By the Numbers: Tracking Carrier Performance

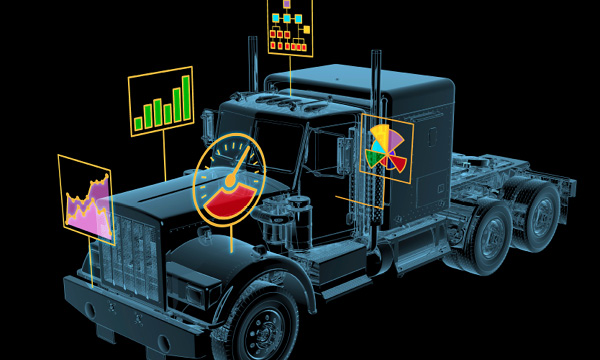

How well is your trucking company working for you? Metrics offer insight into carrier performance and benchmarks for improvement goals.

Safety First: Tracking Scores Online

If you want to know what’s going right—or wrong—with your carriers, look to the numbers. Some transportation companies are so eager to demonstrate the great job they’re doing, they monitor their own performance against specific goals, and publish the results to their customers. In other cases, shippers capture data on carrier activity and use it to assemble carrier performance reports.

Either way, performance reports offer fodder for crucial conversations between shippers and their transportation partners. Carrier metrics can help determine who gets more of your freight in the future, and who gets less. They can provide substance for price negotiations, and inspire both parties to modify processes to achieve more efficient and effective transportation.

How well is your carrier working for you? Here are several approaches that could help you find out.

Central Freight Lines: 99 is the Magic Number

In early 2012, less-than-truckload (LTL) carrier Central Freight Lines started to produce what it calls a Customer Scorecard for each shipper it serves. "We’re doing a good job, and we want to share that information," says Mari Ellen Borowski, director of business development at Central Freight Lines in Fort Worth, Texas.

Central Freight’s scorecard focuses on five metrics: pickup performance, on-time delivery, exception-free delivery, claims-free service, and invoicing accuracy. The carrier’s goal is to succeed in each category at least 99 percent of the time. The report card shows how well Central Freight has performed against that goal, in each category, for individual customers.

Along with performance figures for individual shippers, the report includes a set of cumulative scores, showing how Central Freight has performed in each category across all of its customers.

The information used to calculate the scores comes from Central Freight’s mainframe computer system, which collects data on every shipment. In-house information technology staff developed the software that calculates the metrics.

Typically, an account manager delivers a printed copy of the scorecard to the customer quarterly. But Central Freight also offers custom reports. "We can run reports by the week, month, quarter, or year," says Borowski. "If customers want to review shipping data, we can provide it when they want it."

Along with the percentage of successful transactions, the report card reveals the data behind each score. If the customer wants more information than the scorecard shows, the account manager can pull up the details.

Say, for instance, that Central Freight based the report on 120 shipments, but the customer doesn’t recall the carrier handling that volume. "We could drill down to show the 120 individual shipments," Borowski says.

The scorecard provides a focus for conversations between the account manager and shipper, to discuss not only Central Freight’s successes, but also any issues that may have emerged. For example, if the carrier accidentally sends a shipment to the wrong destination, that error will show up in the data behind a low score. The account manager will explain why the problem occurred, what Central Freight did to rectify the issue, and what measures it is taking to ensure it never happens again.

"Having the account manager walk in with the scorecard—whether the customer has requested it or not—is very important," says Borowski. "We’re being proactive, and ensuring that all the necessary processes are in place to move freight quickly and claims-free. Initiating the dialogue, and sharing data, creates long-term, solid partnerships with shippers."

Saia LTL Freight: The Data Shippers Want

Saia LTL Freight, based in Johns Creek, Ga., has been producing sets of Customer Service Indicators (CSIs) since 1998. Back then, the only metric most carriers reported was on-time delivery. Saia asked members of its customer advisory board what information would help them decide which carriers should get their business. The customers came up with six metrics, which Saia started to track.

