Vertical Focus: Personal Care Products & Cosmetics

What’s In Store?

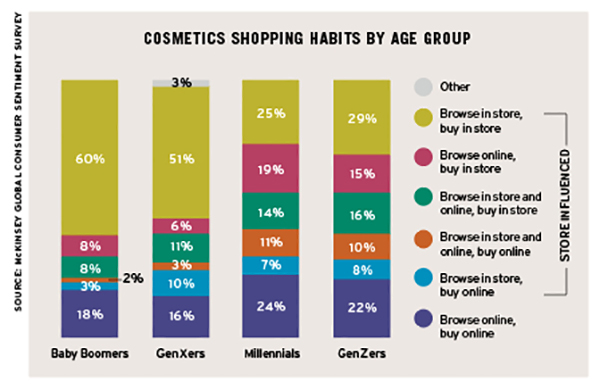

In-store shopping accounted for up to 85% of beauty product sales in most major markets before the pandemic, finds a McKinsey report—even millennials and Gen Zers made almost 60% of their cosmetics purchases in stores (see chart). What will happen to physical beauty product stores in the future?

About 30% of premium beauty product outlets shut—some won’t reopen, and new openings will likely be delayed for one year or more, the report says. Also, increased online sales are not offsetting the decline in in-store sales.

In China, the return to in-store shopping may be slow. While many stores reopened in March 2020, they report that sales have not fully bounced back.

However, brands that were able to scale their operations report online sales twice as high as pre-COVID-19 levels. For example, Sephora’s U.S. online sales are up 30% versus 2019, as were Amazon’s beauty product sales in April 2020, McKinsey says.

Retailers are using promotions to bring back consumers and move unsold inventory. In an atypical move, many high-end beauty brands are offering discounts of up to 40%. As brick-and-mortar stores reopen, more promotions will likely be aimed at reclaiming foot traffic, the report says.

Counterfeit products cost the cosmetics

industry more than $75 million each year.

—U.S. Customs and Border Protection

Beauty Box Subscriptions Survive

Although the pandemic initially caused an increase in cancellations of beauty box subscriptions, many services bounced back. Consumers buy beauty boxes to try new products as they avoid physical stores, says a report from Glossy.co—shifting retailers’ focus to e-commerce fulfillment.

Even before stay-at-home orders began in the United States, both Birchbox and FabFitFun went through layoffs, and Sephora ended its subscription service.

Box of Style’s subscriber growth declined up to 30% in March 2020, says CEO Rodger Berman. However, sales have since rebounded and retention was unaffected. The average daily subscriber growth is now 20% higher than in Q1.

Birchbox also experienced an increase in subscribers across all subscription tiers, Glossy.co says. Since April, it added more personal care products, such as hand sanitizer and nail kits, to meet demand.

Retention at BoxyCharm has stayed nearly the same since March, says founder Joe Martin. It introduced wellness items, such as vitamins, into its monthly online shopping events, which boosted retention.

Ulta Beauty’s e-commerce sales grew 90% YOY in Q3 2020,

driven by ITS buy online/pick up in store option.

—Digital Commerce 360

Nailed It

With many hair and nail salons closed during the pandemic, DIY beauty categories and self-care products found new customers:

- Hair dye sales were up 23% and hair clipper sales were up 166% in the United States in the first week of April 2020 versus 2019, Nielsen reports.

- Sales of Madison Reed’s at-home hair-coloring kits increased tenfold from mid-March to mid-April 2020.

- Online sales of high-end nail polish have seen double-digit growth every week since March 2020 in the U.K., McKinsey reports.

- Zalando, Europe’s largest fashion and lifestyle e-commerce marketplace, says that sales of its skin, nail, and hair care products were up 300% year on year in April.

- Amazon’s sales are way up for nail products (218%), hair coloring (172%), and bath-and-body products (65%) compared to 2019.

- Revlon has seen nail polish sales grow 13.1%, nail tools grow 15%, and foot tools grow 274% year over year.

"Beauty, much like during the recession in 2008,

will continue to thrive because people want small luxuries

h2o help them feel better both physically and mentally."

—Kirbie Johnson, Beauty Reporter, Gloss Angeles

Personal Care On Demand

Shoppers can order takeout and groceries almost instantly with various mobile apps, but what about personal care items like deodorant and shampoo? With the influx of online orders during the pandemic, same-day and two-hour delivery options are popping up for trendy personal care brands, many of which have never been able to offer same-day shipping.

To meet this demand, fulfillment technology startup Darkstore launched FastAF, a digital shop that curates premium personal care products and delivers them to doorsteps in two hours. Currently serving New York City and Los Angeles, FastAF uses dark stores—microfulfillment centers strategically placed in urban areas—to deliver in-demand beauty, personal care, and wellness products from popular brands such as Glossier, Aesop, Le Labo, Moon Juice, and Drunk Elephant.

Among the top beauty brands that now offer same-day delivery: Sephora partnered with Instacart to offer one-hour delivery from nearly all its North American locations. MAC Cosmetics offers a same-day delivery option through Postmates. Coty, whose brands include Covergirl and Sally Hansen, partnered with GoPuff to offer 30-minute no-contact delivery.

Eye Lift

Demand for eye makeup is on the rise as consumers set their sights on above-the-mask products. While Amazon sales of lip care and lipstick dropped 15% for the month ending on April 11, 2020, eye makeup sales were up 204% year-over-year for the three-month period ending in June 2020.

This trend challenges the "lipstick index," a term coined by Estee Lauder chairman Leonard Lauder to explain the rise in lipstick sales during economic distress. Lauder says the concept may pave the way for other accessible luxury items during the pandemic, such as eye makeup. The global beauty market—currently valued at $500 billion—will decline by 20% to 30% in 2020.

Some beauty brands have found silver linings in eye makeup and skin care sales. Alibaba saw success in the category in China, reporting 150% month-over-month growth for eye cosmetic sales during the week ending February 18.

Beauty chain Amazing Lash Studio reports a 480% rise in eye makeup sales since March, and Tweezerman experienced a 330% rise in eyelash curler sales.

Skin care sales are also booming as Americans focus on self care and mitigating "maskne," a new phrase describing skin breakouts caused by wearing face masks.