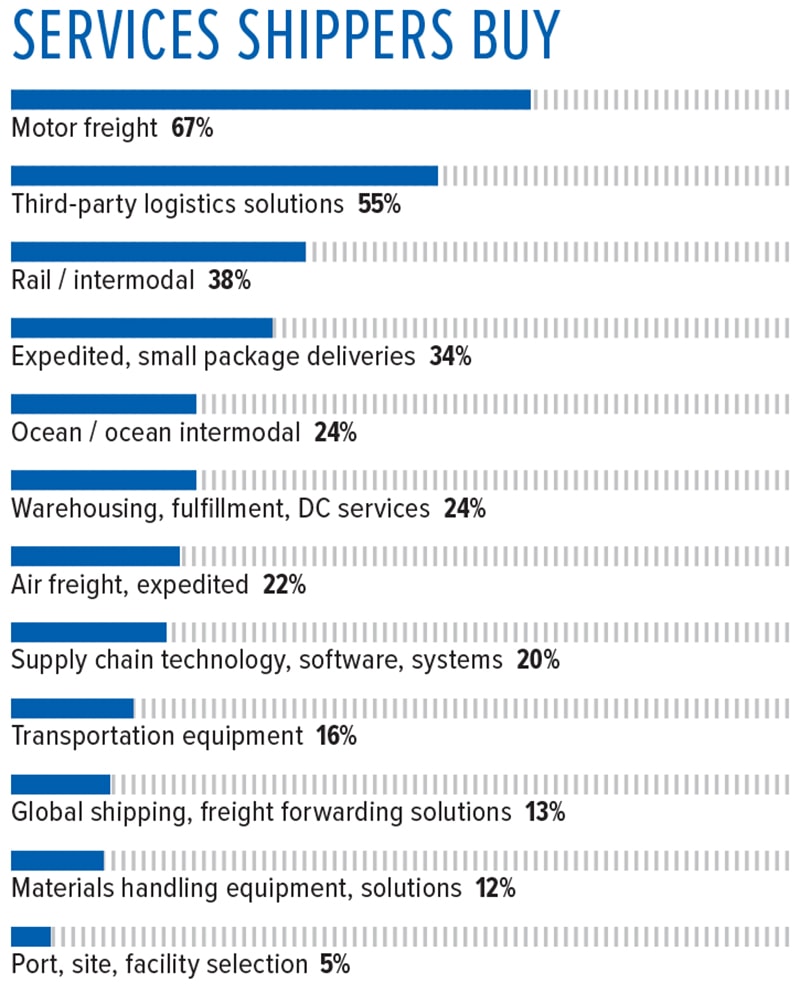

When the shippers in our survey get down to work, the service they are most apt to purchase is motor freight transportation, cited by 67% of respondents. Smaller numbers of shippers buy services in other modes: rail/intermodal (38%), expedited/small package deliveries (34%), ocean or ocean intermodal (24%), and air freight and expedited transportation (22%).

When the shippers in our survey get down to work, the service they are most apt to purchase is motor freight transportation, cited by 67% of respondents. Smaller numbers of shippers buy services in other modes: rail/intermodal (38%), expedited/small package deliveries (34%), ocean or ocean intermodal (24%), and air freight and expedited transportation (22%).

When it comes to outsourcing, 55% buy third-party logistics solutions, 24% buy warehousing, fulfillment and/or distribution center services, and 13% buy global shipping or freight forwarding solutions. Twenty percent of the shipper-respondents buy supply chain technology, software or systems, while only 12% buy equipment and solutions for materials handling.

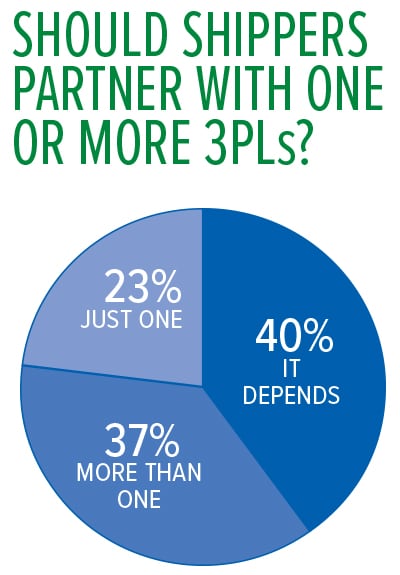

Work with just one 3PL, and you gain a partner who deeply understands your business, plus a single place to call for all your needs. Work with more than one 3PL, and you benefit from those partners’ different strengths in different areas. Which is the best course? It depends on circumstances, say 40% of survey respondents.

