Reverse Logistics: Moving Against the Current

Handling the growing volume of returns has never been more challenging—or important—so now is not the time to play “Go Fish” with your reverse logistics operations. Learn to to swim against the typical supply chain flow with effective and efficient reverse strategies.

When seeking to understand what makes reverse logistics one of the most complex components of any supply chain, think of the supply chain as a river flowing in one direction, suggests Frank Dreischarf, senior vice president of LTL operations for R2 Logistics, a Jacksonville-based 3PL. As the river current flows, raw materials run downriver to become finished goods that make their way to a customer.

“Reverse logistics requires movement against the ‘current,’” Dreischarf says.

Recent years have made reverse logistics even more complex as the volume of returns grows in step with the popularity of ecommerce. “More customers moving to online shopping and home delivery dramatically increases the chance that a product will be returned,” Dreischarf says.

Retailers and others in the supply chain sector are exploring and experimenting with a range of options to keep reverse logistics challenges from undermining their profits and overwhelming their processes and resources.

The High Costs of Returns

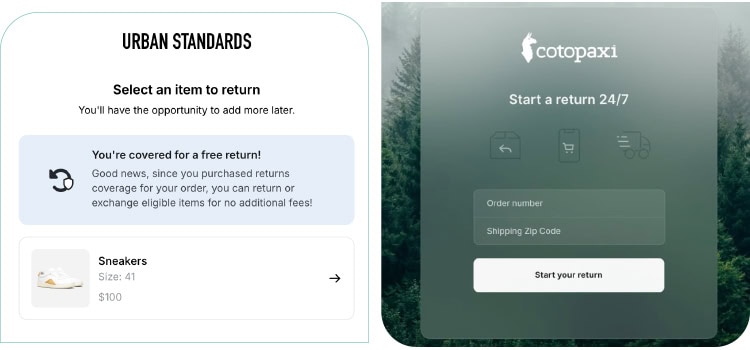

Automated returns solutions, like these online and mobile options from Loop Returns, help brands reduce manual errors and cut the cost of reverse logistics.

High costs and operational complexity also add to the challenge.

“Unpredictable expenses such as transportation, inspection, and refurbishing make reverse logistics less efficient than forward logistics,” says Katie Hilton, national sales account executive for IronLink Logistics, a 3PL based in Ontario, California. “The rise of ecommerce and lenient return policies have driven a surge in returns, especially after the holiday season, when volumes can spike by 25% to 50%. This increases strain on storage, labor, and processing capacities, leading to higher overhead costs.

“The process is intricate, involving condition assessments plus sorting and navigating diverse return policies, all of which require robust systems to handle effectively,” she adds.

“Assume an ecommerce brand nets a 10% margin when it sells a product. When a customer returns that product, the cost of shipping and processing the return is often 20% to 30% of the original sale price,” adds Peter Davis, vice president of fulfillment and chemical at WSI, a 3PL based in Appleton, Wisconsin. “If the brand picks up the tab on that return, it means it will have to add two or three more sales just to cover the cost of that one return.”

Overall, reverse logistics is “an expensive and resource-intensive process,” notes Kristen Kelly, senior vice president of product at Loop Returns, a Columbus, Ohio-based business that provides returns management software. “Contributing factors include the costs of postage and warehousing, and the refurbishment of items before they can be resold.”

These challenges are amplified during peak shopping periods, when retailers and brands are already dealing with additional shipping, labor, and storage expenses, which can further impact profits.

Incorporating Automation

Retailers that frequently revamp their operations for efficiency and automation can address multiple supply chain challenges in the process, including reverse logistics concerns.

“This ultimately starts with investing in automation technology, which allows brands to deliver a strong customer experience without expanding support, which is a significant expense,” Kelly says.

“Automated returns, for example, make it easier to track inventory in real time for both brands and consumers,” she adds. “A solution that automates processing events when items are scanned by the carrier eliminates the need for manual entry.”

Companies must also balance a frictionless, automated experience with the need to prevent returns fraud and abuse. Technology can help limit those occurrences.

Merchants are aiming to create the best experience for customers while still maximizing the yield from returned items. “Retailers want to ensure they receive the actual item being returned in a condition that allows it to be resold,” Kelly explains.

