2022 Trucking Perspectives

Inbound Logistics’ exclusive yearly survey of motor carriers and shippers offers a close look at the state of the trucking industry in an era of inflation and supply chain volatility.

In 2022, as shippers and their trucker partners have settled into what might or might not become the “new normal,” some are breathing a bit easier than last year. COVID precautions have eased in most of the United States. Consumers are spending. The congestion that so badly jammed ocean ports last year has eased, at least a bit.

Yet world conditions in general, and the economy in particular, still offer much to worry about. Ongoing COVID lockdowns in China keep companies guessing about access to essential materials, components, and finished goods. The war in Ukraine and sanctions against Russia have skewed the energy market.

Inflation feeds fears of a recession. Spot trucking rates have fallen, but contract rates remain high. Fuel prices have dropped a good deal since mid-year, but are still too steep for comfort. And the ongoing driver shortage still inflicts pain.

Both shippers and truckers are feeling their way through this new environment, trying to keep operations profitable while planning for a future that’s hard to predict.

One trend our market research survey reveals is that while trucking capacity is somewhat more available than it was a year ago, that hasn’t reduced the cost of shipping freight by truck. We also find that, despite ongoing money worries, shippers still say that finding a reliable partner for over-the-road transportation is even more important than finding a partner with competitive rates.

Inbound Logistics’ annual survey of shippers and truckers provides a chance to see the effects of current conditions, discover how companies are responding, find out about their biggest concerns, and learn how they’re preparing for the future. This year’s survey offers a look at how shippers and truckers are navigating in a time of particular uncertainty.

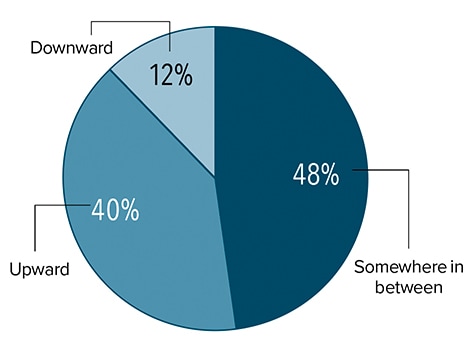

TRUCKERS: As a leading economic indicator, where do you see the economy trending?

Truckers seem to be more optimistic about the economy than many in the United States. According to a CNBC Q2 small business survey, 81% of small business owners expect to see the domestic economy fall into a recession in 2022 due to high inflation. But only 12% of trucking companies that responded to our survey in 2022 say they expect the economy to head south. Forty percent foresee an upturn, while 48% expect that a combination of positive and negative forces will keep the economy somewhere in the middle.

Truckers seem to be more optimistic about the economy than many in the United States. According to a CNBC Q2 small business survey, 81% of small business owners expect to see the domestic economy fall into a recession in 2022 due to high inflation. But only 12% of trucking companies that responded to our survey in 2022 say they expect the economy to head south. Forty percent foresee an upturn, while 48% expect that a combination of positive and negative forces will keep the economy somewhere in the middle.

While this is a rosier outlook than the one in the small business survey, truckers are less optimistic today than they were in 2021. Then, 59% of them predicted an economic upturn, and only 2% said they expect a downturn.

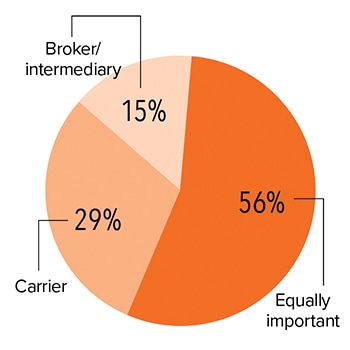

SHIPPERS: Which is more important, your relationship with your carrier or with your broker/intermediary?

A conviction is slowly growing among shippers that they need to maintain strong relationships with both their carriers and third-party intermediaries. This year, 56% of shippers said that those two relationships are equally important. That number was 55% in 2021 and 52% in 2020.

A conviction is slowly growing among shippers that they need to maintain strong relationships with both their carriers and third-party intermediaries. This year, 56% of shippers said that those two relationships are equally important. That number was 55% in 2021 and 52% in 2020.