Thirty-seven percent say a shipper should always work with more than one logistics partner, while 23% advocate building a strong relationship with a single 3PL.

3PL Services + Capabilities

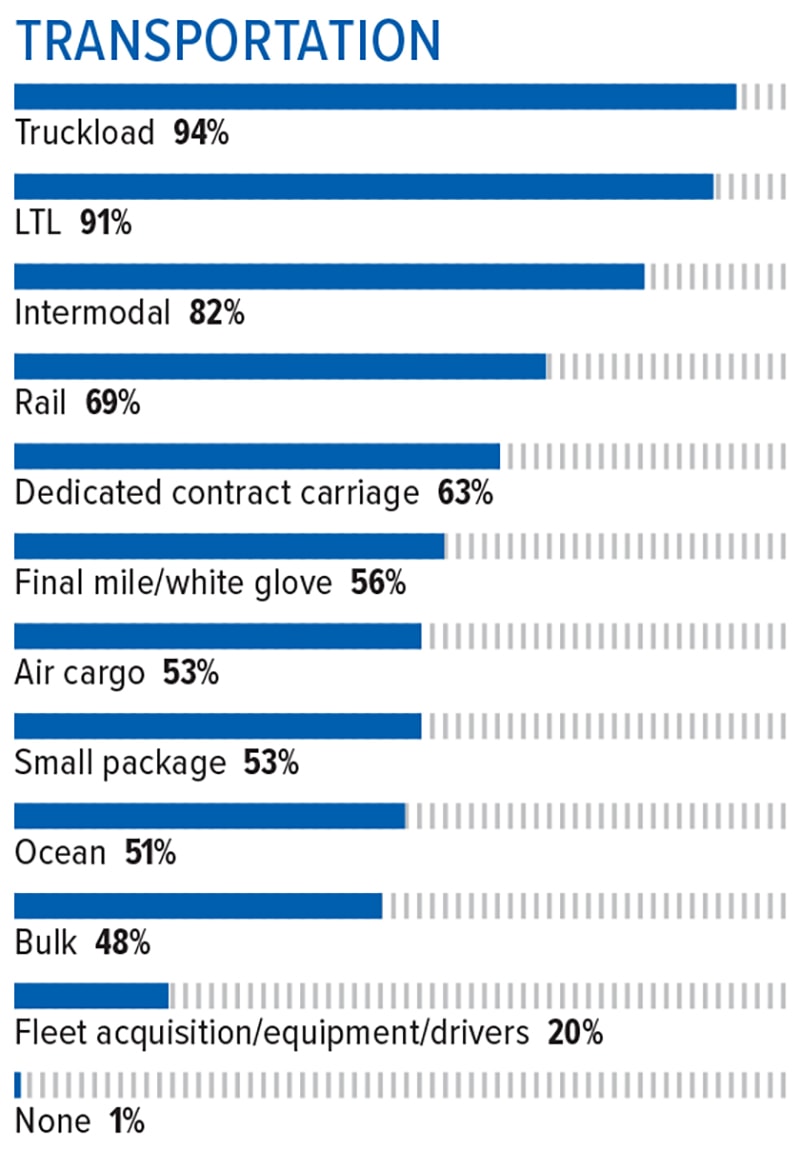

If you need over-the-road capacity, 94% of the 3PLs in our survey can provide truckload transportation, and 91% offer less-than-truckload (LTL). A large proportion (82%) provide intermodal services, while 69% offer general rail services, 53% offer air cargo, 53% do small package transportation, and 51% provide ocean transport. More than half also have specialized services in their portfolios, such as dedicated contract carriage, final mile/white glove, or bulk transportation.

