Global Logistics—May 2014

U.S. Welcomes European Invasion

A European invasion is coming, but no need to worry—U.S. retailers will be welcome beneficiaries. Many U.S. companies are exploring European materials handling and last-mile strategies as omnichannel complexity, delivery urgency, and urban logistics complicate new market opportunities.

A few notable examples of this European invasion were on display at the March 2014 MODEX Expo in Atlanta. One is Swisslog‘s robotic AutoStore small parts storage system—which optimizes the use of labor and space, two constraints pervasive in Europe. There are only a few installations in the United States thus far, but Bill Leber, Swisslog’s director of business development, expects the system to gain traction because emerging retail and distribution dynamics are changing the way companies view their automation architecture.

Businesses are moving toward more decentralized DC networks, with facilities located closer to demand. They want to consolidate inbound moves, and keep expensive last-mile transportation in check. Consequently, warehouse footprints are trending smaller, which requires a different type of storage solution. Leber even envisions brick-and-mortar retailers eventually using the AutoStore system in their back rooms to fulfill direct-to-home orders.

The omnichannel phenomenon is creating new retail formats at same-day speed. Walmart, for instance, now operates five different types of stores: the Supercenter, Sam’s Club, Neighborhood Markets, Express stores, and Campus stores. The retailer is also starting to leverage these footprints in unique ways — tethering smaller stores to larger ones, for example.

At the same time, the world’s population is getting denser. "By 2050, 85 percent of the developed world population will live in cities," notes Alan Erera, associate professor and chair for graduate studies at Georgia Institute of Technology. "In the United States, urban population growth is currently outpacing the suburbs."

This densification requires new tactics to manage e-commerce growth, omnichannel complexity, and expedited delivery demands.

Space has always presented a challenge in Europe—especially in densely populated cities. Continental service providers, who have been dealing with the space problem for years, developed some innovative distribution strategies for managing timely deliveries and same-day service.

"Europe is adept at ensuring timely deliveries in dense areas," explains Bobby Miller, global CPG strategist for planning software vendor ORTEC. "The strategy is all about mom-and-pop stores, smaller trucks, and fulfilling from everywhere."

Atlanta-based ORTEC has been helping European grocers use technology in innovative ways. While urbanization presents routing challenges, retailers can focus on value-added last mile, direct-to-home delivery services if they work in high-volume markets, which Europe has in abundance.

At the MODEX Expo, Miller demonstrated how some grocers are getting away from traditional planning — instead seeing order fulfillment as a constant churn of data transmissions and route optimization. He cited Dutch international retailer Ahold, which is using ORTEC’s technology, and a network of distribution hubs and local depots, to fulfill same-day orders in Rotterdam — within 18 hours of order acceptance.

Belgium-based Delhaize Group has enjoyed similar success in Greece with a hybrid omnichannel approach. It leverages a network of seven hubs, 50 satellite neighborhood stores, and 100 trucks to fulfill online, phone, click-and-collect, email, and fax orders — all same day. The key differentiator is continuous planning and dynamic route optimization.

European technologies and strategies have had time to develop and mature. As U.S. companies start tackling similar parameters — especially in the context of smaller footprints and omnichannel complexity — a working lab with empirical results is just a continent away.

2014: Bad Air Days Ahead?

Air cargo is poised for stronger growth in 2014 after years of stagnation following the global financial crisis, reports the International Air Transport Association (IATA). The airline industry is on track to post its second consecutive year of improved figures, despite revising expected profits from $19.7 billion to $18.7 billion. Higher oil prices are expected to erode revenue.

"In general, the outlook is positive," says Tony Tyler, director general and CEO of IATA. "The cyclical economic upturn is supporting a strong demand environment, which is compensating for the challenges of higher fuel costs related to geopolitical instability. Overall industry returns, however, remain at an unsatisfactory level, with a net profit margin of just 2.5 percent."

While cargo is showing renewed strength (projected at four-percent growth in 2014), the industry is still challenged by poor infrastructure, restrictive regulations, and high taxes in different parts of the world. Moreover, the trend toward nearshoring will continue to have a negative impact on air freight as production locates closer to demand.

Here are some highlights of IATA’s report, by region:

- North America. The efficiencies gained through consolidation, and the contribution of ancillary revenues on the passenger side, are driving a 2014 profit forecast of $8.6 billion.

- Europe. Despite optimism over the end of the Eurozone recession, and the winding down of austerity measures, major structural issues—such as the failure of the Single European Sky—remain. With a $3.1-billion profit forecast for 2014, the European region also faces the greatest exposure to the geopolitical conflict in the Ukraine.

