2021 Inbound Logistics Perspectives: 3PL Market Research Report

Our 16th annual 3PL market research report reveals the current state of the union between shippers and their logistics service partners.

With COVID-19 still raging in some regions while fading in others, it’s a complicated time for supply chains. Many buyers have cash in hand and the will to spend it, but shortages of key commodities such as microchips and plastics are slowing production of the items they crave. Port congestion, labor shortages, tight freight capacity, and other constraints also stymie shippers as they try to maintain the flow of materials and finished goods.

Third-party logistics (3PL) service providers are the natural allies of shippers in these perplexing times. These logistics partners help shippers devise and execute new strategies to deal with today’s unusual conditions as they evolve. Often, they help overcome supply chain challenges with broader and deeper resources, more sophisticated technology, and more clout in the transportation marketplace than shippers command on their own, plus insights they’ve gained while serving a broad spectrum of clients.

Clearly, a good number of shippers understand the benefits 3PLs provide. Most of the 3PLs who responded to Inbound Logistics’ annual 3PL marketplace survey in 2021 report growth in their revenue, profits, and customer base.

Inbound Logistics’ 16th annual 3PL Perspectives report uses data gathered from 3PLs and shippers to paint a picture of how these relationships work across the whole spectrum of 3PL services. After diving into this report, check out the Top 100 3PLs for 2021 (page 84) for a closer look at the companies that help shippers keep their supply chains fluid, flexible, and smart.

About the 3PL Respondents

Asset-Based or Non-Asset-Based

- Both 48%

- Non-asset 45%

- Asset-based 5%

Geographic Coverage

- North America 45%

- Global 39%

- U.S. Only 16%

Markets Served

- Manufacturing 87%

- Transport sector 87%

- E-commerce 75%

- Retail 74%

- Wholesale 73%

- Services 54%

2020 Revenue

Participants in this survey report in excess of $178 billion in sales. Several did not report revenue so the amount is likely higher.

Top Challenges Shippers Face

With capacity tight and freight rates running high, it’s no wonder the need to cut transportation costs tops the list of challenges shippers face in 2021. Half of respondents list transportation spending as a crucial concern. While that’s a smaller group than the 70% who were seriously concerned about transportation costs in 2020, many shippers are still trying to figure out how to spend less on getting freight where it needs to go.

Nearly as crucial for shippers this year is finding, training, and retaining qualified labor, cited by 47% of shippers who took part in the 2021 survey. That’s the same percentage as last year, suggesting that labor shortages—those triggered by COVID-19 on top of the nearly chronic shortage of commercial drivers—haven’t eased in the past 12 months.

Forty-four percent of shippers cite e-commerce as an important challenge this year, an increase from 37% in 2020. The pandemic accelerated consumers’ shift to online shopping, and that effect has persisted even as the United States emerges from COVID quarantine, making e-commerce an urgent concern. And in an era of commodity shortages and port congestion, 39% of shippers say they face challenges in managing inventory, up from 31% in 2020.

Notably, only 4% of shippers this year say they are concerned about corporate social responsibility, including sustainability, down from 14% in 2020, reflecting the precedence of existential concerns and urgent challenges.

TOP CHALLENGES 3PLs FACE

Among the challenges 3PLs face in 2021, four stand out as key concerns for three-quarters or more of respondents, and all four have gained weight since 2020. Capacity and growth management top the list, each cited by 78% of 3PL respondents. In 2020, just 49% named capacity as an issue, and only 32% cited growth management.

Finding and retaining customers runs a close third in 2021, noted as a challenge by 74% of respondents. In 2020, that issue topped the list, although it figured in responses from slightly fewer 3PLs—67%.

Like employers in many other industries, 3PLs are feeling the effects of a tight labor market: 73% of respondents say finding, training, and retaining qualified labor is an important challenge. That’s a big jump from one year ago, when 58% cited challenges related to the labor pool.