The list has evolved since then. For example, Saia used to track how quickly it responded to inquiries about freight status. "Once carrier websites started providing real-time shipment tracking and tracing, that became a moot issue," notes Sally Buchholz, Saia’s vice president of marketing and customer service.

Today, Saia’s CSIs measure pickup performance, on-time delivery, claims-free service, exception-free delivery, claims settled within 30 days, and invoicing accuracy.

Much of the data Saia uses to calculate the CSIs is captured automatically from onboard computer systems, which eliminates the risk of human error. The carrier posts a new report for each shipper every month. Customers can log into Saia’s website and pull up their own reports at any time, rather than having to contact the carrier.

Saia’s sales reps use the CSIs in monthly or quarterly meetings with customers. "The rep can update the shipper on how many shipments we’ve handled for them, and how many were delivered and picked up on time," Buchholz says. "The meeting provides a chance to show the customer we understand their business."

Before the meeting, if reps notice a dip in any of the scores, they research the cause of the problem, and find out how Saia expects to resolve it. "They can approach the customer proactively and say, ‘I see this, but I want you to know what we did about it, and it’s not going to happen again,’" Buchholz says.

Saia’s pickup performance and on-time delivery CSIs are especially important to Nancy Williamson, vice president of distribution at the GF Health Products distribution center in Hazelwood, Mo.

GF Health Products, also known as Graham Fields, manufactures and distributes healthcare equipment for medical-surgical and long-term care facilities. The company uses Saia for many of its shipments from Hazelwood to customers in the Midwest and the West. The DC loads a trailer for Saia to pick up every evening at about 5:30. "If Saia misses that pickup, we lose a day of service to our customers," Williamson says.

On-time delivery is crucial because Graham Fields’ customers require delivery on specific dates. Metrics help the company decide which carriers can best serve specific regions, and determine when customers must place orders to meet their delivery requirements.

Sometimes, a lower-than-usual CSI might point to problems that the shipper, rather than Saia, needs to correct—excess damage claims, for example. "We’ve helped companies fix their packaging, or find a different way to load freight so it travels safely," Buchholz says.

A dip in the score for invoicing accuracy could trigger an investigation at Graham Fields. For instance, the underlying data might reveal many "reweighs," in which Saia charges for a load that weighs more than Graham Fields thought it was shipping.

"If the report shows many reweighs, I ask if the item master in our system contains the correct weight and dimension information," says Williamson. The DC might start weighing items right before shipping and recording that weight. If a discrepancy arises, the company can tell if the error lies with the shipper’s or carrier’s IT system.

UltraShip TMS: Less Labor, More Consistency

Shippers that want full reports on all their carriers don’t need to wait for each one to create a scorecard of its own. Several IT vendors offer tools shippers can use to calculate performance metrics, letting them make apples-to-apples comparisons among their transportation providers.

One such vendor is UltraShip TMS, based in Fair Lawn, N.J., which has included a carrier scorecard feature in its Software-as-a-Service (SaaS) transportation management system (TMS) since 2004.

Before then, UltraShip customers assembled performance reports manually. "Some companies still collect all the data at the end of every month, compile the scorecards, then distribute them," says Nicholas Carretta, president of UltraShip. By generating scores automatically, UltraShip’s tool makes performance reporting a consistent part of the shipper’s process, and eliminates inefficient work.

Shippers determine which metrics they want to track, often using different indicators for truckload, LTL, ocean, and air carriers. Popular metrics include the rate at which a carrier accepts tendered loads, on-time pickup and delivery, and how promptly the carrier provides status updates.

It’s also important to track when drivers arrive at pickup and delivery sites, and when they leave. That helps determine whether a carrier deserves to collect detention charges—penalties imposed when drivers wait too long for a company to load or unload freight.

"The carriers certainly won’t get the same consideration for detention if they arrived late as if they arrived on time," Carretta says. But if drivers consistently arrive on time and leave late, the shipper might need to improve loading or unloading procedures.

