Trucking Perspectives 2013

Shippers and carriers face myriad uncertainties as the economy slowly begins to recover. Will compliance with new regulations raise rates? Is a capacity crunch on the horizon? Do green mandates raise red flags? And what about a driver shortage? Inbound Logistics’ exclusive trucking market research survey provides some in-depth answers.

Trucking Companies from the Driver’s Seat

Trucking Perspectives Methodology

For trucking companies, objects in the mirror are always closer than they appear. It’s the nature of the business. In the day-to-day fray, every detail is magnified—whether it’s a late shipment, freight claim, dissatisfied customer, spike in fuel prices, or increased regulatory bureaucracy.

Fortunately for truckers, the biggest bump in the road appears to be disappearing from view. After five years of industry attrition and contraction, the U.S. economic engine is spitting and sputtering toward sustained life.

Capacity, cost, and regulations are top of mind for freight shippers and carriers responding to Inbound Logistics‘ 2013 Trucking Perspectives market insight survey. Some uncertainties that shrouded last year’s report—notably the 2012 election and the U.S. Federal Motor Carrier Safety Administration‘s (FMCSA) Hours-of-Service (HOS) implementation—have been resolved. Others remain fluid.

While truckers overwhelmingly express confidence about economic recovery—40 percent see the economy trending upward, 59 percent forecast static growth, and only one percent fear another downturn—increasing regulations and operating costs harden optimism.

Truckers face a litany of concerns: the Affordable Care Act; Moving Ahead for Progress in the 21st Century (MAP-21); FMCSA’s HOS and Compliance, Safety, Accountability (CSA) safety rating program; and California Air Resources Board and Environmental Protection Agency mandates. Truckers are on edge, sensitive to how shifts in driver availability and government policies will shape industry’s trajectory moving forward.

Assessing Assets

Following the economic doldrums that beset much of the trucking industry, and forced many companies to streamline assets to better match available capacity with demand, carriers are slowly rebuilding their fleets. For some, it’s a matter of compliance, investing in more fuel-efficient and cleaner-burning tractor engines; others sense the perfect capacity storm that is swirling as freight volumes accelerate and driver recruitment idles.

Carriers responding to this year’s poll account for an average of 2,801 tractors and vans, compared to 2,988 units one year ago, and 2,542 in 2011. There appears to be some stabilization as companies optimize their networks and match assets to growing demand. Carriers are also investing in trailers—operating 6,755 on average in 2013, up from 6,643 last year.

While capacity can be interpreted in different ways, the true measurement is driver availability. In 2013, trucking companies report an average of 2,871 drivers (owner operators included), down from last year’s high-water mark of 3,024, but above the 2,507 reported in 2011. Interestingly, drivers and trucks appear to be balancing out at a similar rate.

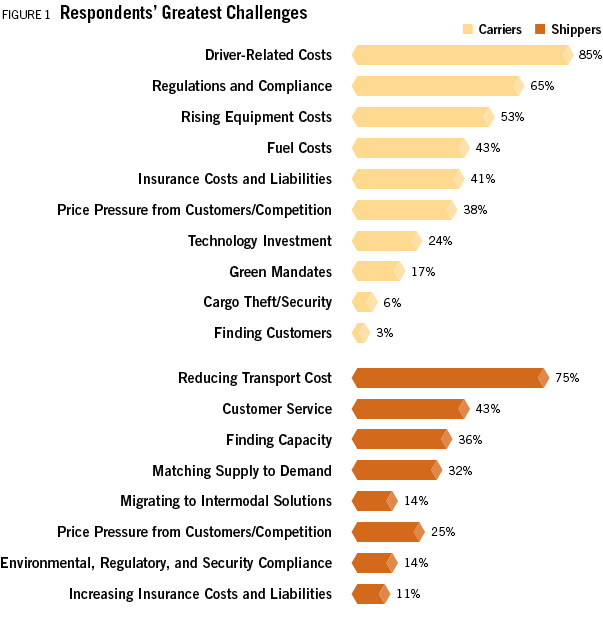

Not surprisingly, managing driver-related costs—recruitment, retention, and training—remains the foremost challenge, according to 85 percent of carriers responding to this year’s poll (see Figure 1). Little has changed in terms of priority since last year. Regulations and compliance (65 percent), rising equipment costs (53 percent), fuel costs (43 percent), and insurance costs and liabilities (41 percent) round out the top five concerns.

Pricing pressure from customers and competition, which last year rated fourth among top priorities, has dropped—with only 38 percent of carriers citing this as a problem. It’s another indication that the market is contracting, and there’s more freight to go around.

