2023 Trucking Perspectives

In a year of looser capacity but higher operating costs, Inbound Logistics provides an exclusive look at the issues that are top-of-mind for motor carriers and shippers.

The trucking market—in some ways—is more congenial than it has been since the onset of the pandemic. Supply chains no longer suffer from massive bottlenecks at ports and other crucial nodes, and capacity is easier for truckers to provide and shippers to secure.

But truckers and their customers still face big challenges, especially from inflation, a tight labor market, and high interest rates.

“The rising cost of interest rates has had a hugely negative effect, as it stagnates our industry and, more importantly, significantly increases the cost of transportation,” says Mike Moran, president, Moran Transportation Corp. in Elk Grove Village, Illinois.

“We have already been hit with rising costs in the form of wage increase, healthcare increases, auto/umbrella insurance coverage increases, fuel, and truck/trailer asset replacement increases,” he adds.

On top of all that, high interest rates make it even harder for trucking companies to invest in the new equipment they need to operate efficiently.

The industry also saw transportation giant Yellow Corp. file for bankruptcy this year, done in by labor troubles and mounting debt.

What are the biggest concerns trucking companies and their customers face today? What has gotten easier, and what triggers the biggest headaches?

With our annual survey of truckers and shippers, Inbound Logistics provides a look at how these companies are responding to the mix of conditions that define the current environment.

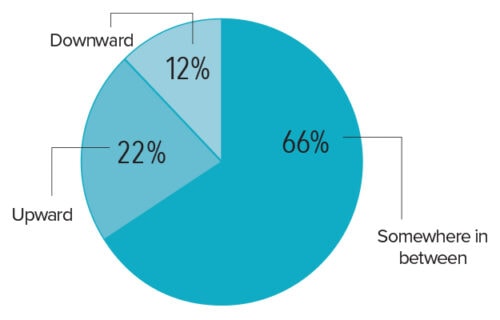

TRUCKERS: AS A LEADING ECONOMIC INDICATOR, WHERE DO YOU SEE THE ECONOMY TRENDING?

Executives at trucking companies hold a cautious view of the economy this year. True, only 12% of survey respondents say the economy is trending downward. That’s the same proportion as in 2022. But only 22% think it’s getting better, compared with 40% one year ago. Two-thirds say the true state of things is somewhere in between.

Executives at trucking companies hold a cautious view of the economy this year. True, only 12% of survey respondents say the economy is trending downward. That’s the same proportion as in 2022. But only 22% think it’s getting better, compared with 40% one year ago. Two-thirds say the true state of things is somewhere in between.

And no wonder there’s so much uncertainty. Political and economic tensions between the United States and China, the ongoing war in Ukraine, high energy prices, climbing interest rates, and other difficult conditions make it hard for businesses, including trucking companies, to determine how to move forward.

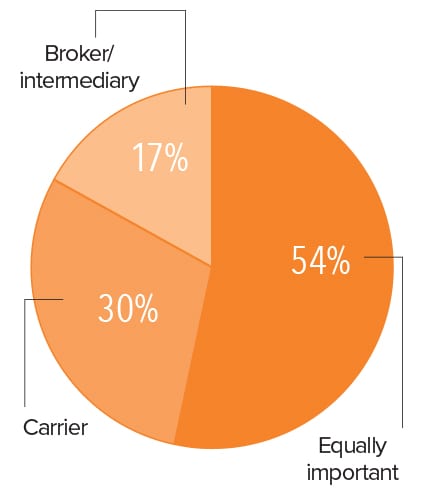

SHIPPERS: WHICH IS MORE IMPORTANT, YOUR RELATIONSHIP WITH YOUR CARRIER OR WITH YOUR BROKER/INTERMEDIARY?

About half of shippers continue to believe their relationships with carriers and with a broker or other intermediary are equally important. This year, 54% of shipper respondents express that conviction, just slightly down from 56% in 2022. Among shippers who feel that one type of relationship carries more weight than the other, carriers win, garnering 30% of the vote, versus 17% for brokers/intermediaries.

About half of shippers continue to believe their relationships with carriers and with a broker or other intermediary are equally important. This year, 54% of shipper respondents express that conviction, just slightly down from 56% in 2022. Among shippers who feel that one type of relationship carries more weight than the other, carriers win, garnering 30% of the vote, versus 17% for brokers/intermediaries.

