TAKEAWAYS: Shaping the Future of the Global Supply Chain

From a robotics and warehouse automation update to a look at the impact of congestion at the Panama Canal on long-distance shippers, here are current supply chain trends that will affect outlooks and strategies.

Preparing for AI Overhaul

A majority (93%) of manufacturing and business-to-business companies plan to increase their investments in artificial intelligence within the next 12 months, finds a new benchmark study from Lucidworks. However, the survey finds differences depending on location: 100% of Chinese and Australian manufacturing respondents say they plan to increase investment, compared to only 92% of U.S. participants.

Here are some additional key takeaways:

- 42% of manufacturing participants have a positive sentiment toward AI, 12% of participants have a negative sentiment and the rest are neutral.

- The most common expected impact of Gen AI in manufacturing is business operations improvement, followed by automation and efficiency gains.

Beyond the Line of Sight

The Federal Aviation Administration (FAA) has authorized UPS’s drone delivery subsidiary, UPS Flight Forward, to operate drones beyond an operator’s line of sight. This effectively permits autonomous UPS drones to fly across much longer distances—and potentially carry packages from a distribution center to customer homes.

UPS plans to utilize Matternet’s M2 drone, which can carry up to 4.4 pounds as far as 12.4 miles in suburban and urban corridors. The parcel delivery giant operates a “remote operations center” in Kentucky and plans to make flights in Florida, North Carolina, and Ohio, FAA officials told Reuters.

The FAA had asked for public feedback on drone authorization requests from UPS and three other prospective operators. The FAA approved Phoenix Air Unmanned’s inspection and aerial work in late August 2023, while the UPS announcement cleared Montana startup uAvionix. The final request—whose name was not disclosed—remains pending.

FAA officials hope to make “beyond line of sight” operations routine, economically viable, and scalable. Agency personnel continue to review the final report of a committee charged with developing those rules.

Warehouse Automation Powers Up

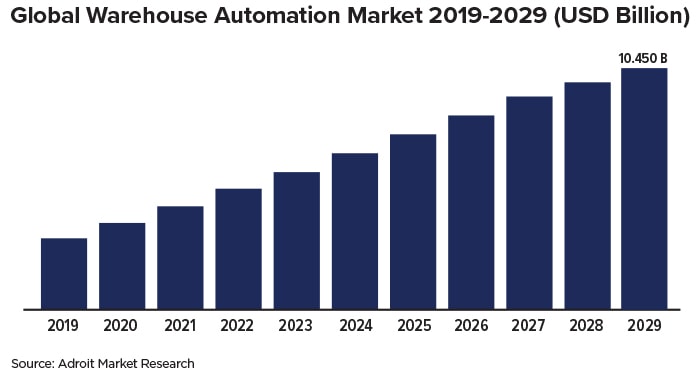

Robotics and warehouse automation are in high demand and poised to grow. As companies look for ways to handle growing e-commerce orders, increase productivity, reduce labor costs, and enhance overall supply chain operations, these high-tech solutions are a potential answer.

Robotics, artificial intelligence, machine learning, and sensor technologies are constantly improving, making robots more powerful, adaptable, and economical for warehouse applications.

The growth is substantial. The global warehouse automation market was valued at $4.4 billion in 2020 and is expected to reach close to $10.45 billion by 2029, with an annualized growth rate of 15.6% from 2022 to 2029, finds Adroit Market Research.

Blowing in the WindWings

A first-of-its-kind propulsion system for large cargo vessels is in the works.

Agribusiness company Cargill collaborated with BAR Technologies, Yara Marine Technologies, and Mitsubishi to debut “WindWings”— rectangular sails measuring more than 120 feet high that can be affixed to cargo ships, using wind power to replace some propulsion that would ordinarily be powered by diesel fuel.

BAR partnered with Cargill to develop the sails with funding from a European Union initiative to decarbonize the shipping sector. The sails were manufactured by Yara Marine Technologies and installed on the Pyxis Ocean, a Mitsubishi-made cargo vessel chartered by Cargill.

