Manufacturing CEOs Accelerating Investments in AI, Automation & Robotics

Manufacturing CEOs are making big plans for 2024, including accelerating investments in artificial intelligence, automation and robotics. Plus, other news shaping the global supply chain.

What’s on the Minds of Manufacturing CEOs?

Manufacturing CEOs are making big plans for 2024, including accelerating investments in artificial intelligence, automation and robotics, while also raising the skill level of their current employees and recruiting highly trained workers. That’s the consensus of a year-long series of polls conducted by Xometry, an AI-powered, on-demand industrial parts marketplace. Here are some in-depth findings from the polls:

- Modernizing through AI. Manufacturing CEOs say AI will play a significant role in their company in the next one to two years. Of the CEOs who have already implemented AI, more than 70% have seen significant ROI in key areas such as supply chain management, quality control, and procurement.

- Domesticating manufacturing. Reshoring will continue to trend upwards with 76% of manufacturing CEOs having successfully reshored some or all of their operations throughout 2023, a move accelerated by federal tax incentives and initiatives such as “Build America, Buy America.”

- Tapping the brakes on EVs. While the automotive industry is primed for growth and innovation in 2024, EV manufacturers may be taking their foot off the accelerator when it comes to electric vehicles. Xometry’s Automotive Survey finds that 84% of automotive executives said current production timelines and waning consumer demand may make it difficult for the industry to meet the Biden Administration’s goals for the years ahead.

- Tracking a more sustainable future. Though EVs may be hitting a road bump for now, manufacturers are taking proactive action to limit greenhouse gas emissions across their industrial supply chains. Fifty-two percent of CEOs view climate change as an existential threat caused by human activity. In 2024, companies will make sustainability a business goal with more investment in measuring and tracking tools to prioritize decarbonization of their operations.

- Investing to fight a skilled labor shortage. Nearly four years post-pandemic, there remains a shortage of more than 600,000 manufacturing jobs waiting to be filled. As American process manufacturing becomes more high tech, CEOs remain worried about attracting highly skilled talent. According to Xometry’s research, more than half (56%) of CEOs said they struggle finding qualified employees in today’s tight labor market.

- Pushing aside politics. Xometry’s Q4 CEO survey shows a near 50/50 split on whether Democrats or Republicans will better support manufacturing and the economy at large. The priorities remain non-partisan: bipartisan collaboration, public-private partnerships that invest in skilled labor, and proactive assistance from the federal government for the reshoring of manufacturing.

Help Wanted x 2 Million

The logistics and transportation sector is no stranger to challenging employment trends. Combating driver shortages, for instance, has been a top priority for trucking and intermodal companies for the past several years. And finding and retaining skilled warehouse workers has also been problematic for the distribution field.

The sector should continue to expect ongoing employment difficulties in the near future, according to Chad Raube, president and CEO of IntelliTrans, a global provider of multimodal solutions for bulk and breakbulk industries. What’s driving these trends? Raube points to increased order complexities; lower levels of available, seasoned staff; and changes in economic conditions where recovery rarely generates a return to prior staff levels.

“With continued growth forecast for domestic freight in 2024 and beyond, there is an expected need of nearly two million new employees for transportation and warehousing jobs, due to growth and attrition,” he says.

Adding to the challenge is the fact that companies are competing for a shrinking share of the population. Raube points to these stats: For workers aged 25 to 65, only 19% of the labor force will increase from 2021 to 2031, and 80% of the workforce in 2031 will come from the over-65 population.

Also, construction of new manufacturing sites has tripled in the past two years because of reshoring, which will change distribution patterns and transportation modes, adding to the urgency around these trends, he notes.

Three Industrial Real Estate Predictions

1. Look for vacancy rates to inch up further, as the construction pipeline continues to deliver new product throughout the country, while demand moderates further. The national vacancy rate should peak at just over 6% in 2024 before re-tightening.

2. Net absorption will remain tempered in 2024, as cooler consumer demand for goods, persisting elevated interest rates, and sticky inflation hamper growth.

3. As this wave of industrial product delivers over the next 12 months, the construction pipeline will shrink further, leading some markets to become supply constrained in 2025 as absorption starts to regain momentum.

Source: Cushman & Wakefield

Oversupply Makes Waves for Ocean Shippers

What do ocean freight experts see for 2024?

Shippers should expect more service disruption as container lines seek to manage oversupply and limit losses, predicts Philip Damas, managing director of Drewry Shipping Consultants and head of Drewry’s Supply Chain Advisors practice.

To control the level of oversupply, Damas expects a greater number of blank sailings, which will significantly reduce the predictability of containership departures.

Here are Damas’ key predictions:

- Container lines will collectively record profits of roughly $20 billion for 2023, but the oversupply of vessels will result in a collective loss of $15 billion in 2024.

- 2024 will be an ocean freight buyer’s market, and shippers should be able to secure significant rate cuts. “But,” Damas warns, “there will be a price to pay: the service reliability and service level of carriers will probably worsen.”

- In 2024, shippers will also need to contend with new EU Emission Trading System (ETS) surcharges from carriers. While current ETS surcharges on most trades are not high, Drewry is concerned about whether surcharges are “set at a justified, reasonable level,” as ETS surcharges are likely to more than double in 2025 and 2026.

2024: Year of Optimism and Growth?