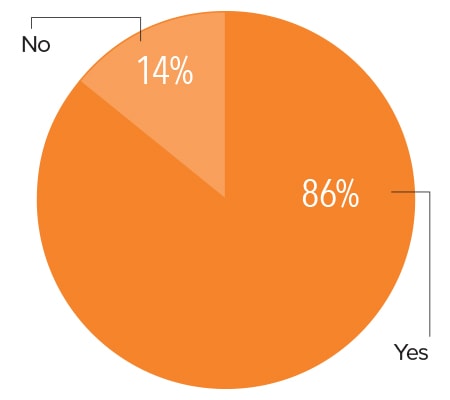

SHIPPERS: DO YOU BUY OR PARTICIPATE IN SOURCING/PURCHASING TRUCKING SERVICES?

Not all the shippers who participate in our survey are directly involved in finding and buying trucking services. Fourteen percent are not, presumably relying on brokers or third-party logistics providers (3PLs) to make those decisions on their behalf.

Not all the shippers who participate in our survey are directly involved in finding and buying trucking services. Fourteen percent are not, presumably relying on brokers or third-party logistics providers (3PLs) to make those decisions on their behalf.

TRUCKERS: DO YOU HAVE A FREIGHT BROKERAGE OR LOGISTICS SERVICES DIVISION/SUBSIDIARY?

The percentage of trucking companies that also provide third-party transportation services continues to creep up—87% this year compared with 86% in 2022 and 84% in 2021.

The percentage of trucking companies that also provide third-party transportation services continues to creep up—87% this year compared with 86% in 2022 and 84% in 2021.

SHIPPERS: What is your role?

Among the shippers who responded to the survey this year, 67% buy transportation for freight that they themselves ship or receive. Nineteen percent of shipper responders are third-party service providers, securing capacity for their clients. Another 14% are carriers who buy capacity to fill holes in their own coverage.

Among the shippers who responded to the survey this year, 67% buy transportation for freight that they themselves ship or receive. Nineteen percent of shipper responders are third-party service providers, securing capacity for their clients. Another 14% are carriers who buy capacity to fill holes in their own coverage.

Truckers: What are your greatest challenges?

The cost of doing business remains the biggest challenge for trucking companies, but the pain inflicted by various cost components has shifted. In 2022, costs related to drivers were far and away the biggest pain point, cited by 82% of respondents.

The cost of doing business remains the biggest challenge for trucking companies, but the pain inflicted by various cost components has shifted. In 2022, costs related to drivers were far and away the biggest pain point, cited by 82% of respondents.

This year, while that challenge still tops the list, it does so by a smaller margin: 66% of respondents cite driver-related costs as a major challenge. Have trucking companies simply adjusted to the fact that they need to pay drivers more?

Other expenses pose challenges for more trucking companies than they did one year ago. Inflation makes rising equipment costs a problem for 58% of trucking respondents, compared with 38% in 2022. And anyone who checks the price of diesel while out driving understands that the cost of fuel remains a major challenge, identified by just over half of respondents this year.

On the other hand, only 13% of truckers in our survey are worried about their ability to provide capacity this year, compared with 46% in 2022, when there was more demand for space on trucks.

SHIPPERS: What are your greatest challenges?

Many shippers still face challenges when it comes to reducing transportation costs. But with freight rates lower today than one year ago, cost is a problem for fewer respondents—70% this year, versus 84% in 2022.

Many shippers still face challenges when it comes to reducing transportation costs. But with freight rates lower today than one year ago, cost is a problem for fewer respondents—70% this year, versus 84% in 2022.

Many other areas also pose less of a challenge than they did one year ago, including the search for capacity (cited by 30% of respondents this year vs. 52% last year), the ability to efficiently match product supply and demand (20% this year vs. 35% last year), and a surge in ecommerce volume (3% this year vs. 14% last year).

Shippers do feel a good deal more pressure these days to lower the prices of their products, a challenge cited by 51% of shipper respondents this year compared with only 30% in 2022. As inflation makes consumers more cautious, their frugal impulses flow up the supply chain to retailers, brand owners, and suppliers.

Truckers: What primary types of service do you offer?