The project could help existing ships meet upcoming emissions limits by retrofitting their vessels with WindWings. The global shipping industry accounts for roughly 3% of the world’s greenhouse gas emissions, and the International Maritime Organization recently reached an agreement to gradually bring those emissions down to zero by 2050. Newly built ships, meanwhile, could see average fuel savings of 30%. With alternative fuels, those savings could be even higher.

Project officials plan to monitor the Pyxis Ocean over the coming months to optimize the design and operation for future trips and production. BAR and Yara plan to build hundreds of sails over the next four years.

Panama Canal Disruptions Extend Beyond Droughts

As droughts have caused congestion on either side of the Panama Canal, global supply lines are battling another slew of problems, according to Brian Alster, general manager, third-party risk and compliance, Dun & Bradstreet.

Due to the high volume of ships currently stuck in the canal, the cumulative estimated impact on the supply chain could potentially rise as high as 13,980 TEUs and more than $333.4 million for volume and value, respectively, according to Dun & Bradstreet findings.

The congestion is especially impactful for long-distance shippers that usually carry large cargo volumes through the Panama Canal. With routes still facing a severe decline in shipment volumes, expect significant delays and impacts, especially on micro and small businesses.

The Yellow Effect on the LTL Market

By: Martin Burnham, President, Hercules

When Yellow Corp., the third-largest U.S. LTL carrier, suddenly stopped operations, shippers were left scrambling to find capacity to cover stranded loads. Fortunately, because of the soft LTL market so far this year, there was plenty of available capacity, and carriers were able and willing to step in and transport those loads.

Some shippers had already shifted freight from Yellow to other carriers over the past year to supplement service or improve performance in certain lanes. So when the official closure happened there wasn’t a panic, as carriers had already been gradually incorporating that freight into their network.

While Yellow’s customers were generally able to find capacity to meet their immediate needs, the company’s absence will be felt across the industry, especially as we head into peak season. If the economy plays out favorably, freight volumes will increase and we’ll see some capacity constraints. This could put pressure on companies, similar to what we saw in 2022 when shippers were scrambling for truck space.

Despite lower freight volumes and economic uncertainty, LTL carriers are looking to add capacity and terminals to their networks to meet future demand. Consequently, trucking companies are working to purchase Yellow’s 12,000 trucks and 150 terminals as well as hire the 30,000 drivers suddenly looking for jobs. Not likely to be confined to a single carrier, those shifts will be spread across many LTL players. In fact, as much as 25% to 50% of Yellow’s freight could go to carriers outside the 10 largest LTL providers, according to Goldman Sachs.

Looking ahead, shippers should plan to diversify their carrier base and use those carriers somewhat regularly to keep relationships strong. When freight volumes increase or disruptions arise with other truckers, the other carriers in your network can adapt more quickly and seamlessly because the relationship has been established and necessary connections and system integrations have already taken place.

It’s also critical to select the right carrier partner. Yellow was an attractive option because of its large service coverage and rates that were below the industry average. But when selecting a carrier there’s more to consider beyond cost and network. The following factors will have a tremendous impact on your business:

- Service specialization. In addition to looking for a broad service network, partner with carriers with specialized services or those that are strong in specific lanes and regions that align with your delivery needs.

- Reliable customer service. While much of transportation and logistics has become automated, the human component is still critical. Working with carriers that provide consistent account teams and can be reached quickly when you need them can be critical, especially when disruptions arise.

- Claims. Claims are a nightmare. They upset your customers when goods are not received on time, they upset the carrier as it reduces profitability, and they strain the shipper’s inventory. Find a carrier with a low claims rate to avoid this operational and financial headache.

- Transit time. Predictability and speed are central to today’s supply chain, making fast and consistent transit times important. LTL carriers that allow for nonstop shipments without passing through multiple breakbulk terminals on the way to a destination can result in faster transit times and minimize an opportunity for product damage.

Shippers should be proactive in partnering with LTL carriers that don’t just provide the coverage and rates they want, but also the fast, quality, and on-time service they need.