Food Packaging: That’s a Wrap

Environmental impacts, cost concerns, and technology advances drive food packaging innovation.

From food packages constructed of cornstarch and plant-based coatings that extend fruit freshness to liquor bottles made of paper, traditional food and beverage packaging is undergoing an overhaul.

“Numerous initiatives in the United States and Europe fund work on alternative plastics,” says Carson Meredith, executive director with the Renewable Bioproducts Institute and a professor at the Georgia Institute of Technology.

Behind this innovation is growing recognition that the convenience of traditional single-use packaging imposes significant environmental and economic costs.

“Single-use packaging relies on the continuous extraction of limited raw materials to keep up with market demand,” says Bridget Croke, managing director with Closed Loop Partners, a New York-based investment firm focused on building the circular economy. This degrades ecosystems and emits greenhouse gases.

Moreover, because materials are thrown away rather than recaptured at the end of their use, their economic value ultimately goes to waste, too. Disposal fees and processes also add costs.

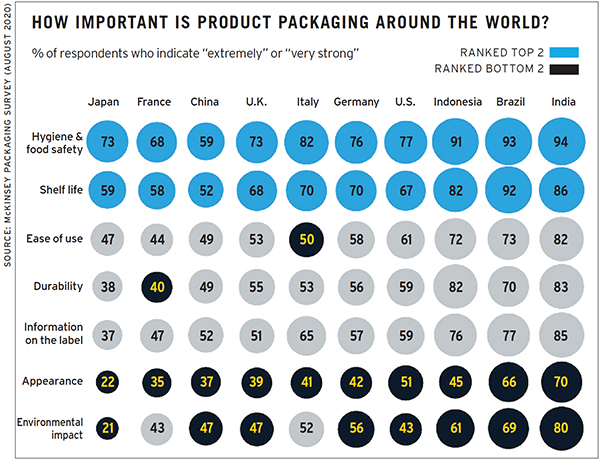

Growing consumer concern about the environmental impact of food and beverage packaging also has an impact. Consumers’ top concerns about food packaging are, understandably, hygiene and safety, according to a recent McKinsey & Company survey (see chart). At the same time, 55% of those surveyed indicate they’re extremely or very concerned about the environmental impact of packaging.

Advances in technology also play a role. “Technology is a game-changer in enabling more reuse opportunity,” says Tim Debus, president and chief executive officer with the Reusable Packaging Association.

One example comes from RM2, which embeds Internet of Things (IoT) sensor technology in its composite pallets. The sensors capture and transmit each pallet’s location, temperature, and shock and tilt events.

“Customers know exactly where their pallets and product are, what temperature they’re experiencing, and whether any damage-causing events occurred—and when and where—in real time,” says Mark Gordon, senior vice president of business development at RM2.

The sensor technology is less expensive and easier to use than the mix of location trackers, temperature and vibration sensors, and accelerometers that would otherwise be needed to capture the same amount of data.

Reusable Packaging

Innovation makes it easier to reuse food packaging. For instance, OZZI has developed a closed-loop system of reusable meal containers along with a patented collection system.

OZZI’s bright green containers have the same basic shape as many Styrofoam to-go containers. However, they’re made from BPA-free plastic that can be cleaned and reused hundreds of times and then recycled, says Tom Wright, chief executive officer with the North Kingston, Rhode Island-based firm.

Just as important as the containers themselves is the collection solution. For reusables to work, you need a “user-friendly” collection system, Wright says.

With the OZZI system, dubbed O2GO, diners check out their containers, enjoy their meals, and then return the containers to a collection device that looks similar to a vending machine. Typically, these are located at multiple places around a facility or campus. When they’re getting full, the machines alert the staff, who can then empty them and move the containers for cleaning. OZZI averages a return rate of about 98%, Wright says.

The company launched its solution on college campuses and has since expanded to other campus-type environments, including healthcare facilities, senior centers, and office buildings.

Another venture, Brooklyn, New York-based Returnity Innovations, focuses on reusable packaging for e-commerce deliveries. The company has developed packaging solutions for other products, including clothes and furniture, and is working on solutions for food and beverage companies, says chief executive officer Mike Newman.

Each solution is tailored to the company and product, and follows what Newman calls the “3P” framework:

1. Process. What process will be used to get the package back? It should be easy and low cost.

“The biggest, most important thing for companies looking at reusables is the cost of packaging return,” Newman says. If a company’s existing logistics model doesn’t include the return of the package, adding this function can impose a significant new expense.

“There are ways to make return costs low enough, but you have to start there and integrate an efficient returns process or it will not scale,” he adds. A returns process added as an afterthought will likely be harder to scale.

2. Participation. How can you entice the customer to follow through? For instance, can consumers return their packages at the same place they make other returns?

3. Packaging. Finally, what packaging will meet the requirements identified in the previous two steps?

Typically, Returnity’s packages use fabric, often manufactured from recycled bottles, rather than plastic molding. One reason: Fabric is usually more cost-effective in small quantities. It also tends to work better for items that are not stacked on pallets, but instead are transported in a bike messenger’s bag.

Any e-commerce package also has to “win the doorstep experience,” Newman says. With online purchases, the package is often the only physical connection between company and consumer, he notes. It needs to create a favorable impression.

The Liviri Shuttle, designed for local grocery delivery services, is lightweight, insulated, and reusable, says spokesperson Logan Martinez. Because the Shuttle can keep perishables in a safe temperature zone for 12-plus hours, it makes unattended deliveries possible, increasing route efficiency.

After a shipment is received, consumers simply take their perishables out of the box, close the lid, attach the included return shipping label for pickup, and return it via FedEx or another shipping service.

In a survey looking into what U.S. consumers expect from product packaging, McKinsey finds that hygiene and food safety, shelf life, and ease of use are the topranked factors.