If you need over-the-road capacity, 94% of the 3PLs in our survey can provide truckload transportation, and 91% offer less-than-truckload (LTL). A large proportion (82%) provide intermodal services, while 69% offer general rail services, 53% offer air cargo, 53% do small package transportation, and 51% provide ocean transport. More than half also have specialized services in their portfolios, such as dedicated contract carriage, final mile/white glove, or bulk transportation.

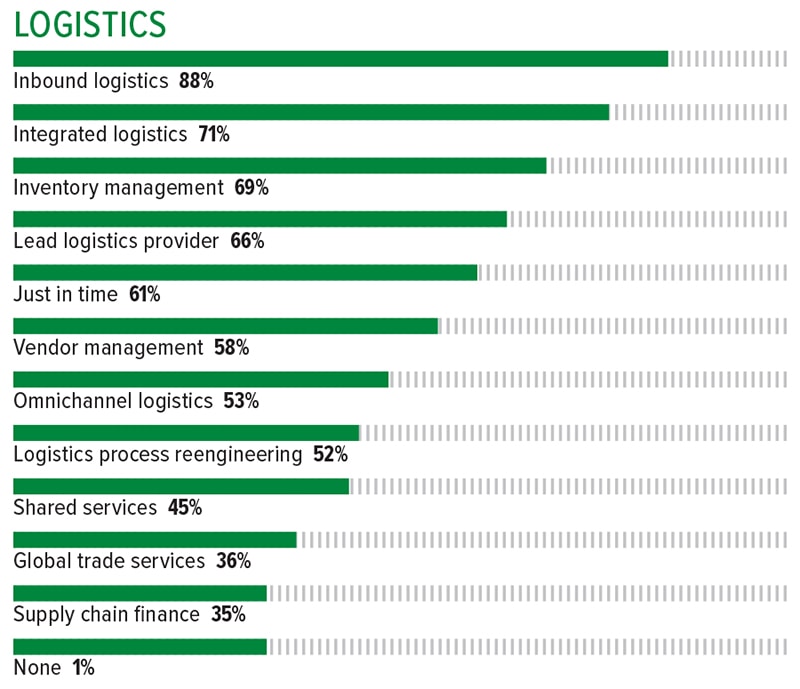

A hefty 88% of 3PL respondents offer services for inbound logistics. Nearly three-quarters provide integrated logistics, coordinating many facets of an operation. Sixty-six percent can also take the coordination a level higher, managing the activities of several 3PLs.

