2025 IL Market Research: What’s Happening in Supply Chain and Logistics Technology?

Companies are accelerating supply chain technology deployments, IL’s annual report reveals. Providers are ramping up AI innovations to boost capabilities and seeing robust growth, even as the trends that shape their solutions shift.

Sophisticated supply chain and logistics technology solutions are seeing a surge in interest as supply chains grow more complex, and shippers and their partners contend with disruptions, rising labor costs, and worker shortages that inspire a growing demand for automation services.

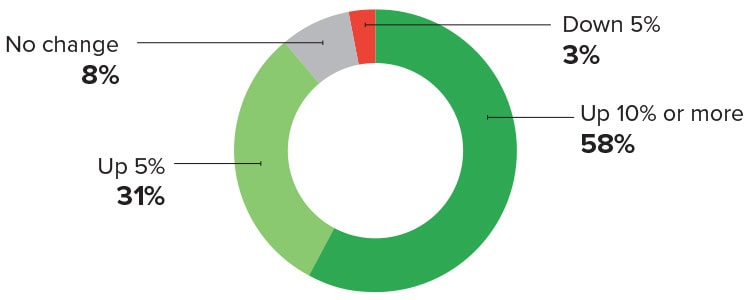

That interest—as evidenced by technology vendor sales growth—is among the takeaways from Inbound Logistics’ latest survey of the supply chain and logistics IT market. Of the vendors who participated in the 2025 survey, a striking 58% report they experienced a growth in sales of 10% or more year over year; another 31% say they saw growth of 5% or more.

Still, even as interest in new IT solutions grows more robust, the logistics field continues to underutilize the tech solutions available to it. “The logistics industry as a whole remains stuck in a digital process time warp, reliant on manually processing email, PDFs, spreadsheets, and non-structured data to keep freight moving,” says Greg Kefer, CMO of Raft, a London-based company that offers an AI-powered logistics platform.

Artificial intelligence is taking on a growing role as a component of logistics and supply chain technology solutions and seems poised to transform the field. “AI has captured so much attention and excitement. The ability to ‘read,’ interpret, and process data from partners without human intervention is potentially game-changing for logistics,” notes Kefer.

IL’s annual survey of a broad assortment of logistics and supply chain technology providers offers a valuable look at their current views of the marketplace. We compile and analyze their responses to yield fresh insights that can help inform you about the technologies that can help strengthen your operations—and what lies ahead. Here are some notable trends from the 2025 survey.

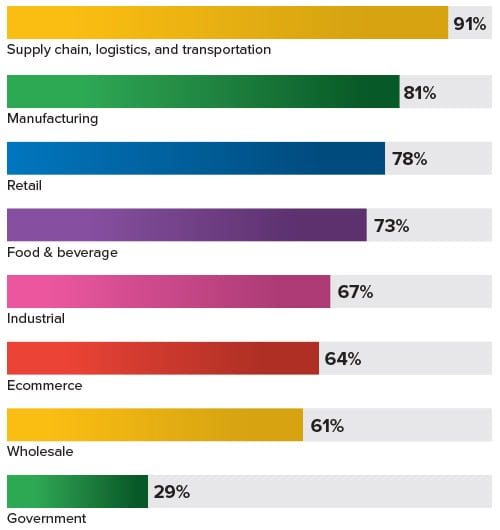

What industries/verticals do your solutions serve?

Supply chain, logistics, and transportation companies remain the heaviest users of logistics IT solutions: 91% of providers report serving that field—a rise of one percentage point from one year ago. The solutions—and the adaptability and sophistication they provide—prove to be more critical than ever for those who offer services for shippers in today’s frequently changing climate. Within that category, current conditions drive 3PLs in particular to embrace tech-based solutions to manage their clients’ nuanced supply chain needs.

Supply chain, logistics, and transportation companies remain the heaviest users of logistics IT solutions: 91% of providers report serving that field—a rise of one percentage point from one year ago. The solutions—and the adaptability and sophistication they provide—prove to be more critical than ever for those who offer services for shippers in today’s frequently changing climate. Within that category, current conditions drive 3PLs in particular to embrace tech-based solutions to manage their clients’ nuanced supply chain needs.