Environmental impact is one of the lowest of seven, after appearance and durability. Forty-three percent of surveyed U.S. consumers cite environmental impact as extremely or very important for packaging, compared with 77% for hygiene and food safety, 67% for shelf life, and 61% for ease of use.

The relatively low importance U.S. consumers attribute to environmental factors is not unique; the McKinsey survey finds similar sentiments in China, France, and the U.K.

Rethinking Traditional Packaging

Some companies are devising ways to use traditional packaging materials in more environmentally friendly ways. Beverage giant Bacardi, for instance, is developing a paper bottle as well as a biodegradable biopolymer bottle, both scheduled for commercial availability in 2023, says Jean-Marc Lambert, senior vice president, global operations. These will help replace the 80 million plastic bottles Bacardi currently produces each year.

Both types of bottles will biodegrade in roughly 18 months, versus the more than 400 years plastic bottles require to decompose. “It’s a major step toward the company’s goal to be entirely plastic-free by 2030,” Lambert says.

What’s more, Bacardi has committed to sharing the technology used to make its biopolymer bottle after its launch. “We want to help move the needle for the entire industry,” Lambert says.

As more companies swap plastics for biodegradable alternatives, production costs will decline, making it a viable option for even more companies.

Recart, a new product from Tetra Pak, a food processing and packaging solutions company, offers an alternative to cans and bottles. The paperboard used in Recart can cut carbon emissions generated with traditional glass and aluminum packages by 81%, the company says. In addition, one truck’s worth of empty Tetra Recart cartons, delivered flat, is equivalent to nine trucks’ worth of empty cans, says Lars Holmquist, executive vice president, packaging solutions and commercial operations with the Lausanne, Switzerland-based company.

Recart packages weigh 20 grams (less than one ounce) versus 50 grams (1.8 ounces) for a can; the difference grows even bigger when compared to glass jars. “The overall cost of production when using Tetra Recart packages instead of cans offers a 15% to 20% savings,” Holmquist says. The rectangular shape of Recart packages also makes them well suited for shipping.

Some companies are developing packages made from renewable resources that aren’t traditionally used as packaging materials. ClimaCell from TemperPack, for example, is made from a mix of cornstarch and kraft paper, and can help reduce the use of Styrofoam, says Jed Dutton, vice president of marketing with the Richmond, Virginia-based company.

The result of numerous experiments with hundreds of formulations, ClimaCell is lightweight, strong, and traps air so it doesn’t let the cold out, nor the heat in. It can protect overnight and two-day deliveries for meal kits, prepared foods, medicines, and other products.

It can also be manufactured at scale, compete with Styrofoam on price, and can be shipped flat. Just as important, it offers “a nice presentation,” Dutton says.

NonPackages provide Protection

Some packaging innovations aren’t technically packages. Apeel, based in Goleta, California, offers a plant-based coating that can double the shelf life of produce, reducing reliance on plastic packaging and the need for refrigeration, the company says. It does this by creating an edible “peel” on the outside surface of fresh produce that retains moisture and resists oxidation, helping to slow spoilage.

The Apeel formula is distributed as a powder and then mixed with water at the packaging center, where it can be applied by spraying, dipping, or brushing. Currently, Apeel is available to organic and conventional suppliers of many varieties of produce, including avocados, oranges, limes, cucumbers, and apples.

The company is also working to develop formulations for other items. Because the factors that determine the shelf life of produce, such as water loss and ripening rates, vary with surface properties like roughness and porosity, different formulations are needed for different types of produce.

In a similar vein, StixFresh uses a sticker that’s placed on fruit to deliver a compound that releases a protective barrier, slowing the ripening process and making it less susceptible to rotting, says chief executive officer and co-founder Moody Soliman. The sticker can be applied at any point after harvesting, including by consumers, although it offers the greatest impact when applied at the distribution stage. That’s also when many branding stickers are applied, making it easy to incorporate into the process.

For berries and other fruits that often come in clamshells, StixFresh can be dispersed through a sachet that’s dropped into the package.

The company, which has its U.S. headquarters in Kirkland, Washington, has tested its solution with a European retailer. StixFresh reduced the losses on blueberries by 25% after seven days and on nectarines by 30% after seven days, Soliman says.

Along with produce, StixFresh is looking to expand to other types of food, such as baked goods. To get there, the company’s research and development team identifies the diseases impacting the foods, as well as the compounds that can target the diseases. “We develop the formulations and can apply them to a variety of surfaces,” Soliman says.

Weighing Challenges and Benefits

While these innovations have already shown substantive benefits, all new packaging solutions face challenges. These packages will reshape how materials flow through supply chains.

“These solutions are designed with entire recovery systems in mind, taking into consideration where materials go after use and how they can be kept circulating in our economy for as long as possible,” Croke says. While these are all positive changes, they still require adjustments.

Because packaging is incorporated within many companies’ processes, shifting from one type to another can require significant operational changes.

Most food companies will require testing of new packaging. Along with confirming that it keeps food safe and clean, they’ll want to check whether it affects the taste of the product, says Tom Porter, vice president, industrial projects with real estate firm JLL.

And, changing long-standing consumer behaviors won’t happen overnight. “There is no panacea to the complex issue of global waste mitigation, and a wide range of solutions that fit different contexts need to be thoroughly tested over time, in the lead up to widespread use,” Croke notes.

At the same time, it’s possible to make a solid business case for many types of reusable and sustainable packaging, even before considering the environmental benefits.

For instance, reusable packaging is often sturdier than single-use options. That may mean more packages can be stacked on top of each other, allowing for more efficient—and less expensive—shipping. Reusable packaging also can cut disposal costs.

“Walk through how reusable packaging will drive efficiencies at your company,” Debus recommends.n