Shippers can receive a scorecard for each of their carriers automatically, at given intervals—say, as an e-mail attachment once a month, or once a week. Users can also enter a carrier’s name, type of shipment (such as inbound or outbound), and date range to obtain an ad hoc report.

Like the performance reports that some carriers provide, shippers use UltraShip’s scorecard to dig into the root causes of transportation problems. The scores also provide a basis for rate negotiations. For example, if a carrier asks for a three-percent increase, and the scorecard shows that it delivers on schedule only 85 percent of the time, the shipper might not accept that hike as it would for a carrier with a 98 percent on-time delivery rate.

"That’s where shippers want to see the metric come into play—to ensure they’re spending their transportation budget on carriers that provide the best performance," says Carretta.

CTSI-Global: Side-by-Side Comparisons

Brian Scott remembers what it took to assemble performance reports in the early 1990s, when he managed logistics for a record company. "We employed staff who did nothing but gather metrics for carriers, so when they came in for meetings, we would have some relevant data to talk about," he says.

Those employees pulled data from three or four sources, including reports from carriers, a freight payment and audit company, and internal systems. Employees would enter that data, then organize it to help spot trends and make comparisons.

When Scott left that company to work for its freight payment and audit service, Memphis-based CTSI-Global, he knew customers needed a simple way to generate carrier report cards. CTSI now offers that capability as part of its business intelligence suite. Scott currently works as CTSI’s senior vice president of global sales.

Data for the CTSI Carrier Report Card comes from the freight bills CTSI manages for customers. The company also offers a TMS, which provides data on pickups, deliveries, claims, and other transactions. If a customer uses a different TMS, CTSI will integrate with that third-party system to capture the necessary data.

Customers generally use the report cards to track their freight costs per pound or per kilogram, on-time performance, claims, and fuel usage.

CTSI delivers the report cards once every month, online. Shippers can view performance data for individual carriers; they can also group data by mode, allowing them to compare carriers that provide similar services. "That way, the shipper can tell the carrier, ‘You move the same basic lanes that this other carrier does, but your cost per pound is $15, while theirs is $12,’" Scott says.

Reducing the time and labor required to assemble performance metrics is the biggest benefit shippers gain from the Carrier Report Card, Scott says. Another is the ability to quickly compare carriers inside their mode. With a few clicks, the shipper can view side-by-side bar graphs showing metrics for two or more LTL carriers, rail carriers, or carriers in any other category.

That data might inform price negotiations, or help a shipper decide to switch some freight from one carrier to another. "Or if the shipper holds annual carrier meetings, they can use these report cards, without the names, to show how carriers are measuring and trending against each other," Scott says.

Alcoa: Award-Winning Metrics

Metals manufacturer Alcoa uses seven metrics in a program that rewards core carriers for excellent performance. Alcoa created the North America Core Carrier Awards to help improve the company’s sourcing model.

"We used to have 1,200 carriers under contract—some provided little, inefficient, or no service to our facilities," says Edward Hamorsky, director of global logistics and transportation at Alcoa in Knoxville, Tenn. Today, Alcoa works with just 165 carriers—all high performers.

Alcoa uses data from its freight payment system and a TMS from BestTransport, Worthington, Ohio, to evaluate carriers based on:

- Acceptance percentage: The percentage of tendered loads the carrier accepts.

- Data population: The number of fields in the TMS that the carrier fills in. Among those fields is the actual delivery date, which Alcoa uses to track on-time performance.

- Pro-number: Whether the carrier enters shipments, identified by invoice numbers, in the TMS.

- Volume: The amount of freight hauled. "If carriers miss their minimum volume targets three months out of 12, they are eliminated from the program," Hamorsky explains.

- Contract publication of rates: Carrier responsiveness in publishing rates in Alcoa’s electronic approval process.

- Scope and sustainability: Whether a carrier is hauling at least a minimum number of shipments for several plants. A carrier that serves multiple plants helps Alcoa match outbound and inbound loads, reducing deadhead miles. And when the same carriers serve Alcoa repeatedly, that helps build trust.

