The Opportunity in Rural Last Mile; Unpacking Freight Underutilization; AI Moves from Hype to Impact & More Logistics and Supply Chain News

The latest insights on global supply chain trends, including the impact of AI, changes in last mile logistics, and optimizing freight utilization.

Honoring A Logistics Legend

In June 2025, the logistics sector marked the death of expedited delivery pioneer and FedEx founder Fred W. Smith, who passed away at the age of 80 in Memphis. Smith didn’t just build a company—he redefined the face of global logistics with the founding of FedEx in 1973, which he launched with 14 jets and 389 employees.

Smith turned a bold college paper idea into one of the most significant supply chain innovations of the 20th century: a centralized hub-and-spoke system capable of overnight package delivery at scale. According to lore, the paper earned a C from his Yale professor, who dismissed the concept as impractical and unworkable at the time. Smith’s original vision is now standard expectation across industries.

His decision to base operations in Memphis and build the FedEx SuperHub there turned the city into a global logistics capital. Fittingly, the Memphis International Airport is being renamed Frederick W. Smith International Airport.

A former Marine, Smith credited his military experience in Vietnam with shaping his understanding of mission-critical operations, speed, and reliability. “Everything I did running FedEx came from my experience in the Marines,” Smith told the Associated Press in a 2023 interview.

Under Smith’s leadership, FedEx pioneered several now-standard practices that grew out of that mission-critical approach: package tracking, barcode scanning, handheld delivery devices, and real-time visibility.

Leaders from industry and government marked Smith’s passing with fitting tributes: “As the founder of FedEx, his leadership and innovation transformed global commerce, and he will be remembered for his relentless drive, patriotism, and commitment to service,” noted U.S. Senator Marsha Blackburn (R-TN).

FedEx President and CEO Raj Subramaniam shared his thoughts: “Frederick W. Smith pioneered express delivery and connected the world, shaping global commerce as we know it. His legacy of innovation, leadership, and philanthropy will continue to inspire future generations.”

Rural Last Mile: Prime Opportunity?

Closing the delivery gap between urban and rural regions is a goal that has long posed operational and economic challenges for supply chain networks. The ecommerce boom has brought increasing focus on last-mile deliveries—and the difficulties of accommodating the demand for fast and effective last-mile operations in rural areas.

Now, Amazon is making a major push to extend its fast delivery capabilities to rural and small-town communities across the United States. The company recently outlined a $4-billion investment to expand its logistics infrastructure aimed at enabling same- and next-day Prime delivery for millions of customers outside major metropolitan areas. The company claims that more than 300 small towns now receive packages with same- or next-day delivery, with continued growth planned.

Amazon’s rural logistics expansion centers on optimizing its middle-mile and last-mile networks by leveraging a decentralized model. Rather than relying solely on large regional hubs, the company is integrating smaller, sub-regional facilities closer to rural customers, enabling packages to be sorted and shipped more efficiently. Amazon has also expanded its network of third-party delivery service partners and flex drivers to reach lower-density areas where traditional delivery models have faced logistical and cost barriers.

For the logistics sector, Amazon’s rural buildout signals a shift toward greater investment in non-urban fulfillment models. This trend could drive innovation in cost-effective routing, decentralized warehousing, and alternative delivery methods tailored for areas traditionally underserved by ecommerce.

New Rules of the Road

Six months into President Trump’s second term in office, a flurry of initiatives, pilot programs, and regulatory updates impacting the trucking sector have taken shape. Touting what it calls its “pro-trucker” agenda, the Trump Administration and U.S. Transportation Secretary Sean P. Duffy recently announced a package that includes funding to expand truck parking as well as initiatives to remove one-size-fits-all mandates, modernize driver resources, reduce red tape, and crack down on bad actors.

Here’s a quick breakdown of what’s on deck:

- A $275 million grant program to substantially increase truck parking nationwide aims to address a bottleneck that costs carriers time and operational flexibility. Grants include $180 million for nearly 1,000 new spaces along Florida’s I‑4 corridor, part of a strategic push to improve safety and mobility in regional freight corridors.