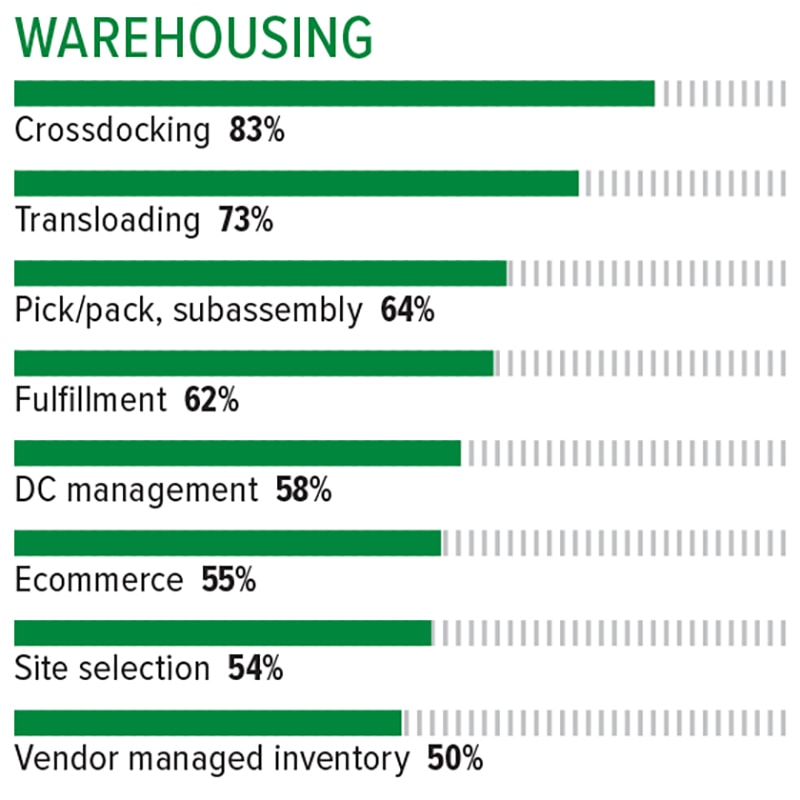

The top warehousing services that 3PLs provide include crossdocking (83%), transloading (73%), pick/pack and subassembly (64%), and fulfillment (62%). In addition, at least half of 3PL respondents offer DC management, help with ecommerce, site selection, and/or vendor managed inventory.

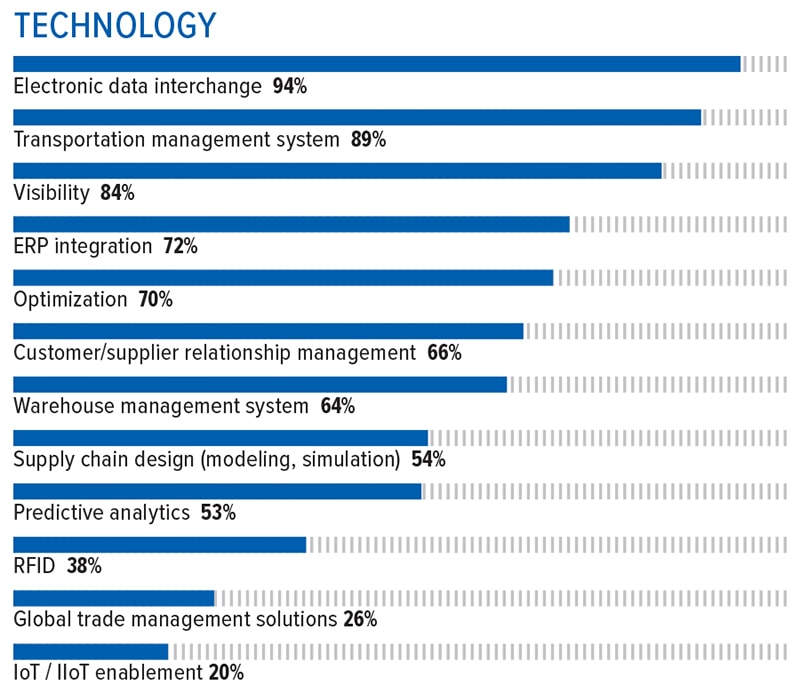

Shippers and their service providers have many options for sharing data, but the old standby, electronic data interchange (EDI), remains important. Ninety-four percent of our 3PL respondents offer that capability. Shippers needing help with day-to-day execution can turn to 3PLs for technology focused on transportation management (89%), visibility (84%), optimization (70%), and warehouse management (64%).

Shippers and their service providers have many options for sharing data, but the old standby, electronic data interchange (EDI), remains important. Ninety-four percent of our 3PL respondents offer that capability. Shippers needing help with day-to-day execution can turn to 3PLs for technology focused on transportation management (89%), visibility (84%), optimization (70%), and warehouse management (64%).