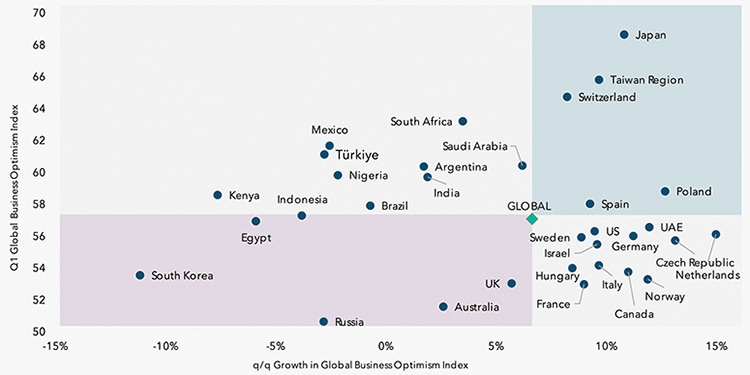

Overcoming a slew of recent challenges seems to be breeding optimism in the supply chain sector. After enduring disruptions such as the pandemic, geopolitical conflicts, and monetary tightening, businesses are now adopting a growth mindset, according to Dun & Bradstreet’s Q1 2024 Global Business Optimism Insights report.

This is despite the fact that the report shows a downturn in global supply chain continuity due to geopolitical tensions, trade disputes, and climate-related disruptions in maritime trade causing higher delivery costs and delayed delivery times.

“Global businesses are adopting a more pragmatic stance towards their future,” explains Neeraj Sahai, president, Dun & Bradstreet International. “This shift in mindset suggests anticipation of additional growth in the forthcoming quarters, albeit with an underlying sense of continued caution.”

Key findings from the report’s five indices—measuring Q1 2024 compared with Q4 2023—reveal the following:

- The Global Business Optimism Index increased by 6.6%, indicating that businesses in advanced economies now feel more confident about their ability to absorb geopolitical and policy shocks, and are focusing more on growth opportunities.

- The Global Supply Chain Continuity Index fell sharply by 6.3%, with suppliers’ delivery time and delivery cost indices both deteriorating.

- The Global Business Financial Confidence Index increased by 10.1%; in addition, liquidity is expected to increase across firms of all sizes and businesses are more optimistic about their competitive positioning.

- The Global Business Investment Confidence Index rose 10.7%, showing a growing consensus that major central banks in advanced economies have reached a peak in the current interest rate hike cycle.

- The Global Business Environmental, Social and Governance (ESG) Index increased 7%, reflecting a positive shift in the commitment of firms worldwide towards sustainability practices.

“Greenwashing” Gaffes

With the current intense focus on sustainability, it’s not surprising that many companies are accused of “greenwashing,” or conveying a false or misleading impression of the environmentally friendly nature of their products or supply chains. Increasingly, however, many firms may be unintentionally guilty of the practice.

Nearly half (45%) of U.S. organizations are concerned they could be at risk of unintentional greenwashing, finds new research from Ivalua. With pressures from customers and regulators on the rise, organizations also face pressure to ensure all green claims are legitimate.

The study reveals less than half (48%) of organizations claim they are “very confident” that they can “accurately” report on Scope 3 emissions (emissions resulting from activities or assets not owned or controlled by the reporting organization). Meanwhile, nearly two-thirds (62%) say reporting on Scope 3 emissions feels like a “best-guess” measurement.

The research also shows that while 88% of organizations are confident they’re on track to meet net-zero targets, many don’t have comprehensive, fully implemented plans in place for:

- Adopting renewable energy (78% are confident in their plans)

- Reducing carbon emissions (68%)

- Adopting circular economy principles (72%)

- Reducing air pollution (67%)

- Reducing water pollution (63%)

The research also finds that more than half (51%) of organizations agree that unless green initiatives to reach net-zero goals also involve suppliers, they are a waste of time.

Quick Take: Sector Sentiment

- 74% of supply chain professionals foresee positive growth in the global container shipping industry in 2024.

- 53% expect an increase in container prices, 26% anticipate stability, and only 21% express pessimism about price decline.

- 30% of supply chain professionals say forecasting and planning is the most important area of business to improve with technology in 2024, followed by real-time visibility and tracking (24%), collaboration and connectivity (27%), and process automation (18%).

Source: Container xChange Industry Speak Survey

A Sea of Investment

The Great Lakes St. Lawrence Seaway system, a marine highway that supports more than 100 ports and commercial docks located in each of the eight Great Lakes states, and the provinces of Ontario and Quebec, has been the recipient of significant investment from public and private sources over the past five years.

An independent survey conservatively estimates that investments made between 2018 and 2027 will total $8.4 billion.

Prepared by Martin Associates, and titled Infrastructure Investment Survey of the Great Lakes and St. Lawrence Seaway System, the survey quantifies ongoing investments in the navigation system to help support long-term planning and economic development goals, while also building confidence in the system’s future viability.

The survey also reveals investment in specific aspects of the system, including:

- $636 million in vessel enhancements between 2018 and 2022; $328 million planned between 2023 and 2027.

- $2.1 billion to enhance port and terminal infrastructure between 2018 and 2022; $1.1 billion planned between 2023 and 2027.

- $3 billion in waterway infrastructure (locks, breakwaters, navigation channels) between 2018 and 2022; $1.2 billion planned between 2023 and 2027.

“The survey’s conclusion is clear: both the public and private sector recognize that maritime commerce on the Great Lakes and St. Lawrence Seaway remains essential to the economies of the United States and Canada, and are investing to protect this irreplaceable system,” said U.S. Transportation Secretary Pete Buttigieg.