- USDOT is withdrawing the proposed rulemaking to mandate speed limiters on heavy-duty trucks. These one-size-fits-all speed-limiters act as safety hazards because they force drivers to go slower than the flow of traffic, according to Duffy.

- The package also includes modernized online driver resources through FMCSA, and a push to eliminate what the Trump Administration deems as unnecessary regulatory language. These steps are aimed at reducing compliance burdens and supporting smoother logistics operations.

- These policies have drawn support from the trucking industry. “A safe and strong trucking industry is critical to America’s economic growth and security, and data-driven measures like these that reduce regulatory burdens are important steps toward that end,” said Chris Spear, president and CEO of the American Trucking Associations, in response to the new initiatives.

Freight Moving Fast, But Not Full

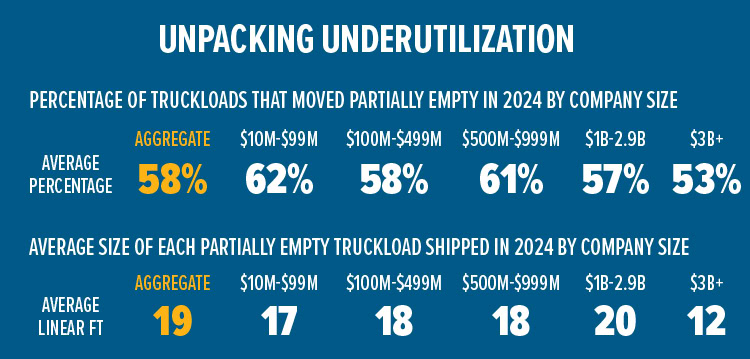

Source: Flock Freight

As pressure mounts on the freight industry to deliver faster, leaner, and more reliably, shippers are being forced to adapt—or risk falling behind.

Rising costs, tighter delivery windows, and persistent inefficiencies are converging to reshape transportation strategy across sectors, notes a new study from Flock Freight. In particular, the growing demand for speed to market has pushed many shippers to prioritize fast, flexible delivery over efficiency—often at the expense of full truckload utilization.

In the 2025 edition of its annual shipper research study, Flock Freight explores the downstream effects of this shift, based on insights from 1,000 transportation decision-makers in various industries.

Key trends include:

- 58% of truckloads moved with empty trailer space in 2024, a 15% increase from 43% in 2023 (See chart below).

- The average underutilized truckload left 34 linear feet of space unused, or the equivalent of every third truckload moving completely empty.

- On-time performance was ranked as the number-one priority for choosing shipping solutions, as delays and penalties cost the average enterprise shipper $6.2 million annually in on-time in-full late fees.

- More than 45% of shippers booked truckloads because they were unsure that other modes would arrive on time.

- Fraud and theft affected 1.11% of shipments in 2024, costing the average enterprise shipper $9.9 million annually.

Certain industries—including technology and electronics, food and beverage, and consumer packaged goods—felt greater impact from fraud and theft.

Logistics Real Estate Recalibrates

The global industrial and logistics market is among many sectors navigating turbulence and transformation. Amid shifting tariff regimes, geopolitical tensions, and escalating customer demands, businesses are under growing pressure to adapt. In response, organizations that lease, own, or use industrial and logistics real estate—including warehouses, distribution centers, and manufacturing facilities—are rethinking their real estate strategies with a focus on resilience, agility, and future-proofing, finds a new report, 2025 Spotlight On The Industrial & Logistics Sector, from global real estate firm Savills.

The report outlines several notable trends and shifts, including:

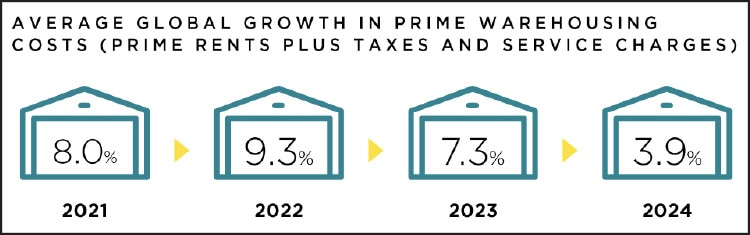

Global warehousing costs rose by 3.9% over the past year, marking the third consecutive year of slowing growth. This trend reflects a market in transition, as post-pandemic momentum gives way to more cautious occupier behavior in the face of geopolitical and macroeconomic uncertainty. Increased supply in some markets also tempered rental increases.

