Channeling the Brick and Click Dilemma

As e-commerce continues to transform consumer behavior, retailers explore hybrid omni-channel supply chain models that deliver the best that online and in-store have to offer.

On July 15, 2015, New York City’s Fifth Avenue lost one of its venerable landmarks when FAO Schwarz closed its doors. It’s a temporary move. Toys “R” Us, which owns the brand, is looking for a more affordable lease elsewhere in Manhattan. The ubiquitous toy retailer is also closing its 110,000-square-foot flagship store in Times Square, which features a 60-foot indoor Ferris wheel—also in search of cheaper real estate.

For their respective e-commerce sites, however, it’s business as usual.

It’s a sign of the times as retailers confront a new paradigm. E-commerce is radically changing how consumers buy product. In turn, the supply chain is trying to keep pace with heightened expectations for on-demand availability and expedited delivery.

Online retail is the bell cow that captures consumers’ attention-deficit demand. But it’s not all gloom and doom for brick and mortar. E-commerce is merely recasting traditional perceptions of retailing.

“Retailers are trying to make in-store shopping more of an experience—so it’s not just a place to pick up your goods,” explains Leslie Ajlouny, vice president of business development for Melvindale, Mich.-based third-party logistics (3PL) provider Evans Distribution Systems.

Make no mistake, the Toys “R” Us 60-foot Ferris wheel will find a new location in Manhattan. So will FAO Schwarz’s flagship store—and it will be more interactive than ever before. Retailers recognize that the convenience of buying products online forces them to adapt in unique ways.

Destination retail is growing more popular. Whether it’s the Mall of America, IKEA’s vast interior showrooms, Walmart’s supercenters, Apple’s service by appointment, or Cabela’s indoor mountains, today’s in-store shopping experience is bridging a new divide.

More changes are coming down the pipeline as e-commerce and brick-and-mortar supply chains continue to converge.

Facing Retail Headwinds

Retailers today face a number of challenges as they try to stay ahead of the e-commerce curve. For starters, consumers can buy anything, anytime, anywhere. But perhaps the greatest hurdle is simply keeping pace with change.

“Retailers must be agile and able to react to new methods of consumption, including the increasing rate of e-commerce purchases that leads to more transactions with fewer items per order,” says Curt Bimschleger, managing director, retail logistics for GENCO, a Pittsburgh-based 3PL.

That means a lot more capital is tied up in inventory.

“Retailers carry a lot of safety stock and still don’t have goods where they need to be,” adds Marc Aument, senior vice president of ProShip, a multi-carrier shipping software developer located in Brookfield, Wis. “They have a difficult time putting every color and every size of a button-down shirt in every location.”

Beyond inventory carrying costs, retailers also have to consider transportation. Shipping has become a competitive differentiator for larger retailers. That creates new expectations.

“When a consumer orders an item online, they expect free delivery—and that it will arrive in two days. Amazon created that reality,” says Sean Mueller, special projects manager for Evans Distribution Systems.

To point, Amazon Prime’s two-day shipment guarantee and Walmart’s competitive three-day option called ShippingPass offer expedited shipping for a nominal yearly fee: $99 and $50, respectively. As transportation costs erode margins, retailers have to account for that additional spend. This poses a big challenge for small companies that can’t shift shipping costs to the product price.

ProShip’s value proposition specifically addresses this problem. Omni-channel is bringing ship-from origins closer to ship-to destinations, creating greater incentive to explore the market for competitive transportation pricing. Rate shopping allows shippers to consider different calculations that impact costs. This way they can find the best price at the last possible moment among different carriers.

“Five years ago, if retailers shipped a product via the U.S. Postal Service, they probably wouldn’t know when or if that product would arrive,” says Aument. “Today, retailers have access to much cheaper methods because they ship from so many more places.”

Still, expedited delivery scenarios pose challenges beyond simply cost.

It remains to be seen whether consumers adapt to, or are willing to pay for, more robust same-day delivery options. Walmart’s latest gambit will test the consumer’s preference for speed over cost by pushing the delivery guarantee to three days.

“Same-day delivery forces retailers to modify their shipping offering to better match the needs of their customers in order to maintain a competitive advantage,” says Bimschleger. “Ultimately, this puts a bigger constraint on the supply chain because fulfillment can potentially have a much shorter timeline.”

It’s not just about speed. The last mile has become a veritable rat race as companies try to figure out how to deliver products and services to consumers who are increasingly on the move. Flexibility is equally important. Consumers are considerably less siloed today because of mobile technology and social media. They will shop online and in the store—at home, while working, and in transit.

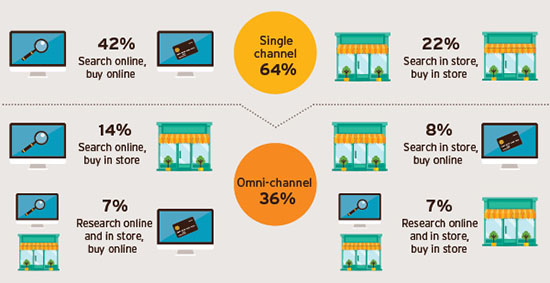

The UPS 2015 Pulse of the Online Shopper report documents this reality. When it comes to channel preference, 42 percent of consumers search and shop online, compared to 22 percent who favor in-store shopping. Importantly, 36 percent invariably cross channels when they shop. That slice of the pie is likely to grow.