Shippers are equally concerned about reducing transport costs—75 percent of survey respondents indicate as much. But other priorities are shifting. Customer service (43 percent) now rates second, up five percent from 2012, displacing pricing pressure from customers and competition (25 percent). Finding capacity has jumped to third, according to 36 percent of respondents; in 2012, less than one-quarter of shippers identified it as a concern.

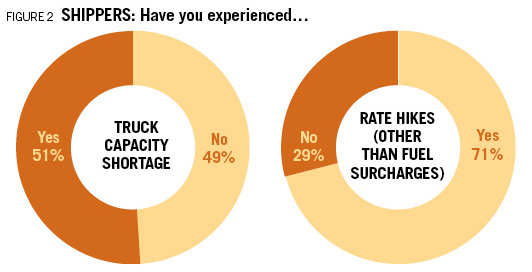

More telling, one in two shippers faced a shortage of capacity during the past year, compared to 45 percent in 2012 and 36 percent in 2011. Meanwhile, freight costs are on the rise. Seventy-one percent of shippers say they have experienced rate hikes apart from fuel surcharges—up five percent over last year’s figures (see Figure 2).

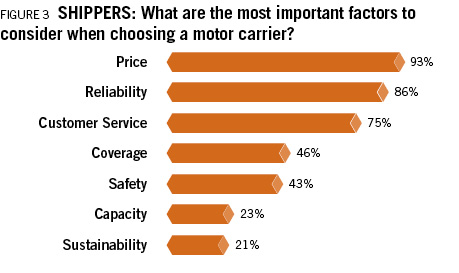

Carriers are gaining pricing leverage as the economy and freight volumes pick up—and their customers are sensitive to this. In 2012, 98 percent of surveyed shippers cited reliability as the most important criterion when selecting a trucking partner (see Figure 3). This year, they reverted to pricing (93 percent), followed by reliability (86 percent), and customer service (75 percent).

Many shippers are in limbo at the moment. Capacity is still soft enough that they have some latitude to try and negotiate on price, but that window is shrinking. As shippers become resigned to paying more—and passing along these costs to consumers—their service and reliability expectations will only grow as they demand more value.

Carriers are responding by expanding their service and technology capabilities. Seventy-nine percent provide logistics services—compared to 66 percent in 2012. One reason for this increase is the growth of e-commerce, which places a greater premium on business-to-consumer delivery options. This year, 31 percent of trucking companies offer final-mile services, up 10 percent from 2012.

As much as reducing costs is a cardinal concern, sustainability is less so—following last year’s findings. Only 17 percent and 14 percent of carriers and shippers, respectively, identify green mandates and regulatory compliance as a challenge. The reality is that trucking companies have made great strides toward improving fuel efficiency as a matter of compliance, economics, and environmentalism.

As further proof, 93 percent of surveyed carriers are EPA SmartWay partners. Carbon and cost-cutting initiatives often go hand in hand. Even though sustainability is not a top-line agenda item, for many companies it has become standard operating procedure.

A similar case can be made for safety and security. Only six percent of carriers cite cargo theft as a challenge. And safety and security aren’t high on the list of carrier selection criteria for shippers—only 43 percent acknowledge as much. This suggests security isn’t a problem until there’s a problem.

Policy Palaver

All indicators point to the capacity balance beginning to shift, putting trucking companies in the driver’s seat as shippers begin to scour the market and lock up partnerships with preferred carriers. Still, the trucking industry—and shippers by extension—is confronted with an uncertain and potentially disruptive regulatory environment.

Now that the FMCSA’s HOS rules have run the appeals gamut and entered into force, trucking companies need to squeeze greater productivity out of their assets by optimizing networks, routes, and operating procedures.

One carrier documents that solo fleets have experienced a 4.9-percent drop in productivity between June and July of this year; and a 3.1-percent decline in July 2013 compared to July 2012. On the long-haul side, the numbers are even more striking. Team fleets saw an 8.6-percent drop between June and July 2013, and a 4.3-percent reduction in July 2013 compared to July 2012.

Trucking companies are taking steps to adapt. For one, they are investing in electronic onboard recorders (EOB) to more easily document driver hours. Seventy-nine percent of surveyed carriers have EOBs installed in their fleets (67 percent in 2012), while 17 percent say they are looking into it.

Trucking companies are also tweaking the way they deliver to customers. “Because we are primarily a just-in-time carrier, we now need to relay freight more often, causing some delays,” explains one carrier respondent.

Another trucking company reports, “We’re having to restructure some shipping and receiving strategies where applicable.”