Among shippers who put more emphasis on one or the other type of service provider, carriers win the day. Twenty-nine percent of shippers consider the shipper-carrier relationship most important, while 15% give top priority to brokers or other intermediaries. Those figures were nearly the same in 2021 and 2020.

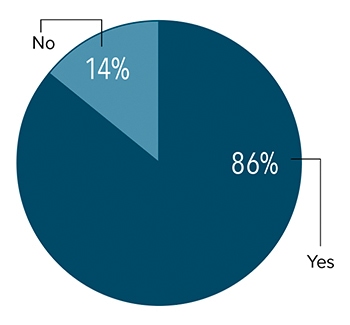

Truckers: DO YOU HAVE A FREIGHT BROKERAGE OR LOGISTICS SERVICES DIVISION/SUBSIDIARY?

Eighty-six percent of trucking companies that responded to our survey say that they provide freight brokerage or logistics services through a division or subsidiary. In 2021, that number was 84%. While two points isn’t a huge increase, it does show that at least some carriers are seeking to secure more capacity for their customers while also bolstering the bottom line with an additional revenue stream.

Eighty-six percent of trucking companies that responded to our survey say that they provide freight brokerage or logistics services through a division or subsidiary. In 2021, that number was 84%. While two points isn’t a huge increase, it does show that at least some carriers are seeking to secure more capacity for their customers while also bolstering the bottom line with an additional revenue stream.

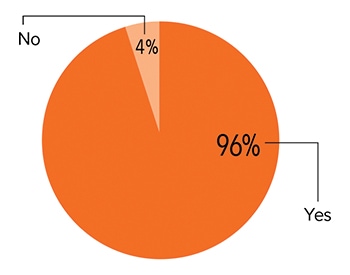

SHIPPERS: Do you buy or participate in sourcing/purchasing trucking services?

The vast majority of shippers in the 2022 survey—96%—participate in sourcing or purchasing trucking services.

The vast majority of shippers in the 2022 survey—96%—participate in sourcing or purchasing trucking services.

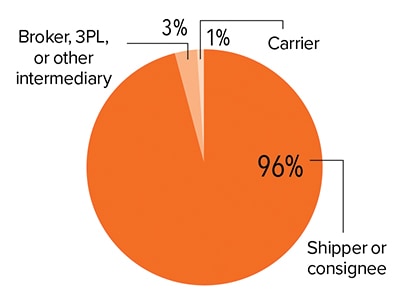

SHIPPERS: What is your role?

Just as in 2021, 96% of shippers who responded to the survey are shippers or consignees; 3% are brokers, 3PLs, or other intermediaries who buy services from trucking companies to move goods on behalf of their clients.

Just as in 2021, 96% of shippers who responded to the survey are shippers or consignees; 3% are brokers, 3PLs, or other intermediaries who buy services from trucking companies to move goods on behalf of their clients.

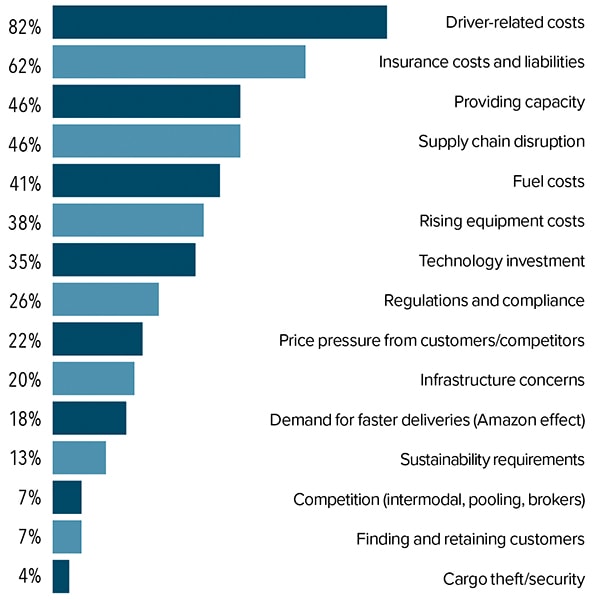

Truckers: What are your greatest challenges?