Retailers are also looking to provide customized experiences for different types of customers.

“For their best, most loyal customers, they may offer faster outcomes. For other customers, they may wait to issue refunds and start exchanges until after they inspect the item and ensure it can be restocked and resold,” she says.

Kelly also notes that other tech features can help with revenue retention, such as “instant exchanges” that encourage shoppers to choose a new product for an exchange rather than completing a return for a refund immediately.

“Automated returns can streamline shipping and handling and make the process less costly, even while offering flexible return options such as self-shipping, drop-off, or in-store returns,” Kelly says.

Keep-it Policies and Returnless Refunds

In 2017, Amazon introduced the returnless refund, which quickly gained popularity across the retail landscape.

“It established a new standard for brands by automatically processing refunds without requiring customers to send the item back,” Kelly says.

These “keep-it” return policies allow retailers to avoid return shipping costs when the product is too inexpensive to process profitably—making it more efficient for the customer to simply keep or donate the item. Keep-it policies also help reduce reverse logistics costs and improve customer satisfaction by eliminating the need to return low-value items or items with high shipping costs.

“These policies cut down on transportation, labor, and restocking expenses while offering a hassle-free experience that fosters customer loyalty,” Hilton says. “They also streamline operations during peak return periods and reduce environmental impact by minimizing unnecessary shipping.”

Keep-it policies are best applied to low-cost items—for instance, those less than $20—or to goods with minimal resale potential. Otherwise, Hilton says, “issuing refunds without product recovery can lead to revenue loss and missed inventory-recovery opportunities.

“The downside includes risks of abuse, as lenient policies may incentivize fraudulent claims, and overuse could devalue the product or brand,” she adds. “To use this approach strategically, businesses should define clear guidelines, limit the policy to specific product categories or customer segments, and leverage analytics to detect fraud.

“By balancing cost savings with controlled application, keep-it policies can enhance customer satisfaction and operational efficiency while protecting profitability,” Hilton says.

“Using predictive analytics to understand where fraud and abuse are more likely to arise can also be a great help,” adds Kelly.

The Benefits of ‘Friction’ in Returns

Many retailers, including popular fashion brand Zara, have moved away from offering free returns for online orders. The large increase in volume has driven up reverse logistics costs, thereby undermining profit margins. Instead, merchants are offering free returns to stores or introducing return fees for online transactions, hoping this “friction” will keep shoppers from buying items they’re unsure about.

Some retailers, however, are shifting away from free returns. The large increase in the volume of returns has driven up reverse logistics costs, thereby undermining profit margins.

Against that backdrop, many brands, including H&M and Zara, have halted free returns and implemented return fees.

“Return fees encourage consumers to be more mindful of what they are purchasing while discouraging abusive behavior,” Kelly says. “By implementing return fees, brands can introduce friction into the process that will make shoppers less likely to buy items they’re unsure about.”

“There was a big expectation of free returns for a while but that has changed,” Davis adds. “More than half of retailers now charge for returns with an average return cost of about $7. Customers seem to be responding well because returns are not letting up.”

Customers expect to pay a fee to return an order, and it does not play a role in their decision to make another purchase in the future, according to Loop research.

“In fact, 70% of consumers are willing to pay a fee for more convenient, premium return experiences,” Kelly says. “The biggest factor is keeping the cost in line with what the average postage cost would be and not inflating it further.”

For paid returns to be effective, retailers must be thoughtful about the customer experience.

“It’s no secret that shoppers want reasonable, convenient return options or they may not go through with a purchase,” Kelly says. “This is why brands need to ensure that charging for returns doesn’t create a poor shopping experience. Certain compromises, such as offering options for free exchanges, in-store credit, free in-store returns, or implementing returnless refunds can help balance these risks. Providing multiple return options allows for a relatively seamless and hassle-free consumer experience.”

When paid returns are implemented thoughtfully, return fees can balance financial sustainability for brands with a positive shopping experience for customers, creating a win-win for both retailers and shoppers.