Manufacturing also saw an increase in usage, climbing four percentage points to 81%. It surpassed retail, which remained steady at 78%, as the category of shippers most likely to contract with logistics IT vendors.

The high numbers for both groups reflect the growing use of the solutions among many shippers since 2023, when the numbers were more subdued. In that year’s survey, for instance, only 61% of logistics IT solutions providers cited manufacturing as a category that they served, and an equal percentage said the same about retail.

Meanwhile, the wholesale industry experienced a notable decline in usage of the solutions—dropping from 70% in 2024 to 61% in 2025. The numbers proved to be steadier for food and beverage (up three percentage points to 73%), industrial (up one point to 67%), and ecommerce (down two points to 64%).

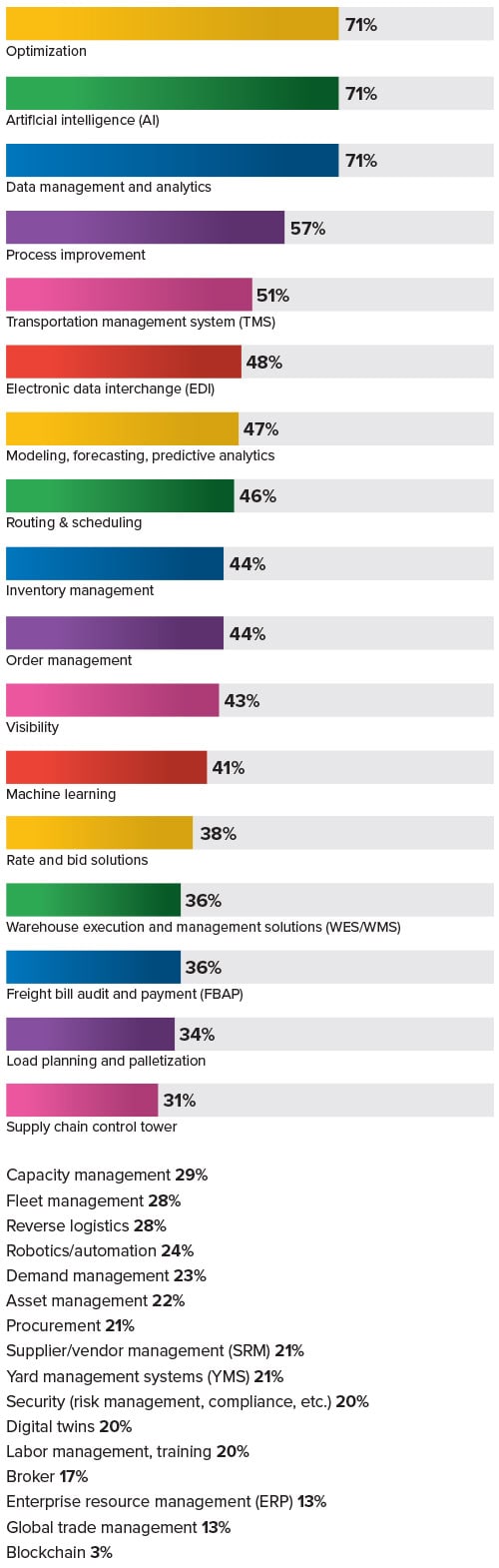

What logistics and supply chain technology solutions do you offer?

The growing influence of artificial intelligence has been well-chronicled in the survey in recent years. In the 2023 edition, 44% of providers said AI was among the solutions that they offered. That number climbed to 50% in 2024—when AI tied for seventh of the most-cited solutions—and then shot upward to 71% this year to a tie for No. 1.

The growing influence of artificial intelligence has been well-chronicled in the survey in recent years. In the 2023 edition, 44% of providers said AI was among the solutions that they offered. That number climbed to 50% in 2024—when AI tied for seventh of the most-cited solutions—and then shot upward to 71% this year to a tie for No. 1.