One surprise is the relatively small number of 3PLs that name supply chain disruptions/contingency planning/risk management as a challenge—31%, compared with 63% in 2020. Given capacity and labor shortages, port congestion, and manufacturing delays, disruption and risk seem to be important issues in 2021.

Perhaps many 3PLs have learned to anticipate potential disruptions and mitigate their effects, transforming disruption and risk from special challenges into business as usual.

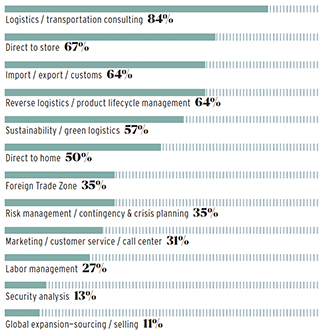

SPECIAL SERVICES 3PLs OFFER

Basic logistics services—planning and executing transportation, storing inventory, etc.—are the bread and butter of many 3PL businesses. But most of these companies also offer more specialized services. Foremost among those are consulting services to help shippers develop their logistics and/or transportation strategies and put them into action. Eighty-four percent of our 3PL respondents offer such services.

The second-most common set of special 3PL services helps shippers deliver product directly to retail stores, rather than to retailers’ distribution centers. Sixty-seven percent of this year’s respondents provide that service, down a bit from 75% in 2020.

Two other important themes in 3PLs’ service portfolios are import/export/customs services and services for handling reverse logistics and managing the product lifecycle, each of them cited by 64% of respondents. The other services offered by half or more of our respondents are sustainability/green logistics (57%) and direct-to-home delivery (50%).

WHAT IS THE MAIN REASON FOR A FAILED 3PL PARTNERSHIP?

When things go sour between a shipper and its 3PL, the problem is far more likely connected to performance than to price.

Sixty-one percent of shippers cite poor customer service as the top reason for a failed 3PL relationship. Another 22% mention a related cause: failed expectations. Only 10% cite cost as the top reason for a shipper-3PL breakup, and just 2% say relationships have foundered when the shipper found a service provider with better pricing.

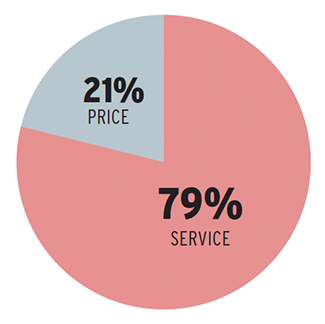

Shippers, Is Price or Service More Important?

Even as shippers grapple with how to control transportation and logistics costs, most know better than to skimp on relationships with 3PLs. A solid 79% tell us that service outranks price when they judge the quality of a logistics partner. Asked why their favorite 3PLs deserve industry recognition, many shippers offer comments such as “excellent service.” Others were more specific:

“They help me move freight with ease and go above and beyond.”

“Quick on quotes, great customer service, on-time deliveries, always helpful.”

“They consistently invest in new technology and meet our needs. They go above and beyond with access to all levels of leadership.”

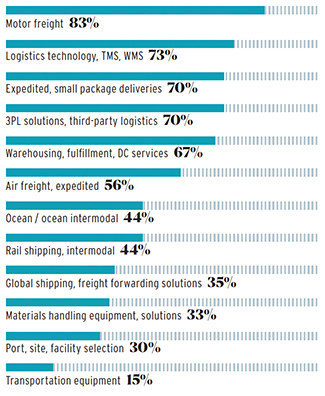

SERVICES SHIPPERS BUY

Most shippers rely on their 3PLs to move product from Point A to Point B: 83% say they buy motor freight services through their logistics partners. And 70% work with 3PLs to purchase services for expedited and small package deliveries, a growing

While over-the-road is the transportation service shippers are most likely to purchase through their 3PLs, other modes also play an important role: 56% buy airfreight services through these partnerships, while 44% cite ocean and ocean/intermodal services and the same number mention rail and rail/intermodal.

Shippers also rely heavily on 3PLs to receive and store inventory and then arrange to move it to its next destination. Among our respondents, 67% say they use 3PLs for warehousing, fulfillment, and distribution center (DC) services.