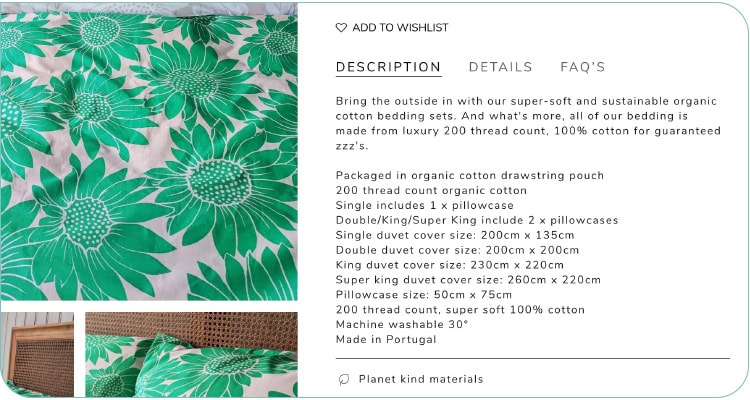

Encouraging Informed Purchasing Decisions

Providing accurate and detailed product information, descriptions, and sizing details goes a long way toward driving down return rates. These tools enable customers to make more confident purchasing decisions, helping to reduce over-purchasing and improve the customer experience.

Helping consumers make better, more successful purchases the first time around is one critical way to cut down on returns. However, growth in online shopping has also led to a rise in over-purchasing.

This has largely been driven by a practice called “bracketing,” which occurs when consumers, for example, purchase an item in multiple sizes with a plan to return the ones that do not fit.

“To avoid this, brands can provide more detailed product descriptions and sizing charts,” Kelly says. “These simple tools help customers better assess the quality and fit of a product to make more confident purchasing decisions.

“We’ve also seen brands invest more in either technology or people to help coach customers through the fit/sizing process so they get it right the first time,” she adds.

In addition, brands can help reduce over-purchasing and encourage responsible purchasing behavior by more effectively showcasing their policies and return windows.

“Clearly sharing these details can reduce impulse buying and buyer’s remorse, which tend to drive higher return rates,” Kelly says. “According to Loop data, one in four people admit that they made impulse purchases that they later regretted.”

Investing in better upfront information for customers can be well worth it.

“Any educational information that allows the consumer to make an informed decision helps reduce returns,” Dreischarf says. “As shopping becomes disconnected from the brick-and-mortar—where a customer can see, try on, feel, and touch the product—returns and customer dissatisfaction with the product will increase.”

Strategic Considerations

It is critical for today’s brands to make their returns process and reverse logistics strategy an operational priority rather than an afterthought.

“Brands lacking an effective use of technology often have customer support teams manually processing return inquiries, and without a proper system in place, CX [customer service] teams spend a disproportionate amount of time on these requests,” Kelly says.

“In addition, relying on CX teams for return inquiries can create inconsistent enforcement of return policies, leading to lost revenues and slower response times,” she adds. “This can impact the overall customer experience, resulting in poor reviews or non-repeat customers.”

Poor data tracking and analysis are a common and serious side effect for retailers that lack a “thorough” returns system. That limits a brand’s visibility into why certain products are being returned—which is vital for brands to understand in order to better serve customers.

“This critical information could aid in product improvements or operational adjustments to improve profit margins and customer satisfaction,” Kelly explains. “Brands should leverage analytic tools to monitor return volumes, identify patterns in return causes and conduct data-driven analyses to inform their decisions.

“AI can also come into play here, with predictive technology offering insight into what items are more likely to be returned based on historical returns data,” she adds. “Brands can use this information to inform merchandising and inventory or to improve personalization during the shopping experience and reduce return volumes over time.”

Options Are Optimal

The complete reverse logistics workflow, as depicted below, is complex. Many companies turn to third-party logistics providers such as IronLink Logistics to optimize the process.

There is no one-size-fits-all approach for returns.

“Rapidly growing companies prioritizing customer acquisition and brand-building probably want a more lenient return policy,” Davis says. “For companies selling low-value and easily replaceable products, a keep-it-policy could be a great option.”

The nature of the product also significantly impacts the optimal return policy. High-value items might necessitate more careful handling and potentially more stringent return policies to mitigate fraud. Ultimately, Davis says, “understanding what your customers value most—easy returns, processing speed, environmental considerations—is crucial.”