The 2022 survey points to several significant changes in the trucking landscape since last year. One is that truckers find it slightly easier to give shippers the capacity they need. In 2021, 56% of respondents listed capacity as one of their greatest challenges; this year, that number fell to 46%.

Trucking companies are also struggling less with pressure to make fast deliveries. While 24% listed that as a challenge in 2021, only 18% say they’re grappling with the Amazon effect this year.

But truckers still have serious money worries. Like last year, driver-related costs top the list of important challenges in 2022; 82% of truckers cite it this year. Insurance costs and liabilities—a challenge named by 62% of truckers this year—took second place.

Some cost concerns have climbed a few notches on the list of challenges in this inflationary era. Not surprisingly, one of those is the cost of fuel. In 2021, 25% of truckers listed that as a major challenge. In 2022, a year when the average price of diesel passed $5.50 a gallon at one point, 41% of truckers say they worry about fuel costs. And 38% of them cite rising equipment costs as an important concern, compared with 26% in 2021.

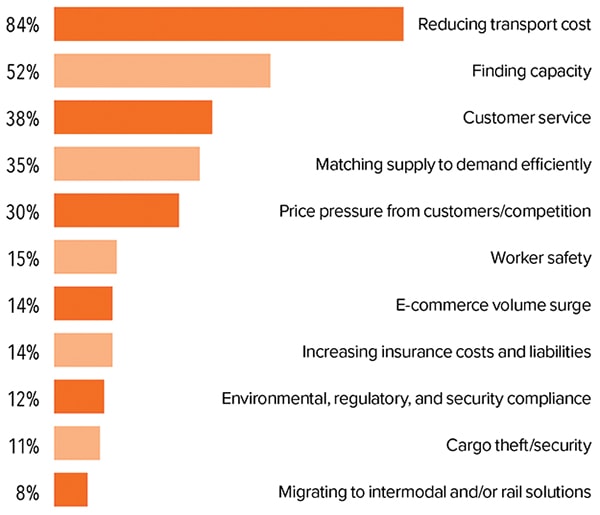

SHIPPERS: What are your greatest challenges?

In 2021, the two biggest challenges for shippers were reducing transport cost and finding capacity. That’s true in 2022 as well, although the emphasis has shifted a bit. Transport cost has taken on slightly more weight—cited by 84% of respondents this year, compared with 80% in 2021.

And shippers this year are slightly less worried about finding capacity; 52% name it as an important challenge, down from 56% last year. Interestingly, shippers’ perceptions on this issue don’t quite match carriers’, as only 46% of carriers say they worry about their ability to provide capacity. If carriers have more trucks and drivers available this year than last, not all shippers have gotten the news.

Fewer shippers this year than last (30% compared with 39%) say they are feeling price pressure from customers and competitors. This is not surprising in an inflationary market, where nearly everyone is charging more and customers are forced to accept it. Customer service and efficiently matching supply to demand remain significant challenges for slightly more than one-third of shipper respondents. Although only a small percentage note worker safety as a challenge, that segment of the survey pool increased from 10% to 15% between 2021 and 2022.

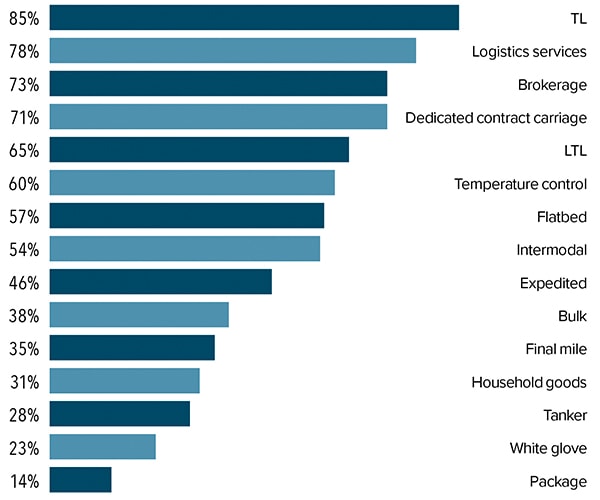

Truckers: What primary types of service do you offer?