Nearly half of surveyed carriers have already witnessed a noticeable cost or service impact to operations as a result of the amended HOS regulations; eight percent have not experienced any disruption; and 44 percent have yet to see an impact, but expect one.

The consensus among trucking companies is that the FMCSA failed to properly study the ramifications of new HOS policy before executing it. Recently, a group of lawmakers sent a letter to Secretary of Transportation Anthony Foxx seeking a field study and subsequent report on the new HOS regulations, claiming the FMCSA did not follow guidelines laid out in MAP-21 before enacting changes.

In contrast with HOS rules, the CSA program has yet to elicit as strong a reaction. Only 18 percent of trucking companies have witnessed a noticeable cost or service impact to operations; and 19 percent have seen no impact at all. The majority (64 percent), however, expect an impact in the future.

When the driver shortage eventually becomes a concern, carriers will likely cite the CSA program as a cause. In principle, the rating system aspires to create a safer trucking environment by vetting qualified drivers—and industry is on board with the ethos of this directive. But carriers aren’t convinced the scorecarding metrics serve as a proper assessment of performance.

As one trucking company explains, “CSA takes a one-size-fits-all approach that does not work the same for all areas of trucking.”

In addition to the double whammy of federal regulations such as HOS and CSA, trucking companies are grappling with inconsistent state regulations that impact industry’s ability to efficiently and cost-effectively engage in interstate commerce. For example, varying emissions standards—notably those enforced by the California Air Resources Board—place added burdens on shippers and carriers to be compliant. In some instances, every party in the chain of custody—from shipper to intermediary to carrier—is held accountable when a violation occurs.

Apart from complying with these myriad policy changes, the most difficult challenge carriers face is educating their customers about potential impacts. Trying to get shippers to share in regulatory costs, when rates and fuel surcharges are increasing, can be a difficult conversation. In time, that consideration may likely be non-negotiable.

The Greater Bond?

As the economy fluctuates, and available capacity ebbs and flows, freight brokers have carved out an important niche within the over-the-road transportation industry. The dynamic relationships among shippers, carriers, and agents play an important role in how product moves.

Shipper views toward brokers are about as fickle as consumer spending. Intermediaries provide flexibility; they allow companies the latitude to rate shop when the market is soft, and access capacity when demand grows. Carriers, too, have found utility in working with brokers to procure loads and optimize asset utilization beyond what their internal sales teams can do.

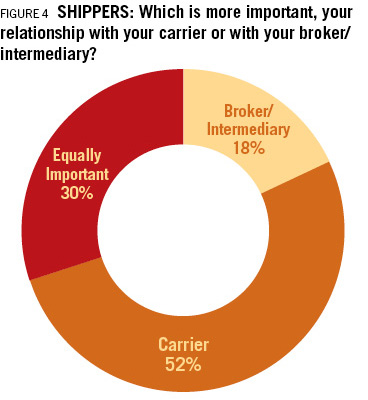

2012 brought a noticeable change as shipper allegiance toward carriers began to grow. That trend continues in 2013. Fifty-two percent of surveyed shippers say they value carrier partners more than brokers—compared to 38 percent last year. Of note, 18 percent prefer brokers (19 percent in 2012); and 30 percent hold both brokers and carriers in similar esteem (43 percent) in 2012.

The data suggests shippers that have traditionally forged strong partnerships with brokers continue to do so—but those on the fence have sidled toward carriers.

The specter of a driver shortage and capacity crunch has compelled many shippers to secure core carrier partnerships for the long haul. Trucking companies, in turn, have been aggressive in their sales tactics. Customers that have wavered or waged price wars with carriers when the market was fluid are destined to come up empty when they need capacity most. That’s reality.

But brokers are evolving their own value propositions to be more competitive. Many provide transportation and logistics execution capabilities beyond the transactional model. The growing importance of brokers has also exposed the industry to greater oversight. The 2012 surface transportation bill increased the freight agent surety bond requirement from $10,000 to $75,000 in an effort to curb fraudulent activity.

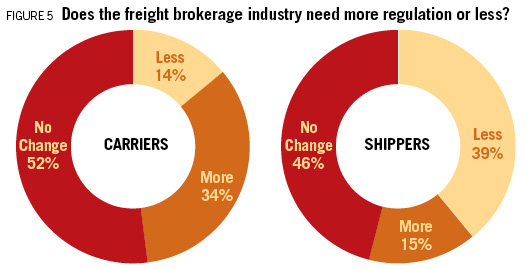

Most shippers (46 percent) and trucking companies (52 percent) say the regulations now in force are sufficient (see Figure 5). But this year, 39 percent of shippers say there should be fewer restrictions (compared to 27 percent in 2012), while 34 percent of trucking companies contend brokers need more regulation—following last year’s data.