If you need a company to haul a full truckload (TL) of goods, a large majority of the trucking companies in our survey—81%—can provide that service. Slightly fewer, 75%, offer less-than-truckload (LTL) service. The same proportion offer logistics services and 73% serve as transportation brokers.

If you need a company to haul a full truckload (TL) of goods, a large majority of the trucking companies in our survey—81%—can provide that service. Slightly fewer, 75%, offer less-than-truckload (LTL) service. The same proportion offer logistics services and 73% serve as transportation brokers.

Many trucking companies in the survey offer specialized services. These include 64% that provide temperature-controlled transportation, 55% that do flatbed hauling, and 49% that can expedite a shipper’s freight. For shippers that need to lock in capacity for a specific period, 70% of respondents offer dedicated contract carriage.

A smaller, but still significant, number of respondents, including the 10 best paying trucking companies, offer transportation with a focus on the end customer, including 42% that provide final-mile transportation and 25% that offer white-glove services.

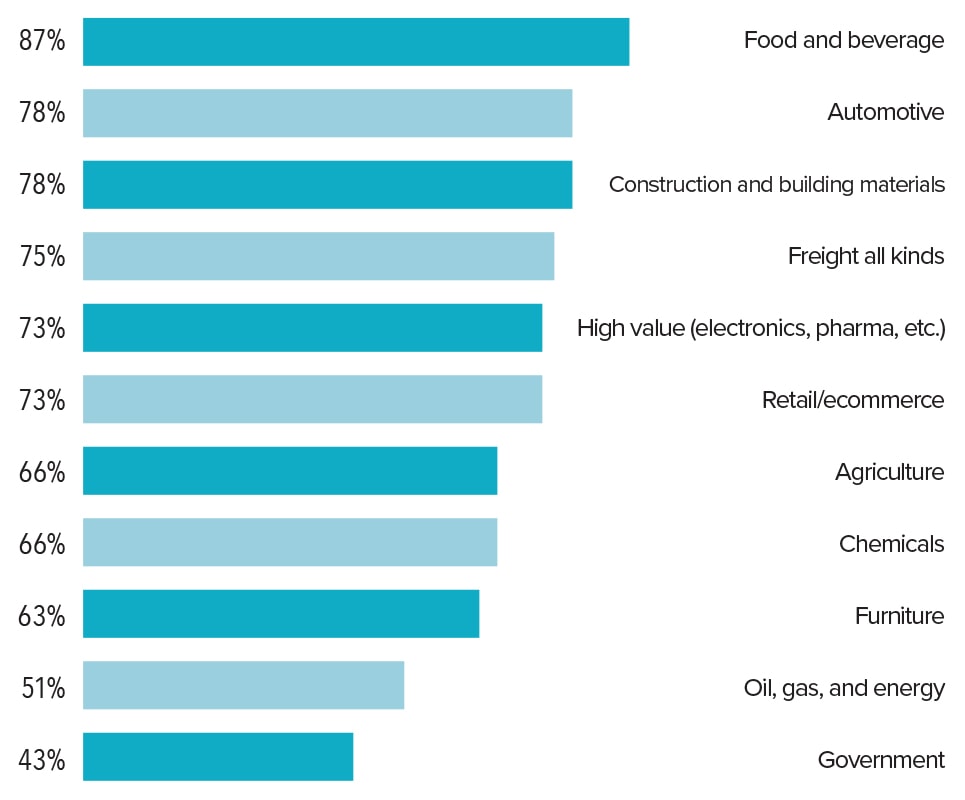

Truckers: What industries/commodities do you serve?

As in past years, the food and beverage industry provides the biggest market for truckers: 87% of this year’s trucking respondents say they haul loads for this business sector. That number has risen a bit from 2022, when it was 81%.

As in past years, the food and beverage industry provides the biggest market for truckers: 87% of this year’s trucking respondents say they haul loads for this business sector. That number has risen a bit from 2022, when it was 81%.

Other industries and commodities that play a major role for our respondents include automotive (78%), construction and building materials (78%), freight all kinds (75%), high-value loads (73%), and retail/ecommerce (73%). The role of high-value freight such as electronics and pharmaceuticals has jumped since last year, when 61% of respondents served that sector.

