End-to-End Visibility: The See-Through Supply Chain

In an era of constant disruption, supply chain leaders seek end-to-end visibility solutions to gain transparency from origin to final mile. The clarity that comes with supply chain X-ray vision helps them detect issues early, respond quickly, and build a resilient, agile network.

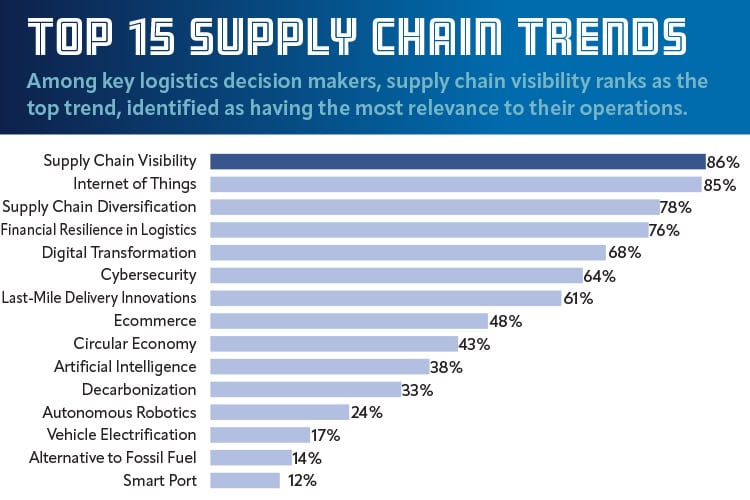

Supply chain visibility is no longer a nice-to-have—it’s the critical edge businesses need to navigate today’s volatile global landscape. Indeed, supply chain professionals ranked visibility first among 15 trends in a 2024 survey by Maersk, placing it ahead of issues such as supply chain diversification, cybersecurity, and ecommerce (see chart below).

Source: Maersk survey

Between 2019 and 2023, more than 5,500 patents were filed for technologies in the field of supply chain visibility, according to the Maersk report.

Interest in visibility solutions is booming as companies seek ways to boost resilience and manage supply chain volatility and disruptions by getting a complete picture of their end-to-end supply chain.

“The earlier you gain visibility, the better you can respond to—or even avoid—disruptions,” says Christian Titze, vice president, analyst, and chief of research with Gartner.

Geopolitical events also make visibility mission-critical, as it enables companies to map suppliers and spot instances where a sudden tariff hike or regional disruption could affect them, says Adhish Luitel, principal analyst with global technology intelligence firm ABI Research.

Real-time tracking and intelligence can provide the agility needed to help firms quickly pivot sourcing or shipping plans when trade policies change or political events disrupt logistics, he adds.

Tariffs are particularly troublesome because they can impact all transportation modes simultaneously. Visibility can help companies identify options, such as redesigning products to shift away from materials impacted by tariffs, so they can maintain service and quality while reining in costs.

“This is hard to do if you don’t know where your goods are,” says Eric Fullerton, vice president, product marketing with project 44, which offers a supply chain platform.

The growing number of regulatory mandates also prompts interest in visibility.

Visibility for All

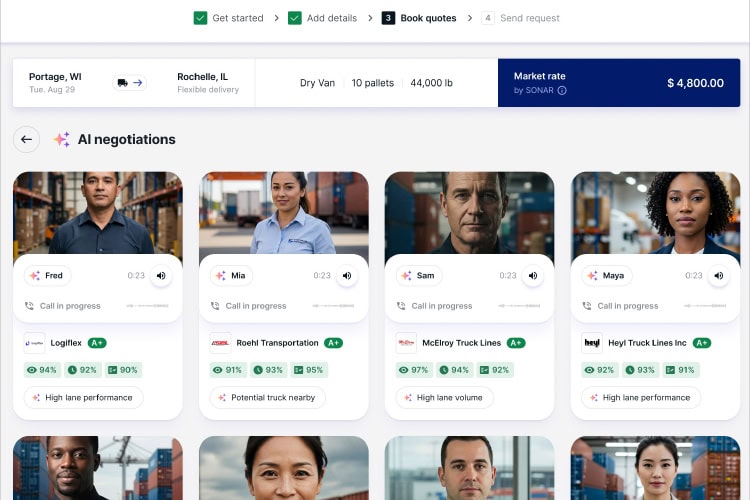

Supply chain platforms like this one from project 44 may offer AI agents who can provide real-time data that leads to greater visibility.