Other popular solutions rounding out the top five are optimization (71%, up from 66%), data management and analytics (71%, up from 63%), process improvement solutions (57%, down sharply from 66%), and transportation management systems (51%, down one percentage point).

Some solutions show signs of waning influence. For instance, 44% of vendors offer order management—10 percentage points lower than in 2024—and 21% offer supplier/vendor management (down from 30%). Most starkly, 43% of respondents say they offer visibility solutions, a dramatic drop from the 66% who reported doing so in 2024.

Blockchain also has faded fast from the offerings of almost all providers—and from the apparent interest of their customers. Just 3% of vendors surveyed report offering blockchain solutions, continuing a downward trend that can be traced to 2022 when 12% provided solutions in that area.

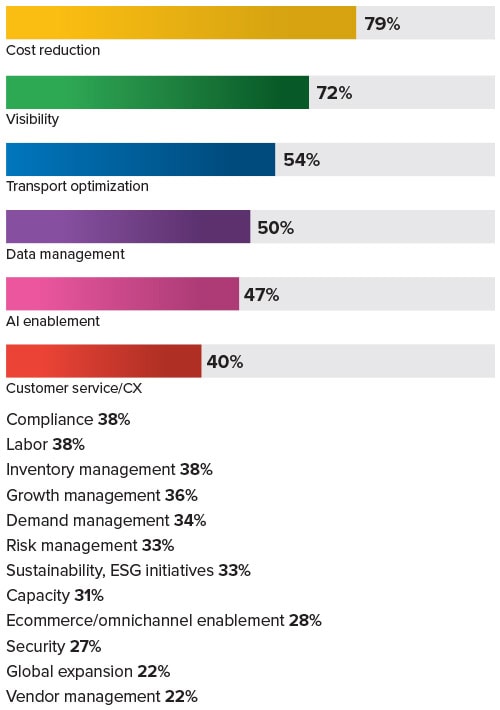

Which supply chain, transportation, and logistics challenges are the most critical for your customers?

Of the supply chain, transportation, and logistics challenges that IT solutions providers’ clients face, reducing cost remains at the top of the list, though this year’s survey results reveal some shifting tides. For instance, though interest in cost reduction remains robust, with 79% of respondents citing it as a critical challenge for customers, that reflects a drop of seven percentage points from last year.

Of the supply chain, transportation, and logistics challenges that IT solutions providers’ clients face, reducing cost remains at the top of the list, though this year’s survey results reveal some shifting tides. For instance, though interest in cost reduction remains robust, with 79% of respondents citing it as a critical challenge for customers, that reflects a drop of seven percentage points from last year.

Farther down the list are signs that other challenges are not viewed as prominently as they have been in the past. Customer service drops from 47% to 40%, compliance falls from 46% to 38%, inventory management falls from 50% to 38%, and risk management falls from 39% to 33%. Also notably slipping in importance for shippers are sustainability and ESG initiatives, which garnered headlines in 2025 amid political headwinds. Technology vendors say only 33% of customers see them as a critical challenge—down from 41% last year.

AI enablement, which was not measured in last year’s survey, debuted on the list as the fifth most frequently cited of the challenges critical to customers at 47%, another sign of artificial intelligence’s rapid rise and the widespread interest in adopting and applying it to logistics. It would not be a surprise to see that percentage grow markedly on next year’s survey.

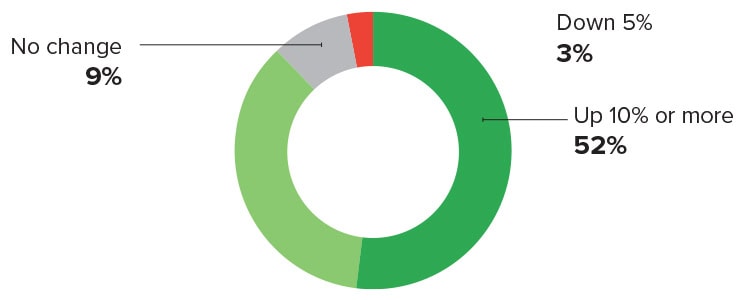

During the last year-on-year period, were sales generally up or down? About how much?