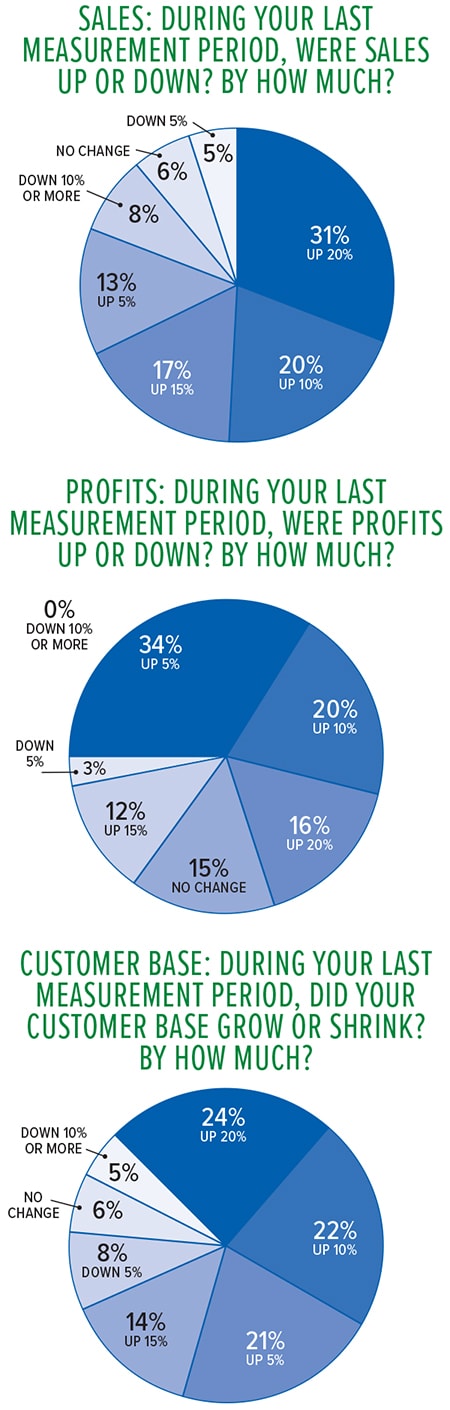

Sales/Customer Base/Profits

Business is softer for 3PLs this year than in 2022, when high transportation costs, commodities shortages, and other challenges drove shippers to seek help from third-party experts. Among 3PLs who responded to the survey in 2023, 81% report that sales had increased in their most recent measurement period, compared with 94% in 2023.

Business is softer for 3PLs this year than in 2022, when high transportation costs, commodities shortages, and other challenges drove shippers to seek help from third-party experts. Among 3PLs who responded to the survey in 2023, 81% report that sales had increased in their most recent measurement period, compared with 94% in 2023.

Thirteen percent of this year’s respondents saw sales go down, compared with just 2% in 2022. Eighty-one percent saw growth in their customer bases this year, and 13% saw them shrink. That compares with 90% who saw growth last year and only 1% who lost customers.

3PLs are doing something right, because many showed a profit in their last measurement period—82% in 2023 compared with 75% in 2022. But those gains are on the modest side. In 2022, 75% of 3PLs saw profits rise by 15% or more, while in 2023 that number is just 48%. Another 34% of 3PLs this year saw profits increase by 5%.

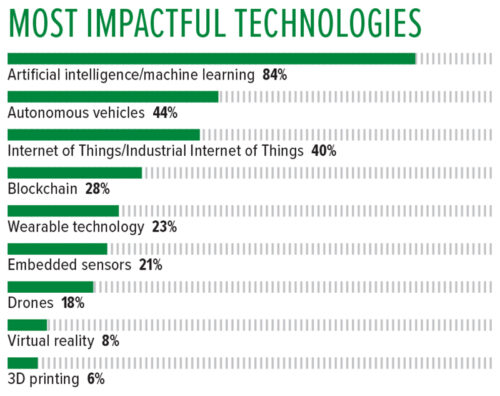

From college instructors who wonder who’s really writing their students’ essays, to creatives who ponder if technology will help them work faster or steal their jobs, this year everyone seems to be thinking about artificial intelligence. That’s also true among 3PLs.

When asked which technologies are likely to make the biggest impact on supply chain management, 84% of 3PLs include AI and machine learning in the list. Of course, these technologies already play a role in many supply chains, as advanced software reveals patterns in an operation’s data and recommends how to respond.

While quite a few 3PLs (44%) expect autonomous vehicles to play an important role in supply chains, that’s a less popular opinion than in 2022, when 52% said AVs would have a major impact. Similarly, while 35% of respondents pointed to blockchain last year, that number dropped to 28% in 2023.

Although 40% of 3PLs say the Internet of Things or Industrial Internet of Things will have a major impact, only 20% of 3PLs in the survey offer IoT/IIoT enablement (see page 76). Perhaps that number will grow as more shippers discover the insights they can gain through this technology, especially when they pair it with AI and machine learning.