Carriers also benefit from greater visibility. “They need to know where goods are so they can optimize routes and planning,” says Rusty Redecker, vice president, sales, global logistics, with Avery Dennison.

The current emphasis on visibility and resilience is a shift from about 20 years ago, when “best of breed” was a more common approach to supply chain planning, notes Mike Raftery, director, digital supply chain solutions with McKinsey. Companies would stitch together multiple systems and software to arrive at a plan that ostensibly provided the most value.

This worked fairly well, given the stability in the market at the time. Companies could work with a single supplier to save a few cents here and there, Raftery says. Companies focused on squeezing costs rather than agility.

From about 2020 on, however, the need to quickly manage disruptions became paramount. Many companies’ priorities shifted to responsiveness and agility.

Visibility is necessary for supply chain professionals to identify challenges, make intelligent decisions about addressing them, and then implement their plans. “Detect, decide, and act,” says Vikash Goyal, vice president of supply chain planning and collaboration strategy with Oracle.

If visibility tools identify an ongoing lane closure that impacts inventory in transit, for instance, an organization may decide to search for a new supplier that is not impacted by the closure.

Among the technologies that can facilitate visibility is sensor technology. A sensor fusion model—one that combines data from multiple sensors to provide a more complete, accurate representation of the environment or system being monitored—can include barcodes, RFID and/or LTE (Long Term Evolution, a wireless broadband standard), among other technologies.

RFID is widely adopted for tracking and identification, and increasingly integrated into AI. One RFID reader can read multiple tags, making it possible to account for products quickly, easily, and accurately. That means more accurate and timely information for AI and machine learning (ML) applications, and ultimately, better predictive analyses.

New visibility solutions emerge regularly, says Blythe Chorn, managing director, lead, supply chain sustainability with KPMG. Yet, while many organizations would like a one-stop visibility solution, success in identifying one may come down to how companies define risk, which can vary by industry, geography, or other factors.

For instance, a company in the food sector may source commoditized agricultural products that historically have been challenging to trace to origin. Regulations, such as the EU Deforestation Regulation (EUDR), require geospatial data on the origin of many agricultural inputs, requiring visibility back to the source, Chorn says. Yet these supply chains often are opaque.

Conversely, visibility for an automotive company facing increased cybersecurity concerns likely will be focused on Tier 1 and 2 suppliers, rather than raw materials. Given these differences, organizations in this sector likely will require more customized solutions.

From Visibility to Action

Sensor technologies, such as RFID, LTE, and fusion models, enhance and facilitate visibility in the warehouse, making distribution operations more efficient and adaptable to real-time demand. Tracking data from sensors is increasingly being integrated with AI solutions.

Visibility tools that can capture data are a first step. Technology that not only aggregates but provides insights based on the data and powered by artificial intelligence is crucial to making supply chains more efficient, sustainable, and adaptable to real-time demand, says Dylan Jones, senior product manager with IBM.

Demand forecasting is perhaps the oldest and most proven use for AI in supply chain, Jones says. Once demand has been established, reorder levels can be optimized by incorporating other available data and applying decision management AI.

That said, AI might not be able to provide all supply chain insights. For instance, the pandemic began abruptly but then rolled out over a long period of time. One might argue that there was some time to prepare and adapt to the upcoming disruption, Jones says. “However, the full extent of the supply chain disruption that followed would have been hard to predict,” he adds.

Technology platforms are increasingly using AI and machine learning for advanced predictive analytics, which is crucial for spotting potential disruptions, delays, and inefficiencies, says Sundip Naik, partner, supply chain, EY Americas logistics leader.

AI systems can aggregate data from diverse sources from within and outside a company, such as ERP systems, IoT sensors, weather forecasts, and supplier performance records, to provide real-time monitoring, for example. Machine learning models can process data to detect anomalies and patterns, such as seasonal demand spikes or supplier failure risks. Through predictive modeling, these can help detect and forecast potential issues, such as delays or bottlenecks.

Along with predictive capabilities, AI tools and platforms can employ simulations to assess risks, evaluate what-if scenarios, and provide actionable recommendations, such as identifying alternative suppliers, rerouting goods, or adjusting inventory.