80% of respondents from the Savills global network report leasing decision delays driven by the shifting tariff environment. In Asia Pacific, 40% of respondents report that planned capital investment projects are being delayed due to uncertainty in the market.

Occupiers of industrial and logistics space are rethinking site selection criteria. While access to transportation infrastructure and labor remains critical, these priorities are weighed alongside growing power demands, the increasing need for smart, tech-enabled facilities, and a shift toward greater automation.

Global cargo volumes surged by 7.3% in 2024, reaching 504.7 million twenty-foot equivalent units (TEUs) across 50 of the world’s largest ports. While all regions saw growth, the greatest increases were in North America and China, partly due to shippers front-loading cargo in anticipation of potential tariff changes.

AI Moves From Hype to Impact

From forecasting disruptions to optimizing order flows, artificial intelligence is fast becoming a cornerstone of modern supply chain strategy. Many organizations are turning to AI and other advanced technologies as essential components of day-to-day operations—but hurdles remain, according to PwC’s 2025 Digital Trends in Operations survey.

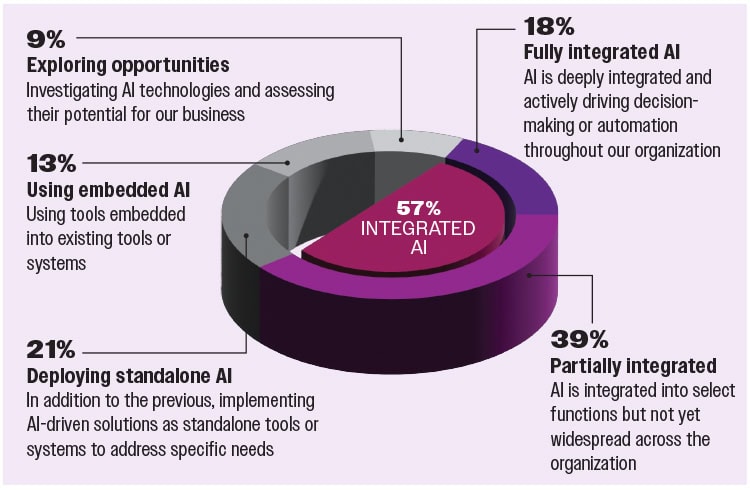

The shift from AI as a buzzy concept to a necessary tool is reflected in the survey, which finds that 57% of supply chain leaders have now partially or fully integrated AI into their operations (see chart below). Overall, AI integration levels vary widely among respondents, the survey shows.

Companies are applying AI across a range of functions, including planning, order management, and real-time risk mitigation, according to the research. But while optimism is high—80% expect long-term value from AI—many are still navigating barriers to implementation, such as the complexity of legacy systems, and data quality issues.

Additionally, the survey underscores a gap between ambition and operational execution; only 31% of respondents say they are actively piloting AI tools, despite their appreciation for its long-term value.

HOW ARE COMPANIES INTEGRATING AI?

The survey asked respondents to describe how their company is approaching AI integration

*Note: Totals may not add up due to rounding. Response to “Unsure” not shown.