3PLs remain strong players in the world of logistics information technology. Although the market abounds with pure-play technology vendors, 73% of our shipper-respondents say they purchase transportation management systems (TMS), warehouse management systems (WMS), or other logistics technology solutions from 3PLs.

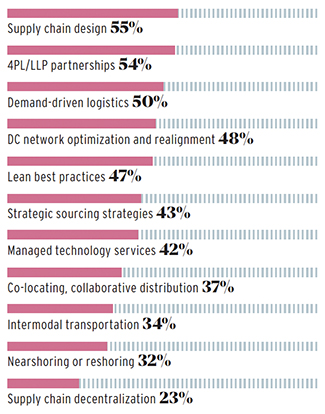

Strategies 3PLs and Shippers Use to Manage Challenges

Of the top five strategies shippers and their 3PLs use to manage challenges, two of them involve the geographic dimensions of the supply chain. Supply chain design, cited by 55% of 3PLs, can encompass all aspects of product flow, from where a company sources goods, to how they’re transported, to what distribution points offer the most efficient access to customers. DC network and realignment, which 48% of 3PLs mention, focuses on the best locations for distribution centers.

Fifty-four percent of 3PLs say they use a fourth-party logistics (4PL) provider or lead logistics provider (LLP) model to orchestrate the services of multiple service companies. Half of this year’s respondents focus on demand-driven logistics.

While pandemic-induced supply chain disruptions have sparked predictions that more companies might soon source products closer to home, only 32% of this year’s 3PL respondents say they’re using nearshoring or reshoring to manage challenges.

SHOULD SHIPPERS PARTNER WITH ONE OR MORE 3PLs?

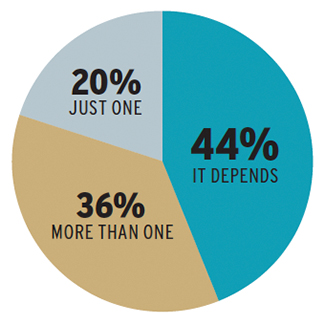

Shippers remain open-minded about 3PL partnerships, perhaps reasoning that different providers are best-equipped to serve different needs. Only 20% of shippers who participated in this year’s survey say that a shipper should work with just a single 3PL. Thirty-six percent say that it’s best to work with more than one, and 44% say the answer depends on the situation. When we shifted from theory to practice, asking shippers how many 3PLs they actually use, responses ranged from one to 10, depending on company size. The median number is two.

3PL SERVICES & CAPABILITIES

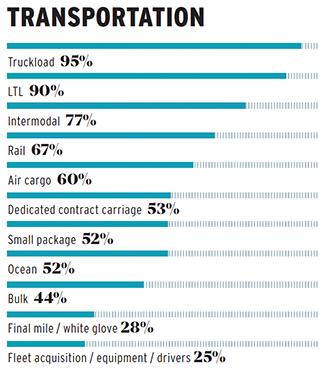

Almost all 3PLs provide truckload transportation, and nearly as many offer less-than-truckload (LTL). Beyond that, 3PLs offer transportation by a variety of other modes, as well as specialized transportation services such as small package, bulk, and final mile/white glove.

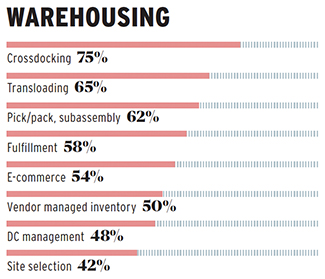

Warehousing services a 3PL is most likely to offer include crossdocking, transloading, and pick/pack and subassembly. In an era of accelerating growth in direct-to-consumer sales, shippers may be pleased to note that more than half of 3PLs provide e-commerce services.