“It will not be one or the other; it’s the integration between the two,” says Ajlouny. “Online sales drive people to the stores; and brick and mortar brings people online to look for special items or returns. The two channels have to support and feed one another.”

The Omni-Channel Proposition

The evolution of omni-channel management is a natural reaction to increasing transportation and logistics costs. The expense of shipping direct to home from a fixed network of distribution nodes increases as e-commerce demand and volumes grow. Delivering product from a Pennsylvania distribution center to New Jersey is reasonable—but to California, it becomes costly. So supply chains have to adjust.

“A successful omni-channel strategy is defined by a seamless customer experience that leverages the DC and in-store capabilities,” explains Bimschleger. “In order to execute that seamless strategy, retailers should start with one view of their inventory to allow multiple options to fulfill the order at the lowest possible cost, including pickup at the store.”

Today, retailers tend to fall into one of two categories.

“One category is small companies new to e-commerce, with a product they’re trying to deliver to market,” says Ajlouny. “They want a simplified solution. They don’t want to understand it all—they simply need a partner that can help manage the logistics while they develop and sell product.

“Second are more evolved e-commerce customers looking to turn the ship from a traditional supply chain model to fit the new world—they want to develop a hybrid solution where they still distribute to DCs and brick-and-mortar stores while also supporting e-commerce demand,” she adds.

For these evolved companies, inventory location becomes increasingly less relevant as they merge online and in-store channels. That’s why brick and mortar still has play.

“We see more pressure on retailers and distribution centers to deliver quick, inexpensive shipping options that align with customer expectations,” notes Bimschleger. “Many times this means leveraging a ‘ship from store’ option.

“Within this option, inventory has to be in the right place to meet delivery expectations,” he adds. “Retailers are looking at brick-and-mortar stores as ‘mini’ warehouses to better manage product flow and ensure they provide consumers with unique options for both direct-to-consumer shipments and returning items.”

Walmart and other retailers are leveraging their physical footprints to get closer to the customer, which Amazon and other e-commerce channels still can’t do. The brick-and-mortar backroom is transforming into a quasi DC; its loading dock a nexus for both inbound and outbound moves.

But this approach creates risks. Big-box retailers face the uneasy reality that providing same- or next-day delivery—regardless of channel—cannibalizes existing business they might otherwise capture in store. Consumers who visit a retail location are likely to spend more money than they originally intended.

In fact, 45 percent of consumers make an additional purchase when they use in-store pickup for online orders, according to the UPS report. Beyond that, 38 percent of shoppers are likely to choose ship to store or in-store pickup to qualify for free shipping, up from 35 percent in 2014; and 41 percent who currently use ship to store plan to use it more often in the future.

The convenience of having a central location where shoppers can pick up products at their leisure grows more popular. It’s a win for retailers because they don’t have to absorb that final-mile cost. Rather, they can shift inventory between stores and DCs.

“Back in the day, retailers shipped from a central DC to a store , and customers came to the store,” explains Aument. “Now they ship from 1,000 locations. It’s too costly to ship to every individual and do last-mile delivery, so retailers want to ship to fewer places.”

The growth of e-commerce has precipitated contraction among brick-and-mortar retailers. But it doesn’t mean that retail stores are disappearing. They’re merely shrinking.

“The retail store has a strong future and will continue to evolve and be used by customers in different ways,” says Bimschleger. “While the overall footprint of brick-and-mortar stores may shrink due to the increased rates of mobile or online purchases resulting in decreased foot traffic at the store, they will still act as an anchor for activity—whether in the traditional sense, or as a shipping point or liaison for in-store pickup.”

For example, big-box retailers may be inclined to open smaller-footprint locations in rural or urban areas where it doesn’t make sense to invest in space. These stores will become more dynamic—where customers have visibility to all products in the retailer’s pipeline and can dictate pickup or delivery options accordingly.

It’s getting to the point where consumers no longer expect to get packages delivered to the porch or front door. They want flexibility. This is where the resurgence of brick and mortar comes into play. In some ways, it’s a return to the past—where general stores were a commercial and social nexus for local communities.

ProShip and parent company NeoPost are already experimenting with a program in the United States that puts parcel depots outside stores. It’s an effort that has been successful in other parts of the world. The project is vertical centric, focusing on places where there is demand density—universities and corporate campuses, for example.

“Putting smart lockers outside a retail location gives customers 24/7 access to orders,” Aument adds. “They’re also at the store, which still drives traffic that encourages impulse buys.”

Europeans are ahead of the curve in this regard. Population density and space constraints have forced retailers to create more innovative last-mile solutions that take advantage of local distribution centers and parcel depots to deliver product to consumers.

A Matter of Choice

Ultimately, it comes down to providing customers with different options.

“Consumers can determine the value of paying an annual fee, or paying more for shipping to get products sooner, or waiting a few extra days for free shipping, or even picking up in a retail store same day,” says Bimschleger. “Customers can pick the option they want for each transaction.”

Integrated shopping models that include both online and in-store options are the new norm. That won’t change. In turn, companies will have to rely on their supply chains to transform the fulfillment process to match these demands.

This carries over to returns as well. “The next big wave is reverse logistics,” says Aument. “As shippers get closer to customers, there should be more options and cost savings. The supply and demand chain is starting to drive a difference in the consumer’s opinion of where and what to pick.”

Changing the Channel

Consumers continue to cross channels when researching and purchasing items.

Source: 2015 UPS Pulse of the Online Shopper