"We know them and they know us," Hamorsky says. "As a result, the carriers understand our expectations and commitment to safety."

- Expirations: Whether carriers respond to loads tendered in the TMS before those offers expire.

Each night, Alcoa’s transportation management and freight payment systems transfer data into a transportation data warehouse, where it is accessed for analysis based on the seven performance metrics. "Each category has a specific target for carriers," Hamorsky says. "If they hit the target, they earn a certain number of points." Carriers that exceed a target net extra points; those that miss a target lose points.

Alcoa recognizes top scorers at an annual awards dinner, presenting each winner with a trophy modeled after the Alcoa aluminum truck wheel. In 2013, Alcoa presented awards to 20 core carriers, including flatbed, van, truckload, and intermodal service providers.

Now that it is working with fewer carriers, each of which handles a bigger chunk of its business, Alcoa’s transportation network operates more efficiently.

"We can offer carriers lane density in our network to help drive down empty miles, and reduce our mutual cost of doing business," Hamorsky says. "This positions Alcoa’s business to be more attractive, and motivates our carriers to collaborate with us to offer creative, cost-effective solutions that benefit both companies."

Describing the benefits of Alcoa’s awards program, Hamorsky refers to a well-known business adage: "You can’t manage what you don’t measure."

Whether the numbers come from a shipper’s own IT systems or from its carriers, performance reports provide vital tools for managing, and improving, freight operations.

Safety First: Tracking Scores Online

When shippers are assessing a carrier’s service performance, they often keep an eye on another set of numbers: the U.S. government’s Compliance, Safety, Accountability (CSA) scores.

The Federal Motor Carrier Safety Administration (FMCSA) launched its CSA initiative in 2010 to identify trucking companies that don’t comply with federal safety rules, so it can target them for enforcement.

CSA uses data from roadside inspections and other sources to assign points to truckers in seven areas, known as the Behavior Analysis and Safety Improvement Categories (BASICs). A company can get points for violations related to unsafe driving, fatigued drivers, driver fitness, controlled substances/alcohol use, vehicle maintenance, cargo, and the frequency and severity of crashes.

The score a trucking company earns is not an absolute measure. It’s a percentile figure that shows how the company compares with other carriers deemed to be similar. The best possible score is zero, the worst is 100.

A carrier that scores above a certain “intervention threshold” (defined differently for each BASIC) gets marked with a yellow “alert status” triangle on the CSA website, and is singled out for close scrutiny.

The comparative nature of the CSA scores makes them controversial. Some carriers with low CSA scores nevertheless have high crash rates, says Steven Bryan, chief executive officer at Vigillo, a Portland, Ore., firm that markets solutions for accessing CSA data.

“And some carriers have high CSA scores and low crash rates,” he adds.

Although not everyone agrees that CSA scores accurately reflect safety performance, liability concerns still force shippers to pay close attention to CSA data, Bryan says.

In 2009, Vigillo debuted an online system that motor carriers could use to see their CSA scores, which at the time were not always easily available from the FMCSA. Then trucking companies that also served as freight brokers started asking to access the CSA scores of other carriers. To help brokers, and shippers with similar concerns, Vigillo developed a solution called Carrier Select.

Vigillo maintains a database on 1.4 million motor carriers, including CSA data and information on each carrier’s insurance status and operating authority—all publicly available facts. A customer uploads the U.S. Department of Transportation identification numbers for the motor carriers it wants to monitor, then sets its tracking criteria.

“For example, some shippers think the unsafe driving BASIC and the Hours-of-Service BASIC are more critical to safety than some of the others,” says Bryan. That shipper might specify that it will not use a carrier with an alert status for both of those BASICS.

“If any carrier on their list violates the rules they have defined, we start alerting them,” says Bryan.

Vigillo doesn’t make decisions for shippers or brokers, nor does it provide advice. “We just have a tool that allows shippers to build in their own comfort levels, and monitor a designated list of carriers,” Bryan says.