Not a single respondent (0%) says they experienced a sales decline of 10% or more versus a small number (3%) of those surveyed last year.

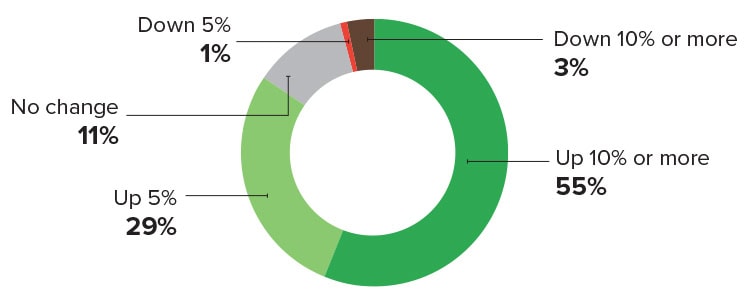

During the last year-on-year period, did your customer base grow or shrink? About how much?

No respondents (0%) report a customer base decrease of 10% or more—the same percentage as in 2024.

During the last year-on-year period, were profits up or down? About how much?

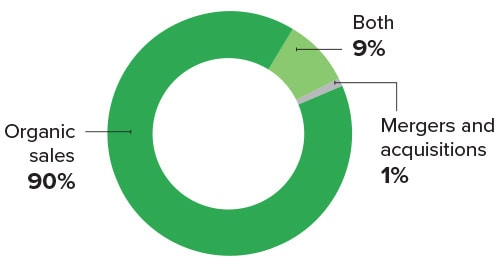

What led to growth in the past year?

IT vendors overwhelmingly cite organic sales as the main reason for growth. Supply chain and logistics technology solutions providers continued to enjoy enviable growth in their customer bases in the year leading up to the 2025 survey, matching the sharp growth they saw in sales.

IT vendors overwhelmingly cite organic sales as the main reason for growth. Supply chain and logistics technology solutions providers continued to enjoy enviable growth in their customer bases in the year leading up to the 2025 survey, matching the sharp growth they saw in sales.

Overall, 88% of respondents saw their customer base grow by about 5% or more, while 85% of last year’s respondents saw similar growth.

That aligns with sales numbers as 89% of vendors report sales growth of 5% or more in the 2025 survey versus 84% in 2024.

Drilling further into those numbers and their impact, 84% had a profit of approximately 5% or more compared to 81% of respondents in 2024.

TECH IN ACTION: How can technology provide supply chain visibility?

A digital twin can offer visibility amidst supply chain complexity. Take the Radeberger Group, for example, a brewery that owns nearly 60 different beer brands in Germany and operates 14 facilities for beer and one for alcohol-free beverages. It also distributes global brands such as Guinness from Ireland and the beverages of U.S.-based PepsiCo in Germany. “We supply every type of food outlet, from corner stores to major wholesalers,” says Emil Wagner, digital supply chain manager for the Frankfurt-based company.

It turned to Siemens Digital Logistics to explore the use of its Supply Chain Suite (SCS), which identifies cross-enterprise, cross-system logistics data and aggregates it according to each customer’s needs. The resulting digital twin allows detailed simulations of the various factors affecting production and logistics and their impact on the supply chain.

The brewery used SCS to optimize its distribution fleet and to plan several truck hubs in the vicinity of a brewery. The Radeberger Group uses the tool to plan its delivery runs, and the digital twin enables the company to study the downstream effects of every action, examine supply chain capacities and breaking points, and work out details, such as how to optimize logistics workflows in brewhouses, tank sites, and storage facilities.

“The digital twin gives us the big picture of the entire breadth and depth of our brewery group’s supply chain,” Wagner says. “We can also respond to day-to-day changes as well as simulate and plan for future changes.”