- Asia-Pacific. Airlines have the largest share of international air cargo. Turmoil in foreign exchange markets earlier in 2014, however, adversely affected growth prospects for large economies such as India and Indonesia. The resulting negative impact on passenger revenues more than offsets cargo improvements. IATA projects $3.7-billion profit in Asia-Pacific for 2014.

- Middle East. As revenues from high oil prices benefit home markets, and the region’s carriers continue to win market share in long-haul connections through Middle East hubs, IATA estimates a $2.2-billion profit for 2014. Cargo, in particular, is experiencing strong growth as a result of tapping into newly emerging trade lanes between Africa and Asia.

- Latin America. Poor economic performance in Argentina and Brazil, along with continued political and social unrest in Venezuela, are driving down profitability expectations to $1 billion for 2014. An improved industry structure achieved through consolidation—within Brazil and across borders—and a closer matching of capacity to demand are contributing to improvements over 2013 performance.

- Africa. Network development by a handful of African airlines is leading growth. But profitability—forecast at $100 million for 2014—is far from being evenly spread across the continent. While African governments are committed to achieving world-class safety levels by 2015, the continent suffers from lack of a holistic vision for developing connectivity across its vast distances. Poor regulation, high infrastructure costs, and an array of taxes and charges continue to hinder development.

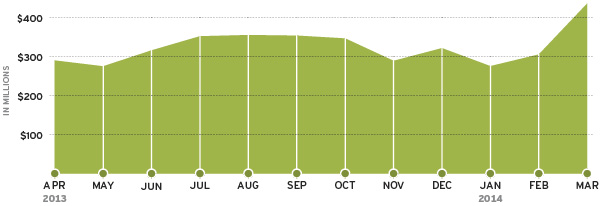

Here Comes the Sun: U.S. Solar Panel Imports

Sustainability initiatives continue to drive an increase in U.S. solar panel imports.

Source: Zepol Corporation

Brazil Gets a Sugar Rush

When the 2013 U.S. Midwest drought severely impacted crop production—notably soybeans—Brazil was widely tapped to help fill the void. But record crops raised new concerns about whether the country’s producers have enough assets and adequate infrastructure to meet export demand. Despite cheaper labor, Brazil is challenged by poor hinterland connectivity, adding to total logistics costs.

But sugar is sweetening the outlook. Declining freight rates are helping Brazilian sugar exporters grow business in Asia and the Middle East—to the detriment of Thai producers, suggests a recent Jakarta Globe report. Despite a longer distance to market, global consumers prefer Brazil’s sugar quality. Cheaper transport costs, in turn, have tipped the scale in favor of Brazil, which is the world’s largest sugar exporter.

Rates for larger Panamax size vessels were hurt by Chinese buyers defaulting on soybean cargoes from the United States and South America, according to the Jakarta Globe. An avian flu epidemic in China curtailed soybean and corn demand in the region, and soybean defaults increased the availability of vessels for hire.

Consequently, in March 2014, only 6,500 tons of Thai raw sugar was sold to China, one of the world’s leading raw sugar importers, compared with 290,000 tons from Brazil. As sugar stocks in Thailand continue to soar, producers are being forced to reduce prices in order to win back business.

Anchors Await

As if the ocean shipping industry needs another concern, global schedule reliability is trending downward, reaching an all-time low of 68.4 percent during the last period, suggests SeaIntel Maritime Analysis’ March 2014 Global Liner Performance report.

Hamburg Süd remains the most dependable carrier from a global perspective, with 84-percent performance reliability in February. Maersk Line at 79.5 percent ranked second, and CSAV ranked third at 75.8 percent. At the other end of the scale, Zim, MSC, and NYK were the lowest-performing steamship lines among the Top 20, according to the SeaIntel report.

Performance declined significantly along all the major east-west trade lanes—Transpacific Eastbound, Asia to North Europe, Asia to the Mediterranean, and Transatlantic Eastbound. Europe to Africa was the one notable exception, demonstrating a seven-percent month-over-month improvement between January and February 2014.

"The continuous drop is now reaching a frustrating level for shippers," says Alan Murphy, COO and partner at SeaIntel. "In February, shippers engaged in the Transpacific Eastbound and Asia-Mediterranean trade lanes had containers arriving on time less than 50 percent of the time."

Remote Scanning Pilot Takes Off

Amsterdam’sSchiphol Airport is giving new meaning to remote control. Authorities recently launched a security scanning system that allows Dutch Customs to view shipments scanned off-site at a freight forwarder’s facility, then decide if selected shipments require further inspection.

Service provider Rhenus Logistics and Customs are currently piloting the system. Once fully operational, the remote scanning scheme—part of the airport’s SmartGate Cargo project, a joint initiative among Customs, Amsterdam Airport Schiphol, Air Cargo Netherlands, and KLM Cargo—will speed the flow of freight, reduce the number of physical inspections, and enable Customs to use its resources more efficiently.