Two other notable increases since last year involve the oil, gas, and energy sector and the agricultural sector. In 2022, 54% of respondents said they hauled loads for customers in agriculture. In 2023, that number is 66%. Similarly, the percentage of respondents serving customers in the oil, gas, and energy industry rose from 39% in 2022 to 51% in 2023.

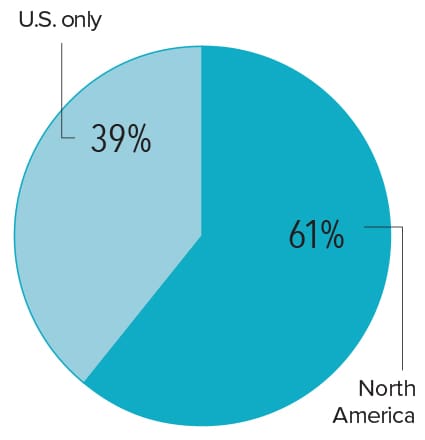

Truckers: What is your operating area?

The proportion of trucking companies that serve all of North America, rather than just the United States, reached a peak in 2021, when 70% of respondents said they covered the whole continent. That number slipped a bit, to 68%, in 2022 and has dropped even further this year, to 61%. Have steeper operating costs spurred more carriers to scale back their coverage?

The proportion of trucking companies that serve all of North America, rather than just the United States, reached a peak in 2021, when 70% of respondents said they covered the whole continent. That number slipped a bit, to 68%, in 2022 and has dropped even further this year, to 61%. Have steeper operating costs spurred more carriers to scale back their coverage?

Truckers: Do you provide global services beyond North America?

Trucking companies with logistics divisions have the option of providing services beyond North America. The percentage of companies that offered such global services dropped from 32% in 2021 to 26% in 2022. This year, intercontinental services have rebounded, with 37% of trucking respondents indicating that they provide services beyond the continent.

Trucking companies with logistics divisions have the option of providing services beyond North America. The percentage of companies that offered such global services dropped from 32% in 2021 to 26% in 2022. This year, intercontinental services have rebounded, with 37% of trucking respondents indicating that they provide services beyond the continent.

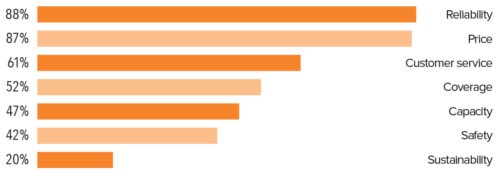

SHIPPERS: What are the most important factors to consider when choosing a motor carrier?

In 2022, when shippers selected motor carriers, reliability counted even more than price. Eighty-nine percent of shippers said that a trucking company’s tendency to deliver on its promises was a crucial factor, vs. 80% who named price. This year—with freight rates down but many other operating costs inflicting pain—reliability and price are practically tied, 88% to 87%.

The quality of a carrier’s customer service remains important, but not quite as much as last year: 61% of shippers mention it as a significant factor, vs. 72% in 2022. But another factor, coverage, has grown a great deal more important, jumping from 38% in 2022 to 52% this year. As some parts of the United States lose population, and other areas grow, companies are re-engineering supply chains to make sure they can reach their customers.

One factor that shippers are less likely to consider when choosing among motor carriers this year is capacity. Forty-seven percent of shippers cite that as a factor, compared with 54% in 2022. As we’ve seen, most shippers this year believe that the market offers plenty of space for their loads, and truckers are confident they can provide that space.

Truckers: What certifications do you hold?

With its dual goals of operational sustainability and freight transportation efficiency, the Environmental Protection Agency’s (EPA) SmartWay certification program remains attractive to many trucking companies. This year, 88% of trucking companies in the survey are SmartWay members.

After SmartWay, the certification that trucking companies most likely hold is one that allows them to haul hazardous materials. In 2023, 64% of trucking respondents are hazmat certified.

As noted previously, the percentage of carriers whose networks cover all of North America, rather than just the United States, has been falling (although the proportion that provide service beyond North America has risen in the past year). So it makes sense that fewer trucking companies this year hold certifications to speed freight transportation across international borders. In 2022, 54% of respondents were certified by the Customs Trade Partnership Against Terrorism (C-TPAT). In 2023, that number is only 40%. Similarly, the portion of respondents certified by the Free and Secure Trade (FAST) program fell from 30% in 2022 to 25% in 2023, and participation in Canada’s Partners in Protection (PIP) program dropped from 25% to 22%.