Full truckload (TL) remains the most ubiquitous form of trucking service: 85% of our survey respondents stand ready to haul a trailer filled with product. If you have a smaller load, 65% of trucking companies in the survey can offer less-than-truckload (LTL) service.

Seventy-one percent can promise reliable capacity through dedicated contract carriage. If you need a partner that can move your loads on other truckers’ assets as well as its own, or one that offers more than just transportation, you might contact the 78% of respondents that provide logistics services or the 73% that serve as transportation brokers.

More specialized transportation services are less abundant but still readily available. For example, 60% of truckers offer temperature-controlled transportation, 57% provide flatbed service, 54% manage intermodal moves, and 46% provide expedited service.

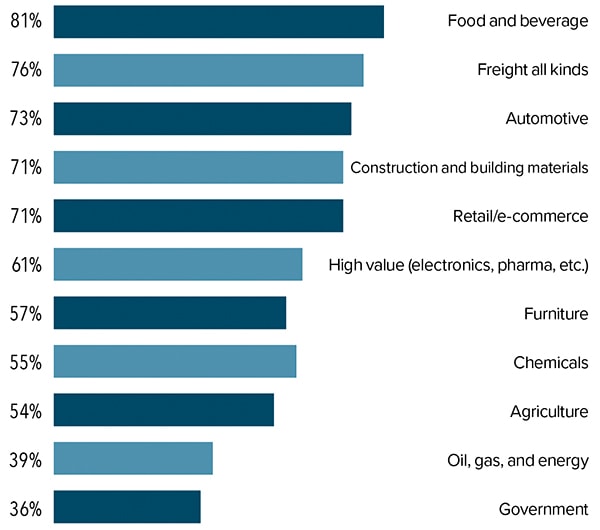

Truckers: What industries/commodities do you serve?

As in 2021, the food and beverage industry is the segment where trucking companies are most likely to find their customers; 81% of respondents said they serve that industry. This represents a slight drop from last year, when 84% said they hauled food and beverage products.

We’ve also seen a slight dip in the second-most popular commodity category, “freight all kinds,” which refers to multiple products combined in one load. In 2021, 80% of respondents were hauling that mixed freight; this year, the proportion is 76%. Other industries served by a significant portion of trucking companies include automotive (73%), construction and building materials (71%), retail/e-commerce (71%), and high-value commodities such as electronics and pharmaceuticals (61%).

The percentage of trucking companies that serve customers in retail and/or e-commerce rose slightly in the past year, from 69% in 2021 to 71% in 2022. Both those numbers are a bit lower than in 2020—the earliest months of the pandemic—when 74% of truckers said they counted shippers in retail/e-commerce among their customers. Pre-pandemic, in 2019, the number was 75%. Retail/e-commerce represents a crucial customer segment for trucking companies, but its importance has ticked down slightly in the past two years.

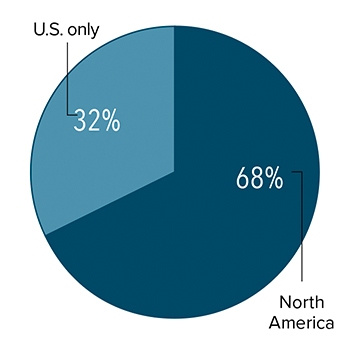

Truckers: What is your operating area?

The proportion of trucking companies serving all of North America, rather than the United States only, continues to hover just above two-thirds, showing a rebound after the first shocks of the pandemic. In 2020, only 57% of truckers said they operated throughout the continent. That number rose to 70% in 2021. This year, it has dropped, but only slightly, to 68%.

The proportion of trucking companies serving all of North America, rather than the United States only, continues to hover just above two-thirds, showing a rebound after the first shocks of the pandemic. In 2020, only 57% of truckers said they operated throughout the continent. That number rose to 70% in 2021. This year, it has dropped, but only slightly, to 68%.

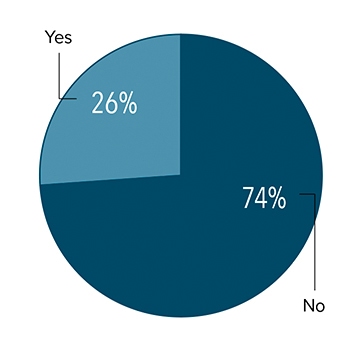

Truckers: Do you provide global services beyond North America?