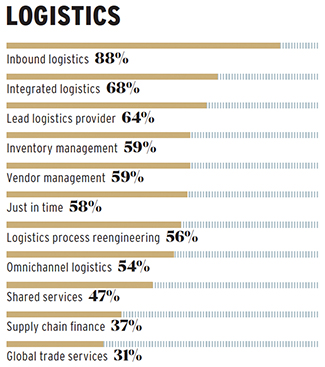

A large majority of 3PLs offer inbound logistics services. Sixty-eight percent provide integrated services to manage the entire logistics process. Nearly as many—64%—can serve as a lead logistics provider, coordinating several companies to serve the shipper’s needs.

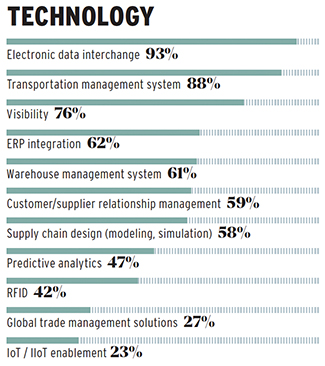

Technology solutions that 3PLs are most likely to offer address basic logistics functions such as electronic data interchange (EDI), transportation management, and supply chain visibility. About half also offer software with a more strategic focus, for functions such as supply chain design and predictive analytics.

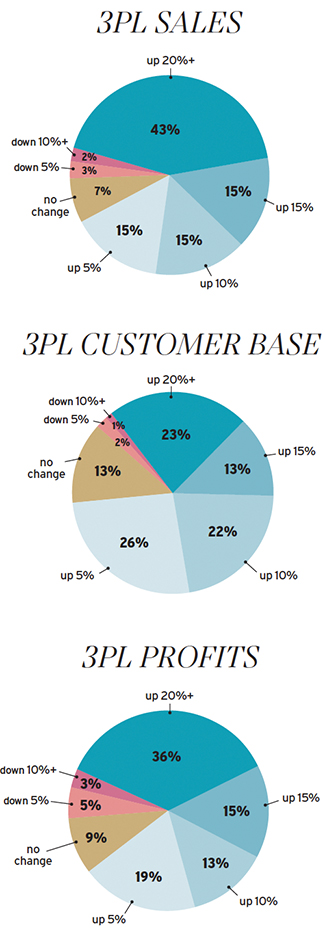

Most 3PLs have grown and prospered over the past year. Among our respondents, 88% report increased sales (compared with 74% in 2020); 84% have enlarged their customer bases (slightly up from 83% in 2020); and 83% have seen profits rise (compared with 72% in 2020). 3PLs haven’t quite returned to the pre-pandemic strengths they enjoyed in 2019, when 95% reported increased sales and 92% saw increased profits. But they are certainly gaining ground.

A look at specific levels of gain reinforces the positive picture for 3PLs. Fifty-eight percent of our 3PL respondents report their sales have grown by 15% or more, and 51% have seen profits grow by that much. Customer gains, however, have not been as strong. Just 36% of respondents saw their customer bases increase by at least 15%, while 26% saw 5% growth.

Many 3PLs attribute their growth in the past year to pandemic-related conditions. Customers needed help finding capacity in a tight market and shipping higher volumes of freight as demand for their products swelled. For some 3PLs, COVID disruptions offered an opportunity to rethink how they did business. Their investments in talent and technology helped their operations run smoothly, and their ability to maintain high levels of service in tough times kept customers loyal.

MOST IMPACTFUL TECHNOLOGIES

Artificial intelligence/machine learning by far tops the list of technologies that 3PLs say will have the greatest impact on the way they do business, cited by two-thirds of respondents. While few 3PLs currently offer AI or machine learning capabilities to their shippers, those technologies can enable predictive analytics, which nearly half of 3PLs do offer.

No other technology comes close to AI in its disruptive power, according to our survey. But 47% of 3PL respondents expect autonomous vehicles to prompt significant changes, and 40% say the same about Internet of Things/industrial Internet of Things (IoT/IIoT) technologies.

With blockchain-based technologies such as cryptocurrency constantly in the news, about a third of respondents say they expect blockchain to make a major impact on logistics, up a bit from last year’s 25%.