Truckers: What legislative measures have the greatest impact on your business?

Trucks can’t provide reliable service without well-maintained roads, bridges, and other transportation facilities. That makes laws that fund and govern public infrastructure especially important to motor carriers. This year, 79% of trucking respondents say that infrastructure legislation makes a significant impact on their business. In 2022, that number was 68%.

Trucks can’t provide reliable service without well-maintained roads, bridges, and other transportation facilities. That makes laws that fund and govern public infrastructure especially important to motor carriers. This year, 79% of trucking respondents say that infrastructure legislation makes a significant impact on their business. In 2022, that number was 68%.

In an era of high fuel prices, ongoing developments in the electric vehicle market, and hot debates about fossil fuels vs. renewables, many trucking executives also keep a keen eye on energy policy. This year, 46% of trucking respondents tell us that legislation in that area makes a big impact on their business, compared with 39% last year.

Trucking respondents are somewhat less concerned than last year about legislation in three other categories: healthcare (21% in 2023 vs. 26% in 2022), the Highway Trust Fund (10% in 2023 vs. 15% in 2022), and vehicle weight (7% in 2023 vs. 13% in 2022).

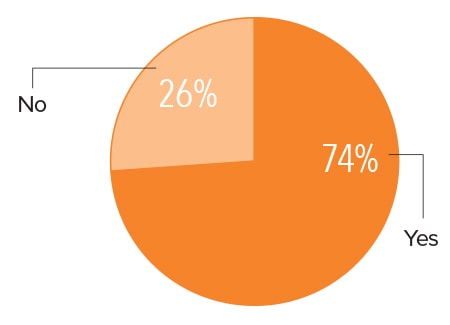

SHIPPERS: Have you experienced rate hikes apart from fuel surcharges?

Although freight rates are generally lower this year than last, many shippers who participated in our survey are still paying motor carriers more than they would like. Nearly three-quarters of respondents say they have experienced rate hikes apart from fuel charges. That’s a smaller proportion than the 85% who reported getting hit with increases last year, but it’s still a significant number.

Although freight rates are generally lower this year than last, many shippers who participated in our survey are still paying motor carriers more than they would like. Nearly three-quarters of respondents say they have experienced rate hikes apart from fuel charges. That’s a smaller proportion than the 85% who reported getting hit with increases last year, but it’s still a significant number.

SHIPPERS: How do you feel about CSA regulations?

Slightly more than half of shippers in our survey say that the Federal Motor Carrier Safety Administration’s Compliance, Safety, and Accountability Act (CSA) has not made any impact on the cost of their operations or on the transportation services their carriers provide. Thirty-five percent say these regulations have affected their costs, or the services they receive, in a perceptible way. One-tenth of respondents say the FMCSA should get rid of the CSA program.

Slightly more than half of shippers in our survey say that the Federal Motor Carrier Safety Administration’s Compliance, Safety, and Accountability Act (CSA) has not made any impact on the cost of their operations or on the transportation services their carriers provide. Thirty-five percent say these regulations have affected their costs, or the services they receive, in a perceptible way. One-tenth of respondents say the FMCSA should get rid of the CSA program.

SHIPPERS: How do you feel about Hours-of-Service regulations?

While more than half of shippers report they feel no ill effects from the aforementioned CSA program, nearly that many—48%—say that federal regulations governing drivers’ work hours affect their costs or the services they receive. Another 10% are so bothered by this program that they say the government should suspend it permanently. Another 42% say hours-of-service regulations have no impact on their service or operations.

While more than half of shippers report they feel no ill effects from the aforementioned CSA program, nearly that many—48%—say that federal regulations governing drivers’ work hours affect their costs or the services they receive. Another 10% are so bothered by this program that they say the government should suspend it permanently. Another 42% say hours-of-service regulations have no impact on their service or operations.

SHIPPERS: Have you experienced a shortage of truck capacity?

There’s a good deal more capacity available today than in the past couple of years. Only 47% of shippers say they have experienced a capacity shortage this year, compared with 60% in 2022 and 70% in 2021.

There’s a good deal more capacity available today than in the past couple of years. Only 47% of shippers say they have experienced a capacity shortage this year, compared with 60% in 2022 and 70% in 2021.