In a tough environment for global trade, fewer trucking companies than last year offer services that extend beyond the continent. In 2022, just 26% of respondents provide services beyond North America. In 2021, that number was 32%.

In a tough environment for global trade, fewer trucking companies than last year offer services that extend beyond the continent. In 2022, just 26% of respondents provide services beyond North America. In 2021, that number was 32%.

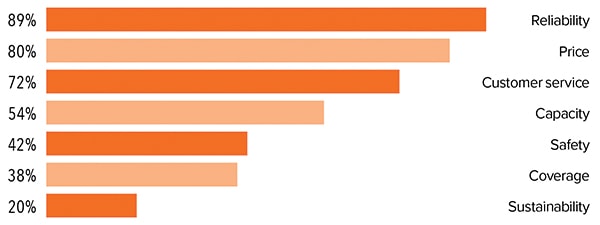

SHIPPERS: What are the most important factors to consider when choosing a trucker?

Not surprisingly, shippers care about price. But they care even more about reliability, indicating that at least some will pay a premium for carriers that send trucks on time and deliver loads as scheduled. In this year’s survey, 89% of shipper respondents name reliability the most important factor to consider when choosing a trucker; 80% name price.

Another value closely linked with reliability—customer service—came in third, cited by 72% of shippers. The proportion of shippers who name capacity as a factor to consider, 54%, nearly matches the 52% who name capacity as one of their biggest challenges.

This survey question also reveals a striking mismatch: While 89% of truckers in our survey participate in the SmartWay program to help reduce their carbon footprints, only 20% of shippers tell us they consider sustainability when choosing a carrier.

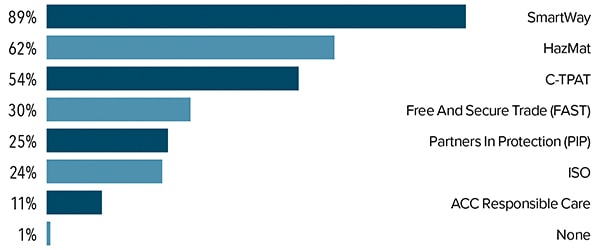

Truckers: What certifications do you hold?

The vast majority of truckers who responded to our survey—89%—have signaled a commitment to sustainability by joining the U.S. Environmental Protection Agency’s SmartWay program. Freight carriers that participate in SmartWay measure, benchmark, and improve their operations to reduce their carbon footprints. Given the high cost of fuel these days, those investments in greener operations can also save money.

The second-most popular certification held by truckers authorizes them to haul hazardous materials. Sixty-two percent of our trucker respondents hold hazmat certification. Just over half—54%—are certified by the Customs Trade Partnership Against Terrorism (C-TPAT), a program that helps them move freight faster and more easily across international borders. A much smaller portion are certified by two other programs designed to speed border crossings for trusted freight: 30% participate in Free and Secure Trade (FAST) and 25% in the Canadian program Partners in Protection (PIP).

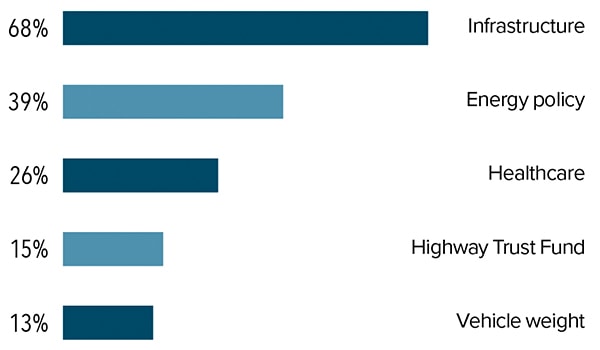

Truckers: What legislative measures have the greatest impact on your business?

Trucks rely on public infrastructure to get where they’re going. So truckers care a lot about laws that affect the construction and maintenance of roads, bridges, and related facilities. Sixty-eight percent of trucking companies in the 2022 survey name infrastructure as one of the legislative measures that have the greatest impact on their business.

