Global Logistics—November 2013

Aviation Climate Emissions Agreement Flies Forward

The October 2013 agreement by 191 countries at the International Civil Aviation Organization (ICAO) general assembly in Montreal, which will develop a global market-based measure for aviation emissions by 2020, is a major breakthrough in the development of global standards for the industry.

Under terms of the resolution, governments will spend the next three years leading up to the scheduled ICAO General Assembly in 2016 on technical discussions. Each country will work on the design elements of such a scheme, including standards for monitoring, reporting, and verifying emissions, as well as the type of scheme to be implemented.

"We must not underestimate the importance of this agreement," says Doug Brittin, secretary general of The International Air Cargo Association (TIACA). "Business is changing, and companies are being forced to deal with harsh economic realities while also working to achieve a sustainable future.

"Collaboration on the development of necessary global standards is essential to achieve the clarity international businesses need, and to remove unnecessary additional processes and costs that inevitably arise when organizations are forced to comply with a raft of different national and regional regulations," he adds.

Colombia, Peru, Chile Gain Ground in Latin America

On account of their sheer size, Brazil and Mexico have long been Latin America’s two primary economic drivers. Increasingly, though, they are facing competition from three South American upstarts.

Significant economic growth is expected over the near term in Peru (6.3 percent), Chile (5.1 percent), and Colombia (4.7 percent)—compared to three percent in Brazil and Mexico, predicts freight transport insurance specialist TT Club.

"Peru has grown its export trade by a multiple of five over the past decade, while Colombia has a sustained GDP growth rate of about five percent in recent years," explains Dan Negron, TT Club’s senior underwriter, commenting on the London-based company’s Transport and Logistics Market Opportunities report.

"Both countries have burgeoning middle classes, which is a significant driver of international trade," he notes.

Such economic growth is one of four factors pinpointed in TT’s analysis; the others include government policies, improved connectivity, and distribution channels.

A number of government policies, particularly the privatization of ports and free trade agreements, are significant in terms of increasing trade, reports Negron. However, greater investment in domestic infrastructure to improve transport connectivity within the region, and more organized logistics supply chain services, are necessary for trade growth to reach full potential.

"In addition to this need for capital investment to improve connectivity, the functions of warehousing, trucking, cargo consolidation, and other related services are performed by individual operators or by shippers themselves," says Negron. "Systems, therefore, tend to not be fully integrated, and the efficiencies of a cohesive supply chain can’t be realized."

Shippers Resist New IMO Container Weight Proposal

The International Maritime Organization‘s (IMO) proposal to amend its Safety of Life at Sea Convention (SOLAS)—which would require a verified certificate of a container’s weight before loading on vessel—has unleashed a tempest of protest among some ocean shipping advocates.

The amendment is not only unnecessary, but will likely cost global shippers as much as $5 billion annually in extra costs, noted Marco Wiesehahn, policy advisor for the European Shippers’ Council (ESC), at Intermodal Europe’s recent event in Hamburg.

Furthermore, the ESC contends there is no empirical evidence to confirm claims of an endemic problem of shippers misdeclaring container weights.

The Asian Shippers’ Council (ASC) has voiced similar concerns. "There are millions of shippers across Asia, with different levels of maturity and different operational constraints," says John Y. Lu, chairman of the ASC. "Before arriving at a key gateway for export, cargo may have to use multiple transport modes—trucks, ships, and/or rail. Can you imagine trying to implement what is agreed upon at the IMO in such a challenging environment?

"Because many emerging countries elsewhere—in South America and Africa—are in a similar situation, a one-size-fits-all requirement cannot work," he adds. "It has not worked for 100-percent security screening, and it will not work for 100-percent verification of gross container weights."

The seed for obvious objection is that the ESC and ASC, which represent 75 percent of the world’s shippers, were not consulted in the IMO decision-making process. Both organizations argue the need for broader consideration for the challenges 100-percent gross weight verification would create, and whether viable alternatives are available. Would the onus lie completely with shippers? Should ship-owners have some responsibility? What about terminal operators, who would likely stand to gain the most in terms of revenue by providing weight verification services?

Criticisms aside, wide support for the SOLAS amendment comes from the Global Shippers’ Forum, World Shipping Council, and International Transport Workers Federation, among others. Properly weighing containers at point of origin would enhance safety and efficiency at sea. Ships would be better able to distribute cargo weight and optimize stowage, which has a direct impact on fuel consumption. There is also consensus that overweight containers present a growing danger beyond ocean transport—specifically for truck transloads.

Whatever the outcome, it won’t come soon. In the meantime, expect a growing debate as shippers, lobbyists, and regulators anchor their buoys on either side of the divide.

Spain, Portugal Seek Rail Rapport

U.S. shippers take for granted the relative harmony that exists between states, railroads, and even passenger and freight rail industries. In Europe, however, those synergies are anything but implicit—even among neighbors.

As one example, Spanish and Portuguese public works officials met to sign a declaration of intent to study the feasibility of coordinating rail freight policies between the two countries, and to better assimilate with the rest of Europe.

Specifically, the document outlines areas of cooperation on issues such as rail freight market liberalization; establishing parameters to measure the efficiency and profitability of goods and passenger movements; collaboration and information exchange; multimodal platforms; streamlining administrative procedures at borders; and adoption of information technology.

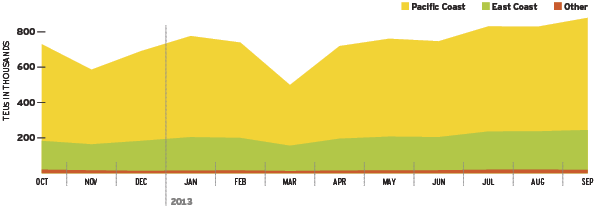

U.S. Imports from China (by U.S. port region of arrival, in TEUs)

The majority of U.S. TEU imports from China arrive at the Pacific Coast. There was a large drop in imports in March, correlating to the low production in China around the Chinese New Year; in 2012, the decline was seen in February.

Source: Zepol Corporation

Rolls-Royce: Substance Over Style

The Rolls-Royce brand is all about panache. But when it comes to moving aircraft engines around the world, substance trumps style.

Rolls-Royce Group, the UK-based power systems manufacturer, is working with B9 Shipping, a Northern Ireland-based firm, to develop a hybrid-powered ship that uses wind energy to help offset fuel costs, according to a recent Bloomberg article. The 330-foot-long prototype will feature a 180-foot Dyna-rig automated sail system and bio-methane engines capable of supporting loads up to 4,500 tons.

The free-standing and free-rotating system—originally developed in the 1960s—has no rigging, and comprises numerous smaller sails that are operated electronically from the ship’s bridge. This allows them to be trimmed quickly to maximize wind power, and turned out of the wind in the event of sudden squalls.

Rolls-Royce will provide back-up power based on its Bergen model, which burns methane produced from municipal waste. The sail and engine can also be used together for optimal efficiency.

The company expects the new ship will help it transition from costlier bunker fuels to alternatives such as dimethyl ether, liquid natural gas, and wind. While the hybrid design increases capital costs, B9 says it will realize a return on investment in three to five years of a three-decade lifespan.