VERTICAL FOCUS: Sports & Recreation

The sports and leisure equipment market is projected to register a compound annual growth rate of 4.5% over the next five years.

Be a Good Sport

The sporting goods industry played a good game during the past two years, with growth equaling or outperforming pre-pandemic levels, but economic conditions could derail progress for some industry players, according to Sporting Goods 2023: The Need For Resilience In A World In Disarray, a study conducted by the World Federation of the Sporting Goods Industry and McKinsey.

The study identifies six actions that active lifestyle companies can take to tackle inflationary and other economic pressures:

1. Implement smart pricing and channel management. Data and analytics related to price elasticity and competitor offerings could inform flexible pricing strategies and revenue management to protect net margins and limit volatility.

2. Reset return on investment. Conduct a top-down review of efficiency by channel and SKU to invest for growth.

3. Strengthen brand communications. Optimize and refocus communications on the brand’s core value proposition to help boost revenue.

4. Build supply chain resilience. Review sourcing and supply chains and apply next-generation levers to the cost base.

5. Foster next-generation organization productivity. An agile approach and innovations, including robotic process automation, could lead to long-term savings. Review warehousing and transportation costs to increase productivity.

6. Optimize finance. Focus on freeing up cash and exploring divestments and acquisitions.

At Your Athleisure

The athleisure market (sneakers, leggings, T-shirts, hoodies, sweatshirts) is expected to grow from $4,18,690 million in 2022 to $8,33,199 million by 2030.

Athleisure’s market value has an annual growth rate of 8.1% worldwide.

The United States is the largest market for athleisure products. It accounts for about 30% of worldwide sales.

A growing interest in physical fitness among young people in the Asia-Pacific region and a cultural shift in apparel preferences has that region set to overtake the United States as the world’s largest athleisure buyer in a global market.

Athleisure is the largest product segment among young people worldwide. In some places, it accounts for more than 65% of the clothing purchased by people in their teens and 20s.

–Linchpinse

How the Lifestyle Industry Stays in Shape

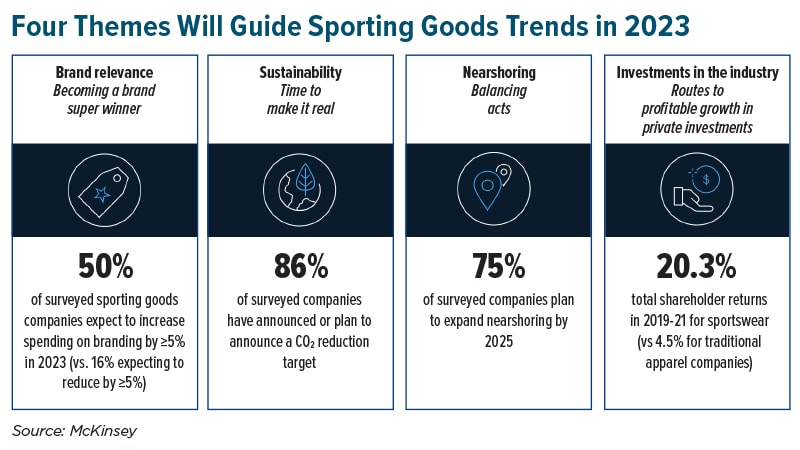

Four key trends are shaping the active lifestyle industry in 2023, according to McKinsey:

1. Brand relevance will increase. Consumers who were once motivated first by factors such as functionality, design, and price, are now increasingly driven by brand. Notably, the industry’s high performers in terms of value creation are characterized by high levels of brand equity and loyalty.

Sporting goods companies need to build strong and trusted brands that leverage the direct-to-consumer revolution, collaborate with other brands, and engage in community marketing.

2. Sustainability. Brands, retailers, and manufacturers have made bold promises of a more sustainable future, but are they up to the challenge? With self-imposed deadlines on the horizon, it is time to deliver.

In an environment where both regulators and consumers are targeting greenwashing, companies should carefully consider how they deliver on their actions and ambitions.

3. Nearshoring. It is important that the nearshore country meets the requirements for raw materials and components and offers the right capabilities and capacity. A detailed business case should take into account a holistic set of variables to determine financial impact and feasibility, as well as potential government incentives.

4. Hot target for private investors. The sporting goods industry has grown strongly over recent years and is likely to continue on that path. In addition, the industry has proven to be more resilient in downturns, bouncing back faster than others.

Further, it comprises many smaller but well-differentiated brands that make attractive targets for consolidation or growth plays. These factors have fueled interest among private investors, with the number of annual deals doubling in the past decade.

On Your Mark, Get Set, Go Shopping

Although online retailing has remained a considerably stable distribution channel for the sales of sports equipment in the past, it is expected to gain more prominence in the future due to the associated convenience, finds a Mordor Intelligence report.

Specialty stores, however, hold the largest share in the current market scenario, the report notes.

The sports and leisure equipment market is projected to register a compound annual growth rate of 4.5% over the next five years. Increased online retailing, widely spreading distribution channels, and easy availability of sports equipment and necessary courses required for tournaments and other competitions are expected to boost market growth.

10 Best-Selling Sneakers of All Time

1. Nike Air Jordan 1

2. Converse Chuck Taylor All Stars

3. Nike Air Force 1

4. Air Jordan XI

5. Air Penny 2

6. Air Jordan XII

7. Nike Zoom Kobe IV

8. Reebok the Question

9. Converse Weapon

10. Nike Air Zoom Huarachie 2K4