The second-biggest legislative concern—although a distant second—is energy policy, named by 39% of trucker respondents. That’s up a bit from last year’s 32%, no surprise in a year of soaring energy prices, and at a time when the newly signed Inflation Reduction Act offers incentives for fleets to shift from diesel to electric power.

Three other legislative areas drew less concern from truckers this year than last: laws involving healthcare (cited by 26% in 2022 vs. 30% in 2021), the Highway Trust Fund (15% in 2022 vs. 19% in 2021), and vehicle weight (13% in 2022 vs. 18% in 2021).

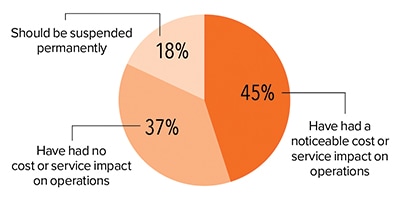

SHIPPERS: How do you feel about Hours-of-Service regulations?

More shippers are bothered by federal rules that regulate truck drivers’ working hours than they are by the CSA program. Forty-five percent of shipper respondents say Hours-of-Service regulations have had a noticeable impact on transportation costs or on the services they receive, and 18% would like to do away with those rules altogether. Thirty-seven percent have seen no cost or service impact.

More shippers are bothered by federal rules that regulate truck drivers’ working hours than they are by the CSA program. Forty-five percent of shipper respondents say Hours-of-Service regulations have had a noticeable impact on transportation costs or on the services they receive, and 18% would like to do away with those rules altogether. Thirty-seven percent have seen no cost or service impact.

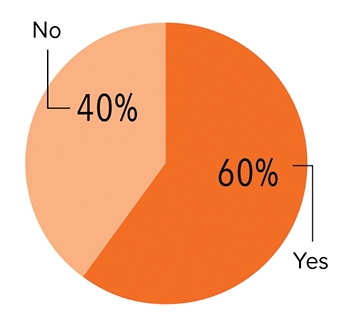

SHIPPERS: Have you experienced a shortage of truck capacity?

Finding a truck remains a challenge in 2022, but it’s not quite as hard as last year. In 2021, 70% of our shipper respondents said they had experienced a shortage of truck capacity. In 2022, that number dropped by 10 points to 60%.

Finding a truck remains a challenge in 2022, but it’s not quite as hard as last year. In 2021, 70% of our shipper respondents said they had experienced a shortage of truck capacity. In 2022, that number dropped by 10 points to 60%.

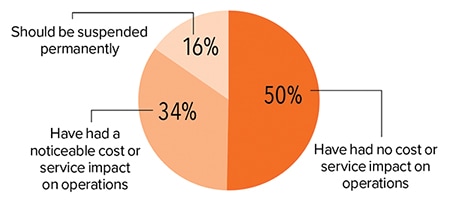

SHIPPERS: How do you feel about CSA regulations?

Regulations in the Federal Motor Carrier Safety Administration’s Compliance, Safety, and Accountability Act (CSA) have not affected the cost of operations or impacted transportation services for half of the shippers who responded to our survey. About one-third of shippers have seen some impact from the program. Sixteen percent of shippers say the CSA program should be suspended permanently.

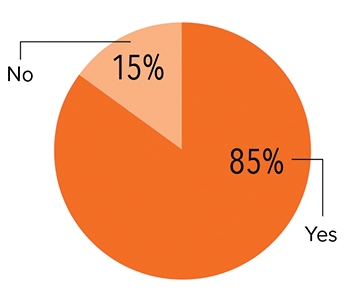

SHIPPERS: Have you experienced rate hikes apart from fuel surcharges?

While the capacity crunch has eased somewhat since last year, increased supply doesn’t seem to have brought rates down. To the contrary, 85% of shippers in our survey say they have experienced rate hikes, even without taking fuel surcharges into account. That’s up from last year’s 80%.

While the capacity crunch has eased somewhat since last year, increased supply doesn’t seem to have brought rates down. To the contrary, 85% of shippers in our survey say they have experienced rate hikes, even without taking fuel surcharges into account. That’s up from last year’s 80%.