Echoes of discontent are sounding among some in the trucking industry who feel brokers should be held to the same standards as carriers. The threat of further regulation stirs an interesting debate between shippers and carriers.

Shippers tend to see regulation as added procedural touches and time—and, therefore, increased costs. “The rules are already becoming too restrictive, without truly improving and adding value to the industry,” says one shipper respondent.

Carrier reactions are expectedly contrarian. “A lot of one-sided brokerage operations take advantage of smaller, entrepreneurial operators or carriers—especially on contractual issues such as waivers of subrogation and accessorial payment obligations,” explains a carrier respondent.

Some suggest that brokers should have to renew authority annually, and meet the same insurance requirements as carriers; that brokers and carriers should compete on a level playing field.

The increased surety bond will force out smaller players, creating less competition and consolidating brokerage power and control—a reality that begs for more guidelines, according to a carrier respondent.

There’s also the matter of CSA, and whether freight agents are properly vetting trucking companies, working through less-reputable operators, or double-brokering loads. Carriers fear brokers wield too much power, dictate shipper behavior, and control capacity when they are looking to fill empty miles. They also see brokers as direct adversaries. Nearly 90 percent of surveyed carriers have their own brokerage divisions .

For shippers, the tension between carriers and brokers only creates more competitive options. And as options become less clear, they will have to rely on a combination of assets and partner resources to move product.

2013 Top 100 Truckers

Inbound Logistics‘ annual Top 100 Truckers directory brings Trucking Perspectives full circle with an in-depth guide to carriers that match the diverse needs of the shipping community. IL editors pared this year’s roster from a pool of 200-plus companies, evaluating surveys, conducting online research, and talking with truckers and shippers alike. This guide serves as a benchmark for the types of services transportation buyers value when looking for new partners or evaluating current ones.

The Top 100 Truckers list offers a snapshot of the motor freight segment, including large truckload and LTL carriers with global inroads, and niche-specific regional haulers that get their white gloves dirty delivering to the final mile.

Together, Trucking Perspectives and the Top 100 Truckers directory provide a comprehensive guide to help you find partners that will put your company in the driver’s seat.

Trucking Companies from the Driver’s Seat

In the wake of the U.S. economic downturn, trucking companies have been optimizing their fleets and operational capabilities to better match the changing needs of over-the-road shippers. Here’s a snapshot of trucking companies’ services, geographic scope, and assets based on Trucking Perspectives survey responses.

Capacity

Average Fleet Size (incl. tractors and vans): 2,801

Average Trailer Fleet Size: 6,755

Average Number of Drivers (including owner operators): 2,871

Operating Area

North America: 77%

U.S. Only: 23%

Global: 41%

Certifications

SmartWay: 93%

HazMat: 77%

C-TPAT: 62%

Free And Secure Trade (FAST): 35%

ISO: 28%

Partners In Protection (PIP): 25%

ACC Responsible Care: 17%

Six Sigma: 16%

Lean: 9%

Trucking Services

Truckload: 85%

Logistics Services: 79%

Expedited: 61%

Dedicated Contract Carriage: 60%

Less-Than-Truckload: 60%

Intermodal: 50%

Refrigerated: 47%

Flatbed: 41%

Final Mile: 31%

White Glove: 27%

Bulk: 25%

Household Goods: 20%

Motor Vehicle Carrier: 16%

Package: 11%

Tank Car: 5%

Vertical Specialty

Freight All Kinds: 74%

Retail: 68%

Construction & Building Materials: 63%

Food & Beverage: 63%

Automotive: 51%

Chemicals: 46%

Valuables (Electronics, Pharma, Jewelry): 46%

Agriculture: 39%

Furniture: 39%

Oil & Gas: 27%

Trucking Perspectives Methodology

Inbound Logistics’ annual Trucking Perspectives market insight report includes input from both motor freight carriers and shippers to provide a comparative analysis supported by empirical data and anecdotal observations. Our outreach effort comprises two parts.

First, IL solicited more than 200 trucking companies to complete a questionnaire that documents their assets, service capabilities, operational scope, and areas of expertise. We also asked carriers to comment on challenges and opportunities in today’s market.

Second, Inbound Logistics reached out to more than 200 unique motor freight shippers to comment on industry trends, regulatory challenges, and their partnerships with carriers.