Source: 2025 Digital Trends in Operations, PwC

The Push For Diversification

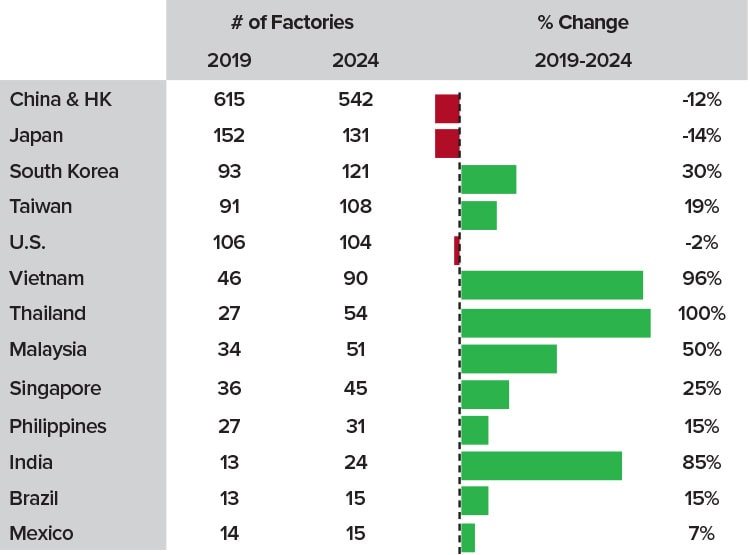

A combination of factors has prompted companies in the technology industry to seek production diversification away from China. While the idea of shifting to new sourcing locations started when Chinese factories were locked down during the pandemic, it has continued to gain steam due to escalating trade tensions between the West and China, as well as China’s gradually increasing labor costs.

Several countries are experiencing increasing demand for production due to these supply chain shifts, finds a new analysis by Everstream Analytics using sets of 2019-2024 supplier data from the world’s largest technology companies. Despite the increased interest in nearshoring, Everstream’s analysis shows U.S. companies such as Apple have kept the largest share of their suppliers in Asia.

Thailand has shown the most significant percentage increase, followed closely by Vietnam and India (see chart below). While China still maintains the largest absolute number of suppliers, the trend line clearly indicates a gradual diversification away from complete dependence on Chinese manufacturing.

Here are the new hotspots, according to the Everstream data:

- India: A fast-growing hub for smartphone and laptop manufacturing, India offers a large, skilled workforce at lower labor costs. Its expanding tech capabilities and strong domestic market have lured major players like Apple and Samsung.

- Malaysia: Known for its role in semiconductor packaging and testing, Malaysia combines low-cost labor with solid infrastructure and government support, making it vital to the global chip supply chain.

- Vietnam & Thailand: Both countries offer tax incentives and government funding for tech manufacturing. Vietnam leads in smartphone and laptop production, while Thailand specializes in smartwatches and computers—each benefiting from proximity to China with lower costs and risk.

- Taiwan: Despite geopolitical concerns, Taiwan remains a critical player in high-end electronics, thanks to its unmatched semiconductor ecosystem led by TSMC and deep technical expertise.

HOTSPOTS: Avg % change in supplier locations across major technology companies by country, 2019-2024

Which Companies Operate the Best Supply Chains?

Uncertainty continues to shape the global supply chain landscape, but the companies topping Gartner’s 2025 Global Supply Chain Top 25 are thriving nonetheless. Schneider Electric leads the pack for the third year in a row, with red-hot chip maker NVIDIA moving up to second place in just its second year on the list (it debuted on last year’s list at number seven). Cisco Systems, AstraZeneca, and Johnson & Johnson round out the top five.

The annual ranking highlights organizations that demonstrate superior supply chain capabilities and deliver long-term value. This year’s list reflects continued investment in digital transformation, with leaders leveraging agentic AI, data, and automation to gain visibility and agility across their networks. A focus on resource stewardship—and specifically on water management and conservation initiatives—is another key trend displayed by these firms.

Here are the top 25 companies on Gartner’s list:

1. Schneider Electric

2. NVIDIA

3. Cisco Systems

4. AstraZeneca

5. Johnson & Johnson

6. L’Oréal

7. Colgate-Palmolive

8. Lenovo

9. Microsoft

10. Danone

11. Nestlé

12. Diageo

13. Walmart

14. Coca-Cola

15. Siemens

16. Novartis

17. General Mills

18. PepsiCo

19. Heineken

20. HP Inc.

21. Sanofi

22. JD.com

23. BMW

24. GSK

25. Intel