Digital twins powered by AI can create virtual supply chain replicas to simulate disruptions and test responses, while machine learning can continuously update these models, creating an evolving, insightful platform to aid decision-making. By leveraging AI, ML, and visibility solutions, companies have the tools to analyze complex scenarios, evaluate various options, and identify actions that can optimize operations, minimize costs, and boost customer satisfaction.

While data is the foundation of visibility, it must be accurate, complete, and relevant to be useful. Titze provides this example: a company implements real-time transport visibility across multiple modes but lacks a crucial link to its bills of lading. As a result, the company could track shipments but couldn’t identify which products were in each shipment.

If the system had integrated shipment data with bills of lading, the company could have understood which products were affected by delays, helping them better assess impacts on production and sales. “The key,” Titze says, “is connecting different data sources to the specific use case.”

Data Accessibility and Accuracy

Concerns over data quality issues shouldn’t be a reason to resist taking action, however. “We have come to a point in time where organizations can no longer be avoidant,” Jones says. Moreover, AI or rules-based processing can help to identify and address data quality problems.

Using AI to remedy data quality issues usually creates a small subset of quality data that can be used for model training, which can then be used to identify gaps in the greater data set.

Now that companies have begun to figure out how to leverage data from within their own facilities, they’re looking outside at the data held by suppliers or customers in order to collaborate insightfully with their business partners. “That’s the next frontier of visibility,” Raftery notes.

One obstacle to conquering this frontier is trust. Suppliers may hesitate to share upstream sourcing information with buyers because it’s often a competitive advantage. Technology can play a role, by enabling protections around data sharing so that supplier data is not inadvertently shared with potential competitors, Chorn says.

Implementing Guidelines

Many food companies now face strict rules and regulations requiring full traceability of agricultural products. As a result, transparency is required all the way back to sources of origin, making greater visibility a top priority.

An “inside out” perspective helps when implementing AI and visibility solutions, Jones says. Businesses need to understand their current processes and data, along with the general areas in need of improvement before placing quantities of information within an AI algorithm. Knowing their current operations makes organizations better positioned to become more resilient.

A key part of evaluating AI visibility solutions is determining how the model is trained. Among other questions, supply chain organizations will want to ask vendors how the solution generates recommendations, and the data it uses.

When evaluating visibility solutions, it’s important to assess their ability to integrate with existing systems, such as the company’s ERP and WMS platforms, as well as external data sources, like supplier systems and IoT devices. Platforms with APIs or middleware that can provide seamless data exchange and integration can help avoid data silos.

As supply chain organizations implement visibility tools, solid communication and training initiatives are critical. For instance, the supply chain team might launch a new visibility solution, yet leave trade and customs out of the planning, so they don’t know it exists. “You leave a lot of value on the table,” Chorn says.

Equally important is the ability to connect insights from a visibility solution to the right teams within the supply chain and the broader business. This often requires data science expertise, explains Mary Rollman, U.S. supply chain leader at KPMG. Such expertise ensures that alerts generated by the system reach the appropriate teams, helping organizations not only maximize the value of their visibility tools but also refine and train the system for ongoing improvement.

Even as visibility and AI solutions advance, challenges remain. Many companies would like an “agnostic clearinghouse for data,” Raftery says, but it’s not that easy. Often, visibility requires connecting systems built for different purposes, which adds complexity.

While the market appears to be moving toward collaboration between suppliers, a silver bullet has yet to be found, he adds.

Human and Technical Challenges

Because different visibility vendors and solutions currently serve different segments of supply chain and logistics functions—say, shipment, product, or inventory visibility—organizations typically need to start by focusing on a portion of their supply chains, and thus a single data hub, as they work toward end-to-end visibility, Titze says.

Human nature can also complicate efforts to gain visibility. Some may feel it’s necessary to look at every possible piece of data in one place, Goyal says. To that end, they’ll create data lakes (centralized repositories that ingest and store large volumes of data in its original form) instead of focusing on the applications that will save immediate effort and money.

After starting with an area likely to generate the most value, supply chain organizations can work through a roadmap of subsequent segments. “Trying to boil the ocean is a recipe for disaster,” Redecker adds.

It’s also critical to consider the return on any investment. Prioritizing flexible subscriptions or modular approaches and avoiding unnecessary features can help organizations capture ROI more quickly.

End-to-end visibility currently remains more an aspiration than a market reality. “But the capabilities are there and the market is heading in that direction,” Redecker says. Some companies are accelerating toward this in a massive way. “There’s huge opportunity,” he adds.